“Just as the Fed doesn’t determine the breadth of the boom, it can’t dictate the scale of the bust.” -The Wall Street Journal’s Greg Ip

“The stock market is a device for transferring money from the impatient to the patient.” -Warren Buffett

Realizing that many of you have read at least some of my new book, Bubble 3.0, I am somewhat reluctant to include the following excerpts. On the other hand, we have thousands of new readers who have had minimal, if any, exposure to its contents.

Further, as we all are painfully aware, there have been fairly seismic market disruptions since we first began to publish it via Substack. It was because I became convinced Bubble 3.0, the mania itself, was bursting last fall, we began to publish chapters as early as last October via my former newsletter, the Evergreen Virtual Advisor (EVA). However, the actual unveiling of the book itself began in January.

On January 31st we threw some readers for a loop by running Chapter 10, The Insanity Bubble, right after Chapter 1. We did so because, by then, my belief was that what I’ve long called the Crazy Over-Priced Stocks (COPS) were beginning to do a Tom Petty… as in, free fallin’. Since that chapter was published, the NASDAQ 100, where many of the COPS were heavily represented, has tumbled 20.75%. Perhaps an even better example of the COPS is the UBS Profitless Tech Basket. It’s no exaggeration to say that there was a long list of these entities which have turned out to be true basket cases. To that point, it has slumped 44% since The Insanity Bubble ran, a little over four months ago.

One of the specific areas of speculative excesses I called out in that chapter was the once white-hot SPACs. These were already in swoon mode when we published, but I had targeted them via my newsletter during 2021, giving readers a heads-up to avoid them. But even if one had only reacted once The Insanity Bubble was published, they would have avoided another 22% hit. From the time I aggressively called out SPACs, in our January 8th, 2021, EVA, the SPAK ETF has lost over half its value.

A development that has bordered on the astounding this year has been the tenacity of the speculative impulses that hit a crescendo in 2021. You would think that based on the severity of the losses inflicted by the COPS, and the other nutty stuff like the shakiest of the cryptos, money would be flowing out of them. Yet, the QQQ, which provides 3x the exposure to the NASDAQ 100, has experienced significant inflows this year. The same is true with Cathie Wood’s ARKK Innovation Fund, which has mostly been highly innovative at losing money for its investors.

What I’ve tried to do below is to pull out the most relevant sections of Chapter 10 to give those who haven’t read it a sense of its main thrust. Even if you have read it, a review in the wake of what’s transpired in the market may be worth your time. However, if you’d like to do a speed-read, feel free to skip to the last section where you will find a short article from Charles Gave.

In addition to being the father of my partner and great friend, Louis Gave, Charles is one of the few dinosaurs left in the investing business whose career included the epic bear market of 1973-1974. Because, as I’ve written a number of times, I think there are many parallels with this decade and the 1970s, his reminiscences of that era strike me as critical for investors to consider. (Long-time readers of my newsletters may recall that, for many years, I would run a Gavekal-authored piece once a month. It’s my intent to return to that cadence; this Haymaker is a hybrid version.)

The Bubble 3.0 excerpts are bracketed by quotation marks with a brief lead-in from yours truly. The overarching theme was my belief that what we’ve seen since Covid was the culmination of the biggest bubble of all-time. In reality it was a series of interrelated bubbles with the underlying common cause being central bank money for — and from — nothing. Events now seem to be validating that viewpoint. My main motivation for writing Bubble 3.0 was to go on record as to its enormity, its perpetrators, and its multitude of dangers to investors and the economy at large.

Enough with the introduction, already! Here’s how I began The Insanity Bubble:

“In my admittedly totally biased opinion, I believe this is one of the most important chapters of this book, if not THE most important. That’s because it pulls together an abundance of evidence on the sheer lunacy that commandeered America’s investing mindset in 2020 and 2021. If you were to suggest friends and family read just one chapter in this book, I’d recommend it for that purpose.

The below April 2021 cover from New York Magazine succinctly captures the prevailing zeitgeist of this era, the ‘new world of money’, as it refers to it, that I will chronicle below. It’s definitely a very brave new world... if not an utterly reckless one.

