Making Hay (Almost) Monday - May 30th, 2023

High-level macro-market insights, actionable economic forecasts, and plenty of friendly candor to give you a fighting chance in the day's financial fray.

“Some extremists, such as Ralph Nader, urged abandonment of nuclear energy, but our institute argues that we should fix nuclear energy, not extirpate it. This was the gospel preach by David Lilienthal… a better-designed reactor that would be immune to meltdown.” -Alvin Weinberg, one of the earliest and most influential advocates of molten salt nuclear energy technology.

Going Nuclear

Let’s face it: humans, particularly of the modern American variety, have a weakness for conspiracy theories. Frankly, I’m no different; I still believe JFK’s assassination was a result of a conspiracy that may have even involved the CIA. (You may have seen that his outspoken nephew, Robert F. Kennedy, Jr, has alleged exactly that and is pressing President Biden to release long-sealed government documents on the murder of the 20th century.)

But the dead president relevant to this Making Hay Monday (MHM) is JFK’s once-rival — the man he defeated in 1960 in one of the closest and most controversial presidential races on record — Richard Nixon. I’ve previously written critically about Nixon’s monumental decision to take America off the gold standard in 1971. This helped usher in the high inflation that would plague the rest of that decade, with two oil embargoes admittedly playing crucial roles, as well. In fact, I would argue that the lack of a hard-money anchor is one of the main factors behind our present disastrous federal fiscal condition.

Yet, as I’ve learned recently, Mr. Nixon also was instrumental in another policy decision that has had a long-lasting and exceedingly negative impact. Around the same time he was severing the U.S. dollar’s tether to gold, he also was influencing the direction of America’s civilian nuclear program.

Early in his first term, there were two competing technologies vying to dominate the adolescent civilian nuclear power industry. One came from Tennessee’s Oak Ridge National Laboratory (ORNL). It was based on a molten salt process to function as a moderator, the cooling medium essential to all nuclear reactors to transfer the heat of fission to a useful purpose. The other was being developed on the opposite side of the country in Mr. Nixon’s home state of California — specifically, Southern California, where he was raised. This approach involved a liquid metal reactor with the fluid metal providing the cooling, along with “light water”. Essentially, this was ordinary H20, as opposed to the famous heavy water which is used in the fission process to slow down neutrons.

This method, involving Light Water Reactors (LWRs), had been in use since the 1950s, meaning it had the advantage of 15 years or so of real-world operation. LWRs, on a much smaller scale, were also successfully used by the U.S. Navy to provide propulsion for subs and aircraft carriers. The father of the nuclear Navy, Hyman G. Rickover, was an ardent advocate for LWRs.

On the other hand, the prestigious ONRL had developed a reactor that was cooled by the aforementioned molten salt solution. Units were placed in service in the mid-1960s and operated successfully until ONRL’s reactors were shut down in 1973.

The advantage molten salt reactors (MSRs) had over traditional LWRs was safety. With the former there was virtually no chance of a meltdown that could lead to a catastrophic separation of the H2O molecule. The H atom could be particularly explosive if its nearly inseparable bond with oxygen was broken — note the “nearly”. However, at the time, there had been no accidents at a nuclear facility in any country, save for in a remote region of Russia in 1957. As a result, the warnings from one of the fathers of MSRs, Alvin Weinberg, about the risks posed by LWRs, went unheeded. Actually, as you will soon see, they were derided.

Here’s a recollection by Dr. Weinberg of a powerful California congressman, Chester Holifield, chastising him for his apprehensions:

[Congressman] Chet [Holifield] was clearly exasperated with me, and he finally blurted out, “Alvin, if you are concerned about the safety of reactors, then I think it may be time for you to leave nuclear energy.” I was speechless. But it was apparent to me that my style, my attitude, and my perception of the future were no longer in tune with the powers within the AEC.

