Friday Highlight Reel - Edition #15

A sampling of interesting observations from the Haymaker's network of market experts and favorite resources.

(Directly quoted and referenced content appears in block-quote format, unless otherwise indicated)

Follow-up Note:

We received some good clarifying feedback on Tuesday’s Making Hay (Almost) Monday edition. As a result, we wanted to address that and provide technical clarification of our own; we’ve done that in the original piece which is directly linked for your convenience at the end of this post.

Note: The first part is based on a description of nuclear fuel from the Energy Information Administration (EIA). The second section is from my friend and nuclear expert referenced in that article. For almost all of you, I realize this is highly esoteric and may seem like splitting hairs (or atoms!), but we strive to be as accurate as possible.

#1: Financial Times’ Derek Brower on Falling Oil Output:

Even in the prolific Permian Basin of Texas and New Mexico output from each new well drilled has fallen almost 30% in the past two years, according to the Energy Information Administration… The International Energy Agency said last month that global oil production would increase in 2023 far more slowly than demand, which will hit another record later this year.

Team Haymaker Take: There are a couple of extremely important points Mr. Brower is making in this article, in my opinion. One is that productivity in the Permian is under downward pressure. This is a critical development because the U.S. has been responsible for nearly all global oil production growth over the past decade and most of that has come from the Permian. As I’ve expressed many times, the Permian Basin has a unique geological profile that is often referred to as a “layer cake”. This means it has an unusually deep formation of productive zones stacked on top of each other. Because of this, it has been able to slightly increase its total output beyond the pre-Covid peak. Most other shale basins are still not back up to 2019 production levels and their output is slowly eroding. A main driver for this is the typical 80% fall-off rate by shale wells during the first two years post-completion. Virtually all of America’s oil production growth has come from shale, and the related horizontal drilling and fracking process. Based on the above, that’s also true on a global basis. Consequently, a plateauing, much less a contraction, in U.S. shale output should be ringing ear-splitting alarm bells. This is particularly the case based on how depleted oil inventories are currently.

The other key factoid in his article is that the IEA is admitting that supply will trail demand this year. That’s a complete 180° from their usual outlook, which has consistently — and enormously — overstated supply while underestimating demand. Yet, I keep reading and hearing that there is a glut of oil which is why prices deserve to be under the downward pressure they’ve experienced for almost a year now. A flood of oil exports from Russia has been the latest rationale for this alleged oversupply. Yet, anyone objectively reviewing inventory data must come to a radically different conclusion. A much more credible reason for the seemingly nonsensical oil price weakness is the fact that speculative futures market participants have sold short 50 million barrels of crude in the last five weeks. This morning’s Wall Street Journal notes this is equivalent to 60 supertankers! The U.S. Strategic Petroleum Reserve (SPR) is effectively short roughly another 300 million barrels. Meanwhile, OPEC is making rumblings of another output cut to punish those betting on further price declines (though I doubt it will). Accordingly, I expect another explosive rally in oil in the not-very-distant future.

#2: Raymond James’ Marshall Adkins on the Crude Market

•Current damage to oil industry will lead to limited supply growth through 2025

•Inventories are still falling through 2023

•With OPEC maxed out, there is no margin for error on supply disruptions

•Oil prices must rise to kill demand growth

•Long-dated prices are $40+/bbl too low!

Team Haymaker Take: Because my Entry #1 comments on the oil market were on the lengthy side, I’m going to keep my reaction to Marshall’s points concise. First, he’s one of my favorite energy strategists, along with Cornerstone’s Analytics Mike Rothman. Second, I’ll readily concede that they have been generally bullish on the oil and gas sector in recent years; thus, I could be guilty of confirmation bias. However, being an energy bull has been the correct stance, at least in the post-Covid era. This year has seen a correction of the extreme outperformance generated by both oil and energy securities that began in the fall of 2020.

