The Seagull Has Landed

“To begin with, you’ve got to understand that a seagull is an unlimited idea of freedom, an image of the Great Gull…” -from Richard Bach’s early-1970s mega-bestseller, Jonathan Livingston Seagull

Sorry to break it to you, but your long list of new-age acronyms and initialisms needs to expand a bit more. For all of us who have grown familiar with “EVs” there’s now an enhanced version: “NEV”. This stands for “new energy vehicle”. The main difference is that it includes both EVs and plug-in hybrids. The latter are more of a curiosity in the U.S., but in the world’s most important EV market — make that NEV market — plug-in hybrids are a big deal. That would, of course, be China.

Plug-in hybrids — here I go again, PIHs — have both batteries and small internal combustion engines (yup, here I go again — ICEs). The latter provide on-the-fly recharging, which goes a long way (pun intended) to alleviating “range-anxiety”. This is the fear of finding yourself stranded God-knows-where — but nowhere near a charging station — with a battery as dead as King Tut.

In the global competition to be the numero uno NEV producer, you might be surprised to learn that Elon Musk’s company lost that lead in the second quarter of last year. Since then, Tesla has been falling further behind in total NEV deliveries. His considerable fan base would no doubt point out that TSLA still sells more pure EVs than his new archrival, a company that happens to count the ultimate icon of American investing success as one of its largest shareholders. The referenced entity is China-based BYD and the 10% owner is Omaha-domiciled Berkshire Hathaway, Warren Buffett’s legendary conglomerate.

To learn more about Evergreen Gavekal, where the Haymaker himself serves as Co-CIO, click below.

“BYD” stands for “Build Your Dreams”. And for Mr. Buffett, as well as his nonagenarian sidekick, Charlie Munger, it has been a dream investment indeed. The ever-opportunistic duo invested $230 million for a 10% stake in BYD during the depths of the Global Financial Crisis. Their timing was impeccable. With BYD valued at $100 billion today, that $230 million is now valued at $10 billion. Even by the Oracle of Omaha’s standards, that’s a spectacular return on investment.

The best may be yet to come. Mr. Munger was recently quoted to the effect that BYD is so far ahead of Tesla (TSLA) that “it’s almost ridiculous”. What is unquestionably ridiculous is the valuation gap between TSLA and BYD. Currently, that amounts to nearly $800 billion, with TSLA valued at almost nine times BYD’s market capitalization.

Another unquestionable fact is that the Chinese market for NEVs is brutally competitive. BYD is poised to make it even more brutal. It has unveiled an EV (i.e., not a hybrid), the Seagull, that will have a base price as low as $10,000, per The Wall Street Journal. Good grief, I thought the batteries cost more than that! But I guess BYD has dreamed up a way around that affordability problem. Some experts are predicting the Seagull will become the highest-selling car in the Chinese market within six months of its launch. At that price, it certainly seems possible, if not probable. If its producer’s dreams are realized, that will definitely qualify as a Great Gull, perhaps the Great Gull of China.

This can’t be good news for TSLA’s position in its second-biggest market (admittedly, an amazing accomplishment a mere four years after first production). Moreover, it’s not just BYD that poses a threat to Mr. Musk’s Chinese empire. Local brands overall now represent 54% of sales. This is a remarkable reversal after decades of playing runner-up to Western brands. Including BYD, nine of June’s top 10 bestselling models in China were local nameplates. Only TSLA is still on that list.

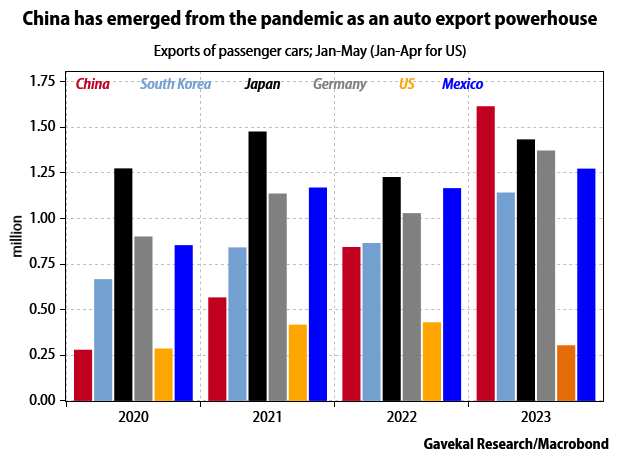

But this isn’t only a problem for Western automakers like Volkswagen, GM, and Ford which once either were coining big money in China or had grand aspirations to do so. Chinese automakers are now on the verge of taking the lead in global exports, as you can see below. Based on the slope of the red line — an appropriate color for a country whose name in the West once was co-joined with it — a new leader will soon be crowned. Based on the trend through April of this year, that’s already happened.

Overall NEV sales in China are leaving the rest of the world in the dust. Their sales vaulted 44% in the first six months of 2023. They now represent a third of total sales, compared to 7% in the U.S. One might be tempted to think this is great news for limiting CO2 and, more importantly, other truly noxious emissions. Sadly, the opposite is true.