(My note, the Atomic Energy Commission)

Mr. Nixon fired Dr. Weinberg in 1973 due to the scientist’s ongoing support of MSRs and growing concerns over LWRs. (At the end of this issue, you’ll find a link to an excellent nuclear energy tutorial by MacroVoices’ Erik Townsend. It includes a tape recording of a conversation between Mr. Nixon and another California congressman, Craig Hosmer, during which the former president made clear his desire that his home state’s program should prevail.) Ironically, Dr. Weinberg had been one of the early developers of LWRs and the related High-Pressure Reactors. He was truly one of the fathers of America’s overall civilian nuclear program and he became convinced that MSRs were meltdown proof. He was also increasingly worried that LWRs were anything but… and he didn’t keep his concerns to himself.

Six years later, at Pennsylvania’s Three Mile Island nuclear facility, Dr. Weinberg’s fears were validated. (In another one of life’s endless ironies a film, The China Syndrome, predicated on the vision of an imagined nuclear meltdown, had just been released.) Seven years later, an even more disastrous nuclear accident occurred in what was then a province of Russia, Ukraine, where the now infamous Chernobyl atomic power plant was located. Twenty-five years after that, on March 11, 2011, Japan’s nuclear facility at Fukushima was damaged by an immense tsunami resulting from a 9.0 earthquake, the most powerful to ever hit the island nation, off its eastern shore. This produced the nightmare scenario of every nuclear scientist when enough energy was inadvertently released to produce the dreaded separation of hydrogen and oxygen.

The loss of the Fukushima plant’s reactor cooling, due to an extraordinarily unfortunate sequence of events, caused three core nuclear meltdowns. These, in turn, produced three hydrogen explosions. Radiation was released into the atmosphere, forcing the evacuation of 110,000 local residents.

Dr. Weinberg lived until 2006, long enough to see his worries about LWRs validated, though he missed the last, the most cataclysmic of them all. As a result of these terrifying incidents, the safety redundancies designed into next-generation nuclear power plants became onerous and prohibitively expensive, particularly in the U.S. In fact, since the Nuclear Regulatory Commission (NRC) was established in 1974, not a single new nuclear facility had entered operation until Tennessee’s Watts Bar Unit 2 plant achieved fission in 2016. This was followed by Georgia’s long-delayed and enormously over-budget — as usual — LWR Vogtle twin nuclear plants that have finally begun to enter service this year. (The Tennessee Valley Authority was able to construct two nuclear power plants but those were started the year before the NRC’s founding. One began operating in 1996 and the other in 2015 — 23 and 42 years, respectively, after construction started!)

Basically, the decision to focus on LWRs and ignore MSRs was an epic policy blunder, not only in America, but around the world. The customized nature of each of these gigantic power plants also led to continual and staggering cost overruns. (China and Russia, by contrast, have utilized standardized designs.) But much of that had to do with providing ever-increasing margins of safety for what is inherently a far more dangerous technology. This is a function of the high pressure LWRS need to create steam to turn the turbines and the related risk of a loss of power to maintain the cooling process. MSRs eliminate both of those requirements and risks. If power is lost, they safely shut down.

Years after Dr. Weinberg was fired, another person entered this saga — Kirk Sorensen. Mr. Sorensen became aware of Dr. Weinberg’s success with MSRs while working for NASA on developing nuclear power for a proposed moon colony. To his horror, he learned that the documents from ONRL’s successful research and trials were stored in a rural children’s museum and were scheduled to be destroyed. He was able to access and scan them in before that happened. He is now a tireless advocate for MSRs, using thorium as the fuel as opposed to uranium and/or plutonium.

Fortunately, he’s not alone. MSRs are now considered to be fourth-generation nuclear reactors — the most advanced — despite that they were operating in the 1960s. They also hold the promise to largely solve the vexing nuclear waste problem.