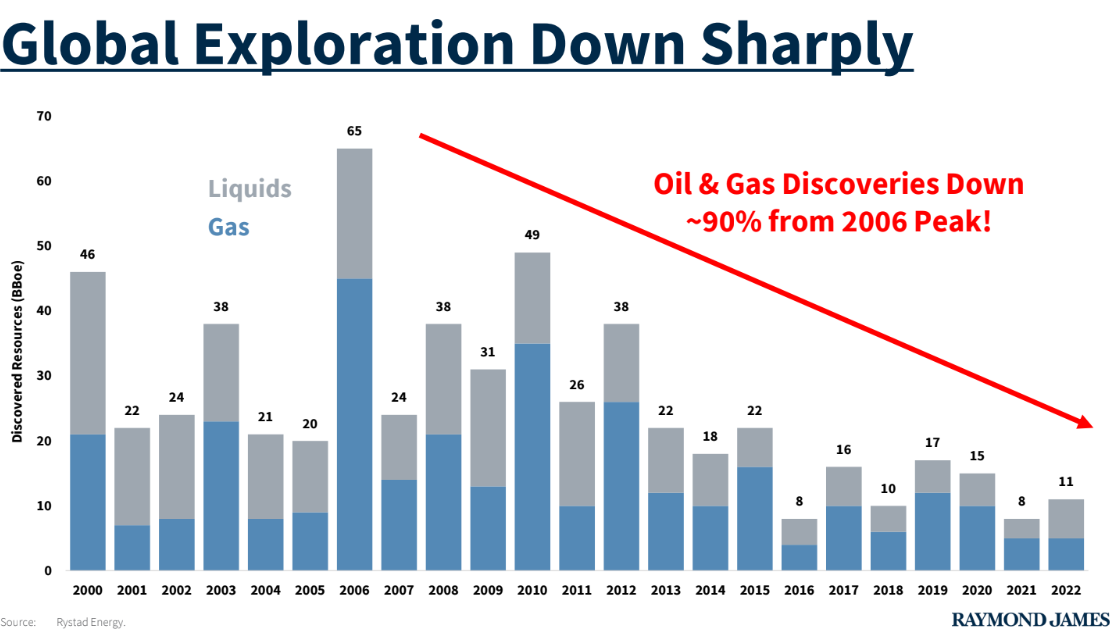

It seems as though most investors are giving up on this sector and charging into AI plays. Yet, as you can see in Marshall’s two visuals shown above, the likelihood of a supply crunch is extremely high. Thus, we could see another powerful rotation back into energy if Marshall Adkins, Mike Rothman, and yours truly are right about a second-half price spike. Unsurprisingly, I like our chances and maybe, just maybe, yesterday’s and today’s muscular oil price rally is a foretaste of the big up-move to come.

#3: Markets Insider on the Nation’s Housing Outlook

The US housing market faces a chicken and egg problem, according to Realtor.com.

High mortgage rates are deterring buyers, and sellers who don't want to swap out low rates they locked in previously.

New home listings dropped 22.7% in May as many sellers and buyers stay put, but home prices could start falling.

Realtor.com pointed out the "chicken and egg" problem plaguing the housing market right now: High mortgage rates are keeping both home buyers and sellers sidelined, with the former hesitant to spend and the latter unwilling to part ways from the lower rates they locked in on current homes.

This means that even those buyers who are willing to pay high rates are struggling to find homes for sale. In May, there were 22.7% fewer new homes listed than last year.

Team Haymaker Take: The U.S. housing market appears to be stuck between a rock and a hard place. As the Fed tries to put its monetary genie back in the bottle — that was released to combat high inflation largely created during Covid (see: MMT, Modern Monetary Theory) — interest rates currently sit near an uncomfortably high level of 7%. This massive jump in the cost of borrowing from a couple years ago has sent shock waves through the U.S. real estate market and continues to be a headache for prospective homebuyers. But the turbulence in housing is not as simple as buyers being dissuaded by higher interest rates; sellers don't want to sell because they're locked into their mortgages at extremely attractive rates. Rock, meet hard place.

