Guest Haymaker - Charles Gave

In The Ring - September 30, 2022

Introduction & Haymaker Thanks

Image: Shutterstock

"In all debates, let truth be thy aim, not victory, or an unjust interest." -William Penn

First, a massive “Mahalo” to those many readers/subscribers who have generously shared their thoughts on the ReasonTV climate change debate to which we linked and about which we ourselves opined last week. More specifically, our thanks to:

X75

Alphadennis

Steve Armitt

Norman B.

Batman

Bob Brown

Hal Cumberland

DSB

Alex E.

Michael Edenfield

Andy Fately

Mark Gayhardt

Al Grebliunas

Jeffrey Muir Hamilton

Jim Hilsenteger

Ilya

Jim T. Malone

Bruce McIntyre

Philip Michaels

Steve Mudge

Craig Offenhauser

Lynn P

Patton

William York Richardson III

Howard Roberts

Barry Rose

Seamus

and David Sprott

The knowledge level and ample courtesy on display was so impressive that it might make sense for us to host a 20+ person debate of our own. There’d only be one problem with that (not counting the impracticality of so many debaters vying for speaking time): almost all of you agreed with the Koonin side of the argument, which would make a debate difficult to frame.

While the Haymaker team respects Dr. Dessler’s sincerity and passion, we, too, believe Dr. Koonin’s arguments were more persuasive. For one thing, we’ve had a hard time getting the temperature chart showing the divergence in NY City warming since 1915 versus that of West Point, NY, a mere 40 miles or so away, out of our minds. The latter remains far more pastoral and that would seem to be the logical cause of why it has only seen about a half a degree of warming since 1915 and just ¼ of a degree since 1930. (Unfortunately, logic seems to be all too often left out of the climate change debate.) If someone has another reason, besides the urban heat effect, for this dramatic dichotomy, we’d love to see your thoughts.

All that said, if climate science is a topic you’re interested in having us cover, let us know below. We may well invite Dr. Koonin or others in the field to join us as interviewees in the near future. Happy to welcome any recommendations you might offer or introductions you might make.

This week we’re returning to economic and financial conditions, specifically one of the Haymaker’s favorite topics: the risks to S&P 500 earnings. As many of you know, this newsletter has been warning of an earnings recession for much of 2022.

We also reluctantly began calling for an overall downturn in the U.S. economy back in June. Since then, Haymaker has been consistently elevating our odds for that to occur. However, we’re not up at the level of the prestigious Ned Davis Research firm, which now has them at 98%.

For this month’s Gavekal Haymaker, we’re highlighting the work of one of Dave’s favorite thinkers and writers at the firm of his close friend, Louis Gave. This article, though, is authored by his father, the other “GAVE” in Gavekal, Charles Gave.

Charles is making a strong case that S&P profits are inflated and vulnerable to a reversion to the mean. These events are typically mean indeed for investors who are overly exposed to stocks at a time when the economy is rapidly losing altitude. A full-blown recession, of course, will only make the earnings reset even more painful, a word that Fed chairman Jay Powell seems to relish these days. Considering the extreme amount of pain already being inflicted on investors, that isn’t a comforting prospect.

Octobers are often when the stock market has jarring declines, followed by rousing rallies. Accordingly, this month could provide a spectacular fireworks display and the key is not to get blown up should a detonation actually occur. The reality is, someone who’s fully invested is unable to capitalize on market panics. For Haymaker readers, that’s unlikely to include them… if they’ve been following the advice of this newsletter to hold an unusually high level of short-term government bonds for now.

-The Haymaker Team

Corporate Profits And Creative Accounting - Charles Gave

Originally published September 21st, 2022; minor corrections made where necessary.

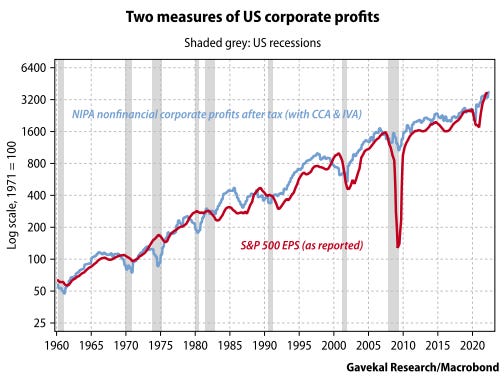

In a few weeks’ time, the US third quarter reporting season will get under way. Judging by the drip-drip of profit warnings over recent days, there could well be more surprises in store. So before the trickle becomes a spate, it might be helpful to remind ourselves of some eternal truths about the profit cycle, which equity investors would do ill to forget. First, please take a look at the chart below, which shows two measures of US corporate profits. 1) The blue line is from the US National Income and Product Accounts, or NIPA, and shows corporate profits after tax (complete with inventory valuation adjustment and capital consumption adjustment). 2) The red line is S&P 500 earnings per share, as reported by the index’s constituent companies.