At least one entity purports to have a design that eliminates pumps and valves, making this an even more reliable technology. In fact, in a Haymaker podcast coming to you soon, I’ll be doing an interview of one of the senior executives of this company, Micro Nuclear. We’ll be joined by the investment world’s most famous chicken, Doomberg. The latter is a strong proponent of small modular reactors but, as they say, he has no dog in the hunt. My expectation is that he’ll express a healthy skepticism to the alleged MicroNuclear breakthrough while keeping an open mind to its viability.

The more research I do on this topic, the more I’m convinced SMRs are ready for prime time. But don’t take my word for it — last year, the U.S. Department of Energy’s Office of Nuclear Energy endorsed three SMR designs, including molten salt reactors. Just last week, the Biden administration announced a $275 million public-private commitment for a SMR designed by another company, the now-publicly traded NuScale Power, to be built in Bulgaria. (Its reactors are considered Generation 3.5; i.e., not as advanced as the molten salt process.)

Currently, investors worldwide are captivated by the promise — and peril — of generative AI. But, before long, their focus may be shifting to a technology that has the potential to power the planet with carbon-free and highly affordable energy. It’s heartbreaking that it took 50 years for MSRs to get the consideration they deserve. But, as they say, better late than never. And, boy, could humanity use some good news right now.

Who knows? Maybe AI can even accelerate the nuclear industry’s transition to molten salt reactors. Wouldn’t that be among the wiser ways to apply artificial intelligence to a half-century-old “new” technology?

To learn more about Evergreen Gavekal, where the Haymaker himself serves as Co-CIO, click below.

Champions

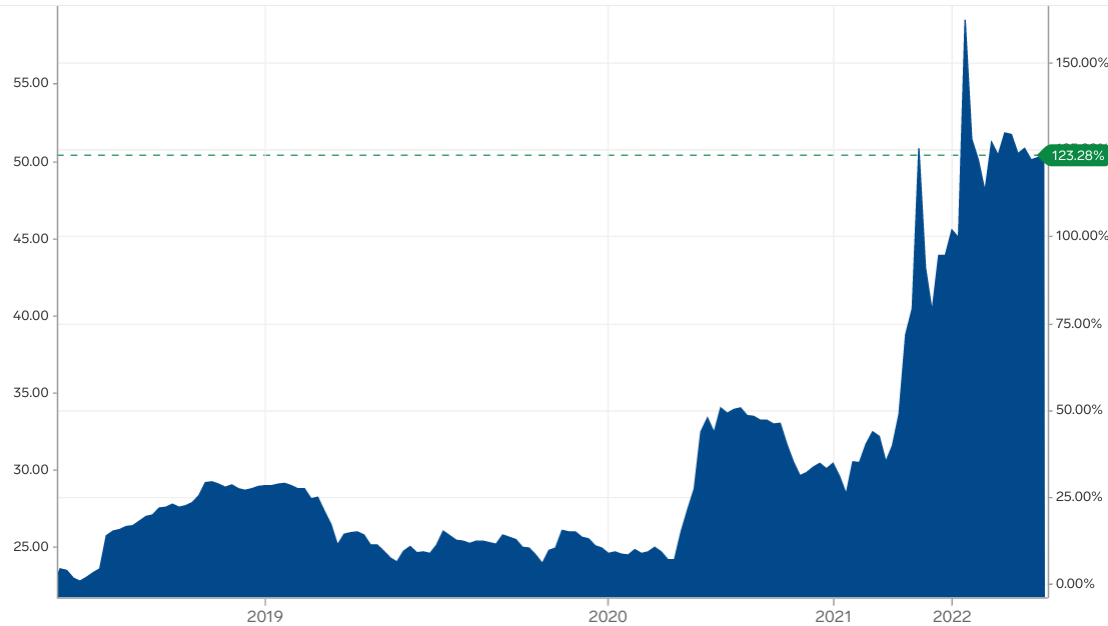

The foregoing is a natural lead-in to re-recommending one of my favorite natural resources: uranium. As you can see below, it has been bouncing around the $50/ pound level for most of the last two years. Yet, that’s not nearly high enough to incentivize new uranium mines.

