“Like Liberty, gold never stays where it is undervalued.” - John S. Morrill

“Invest in scarcity.” -Tony Deden, as relayed to me by Grant Williams

Charts of the Week

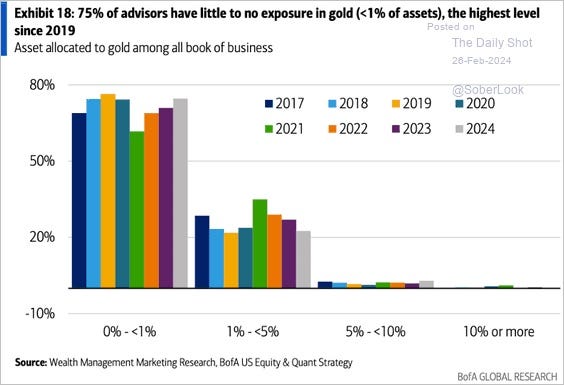

Gold’s decisive breakout this week has attracted scant media coverage. Perhaps that’s because the yellow metal has been out-of-favor since 2020. Its steady, but deliberate, increase from the September 2022 trough — when the S&P 500 coincidentally also hit bottom — might be why it has stayed off the financial media’s radar. Since then, it is up 29%. While that trails the S&P’s 45% return over the same timeframe, it is nonetheless a respectable return, particularly for a lower risk asset. Reflecting its store of value nature, it is increasingly edging out U.S. Treasurys as the reserve asset of choice for foreign central banks. Despite its rising popularity, particularly in China and India that have a combined population of nearly 3 billion, the majority of U.S. investment advisors have less than 1% exposure to bullion. That may be poised to change in a significant way.

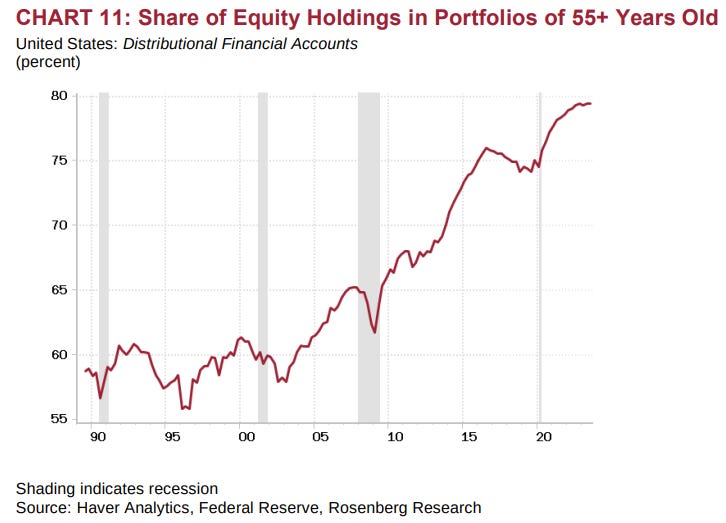

The long bull market has caused older investors, those who should be the most risk-averse, to be heavily exposed to the stock market. Although the trend is clearly up, it will be challenging for this percentage to rise much higher. Also, if you look closely at the below chart, you’ll notice an example of another excellent breakout signal back in 2005. There was a sharp reversal during the Great Recession/Global Financial Crisis, but the rising trend quickly reasserted itself. Much of that era was characterized by negligible competition from bonds due to the Fed’s long war against interest rates. Now, however, more mature investors can earn 6% type returns from bonds, as highlighted in numerous prior Haymaker publications. In other words, there are some compelling alternatives out there for investor capital. (Thank you, Jacob Rosenberg, for consistently being willing to let us run your excellent charts!)

Good morning, Readers and Subscribers!

It’s been a little over a week since my good friend Adam Taggart had me on his successful new program, Thoughtful Money. Adam always pushes me to bring my A+ game, which for me means coming to the table with loads of charts! Hopefully, I didn’t disappoint in that regard. This time around, my team and I (thank you to my Gavekal partners!) put together some data-dense slides on government capital needs, the viability of our oil wells, the 2024 inflation outlook, U.S. IPO history (the ‘90s are back), IT/Communication companies’ stock surge, and even the Hong Kong market, along with much more.

This interview isn’t just the slides but Adam grilling me on what they mean. I’m always happy to share my insights (and Gavekal data!) with Adam’s audience, and I’m doubly happy to re-share them here.

By the way, around the 24-minute mark, I admit my frustration with the gold mining stocks, and have more to say on their performance around 41:40. Fortunately, since then, they’ve come alive. In fact, the Junior Gold Miners that I upgraded recently are up 14% from when Adam and I chatted. That’s nice, but be careful about your entry price should you like this idea (and if you didn’t accumulate some already). Long-term, they have a tremendous amount of catching up to do, in my view, relative to the gold price.

Enjoy!

Dave “The Haymaker” Hay

Video: Thoughtful Money

IMPORTANT DISCLOSURES

This material has been distributed solely for informational and educational purposes only and is not a solicitation or an offer to buy any security or to participate in any trading strategy. All material presented is compiled from sources believed to be reliable, but accuracy, adequacy, or completeness cannot be guaranteed, and David Hay makes no representation as to its accuracy, adequacy, or completeness.

The information herein is based on David Hay’s beliefs, as well as certain assumptions regarding future events based on information available to David Hay on a formal and informal basis as of the date of this publication. The material may include projections or other forward-looking statements regarding future events, targets or expectations. Past performance is no guarantee of future results. There is no guarantee that any opinions, forecasts, projections, risk assumptions, or commentary discussed herein will be realized or that an investment strategy will be successful. Actual experience may not reflect all of these opinions, forecasts, projections, risk assumptions, or commentary.

David Hay shall have no responsibility for: (i) determining that any opinion, forecast, projection, risk assumption, or commentary discussed herein is suitable for any particular reader; (ii) monitoring whether any opinion, forecast, projection, risk assumption, or commentary discussed herein continues to be suitable for any reader; or (iii) tailoring any opinion, forecast, projection, risk assumption, or commentary discussed herein to any particular reader’s investment objectives, guidelines, or restrictions. Receipt of this material does not, by itself, imply that David Hay has an advisory agreement, oral or otherwise, with any reader.

David Hay serves on the Investment Committee in his capacity as Co-Chief Investment Officer of Evergreen Gavekal (“Evergreen”), registered with the Securities and Exchange Commission as an investment adviser under the Investment Advisers Act of 1940. The registration of Evergreen in no way implies a certain level of skill or expertise or that the SEC has endorsed the firm or David Hay. Investment decisions for Evergreen clients are made by the Evergreen Investment Committee. Please note that while David Hay co-manages the investment program on behalf of Evergreen clients, this publication is not affiliated with Evergreen and do not necessarily reflect the views of the Investment Committee. The information herein reflects the personal views of David Hay as a seasoned investor in the financial markets and any recommendations noted may be materially different than the investment strategies that Evergreen manages on behalf of, or recommends to, its clients.

Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this material, will be profitable, equal any corresponding indicated performance level(s), or be suitable for your portfolio. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Investors should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Is investing in India a good idea at this point?