Image: Shutterstock

”Let’s begin by throwing out projecting an end of fed fund rate increases based

upon inflation, unemployment, or other macroeconomic factors. The end of Fed

tightening will come when something breaks and the Fed will have no choice but

to reliquefy the system, an event which I would expect before year end, and most

likely before the end of the World Series.” -Scott Minerd

October has been and will continue to be a big month for the Haymaker. We have exciting interviews scheduled (both hosting and appearing on other programs), another one already recorded (with the Millennial Investor), and we’re also making some formatting/calendar adjustments about which we’d love your input. First, though, let’s quickly cover a few market observations and suggestions.

For financial markets, this week/month started out with a bang… and of the positive variety, for a change. Admittedly, some of the air has been sucked out of the rally the last two days. Despite that fade, it’s been particularly gratifying to Team Haymaker to see the hard-asset sectors like the gold miners and energy stocks, that have suffered severe corrections in recent months, lead the way. To that point, they bottomed, at least for now, about four trading days before the S&P 500 did. From their lows, the gold mining stocks ETF, GDX, and the energy ETF, XLE stocks, have snapped back roughly 14% and 20%, respectively. This is compared to a mere 2% for the S&P itself (at this week’s apex, the S&P had rallied nearly 6%). Another member of our Tracked Equity Portfolio, the iShares U.S. Oil Equipment and Services ETF (IEZ) has soared an even more impressive 25% in the last nine trading days.

Leading copper producer Freeport-McMoran (FCX) also rallied by about 10%, again much more than the overall market. Interestingly, GDX, XLE, FCX and IEZ all bottomed on September 26th. It was at that point that rumblings of “peak dollar” began to circulate. If what I’ve often referred to as “The Wrecking Ball Dollar”— shamelessly stealing this term from Michael Kao — is done slamming almost everything in sight, that’s very good news for a multitude of asset classes. But few areas are likely to benefit as much as the resource-based sectors which have been so negatively impacted by the dollar’s remarkable ascent. (In fairness, economic fears have also been a heavy weight on them.)

To learn more about Evergreen Gavekal, where the Haymaker himself serves as Co-CIO, click below.

The reality is that these fiat currency hedges remain well off their highs set earlier this year. In the case of GDX and FCX, “well” is an understatement. They have been crunched by 39% and 44%, a not-very-respectable respectively. After its recent pop, XLE has had a controlled correction of 10% and is still up a standing-ovation-worthy 51% for the year, made all the more extraordinary in comparison to the S&P’s approximate 22% slump.

As we’ve noted a few times since financial markets began their downward acceleration last spring, this has been the greatest wealth destruction seen since at least the Great Depression. But if you really want to see some serious pain and suffering, check out the below table:

Table: Sterling Kuder

Real estate was one of the biggest winners through Bubble 3.0, particularly in the post-pandemic period when the Fed flooded the system with a tsunami of fabricated trillions. As you can see above, the payback for the excesses created by reckless monetary policies has been horrific. But, again, it’s a far more precarious situation in many other countries.

Australia has long been known as “The Lucky Country” because it has avoided a recession for decades. It also experienced a housing bubble that makes the U.S. version look like one of Don Ho’s tiny bubbles (a pop-culture reference I also used, of course, in Bubble 3.0).

Image: Wikipedia

But its luck may now be running out; Aussie housing prices are falling at the fastest clip in 30 years. Because they are coming down off such a grotesquely inflated level, the potential for a 2008-like price crash, such as America and Europe experienced back then, is considerable.

It’s much the same story in Canada, where home prices have risen 400% this century/millennium. Incomes have increased a much more modest 70%. Illustrating the magnitude of the difference versus the U.S., the numbers are 100% for both appreciation and income gains in the States. Yet, the U.S. has also seen home prices rise materially above what was considered to be the mother of all property bubbles. The increase in new home prices is particularly shocking.

Chart: BWD (Rosenberg)

The risk of a global bear market in housing is toward the top of my long worry list, as many readers are aware. It continues to concern me that there is precious little media coverage of this evolving debacle. Be prepared for that to change in a big way in the months ahead. We’ll continue giving it the attention its concerning nature warrants.

Returning to the stock market, despite this week’s mini rally, there are increasing signs of serious stress throughout the global financial system. The UK bond fiasco, as discussed last Monday, is the most salient example. However, the old market saw that there is rarely just one cockroach is highly applicable in this case. The many years of central bank-eradicated interest rates forced entities with long-term liabilities (pension plans, insurance companies, etc.) to play a plethora of dangerous games. Expect more revelations of massive losses from derivatives — the typical gambit employed to goose returns — to be forthcoming shortly.

