Tallying Time

Image: Shutterstock

“It’s always hard to make predictions, especially about the future.” -Yogi Berra

Recently, I expressed an intent to provide a summary of my best and worst “anticipations” for this year. That time is now. Pulling this together was more of a project than I anticipated but it was valuable for me to go back and review both my hits and misses. Fortunately, there were more of the former than the latter but some of my whiffs were on the embarrassing side. Let’s start with those.

Haymaker Misses

Miss #1: The economy would accelerate by summer, 2022.

This wasn’t totally off the mark because after, arguably, a recession in the first half, the U.S. economy did perk up a bit. Yet, to be fair, I expected something much more vibrant after getting past the economic drag caused by the two Covid variants, Delta (remember that one?) and the oddly named Omicron. My belief was that there was considerable pent-up demand and at least $1.5 trillion of excess savings that built up through the first phase of the pandemic, as well as during Delta and Omicron.

However, the war in Ukraine was a shock to the global system and caused me to become much more guarded in my outlook. This was in no small part due to the energy price explosion that followed Putin’s aggression, particularly in Europe. Coal and natural gas prices surging to previously unseen levels made a European recession a virtual lock (a view I still hold despite a material moderation in energy costs over there).

China’s repeated Covid lockdowns were another drag on global growth that I didn’t anticipate. Regardless, by last June I had grudgingly shifted into the “There will be a recession soon” camp. (As Lord Keynes said: “When the facts change, I change my mind. And what do you do, sir?”)

Miss #2: Oil prices wouldn’t retreat to $70/barrel.

That looked like a safe prediction until the very end of the year but I was ultimately proven wrong. My focus was, and continues to be, on record-low inventories of crude, at least when including the Strategic Petroleum Reserve. As you may know, this has been drawn down to the lowest level in at least 20 years. It may even be the lowest since its creation as a percentage of global demand; if not, it’s at least in that zip code. While I think of it as a near-term anomaly, and oil prices are headed much higher in 2023, this one goes into the “Miss” column.

Miss #3: The U.S. dollar would weaken.

As I’ve previously admitted several times, this was my worst call for 2022. Instead of breaking down, as I thought it would, it did a moonshot, at least by major currency standards. Generally, a 10% move in a year is a big deal. But the dollar index was up 19% by late summer, before experiencing a sharp correction. Despite that retracement, it remains up 9% for 2022, a remarkable performance.

My view continues to be that it’s highly likely to endure a steep decline relative to scarce natural resources like oil, natural gas, copper, uranium and aluminum, as well as many agricultural commodities. Ironically, commodities did perform well in 2022, as I anticipated, spurting 25%, and that rarely coincides with a strong dollar. Yet, as you know, the world we now live in doesn’t lack for stranger things.

Now the fun part — what I got right!

Haymaker Knockout Hits

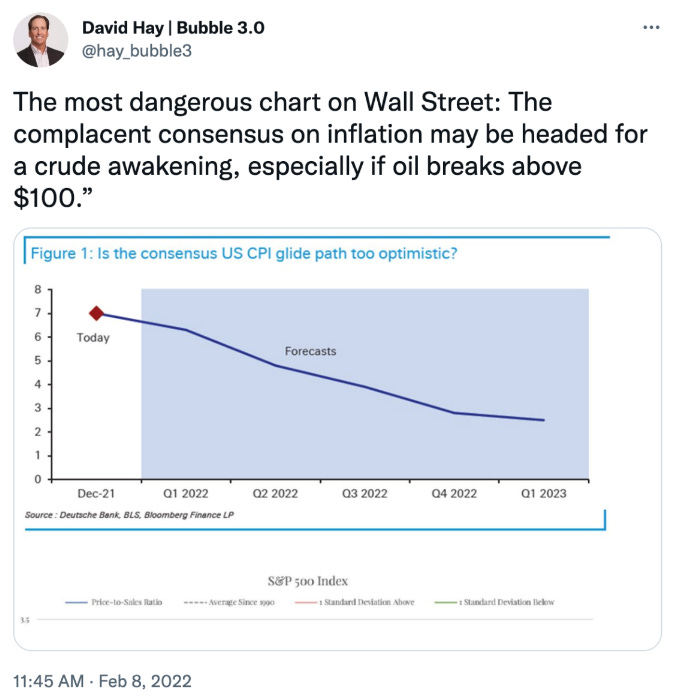

Hit #1: Inflation would stay high.