Uranium Prices: Five-Year Chart

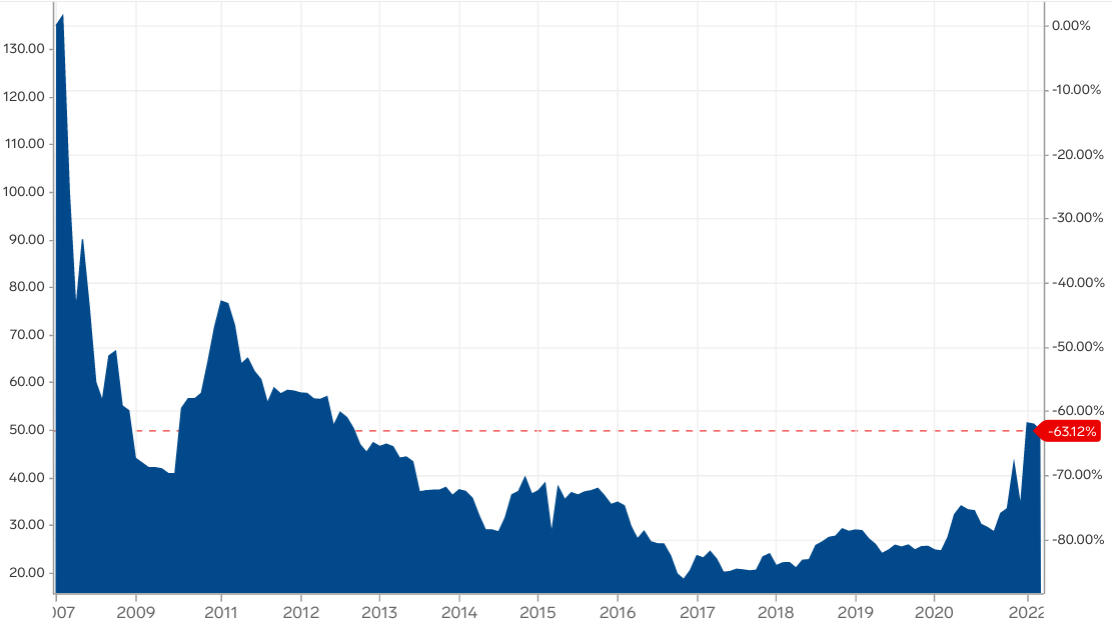

Uranium Prices: Sixteen-Year Chart

For over a decade, that didn’t matter because there was a major oversupply of U-92 in the wake of the Fukushima disaster. Japan closed over 40 reactors as a result of it, eliminating 13% of global demand nearly overnight. As more countries, especially Germany, turned against nuclear after the catastrophe, uranium prices gradually eroded down to $18 per pound. This was down 75% from the pre-Fukushima level and off over $100/pound from the 2007 peak. As a result, hundreds of producers shut down operations.

Decommissioned nuclear warheads — the megatons-to-megawatts program — that began after the former USSR disintegrated also amplified the glut. The persistence and magnitude of the excess supply bred complacency among the primary consumer of U-92, the global utility industry.* Aggravating the supply/demand imbalance, a plethora of nuke power plants were shut down post-Fukushima in Western countries.

Today, it is a radically different story. There are 60 new nuclear reactors under construction, over one-third of them in China. Hundreds of others are in the design stage. Moreover, scheduled de-commissionings of existing plants are being postponed and some shuttered facilities are coming back online. Uranium inventories were already dangerously depleted prior to this sudden nuclear renaissance. This has created upside price pressures, but virtually every expert I have read or listened to believes they need to go much higher from here to stimulate new output.