Beyond dodgy Dogecoin and the thousands of likely value-free cryptos floating around, there is also the issue of the so-called ‘stable’ coins. (In my mind, due to their questionable long-term viability and fiction of stability a better name might be ‘fable’ coins.) Tether is the dominant stable coin and is used for most crypto transactions, including Bitcoin.* Thanks to my great friend and fellow newsletter author extraordinaire, Grant Williams, I came to believe in the summer of 2021 that Tether is a fraud. That’s a strong word, and it deserves some serious backing up… which is exactly what I’ll now do.

In case you don’t know, a stable coin is supposed to be backed one-to-one with something like U.S. treasuries or other ultra-safe assets. For years, Tether insisted that was true in its case. Unfortunately for the planet’s leading stable coin, New York State Attorney General, Letitia James, begged to differ.”

*As many readers are aware, one of the most widely used stable coins, TerraUSD, totally collapsed last month, precipitating another down leg in the cryptocurrencies. (This footnote does not appear in the book.)

“Many crypto fans concede that Tether smells bad. But their common rationalization is that it really doesn’t matter to Bitcoin and the other digital ‘currencies’. Some even think Bitcoin would go up as money flows from Tether into Bitcoin directly, should the leading fable-, sorry, stable-coin implode.

They might be right but, again, I don’t think that’s what the odds favor. Because so much funding of cryptos has been via Tether and other ‘stable coins’, anything causing millions of investors to question their backing would seem to me to be a cataclysmic event in crypto space.

The crypto exchanges like Coinbase* also would almost certainly come under intense pressure due to any broad crisis of confidence. Even some ardent crypto fans are advising investors to extract coins from the crypto exchanges to avoid what could essentially be a run on them.

Here’s one fascinating factoid to end this section on: during the Covid crisis, the market value of all cryptos was $154 billion. By March of 2021, it was $1.75 trillion. Astounding, yes, but not the ultimate shocker — four months later that number was $3 trillion. And yet our precious central bank is still afraid to utter the “B” word**!”

Then there were NFTs:

“Consider these illuminating comments by Evan Beard, national art services director at BofA’s Private Bank in Barron’s Penta. First, he noted the advantages, and then just a bit of a problem. ‘Art gives you utility and NFTs have been lacking in the utility delivered to the client—in the aesthetic value, the pleasure, the status.’ Then, the not-so-hot news: ‘We believe 99.9% of NFTs being minted right now will go to zero.’ That seems a bit extreme to me but in the approximate disastrous neighborhood (and reminiscent of what is probably in store for almost all those 6000 or so cryptocurrencies)”

Next was my SPAC attack:

“The craziness doesn’t end with NFTs, of course. There is another acronym that is in some ways yet more outrageous, if nothing else for the large sums involved. This initialism is SPAC and it stands for Special Purpose Acquisition Company. SPACs are basically so-called ‘blank check’ entities. They are funded by investors who are willing to trust that the SPAC will make wise investments with the capital they raise. Typically, the actual investment is unknown at the time of funding, hence the blank check nomenclature.

SPACs became enormously popular in 2021 despite their opacity. In the first quarter alone, SPACs represented $170 billion in mergers and acquisitions, commonly known as M&A, amounting to roughly 25% of all M&A activity...This early year hyper-popularity caused me to warn in my January 1st, 2021 EVA that SPACs were due for a serious spanking.

* Coinbase has lost nearly two-thirds of its market value since Chapter 10 was published. (Again, this footnote, and the following, were not in Bubble 3.0.)

** As in bubble, a term the Fed has repeatedly gone out of its way to avoid.

“Before moving ahead to the next example of 2021’s casino conditions, I’ll end this section with one of the most incredible case studies in SPAC absurdity. A SPAC by the name of Hometown International managed to raise $2.5 million, including from the universities of Duke and Vanderbilt. Perhaps that sounds like a modest amount, but its market value was anything but in May of 2021 when it hit $100 million. What was truly modest was the SPAC’s lone asset (other than its rapidly depleting cash): a delicatessen in Paulsboro, New Jersey. This was not exactly the second coming of Carnegie Deli; it’s total sales in 2020 were $13,976. That’s right — no zeroes after the number.

