Hello, Readers and Subscribers:

This week we are once more highlighting the work of one of our favorite financial market and economic thinkers, Vincent Deluard. Vincent is the Global Macro Strategist at San Francisco-based StoneX (yes, there are still some businesses located in Babylon by the Bay).

As we’ve admitted before, Vincent has been more accurate in his economic forecasts than we have over the last couple of years. While we did correctly anticipate the profits and industrial recessions, we were wrong about an economy-wide downturn. Vincent, however, was dead on the mark. Accordingly, it’s a good idea to consider what he has to say at this juncture, particularly with incoming data looking like the powers-that-be might want to foam the runway for the so-called soft landing.

One of Vincent’s most persuasive points is that tax collections are still coming in strong. Unsurprisingly, consumers and businesses rarely pay taxes on income they don’t actually generate. His factoid about a 26% increase in self-employed tax payments to a surprisingly hefty $432 billion is particularly convincing.

Vincent has consistently been noting the vitality of the “gig economy” with Uber and its army of drivers being the poster child. Other economic oracles have viewed such jobs as a sign of weakness due to a swelling number of people needing to work part-time jobs to maintain their lifestyles. However, the jump in tax collections would indicate that’s not the case in aggregate.

Because of this surge in U.S. government receipts, he’s also noting that the deficit is falling materially. Frankly, that runs counter to the Congressional Budget Office’s full-year deficit forecast of $1.9 trillion for this federal fiscal year. That was a big increase from the $1.5 trillion it had been predicting. But perhaps Vincent’s data are more up-to-date.

Conversely, this week brought a whopping 818,000 downward revision to the official payroll report for the year ending in March. As most readers are aware, this is a development we’ve been expecting. Accordingly, the jobs market is not nearly as robust as popularly believed.

Admittedly, this seems at odds with the aforementioned income tax receipts. At this point, we would chalk it up to yet another conflicting and confusing data point, of which there have been a plethora.

From the Haymaker perspective, the scales seem to be tipping more toward the probability of a pending recession. However, as we did recently by sending you a link to a podcast Adam Taggart recorded with Danielle DiMartino Booth — who is becoming even more adamant a downturn has already begun — and one Adam did with Darius Dale, who is in the Vincent Deluard camp, we like to provide you with both sides of this essential debate. As our other friend, Cornerstone Analytics’ energy savant Mike Rothman, likes to say, stay focused on the data. Hopefully, someday economic data won’t be so muddled; maybe at that point we won’t feel quite as stupid as we do now!

The Haymaker Team

It’s Not the Economy, Stupid!

Vincent Deluard

“Whoa, man! You just ran through a big pile of dog shit!

- It happens.

- What, shit?

- Sometimes.” – Forrest Gump, 1994

Forrest Gump’s observation that “sometimes, s%#t happens” may be true but it is unacceptable for CNBC’s advertisers.

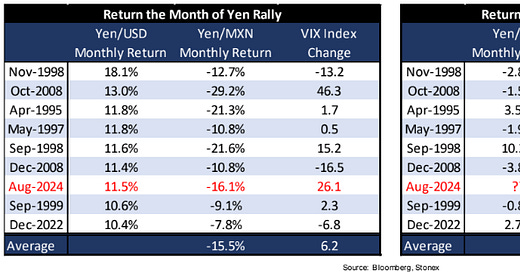

The VIX’s intraday spike to 65, the Nikkei’s 12.4% plunge last Monday, and the triggering of the arbitrarily-defined Sahm rule must be woven into a narrative which can be related to the lives of its audience.