Further aggravating this is the momentum that is building around SMRs. These, of course, require uranium. (Thorium is another potential fuel source, as noted above, but it appears many years, if not decades, away from being widely used, also based on what I’m hearing from the pros.) In essence, there is a high probability of an acute shortage of uranium and a vertical move in prices. Perhaps it won’t be the tenfold increase seen by lithium in 2021 and 2022, but it has the potential to be extremely rewarding to uranium miners and investors.

There are a number of publicly traded uranium mining stocks but they look expensive to me right now, unlike with other natural resources producers, like copper, oil, and natural gas. An interesting ETF exists that provides a convenient way for retail investors to play the resurgent demand for U-92, but you’ll need to look that up on your own due to SEC restrictions. From the time of its formation in the summer of 2021, it has been a steady buyer whenever the price dipped. This is helping to put a floor under the prices of spot market uranium.

If I’m right that molten salt nuclear reactors are on the verge of their AI moment, uranium will almost assuredly go along for the ride. Even if I’m wrong, there are plenty of upside catalysts for U-92. But it’s always nice to have a kicker, especially one that could go nuclear.. literally.

Champions List:

Uranium

Farm machinery stocks

Select financial stocks

Oil and gas producer equities (both domestic and international)

U.S. Oil Field Services companies

Japanese stock market

S. Korean stock market

Physical Uranium

Copper-producing stocks

For income:

Certain fixed-to-floating rate preferred stocks

Select LNG shipping companies

Emerging Market debt closed-end funds

Mortgage REITs

ETFs of government guaranteed mortgage-backed securities

Top-tier midstream companies (energy infrastructure such as pipelines)

BB-rated energy producer bonds due in five to ten years

Select energy mineral rights trusts

BB-rated intermediate term bonds from companies on positive credit watch

Contenders

There is a major European bank that broke out to a new five-year high (even better than a three-year high!) in early March, right before the latest banking crisis erupted. It has pulled back about 15% since then and looks to be stabilizing. (This is based on its price in its home currency, not U.S. dollars.)

It received what I believe to be a sweetheart deal in a government-forced-orchestrated merger with its domestic arch-rival. It’s also domiciled in one of the world’s most fiscally sound countries. At this point, it’s just a name my team and I are researching, but it’s worth noting that there are some interesting opportunities emerging with acquiring financial institutions that appear to have received extremely generous terms on their rescue deals.

However, my fears that we haven’t seen the complete flushout from the second banking fiasco of the last 15 years are certainly a reason to be very cautious with any purchase in that sector for now. But it may be getting close to the time to do a little accumulating among those that qualify for a “survival of the fittest” designation.

European banks

U.S. GARP (Growth At A Reasonable Price) stocks

Telecommunications equipment stocks

Swiss francs

Singaporean stock market

Short-intermediate Treasurys (i.e., three-to-five year maturities)

Gold & gold mining stocks

Intermediate Treasury bonds

European banks

Small cap value

Mid cap value

Select large gap growth stocks

Utility stocks

Down for the Count

The stunning rise by Nvidia last week has left my negative stance on the semiconductor sector looking rather foolish. However, it’s a very mixed bag in that group right now. There are certain companies poised to benefit considerably from the AI phenomenon while others are left out in the cold. (The latter includes what was once the planet’s most dominant and innovative semi producer). Personally, I remain short the semiconductor ETF, but I may cover that before long and replace it with more targeted negative bets. In the meantime, it might be wise to consider those companies that are major suppliers to Nvidia as buy candidates, particularly the one that provides them with their most advanced chips. For now, I’d hold off on any buys due to the extreme price increases seen by the AI chip winners, but putting some of the “arms merchants” on a watch-list is logical, in my view.

The semiconductor ETF

Junk Bonds (of the lower-rated variety)

Homebuilders stocks

Meme stocks (especially those that have soared lately on debatably bullish news)

Financial companies that have escalating bank run risks

Electric Vehicle (EV) stocks

The semiconductor ETF

Meme stocks (especially those that have soared lately on debatably bullish news)

Bonds where the relevant common stock has broken multi-year support.