Hometown International’s CEO also serves as the wrestling coach at the local high school. He grandly told The Financial Times that: ‘We will not restrict our potential candidate target companies to any specific business, industry, or geographical location.’ Perhaps a wrestling coach’s skills are exactly what’s needed for a tiny deli to do a takedown of a much larger entity… which would be just about any company.

As Columbia law professor and takeover expert John Coffee told the FT, referring to Hometown International, … ‘(It) is a self-parody of a SPAC. And that’s what I would expect at the end of a bubble.’ Hedge fund legend David Einhorn, marveling at this monstrous disconnect between true value and market value — even by 2021’s outrageous standards — quipped: ‘The pastrami must be amazing.’”

Source: CNBC

And, of course, I highlighted the memorable meme stocks:

“Due to their stunning ascents, GME and AMC became two of the Russell 2000’s largest holdings, regardless of their fundamentally unjustifiable valuations. (When AMC was trading in the 40s in the summer of 2021, the average analyst price target was $5.40, with a high of $16 and a low of $1!) Thus, BlackRock and Vanguard, with their constant inflows of billions upon billions, became two of the largest holders of GME and AMC in 2021. So much for the efficient market theory in action! And perhaps that’s why, by late January 2022, the Russell 2000 Growth Index was approaching a 30% smackdown from its early 2021 peak even as the S&P 500 was still not even in actual correction mode.

As I was writing these words in the fall of 2021, GME and AMC, the signature meme stocks, have gone through multiple cycles of breathtaking run-ups and nauseating bungee dives. However, the Himalayan heights they hit in January and June 2021, respectively, have not been retaken. At this point, they appear to be in a long, jagged return to terra firma and their legions of FOMO/YOLO traders seem to have increasingly lost interest in them. As numerous media reports indicated, many (most?) of them have lost considerable sums of money, too. Of course, the influencers, like Mr. Gill, likely made a killing. When he reportedly liquidated his position in GME, he was alleged to have accrued $20 million in gains on it. Who said ‘pump and dump’ was illegal?”

Here's how I concluded The Insanity Bubble:

“These manias are in a way metaphors for the new American meme, to borrow that term, which has, in many ways, replaced the old American dream: The idea that money, success, prosperity, fame, early retirement, to be another Kevin Gill and have all of the above, whatever is your ultimate dream scenario, can be attained nearly overnight and without the typical extreme effort, like Gladwell’s oft-cited 10,000-Hour Rule.

Maybe today it’s the Fed’s ten-trillion (almost) rule. If it can magically whip up trillions of fake money, why try to succeed the old-fashioned way? We’ve moved to the polar opposite of those ancient John Houseman Smith Barney ads: ‘They earn it!’ Rather these days, it seems as though with outfits such as Robinhood it's more like ‘We churn it!’ It wins — and Citadel wins even more — but the millions of social media market warriors who trade through them and fell for the get-rich-quick siren song, end up wiped out and even angrier than they were before they were infected with meme madness.

It’s the ‘something for nothing’ mindset and I believe the Fed has enabled that attitude. The eight trillion it has generated literally just from its computer banks has reverberated and been amplified not only through financial markets but through much of American society. We’ve been led to believe, particularly through MMT — which, in my mind, unquestionably produced the insanity bubble — that fake money can produce real and lasting prosperity. Again, to me, nothing could be further from the truth. This has been a massive fake-out and millions have fallen for it.

To end this chapter on the modern-day madness of crowds, I thought this anecdote was an ideal capstone: Someone very lucky, or very smart, bought $8000 of a Dogecoin knockoff known as Shiba Inu (SHIB) in August of 2020. It was worth $5.7 billion 13 months later! Somehow, being a billionaire just isn’t quite as exclusive as it used to be. In my mind, the eventual post-mortem of this biggest bubble ever is almost certain to conclude along the lines of: ‘How could so many have been so stupid?’ Except, of course, for those rare individuals savvy enough to sell into the insanity.”

Now, let’s get Charles Gave’s take on current market conditions…

Are We There Yet?

As young parents, my wife and I would bundle our four children into the car for a nine hour drive to my parents’ house in southern France. Mere minutes after starting on the road, at least one child would ask a question that the others would often repeat throughout the journey: “Are we there yet?”