May’s sharp drop in new listings created a standoff that forced many potential participants to remain on the sidelines. Sellers are keenly aware that even if they were to make a profit on selling their residence, finding a new place would be difficult at best. As a result, the U.S. housing market is left with sparse inventory and many trigger-shy buyers — a group that's had to deal with the brutal combo of rising prices, higher rates, and precious little inventory. It's hard to predict where this is all headed. We do know that June tends to be a historically strong month for home sales. After that, there could be a serious reckoning for home prices, which may finally crumble under the massive pressure of the Fed's interest-rate war on inflation.

To learn more about Evergreen Gavekal, where the Haymaker himself serves as Co-CIO, click below.

#4: Axios on Where All That S&P 500 Growth Is Coming From

A hypertrophied tech sector is carrying the stock market once again.

The big picture: The S&P 500 is up 8.9% so far in 2023, or 9.7% including dividends. But the lion's share of that increase is due to the surging prices of a few of the largest companies.

State of play: The big five that are responsible for the vast majority of the stock market's 2023 gains are Apple (up 36% this year), Microsoft (37%), Alphabet (39%), Amazon (44%), and current stock market darling Nvidia, which has surged 159% on AI-related excitement.

Without them, the overall market (including dividend payments) would be up just 1.5% this year, according to data provided by Howard Silverblatt, senior index analyst at S&P Dow Jones Indices.

If you also remove the contributions from the two other largest tech companies — Meta (up 120% in 2023) and Tesla (66%) — the S&P 500 would be slightly underwater for the year, Silverblatt says.

Team Haymaker Take: The confluence of falling inflation, decent economic growth, and hype surrounding AI has provided fertile ground for these names to thrive. While it's not surprising to see marquee names shouldering the weight of the broader market given their humongous market caps, it's fair to wonder how long retail names like Amazon and Apple can defy earnings expectations with the many economic headwinds facing the U.S. consumer.

#5: The New York Post on Target’s Recent Stock Hit

Target’s stock has lost a whopping $13.8 billion over the past two weeks, hitting its lowest levels in nearly three years as the “cheap chic” discount retailer continues to face backlash over LGBTQ-friendly kids clothing.

Shares of the embattled chain sank 2.2% at $130.93 on Wednesday after dropping for eight straight sessions — the stock’s longest losing streak since November 2018 — giving the company a market capitalization of $60.4 billion.

That’s off 19% from two weeks earlier on May 18, when the stock was trading at $160.96 on the eve of the crisis.

Team Haymaker Take: Ouch.*

*But it’s not the only casualty in the retailing sector and it’s fair to note all of the carnage is not related to PR virtue signaling miscues. Advance Auto Parts (AAP) reported a huge earnings miss and a big cut to its dividend. This was without the type of controversy that has dogged Anheuser-Busch and Target. Its announcement of a 40% shortfall in expected 2023 profits caused its shares to endure the worst one day decline in its history on Wednesday, a 35% buzzcut. Double ouch!! Over the years, AAP has been an outstanding earnings grower, despite a tough 2017. Thus, this is far from a weak retailer indicating that perhaps consumers are pulling in their horns. CNBC also reported yesterday that credit card delinquencies are at their highest levels since the Great Recession. Soft-landing believers might want to double-check their thesis.

#6: Washington Examiner on Biden and Chips

Last August, Biden signed the CHIPS and Science Act into law. Biden said the legislation would enable the United States to "win the future." Indeed, semiconductors are the oil and more of this century. Without advanced semiconductors, there will be no second industrial revolution centered on artificial intelligence. AI offers the promise of doubling the nation's economic growth rate.

All of the promises of AI are dependent on the most advanced semiconductor technology, design, and fabrication. And while the U.S. is preeminent in designing the most advanced semiconductors, it lags woefully in the fabrication area. In fact, the U.S. is completely dependent on semiconductor fabrication facilities in Taiwan for the most advanced chips. Without companies located in Taiwan, a country China covets, the U.S. preeminent position in AI would collapse. Unfortunately, Biden’s CHIPS Act promises about technology supremacy were hot political air.