By the end of last year, even Jay Powell was conceding inflation was no longer transitory as he and his fellow Fed-heads had so repeatedly assured the world. But the rise in the CPI through most of 2022 was well beyond what all but the most cynical observers anticipated (even me!). Please realize that’s why those of you collecting Social Security received an almost double-digit increase.

As the year matured, I began anticipating its rate of increase would decelerate. That has indeed happened, but it remains uncomfortably high. This has caused Jay Powell to summon up the ghosts of Fed chairmen past, particularly the legendary inflation slayer Paul Volcker. It has also caused many pundits to now accuse him of overdoing the tightening. So far, however, he’s showing no indication of backing down anytime soon.

Hit #2: The stock market would have a rough year.

As usual, Wall Street overall was predicting an up-year with only a few renegades like Morgan Stanley’s ultra-astute Mike Wilson dissenting. Here’s what I wrote, again early in 2022:

“Is a serious bear market guaranteed to happen again? There’s no such thing as certainty when it comes to stock and real estate prices but… My personal twist on this is that I believe both the economy and inflation will prove more resilient to Mr. Powell’s own sudden epiphany — his desire to be the second coming of Paul Volcker. Ironically, this comes after years of him acting like the Anti-Volcker. The stock and property markets — especially, office buildings, in the latter case — are a much different story."

For extra credit, commercial real estate (and in particular office buildings) is under serious stress as 2022 comes to a close. I was also exceedingly negative on absurdly overpriced growth stocks at year-end 2021, as this excerpt underscores:

"As various EVAs over the last two months have noted, there has been serious carnage over that timeframe in a wide range of aggressive growth stocks. Yet, there remains a multitude that continue to trade at heroic, if not absurd, valuations. In my view, most of these are poised to get crushed in 2022.”

(EVA, the Evergreen Virtual Advisor, was my long-time newsletter that was the predecessor to the Haymaker)

The devastation seen in high P/E stocks — if they had any “E”, or earnings — was only rivaled by the first tech bubble implosion. By the way, that was the cataclysmic blow-up of Bubble 1.0 which, in turn, led to Bubble 2.0 (housing) and Bubble 3.0 (almost everything).

To learn more about Evergreen Gavekal, where the Haymaker himself serves as Co-CIO, click below.

Hit #3: A likely cryptocurrency crash was looming.

Most of my attacks on the crypto mania were in Chapter 10 of my book, Bubble 3.0. We published this out of sequence as only the third installment of our digital publication. We did this to be ahead of what I felt was an intensifying bear market. This went out to our subscribers during the first week of February 2022 (the complete chapter published on the 12th). The particular object of my scorn was Dogecoin, though I commended its founder for his candor. Here’s an excerpt:

“While there has been a lot of shameless promoting of various cryptos by their creators and paid floggers — often with the express intent of the insiders selling into the buying frenzy they whip up — that accusation cannot be leveled at Billy Markus, the co-founder of Dogecoin. In early 2021, Mr. Markus told The Wall Street Journal that: ‘The idea of Dogecoin being worth 8 cents is the same as GameStop being worth $325’…’It doesn’t make sense. It’s super absurd. The coin design was absurd.”

To make it clear it wasn’t just Dogecoin that I believed was a total dog, I added this: “While there may be a bounce in them after the cliff-dive they’ve experienced since last fall (when I was writing this chapter!), I’m convinced there is considerably more downside in many of these ‘securities’ such as the craziest of the cryptos. And that would be almost all of them.”

Hit #4: The “joys” of Modern Monetary Theory (MMT).

It was my contention that the fiscal (government spending) and monetary (Fed money printing) incontinence seen during Covid would lead to inflation and a nasty day of reckoning. Below was my commentary from January 31st, 2022, when it was already revealing its dark side:

“As many EVA readers know, this is the policy the US adopted in the post-Covid world that permits trillions of dollars of deficit spending financed by the Fed’s Magical Money Machine (MMM). Thus, it’s a perfect duet starring MMT and MMM … one that is destined to bomb.

It’s been my view, expressed as far back as early 2019, that MMT’s Achilles heel was inflation. Now that it’s been fully implemented that tendon has ruptured. Perhaps it’s no coincidence that since inflation has, over the last year, become America’s most serious economic challenge those who were not long ago singing the praises of MMT have suddenly come down with laryngitis. It must be a Covid thing.”

As I warned in Bubble 3.0, this isn’t the first time MMT was attempted. The history of these episodes is that they initially create a boom in asset prices, followed by a disastrous bust. That’s a key reason I don’t think we’ve seen the worst of the fallout from what I’m convinced was the biggest bubble of all-time.