Long-term Treasury bonds yielding sub-4%

Profitless tech companies (especially if they have risen significantly recently)

Small cap growth

Mid cap growth

Technical clarification:

Per the EIA’s explanation, which we’ve paraphrased/summarized here, achieving the UF6 conversion from its so-called “yellowcake” form into the usable U-235 is necessary for compatibility with present-day nuclear reactor function, specifically those used in the United States (standards inevitably vary from place to place). As U-235 is “a stronger concentration” than what one would find in its organic state, the enrichment process is essential for effective operation. The EIA specifies as such: “Two types of uranium enrichment processes have been used in the United States: gaseous diffusion and gas centrifuge.” The aim here is to achieve enrichment within a specified U-235 concentration range, which the EIA characterizes as being from 3-5%. Only at the point of enrichment to within that range is the processed uranium viable as a nuclear-fuel source.

From our knowledgeable consultant:

Yellowcake as you might know is over 99% U238 with about 0.72% U235. As just one step in the front-end process of the nuclear fuel cycle for nuclear power plants, yellowcake then goes through a conversion process and other steps to make fuels for nuclear reactors. While abundant in the earth’s crust, U238 is not a stable isotope. It undergoes alpha decay into U234.

Whether weighing in from a political, environmental, or economic perspective, your thoughts on the nuclear topic are definitely of interest to us. Drop us a comment before you head out!

IMPORTANT DISCLOSURES

This material has been distributed solely for informational and educational purposes only and is not a solicitation or an offer to buy any security or to participate in any trading strategy. All material presented is compiled from sources believed to be reliable, but accuracy, adequacy, or completeness cannot be guaranteed, and David Hay makes no representation as to its accuracy, adequacy, or completeness.

The information herein is based on David Hay’s beliefs, as well as certain assumptions regarding future events based on information available to David Hay on a formal and informal basis as of the date of this publication. The material may include projections or other forward-looking statements regarding future events, targets or expectations. Past performance is no guarantee of future results. There is no guarantee that any opinions, forecasts, projections, risk assumptions, or commentary discussed herein will be realized or that an investment strategy will be successful. Actual experience may not reflect all of these opinions, forecasts, projections, risk assumptions, or commentary.

David Hay shall have no responsibility for: (i) determining that any opinion, forecast, projection, risk assumption, or commentary discussed herein is suitable for any particular reader; (ii) monitoring whether any opinion, forecast, projection, risk assumption, or commentary discussed herein continues to be suitable for any reader; or (iii) tailoring any opinion, forecast, projection, risk assumption, or commentary discussed herein to any particular reader’s investment objectives, guidelines, or restrictions. Receipt of this material does not, by itself, imply that David Hay has an advisory agreement, oral or otherwise, with any reader.

David Hay serves on the Investment Committee in his capacity as Co-Chief Investment Officer of Evergreen Gavekal (“Evergreen”), registered with the Securities and Exchange Commission as an investment adviser under the Investment Advisers Act of 1940. The registration of Evergreen in no way implies a certain level of skill or expertise or that the SEC has endorsed the firm or David Hay. Investment decisions for Evergreen clients are made by the Evergreen Investment Committee. Please note that while David Hay co-manages the investment program on behalf of Evergreen clients, this publication is not affiliated with Evergreen and do not necessarily reflect the views of the Investment Committee. The information herein reflects the personal views of David Hay as a seasoned investor in the financial markets and any recommendations noted may be materially different than the investment strategies that Evergreen manages on behalf of, or recommends to, its clients.

Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this material, will be profitable, equal any corresponding indicated performance level(s), or be suitable for your portfolio. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Investors should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Great read, David. Thank you!

Great history lesson on MSRs and LWRs and Dr Weinberg's role. Very interesting. Looking forward to the Haymaker podcast with Micro Nuclear. I've been long uranium for a good while. Thanks!