Taiwan Semiconductor will not begin to fabricate advanced semiconductors at its new Arizona facility until the end of 2024, a lifetime in the semiconductor space. Construction of advanced semiconductor facilities is being delayed because semiconductor companies resist the conditions imposed by the Biden administration on the release of funds from the CHIPS Act. The administration requires that the semiconductor companies offer childcare benefits to employees and that the companies pay wages equivalent to what government employees would earn. Morris Chang, the founder of Taiwan Semiconductor, has already stated that the U.S. will never be a low-cost producer of the most advanced semiconductors. It is too difficult to build in the U.S., and U.S. labor is not cost-competitive.

Team Haymaker Take: Major geo-strategic concerns to one side, it’s good to see a step towards re-energizing the American manufacturing sector, perhaps even restoring it to something preceding generations might recognize. But as the piece effectively says: America is not Taiwan. And what it doesn’t directly state is that the core of Nvidia’s coveted AI chips all come from Taiwan Semi’s foundries. The reality is, labor here exists at a relative premium, and with good reason, but that premium will determine how any onshoring of this major industry ultimately takes shape, to include factors like production costs and perhaps even factory output. These are the very factors we need to be considering as tech manufacturing becomes almost singularly crucial in the international arena.

IMPORTANT DISCLOSURES

This material has been distributed solely for informational and educational purposes only and is not a solicitation or an offer to buy any security or to participate in any trading strategy. All material presented is compiled from sources believed to be reliable, but accuracy, adequacy, or completeness cannot be guaranteed, and David Hay makes no representation as to its accuracy, adequacy, or completeness.

The information herein is based on David Hay’s beliefs, as well as certain assumptions regarding future events based on information available to David Hay on a formal and informal basis as of the date of this publication. The material may include projections or other forward-looking statements regarding future events, targets or expectations. Past performance is no guarantee of future results. There is no guarantee that any opinions, forecasts, projections, risk assumptions, or commentary discussed herein will be realized or that an investment strategy will be successful. Actual experience may not reflect all of these opinions, forecasts, projections, risk assumptions, or commentary.

David Hay shall have no responsibility for: (i) determining that any opinion, forecast, projection, risk assumption, or commentary discussed herein is suitable for any particular reader; (ii) monitoring whether any opinion, forecast, projection, risk assumption, or commentary discussed herein continues to be suitable for any reader; or (iii) tailoring any opinion, forecast, projection, risk assumption, or commentary discussed herein to any particular reader’s investment objectives, guidelines, or restrictions. Receipt of this material does not, by itself, imply that David Hay has an advisory agreement, oral or otherwise, with any reader.

David Hay serves on the Investment Committee in his capacity as Co-Chief Investment Officer of Evergreen Gavekal (“Evergreen”), registered with the Securities and Exchange Commission as an investment adviser under the Investment Advisers Act of 1940. The registration of Evergreen in no way implies a certain level of skill or expertise or that the SEC has endorsed the firm or David Hay. Investment decisions for Evergreen clients are made by the Evergreen Investment Committee. Please note that while David Hay co-manages the investment program on behalf of Evergreen clients, this publication is not affiliated with Evergreen and do not necessarily reflect the views of the Investment Committee. The information herein reflects the personal views of David Hay as a seasoned investor in the financial markets and any recommendations noted may be materially different than the investment strategies that Evergreen manages on behalf of, or recommends to, its clients.

Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this material, will be profitable, equal any corresponding indicated performance level(s), or be suitable for your portfolio. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Investors should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Your succinctness is greatly appreciated. I read quite a bit of economic, patriotic and political commentary online and very few writers are able to communicate their message without drowning us with words. Time is a terrible thing to waste.

Thank you for Today's Haymaker Highlight Reel. Commenting on the Energy Article portion, a Source I trust is the Gorozen Blog which has recently come out to state that the Permian Field has plateaued and will start declining in output as I type. Thus, with OPEC output declining because of malinvestment, the Supply of crude is going to go down regardless of what the Speculators believe...I think this is what Abdulaziz bin Salman Al Saud meant when He said that Oil Speculators will be "ouching" soon...