Reported profits can diverge from NIPA profits, but the overall trend is the same

There are a few things to note here:

• US corporate profits always fall in a recession.

• The number of companies sampled in the NIPA series is much larger than the number in the S&P 500. However, the trend growth rate is the same for both.

• S&P 500 profits are much more volatile than the NIPA profits. But divergences are short-lived, with S&P 500 profits always converging with NIPA profits again.

So, the first question to ask is whether there is any useful information to be learned if at any point the two series show a statistically abnormal divergence from each other. To answer the question, let us examine the ratio between the two series, which is shown in the chart above.

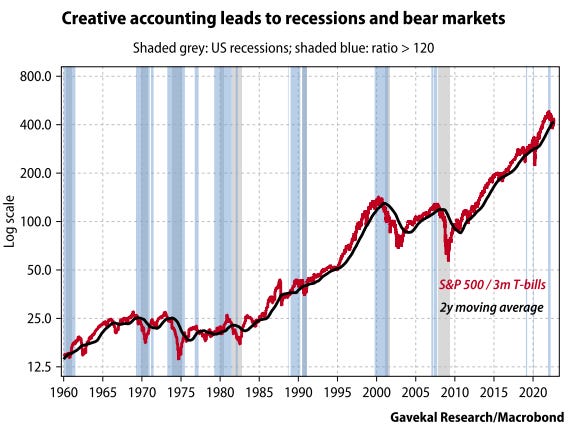

When reported profits run ahead of NIPA profits, recession follows

A couple of observations stand out:

• Since 1960, on every occasion that S&P 500 reported earnings climbed 20% or more above NIPA profits, a recession ensued.

• Every US recession since 1960 was preceded by S&P 500 reported earnings rising 20% or more above NIPA profits.

When recession hits, companies clean up their accounts

So, how do we explain this remarkable phenomenon?

1) In the last phase of every cycle, most quoted companies find it more and more difficult to generate the growth in profits that investors expect.

2) So the accountants come to the rescue, and these periods see the emergence of what I call “creative accounting.”

3) As if by magic, corporate earnings meet their forecasts.

4) Eventually the inevitable recession occurs. Share prices collapse. Companies fire their old chief executives, and install new bosses. And the first thing the new bosses do is “clean up” the accounts, kitchen-sinking all the bad news while they can blame it on their predecessors.

5) As a result, S&P profits fall way below NIPA profits—at which point, it is time to buy shares again.

6) This sequence is repeated, cycle after cycle.

Let me summarize. When S&P 500 profits diverge dramatically from NIPA profits, it is a sure sign that accounting methods have changed at S&P 500 companies. If S&P 500 profits rise to exceed NIPA profits by 20% or more, it is a signal that companies’ reported profits are being generated largely by their accountants. Usually this means that the economy is on the brink of a recession, and that the stock market is about to take a beating.

We have just seen a period of US creative accounting

The chart above illustrates this last point. Creative accounting periods, when S&P 500 reported exceeded NIPA profits by 20% or more, are shown shaded in blue. Historically, each of these periods was followed in short order by a US recession, and by the ratio of total returns on the S&P 500 to total returns on US T-bills falling below its two-year moving average. In short, US equities entered a bear market.

The US economy appears on the verge of a recession

Today, we have just seen a period of US creative accounting, and the ratio of US equity returns to T-bill returns has broken below its two-year moving average. The conclusion is that the US economy is heading into a recession in the near term. In a recession, earnings fall, and past earnings get revised downwards. The capital losses tend to be large. I continue to be bearish on the US stock market.

We welcome your comments and hope you will take a moment to share some thoughts on this week’s Guest Haymaker post.

A bit late to the comment box, but I believe Dr. Dressler's arguments were more persuasive. Great to hear both sides of the issue. Would like to see more of this type of forum with experts covering multiple points of view.

Dave...you might find this informative.... https://www.youtube.com/watch?v=k_uBiHoIZIw