Because China generates around 70% of its electricity from coal, EVs are actually worse for the atmosphere. (BEVs are better, ironically, because of their gasoline-fired engines.) However, I’d argue that’s a secondary consideration for Chinese policymakers. A more pressing one is that coal is both cheap and plentiful in China. In point of fact, it is the world’s largest importer of oil but largely meets its coal needs with internal supply. A cynic might argue that this is why China has made such an aggressive push into NEV manufacturing — not to mention, that it gives it even more control over the Great Green Energy Transition. It’s not a stretch to see the parallels with solar, where it drove prices down to levels that crushed competitors, granting it ever more power over the photovoltaic supply chain.

To learn more about Evergreen Gavekal, where the Haymaker himself serves as Co-CIO, click below.

Besides needing a lot of coal to power them — even in Western countries, though not nearly to the same degree as in China — EVs (and NEVs) also consume a lot of copper. Estimates are that EVs require three to five times as much copper as ICE vehicles. As with oil, copper prices have been slammed due to economic concerns. (The commodity complex has clearly not gotten the no-landing/soft-landing memo, though there are nascent signs that’s changing.)

In its June 19th issue, Barron’s profiled America’s leading copper producer, a long-time Haymaker favorite. Frankly, over the last two years, it’s been a nothing burger. The hot money is obviously not chasing this one, despite its fortress of a balance sheet (unlike in years gone by) and the extremely bullish long-term outlook for copper.

In my admittedly biased view, the market is not appreciating the extraordinary surge in Chinese NEV production that is catalyzing the equally remarkable arc of its exports. These promise to increasingly displace both EV and ICE models in Asia and Europe (less so in the U.S. due to steep tariffs). As Chinese EVs gain more market share in those regions, the shift to EVs from ICEs is likely to accelerate, especially at a $10,000 per-auto price point (plus shipping; not a minor cost, by any measure).

The re-industrialization of America is also nearly certain to be a driver of material incremental demand for the red metal (that term is another selling point in China!). On the downside, China’s halting recovery from its lockdowns and the ongoing extreme stress in its property markets are major drags to copper demand. Overall, I believe the future is shiny indeed for this metal and its leading producers. However, the prices of most copper stocks have rallied meaningfully, along with the overall market, since last fall. As a result, I’d suggest a slow dollar-cost-averaging accumulation process. In the long term, though, I think Cu will at least double, with its miners/fabricators performing even better.

For sure, Seagulls aren’t among the noblest or most intimidating of the avian species. When it comes to autos, though, this one has the potential to morph into a ferocious hawk. If so, it might cause Mr. Musk to admit that Tesla “NEVer” imagined it would have to compete with a $10,000 price tag. If he had, perhaps he wouldn’t have wasted spent $44 billion on Twitter… which might just get ripped to threads.

(Many thanks to my good friend Doomberg for his contribution of key factoids to this note.)

Champion Picks

Copper-producing stocks

Industrial sector ETFs

Uranium

Japanese yen

Defense industry (particularly those contracted to manufacture in-demand weapons systems)

Oil and gas producer equities (both domestic and international)

Gold & gold mining stocks

Farm machinery stocks

Select financial stocks

S. Korean stock market

For income:

BB-rated bonds from dominant media companies and healthy automakers with upgrade potential

BB-rated intermediate term bonds from companies on positive credit watch

Certain fixed-to-floating rate preferred stocks

Select LNG shipping companies

Emerging Market debt closed-end funds

Mortgage REITs

ETFs of government guaranteed mortgage-backed securities

BB-rated energy producer bonds due in five to ten years

Select energy mineral rights trusts

Contenders

After the big run companies like Halliburton and Schlumberger have had since the end of May, the oil field services sub-sector looks much less attractive. This is another case where I still like the multi-year story, but this group is notoriously volatile and prone to sharp corrections. My experience is that it’s wise to cash in some chips after a 25-30% pop in less than two months with these names, as has happened. Even from the date of my table-pounding energy recommendation in our June 23rd Haymaker edition, these have produced very healthy returns.

My preference would be to reduce position sizes a bit, but for short-term traders, a bigger sell-down might make sense. One other consideration is that I have come to believe China may use its own sizable Strategic Petroleum Reserve to keep crude prices under $100, possibly even sub-$90. My partner Louis Gave believes they are unlikely to do meaningful releases, as the Biden administration has done, but that it will simply curtail buying should prices run up too quickly. While that may work for a period of months, I don’t see it capping oil’s upside over the next year or two.