Many years later, I find a similar question being asked of me regarding the current bear market. Though the context is very different, the implied questions are the same: “Is the pain over yet? Can I start having fun again?”

My answer depends on the nature of the bear we are facing. If we are in a gentle, black bear market—meaning -20% from top to bottom—then yes, the worst of it is over. If, however, we are in an Ursus magnus of -50% or more, then there is more pain to come. Unfortunately, there is a high probability that we are in such territory (see On The Cusp Of An Ursus Magnus).

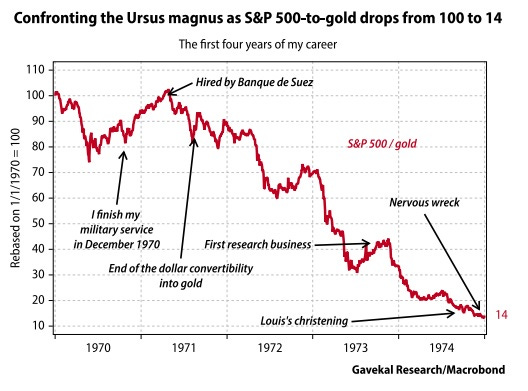

It would not be my first experience with such a market. My career started at the top of a bull run in 1971 before plunging into a four-year Ursus magnus, with the S&P 500-to-gold ratio tumbling from 100 to 14 (see chart overleaf).

• February 1971, I am hired by Banque de Suez, a merchant bank in Paris; a glorious future is in front of me. The S&P 500-to-gold ratio peaks at 102.

• August 1971, Richard Nixon cuts the link between gold and the US dollar. The first leg of the bear market moves the ratio to 60 in 1972, but a rally at the end of 1972 brings it to 70. Nixon is triumphantly reelected.

• In the first six months of 1973, the market loses another 50%, and the ratio hits 32.

• September 1973. As no one at the bank could explain what was going on, I leave to create a research firm based on asset allocation—a relatively unknown concept at the time. A month later, the Yom Kippur war sends the price of oil through the roof. The S&P 500-to-gold ratio hits 20.

• September 1974. Louis is being christened as the ratio passes 17. After the ritual, the priest asks me what I do for a living. “I am loaded with French equities,” he confessed after learning that I worked in finance. “What should I do?” My answer was simple: “Pray, Father. Pray.”

• By end-1974, the ratio bottomed at 14, and I was a nervous wreck.

Thus ended the Ursus magnus, a traumatic experience that shaped the investment philosophy of those who lived through it. Alas, there are fewer and fewer of us, so I would like to share three lessons I have learned.

• According to Warren Buffet, a bear market is the process through which capital returns to its legitimate owner. If such a process has just started, given the excesses of the last decade or so, it may take both time and heavy price movements for the assets to return to their legitimate owners.

• Initially, nobody understands why the market is falling and the return on invested capital is collapsing. In 1973-1974, soaring energy prices helped crater ROIC around the world. The S&P 500-to-gold ratio had fallen by -70% and would tumble another -50% from there. As Irving Fisher wrote in 1934, over-indebtedness is always the cause of great bear markets. My educated guess is that the next Ursus magnus will arise from a collapse in both European bonds and social democracies, leading to a drop in consumption of the middle class similar to the Asian Financial Crisis.

• By the end of the bear market, no one will be asking “are we there yet?,” as those who did would have already been fired. Investors who ask such a question tend to be those who achieved success by borrowing to buy more as the markets went up. In a bear market, however, the survivors are those legitimate owners of capital. One such investor was my mentor, a Swiss banker named Ernest Gutzwiller who told me his secret to success: “Never lend money to somebody who needs it.”

-Charles Gave

A Word From The Haymaker’s Corner

Our readers have been helping out greatly with plenty of “Likes” and insightful commentary on our work. We thank you for that and will always eagerly check out what you have to say. And if you’re loving the Haymaker’s content enough to regularly visit us ringside, we invite you to become a subscriber (if you aren’t one already) and hope you’ll share the content with any friends who might enjoy weekly thoughts on markets, banks, commodities, politics, and more.

There’s that bell once again. The fight continues.

Charles Gave comments are the key to the next few years unless the Fed reverses course soon.

Good write up. Love Charles Gave comments especially the bankers comment.... "never lend money to someone who needs it"