Hit #5: Zero-Covid policies were approaching their sell-by date.

To wit: “In last week’s EVA, I made the point that countries, like New Zealand, and city-states, such as Singapore, that once had a goal of zero Covid infections are giving up on this policy. The strategy of adapting to the pandemic through vaccines, protection of vulnerable individuals, and common-sense protection measures, short of lockdowns, are likely to be adopted by a growing number of countries.”

The big holdout on this reality acceptance was, of course, China. But just last month that changed in a massive way. Xi Jinping’s personal fiefdom has done a complete 180° and is tolerating Covid running rampant in order to achieve some degree of herd immunity. Its resistance to Western vaccines — and, particularly in my view, anti-viral meds like Paxlovid — is making this belated move extremely high-risk, unavoidable as it likely is.

Hit #6: Fed Storm Rising.

While the markets were convinced our precious central bank would tighten, but slightly and slowly, I once again took issue with the consensus view. Here was my Fed anticipation from back in the first quarter:

“Gently tapping the brakes is not an option, it now needs to slam them. Further, as it fabricated $120 billion/month for most of last year — and continued to create fake money even into this year — it now needs to oversee only the second ‘double tightening’ in history.” By double-tightening, I was referring to both raising rates and flipping from its notorious QE (Quantitative Easing) to QT (Quantitative Tightening, the inverse of QE).

This has become the fastest and most extreme Fed tightening in over 40 years. It’s fair to say that hardly any mainstream economists or strategists saw this degree of stimulus withdrawal coming. Maybe that somewhat makes up for my bad dollar call…or maybe not.

Hit #7: The Great Rotation, Redux.

Here was my take on this exceedingly important development for stock market investors: “As regular EVA readers know, it’s been my hope that the US market would experience the oft-discussed ‘Great Rotation’. This refers to a shift away from the Ark Innovation type stocks and toward those that have immensely more reasonable valuations. As I’ve often noted, this is what happened back in 2000 to 2002 as the ‘NAZ’ tanked by almost 80% and ‘old economy’ stocks actually appreciated.”

To drive home how great this rotation has truly been, consider that the NASDAQ is down over 30% this year. Meanwhile, the Russell 1000 Value Index, populated with much lower P/E companies than the “NAZ”, has retreated a mere 10%. Of course, it’s even more striking when comparing to the profit-free cohort which is down (see below) 77%. This was exactly what I was warning about regarding the COPS (Crazy Over-Priced Stocks) when I repeatedly criticized them in this newsletter’s predecessor, EVA, particularly back in early 2021. Another illustration of the magnitude of the shift is that the far more valued-skewed Dow is beating the S&P by the most since 1933.

Chart: Evergreen via Bloomberg

Nevertheless, It seems to me millions of tech-obsessed investors want to see the NASDAQ return to its bull-market ways that so dominated the prior decade, particularly its second half. In my mind, that seems like wishful thinking other than for the type of flashy, but fleeting, rallies it’s displayed this year. They don’t call it a Great Rotation if it only lasts for a year or two. The one that began in 2000, in the wake of the late ‘90s tech frenzy, didn’t truly end until 2008 when the housing market crashed. That destroyed financial stocks, one of the mainstays of the value style. In my opinion, this current rotation is likely to last at least as long. After all, it was growth stocks, especially of the profitless kind, that were among the main beneficiaries of the biggest bubble in recorded human history.