One of the few bright spots in recent months has been the slump in oil prices. OPEC+ managed to at least partially block that ray of light this week by announcing a two-million barrel per day (bpd) cut in its output quotas. As perhaps you’ve read or heard, the net impact is considerably less. Yet, per our crack oil expert, Cornerstone Analytics’ Mike Rothman, the reduction is still a whopper at around 1.5 million bpd. This is more than the Biden administration’s 1 million bpd release from the Strategic Petroleum Reserve (SPR) and that may end soon. However, the actions by OPEC+ (the “+” is basically Russia), have caused the Biden administration to threaten continued SPR drawdowns. If so, this will take what are already dangerously low SPR inventories down to truly alarming levels.

Chart: Michael Hartnett

OPEC+ has made it clear it would like a price of at least $90/barrel. If the market were glutted, as it was in 2020, that would be a pipeline pipe dream. But with global crude markets tight as Spandex on a sumo wrestler, with worldwide demand growing faster than forecast for seven straight quarters, OPEC+ is in the driver’s seat. This should become even more apparent as Chinese demand recovers, sanctions on Russian energy shipments become more severe, and Europe sucks up every barrel North America can spare and ship. (The Biden administration is also now threatening to ban U.S. oil and gas exports, which would be truly cataclysmic for Europe.)

The sabotage of Nord Stream pipelines 1 and 2 is also nearly certain to exacerbate the global energy shortage for years to come. This is likely to be a more enduring bullish catalyst for US oil and liquified natural gas (LNG) demand than OPEC’s move. This is because it makes Germany, in particular, exceedingly dependent on US energy exports.

Mike Rothman maintains a $120 price target in the very near future, at least for Brent Crude. If that happens as quickly as he thinks it might, it’s going to be a major headwind for financial assets… and Mr. Biden’s mid-term election aspirations.

Interviews

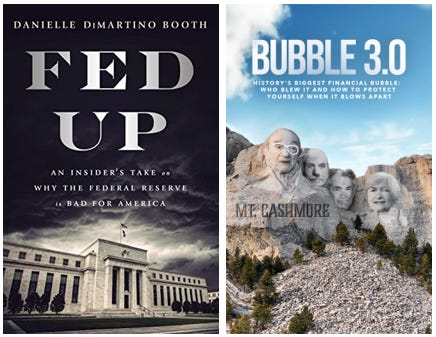

Later this month, I will have the first-time honor, as the Haymaker, of interviewing my friend and financial heroine Danielle DiMartino Booth. The interview itself will take place on October 21st, with the plan of publishing it that following week. If you have particular topics you’d like me to cover with Danielle, or if there are any questions you’d like me to ask during our conversation, please provide them in the comments section. Given the overlap between her Fed Up (see below) and my own Bubble 3.0, you can expect us to take turns hitting the hapless heavy bag that is the Federal Reserve.

Book Covers: Fed Up (Booth), Bubble 3.0 (Hay)

Format Change

I think we can all agree that Making Hay Mondays are extensive. And just when you think you’ve reached the end, we hit you with intricate tables and an addendum of lengthy lists.

So, here’s the change we’re making:

Starting this coming Monday (October 10th), we will be pushing out the Tracking Tables together with our Champions | Contenders | Down for the Count section as standalone weekly editions. Fridays (also starting next week) are to be reserved for the analytical material and will serve as a “strategy review” platform in which we will assess how certain highlighted stocks are performing in relation to the previous Monday’s picks. We’ll also provide updates on the economy, markets and pretty much anything in which I think you’ll have an interest.

As we are continuing to refine our publishing schedule and format, we will always welcome your opinions and ideas as to how we can best serve up our in-depth content. Again, please share those opinions in the comments section.

Holiday Publishing Note

Even with economic challenges and international crises looming, we are looking forward to the 2022 holiday season. We are also providing you some notice here that we have selected a handful of Mondays and Fridays during said season on which we will not be publishing — giving ourselves a moment to breathe and our subscribers a moment to catch up on any content they’ve missed.

Throughout November and December, we will take off about five normal publishing days, meaning we will not publish our standard MHM or editorial content. However, we might elect to share some Video Haymaker content on one or two of those days, as the Haymaker’s interview lineup continues to grow.

As with our request for input above, we are also open to suggestions you might have as to end-of-year topics about which you’d like the Haymaker himself to weigh in.

Thank You

We are coming up on six months in on this immensely fulfilling publishing endeavor, which we ourselves can’t believe. Starting this conversation with you and keeping it going on a twice-weekly basis has been an honor for us here at the Haymaker. Both economically and geopolitically, there’s a lot (maybe too much) to cover, but working away to keep giving you something sane to look forward to every Monday and Friday is a privilege we feel grateful to be enjoying. Thank you for sitting ringside so loyally for the first six months. Here’s to the next sixty.

Please be sure to share your thoughts (and this post) before you head out. We’d also appreciate a “Like” if you did, in fact, like today’s edition. Thank you much!

Mr. Hay, Thank you for your article. If your willing, perhaps you could ask Mrs. DMB which breaks first, the U.S. Dollar or U.S. Debt? Given the rising risks of both, I'd like to hear her answer. Thanks again and have a great week...P.S. If you address her in the manner I have, She'll know who asked the question. (or, at least, I hope she remembers...) :)

Excellent commentary.