Contender List

U.S. oil field services companies

Oil and gas producer equities (both domestic and international, with a particular focus on those well exposed to the Permian Basin)

Top-tier midstream companies (energy infrastructure, such as pipelines)

Singaporean stock market

Top-tier midstream companies (energy infrastructure such as pipelines)

Short-intermediate Treasurys (i.e., three-to-five year maturities)

Japanese stock market

European banks

U.S. GARP (Growth At A Reasonable Price) stocks

Telecommunications equipment stocks

Swiss francs

Singaporean stock market

Intermediate Treasury bonds

Small cap value

Mid cap value

Select large gap growth stocks

Utility stocks

Down For The Count

It’s a trip down meme-ory lane! Meme stocks are back with a vengeance worthy of Dirty Harry. However, it’s not the former Robinhood/Reddit darlings like GameStop and AMC Entertainment leading the second charge of the lightweight brigade. Instead, a car retailer that recently had a near-death experience and a crypto exchange platform that has been in the SEC’s crosshairs are the new lottery tickets du jour. The former is up an astounding 550% since early May. The latter, by comparison, has merely doubled over that timeframe.

The latest catalyst for the car merchant has been a valiant effort to shore up its harrowing balance sheet. Unfortunately, S&P Global wasn’t impressed, as it downgraded this entity’s bonds from CCC to CC yesterday. (By the way, D is the lowest rating rung; D might stand for “default”, because this is where bankrupt bonds reside.) Like most meme favorites, this one continues to lose copious amounts of money.

With the crypto exchange operator, in addition to its regulatory woes, it is also hemorrhaging red ink. As with EVs in China, this industry is coping with fierce price-cutting. This hasn’t prevented its legion of true believers from bidding it up to a market cap of $24 billion.

If you own either of these, reducing your exposure, at a minimum, into these incredible runs is likely your best course of action. If you don’t, and you’re looking for some downside protection during this extension of Bubble 3.0 (aka, the Everything Bubble), buying some puts might prove lucrative. As with all put buying, however, you should realize you might lose your investment. (In full disclosure, I personally have negative bets on both of these companies though, in my case, via outright shorts.)

DFTC List

The current shooting stars of the latest meme mania (remember, those celestial phenomena last only a few weeks — at the most)

Long-term Treasury bonds yielding sub-4%

Homebuilders stocks

Electric Vehicle (EV) stocks

Meme stocks (especially those that have soared lately on debatably bullish news)

The semiconductor ETF

Junk Bonds (of the lower-rated variety)

Financial companies that have escalating bank run risks

The semiconductor ETF

Bonds where the relevant common stock has broken multi-year support.

Profitless tech companies (especially if they have risen significantly recently)

Small cap growth

Mid cap growth

IMPORTANT DISCLOSURES

This material has been distributed solely for informational and educational purposes only and is not a solicitation or an offer to buy any security or to participate in any trading strategy. All material presented is compiled from sources believed to be reliable, but accuracy, adequacy, or completeness cannot be guaranteed, and David Hay makes no representation as to its accuracy, adequacy, or completeness.

The information herein is based on David Hay’s beliefs, as well as certain assumptions regarding future events based on information available to David Hay on a formal and informal basis as of the date of this publication. The material may include projections or other forward-looking statements regarding future events, targets or expectations. Past performance is no guarantee of future results. There is no guarantee that any opinions, forecasts, projections, risk assumptions, or commentary discussed herein will be realized or that an investment strategy will be successful. Actual experience may not reflect all of these opinions, forecasts, projections, risk assumptions, or commentary.

David Hay shall have no responsibility for: (i) determining that any opinion, forecast, projection, risk assumption, or commentary discussed herein is suitable for any particular reader; (ii) monitoring whether any opinion, forecast, projection, risk assumption, or commentary discussed herein continues to be suitable for any reader; or (iii) tailoring any opinion, forecast, projection, risk assumption, or commentary discussed herein to any particular reader’s investment objectives, guidelines, or restrictions. Receipt of this material does not, by itself, imply that David Hay has an advisory agreement, oral or otherwise, with any reader.

David Hay serves on the Investment Committee in his capacity as Co-Chief Investment Officer of Evergreen Gavekal (“Evergreen”), registered with the Securities and Exchange Commission as an investment adviser under the Investment Advisers Act of 1940. The registration of Evergreen in no way implies a certain level of skill or expertise or that the SEC has endorsed the firm or David Hay. Investment decisions for Evergreen clients are made by the Evergreen Investment Committee. Please note that while David Hay co-manages the investment program on behalf of Evergreen clients, this publication is not affiliated with Evergreen and do not necessarily reflect the views of the Investment Committee. The information herein reflects the personal views of David Hay as a seasoned investor in the financial markets and any recommendations noted may be materially different than the investment strategies that Evergreen manages on behalf of, or recommends to, its clients.

Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this material, will be profitable, equal any corresponding indicated performance level(s), or be suitable for your portfolio. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Investors should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Nitpicky note: There's no avian species called seagull. There are several species of gulls. Sorry, I'm a birder.

These Chinese cars cannot be imported into the US as they don't have all the federally mandated safety gear required. I they did, they would not cost $10K. Many US drivers would prefer a slightly less "safe" car for a much better price, IMO. But my IMO does not count :-(

Just when we thought you were smart, you start throwing shade and practically bashing the most innovative automaker in the history of mankind, Tesla -- seemingly to suck up to geezers Buffett and Munger who obviously have a big stake in a competitor. If these guys were as smart as you think they are, they would have scooped up Tesla years ago as I fortunately did.