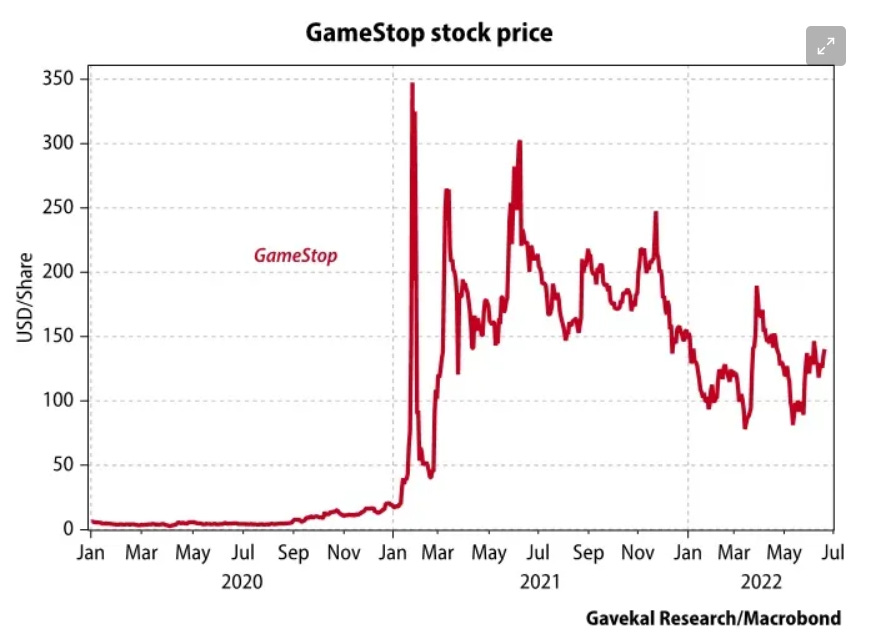

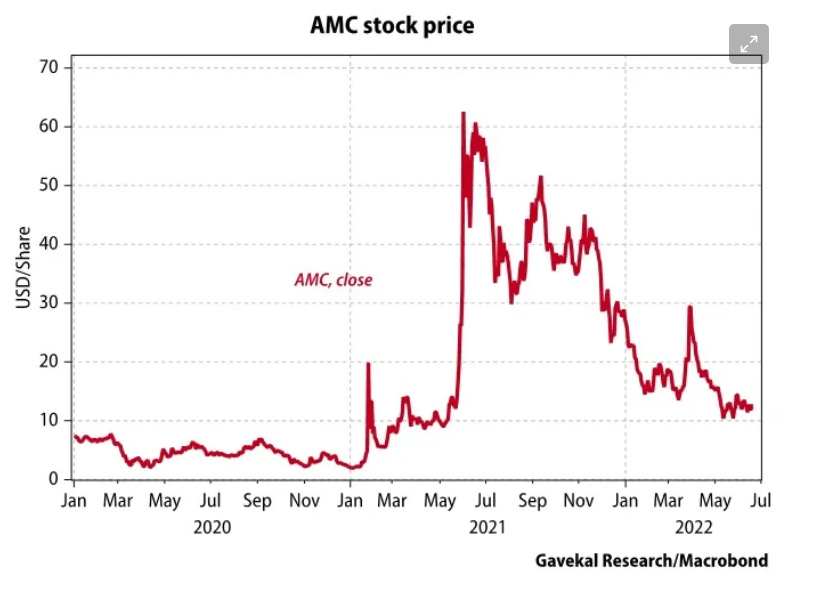

Hit #8: Meme stocks were due for a repeat crash.

In early 2021, my previous newsletter was extremely critical of the hockey stick moves by stocks such as GameStop (GME) and AMC Entertainment (AMC). This was when they attracted tremendous media attention and celebrity touts such as from Mark Cuban and Elon Musk (the latter of whom also shamelessly flogged the worthless Dogecoin). They also broke a couple of previously successful hedge funds, causing the press to view this as a “David vanquishing Goliath” outcome.

The problem is the “David” in this case was David Portnoy, aka, Davie Day Trader who was one of the main “influencers” of the meme mania. He self-styled himself as the new Warren Buffett, though one with a penchant for bombastic obscenities, rather than for Cherry Coke. (Will we lose people with this?) Here was one of his typically “modest” self-appraisals from this era: “I’m sure Warren Buffett is a great guy but when it comes to stocks he’s washed up. I’m the captain now.”

Well, Captain Portnoy better be ready to go down with his sinking ship, because the objects of his desire, and self-serving promoting have, in many cases, vaporized by 80% to 90% from when he was thumbing his nose at the Oracle of Omaha. Meanwhile, Mr. Buffett’s flagship, Berkshire Hathaway, made a new all-time high early this year. It remains above where it was anytime in the past, other than during that spike.

As Haymaker readers know, I’ve also been pretty much on the money with my anti-touts of AMC and GME during their periodic rallies this year. Typically, those have been on the flimsiest of bullish news. Here’s what I wrote this past April Fool’s Day (appropriately enough):

“At one point this year, AMC’s stock had plunged from around 27 on December 31st to under 14. But the news of the company’s mining adventure caused it to perform another one of its moonshots. Earlier this week, it vaulted to just over $30, more than doubling from its March 14th low.

AMC’s terrible meme twin, GameStop, has performed a similar logic-defying jaw-dropping recovery. Like AMC, it was cut in half from 12/31 to 3/14 but since then it also doubled. And it didn’t even need to announce a gold mine deal to catalyze the upside explosion.”

Today, AMC is trading under five while GME has broken below 20 — enough said!

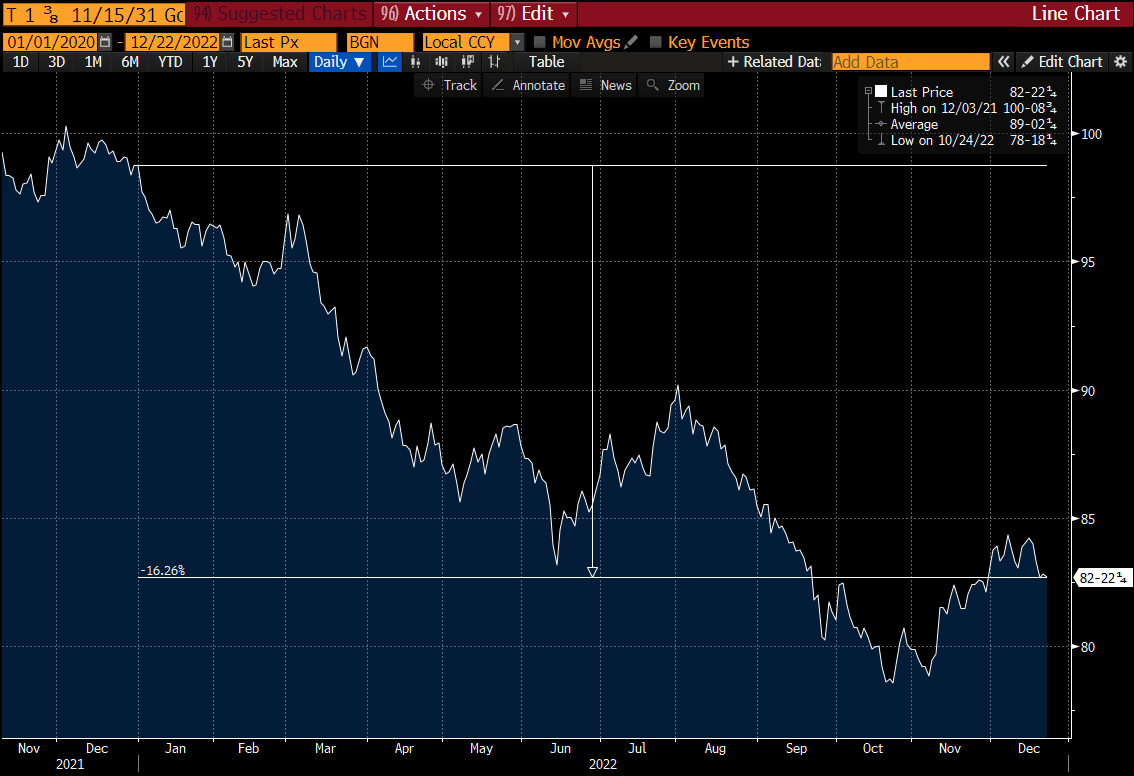

Hit #9: Treasury bonds were poised for a pummeling.

It’s hard to believe today, when a one-year T-note yields 4½%, that at the start of 2022 the 10-year maturity was yielding a mere 1½%. This was with inflation running in the vicinity of 6%.

Chart: Evergreen via Bloomberg

Because I believed inflation was likely to stay elevated, if not move higher, that yield made no sense to me. As a result, I repeatedly expressed my negativity towards longer-term treasuries until summer when their much higher yields caused me to become neutral on them, and even suggest light buying.

This was definitely among my better calls, as this has turned out to be the six worst year for global government bonds since — wait for it — 1700! At one time, U.S. treasury debt had its biggest losing year since the founding of the Republic.

Be sure to check out our next Haymaker for my anticipations about 2023 (scheduled for Friday, January 6th), including on where interest rates are headed in my view. Naturally, there will be a lot more ground covered but the direction of bond yields and Fed policy are among the most critical factors, as this year demonstrated.

The Haymaker team wishes you a healthy and happy Holiday Season! And how about this for a gift idea: share this Haymaker edition with your friends, colleagues, associates, and family members. Those who choose to subscribe (as you all have wisely done) can start receiving our twice-weekly content on January 6th. It really does mean a lot to us.

Until next year…

Appreciate the clear evaluation, and putting the misses up front.

Merry xmas. Hopefully there will be as many hits and misses in 2023 as in 2022. Thats what makes investing interesting after all (of course in total, we want to have more hits than misses, monetarily speaking :) )