The Next Big Short - Part I

In The Ring - November 18th, 2022

"... the whole world is one trade right now. And it's the trade on the dollar." -Brent Johnson

“Your strength is just an accident arising from the weakness of others.” -Joseph Conrad in Heart of Darkness

Image: Shutterstock

For those of you who have read my book Bubble 3.0 (sub-title: History’s Biggest Financial Bubble: Who Blew It And How To Protect Yourself When It Blows Apart), I think it’s fair to say it contained a number of accurate anticipations. One of them, however, was NOT my negative stance toward the U.S. dollar (USD).

Bubble 3.0 was digitally published early in 2022 when the dollar was trading at 96 vs its current 106-and-change level. For a stock, that’s not a big deal. For a currency, however, that’s a monster move and, consequently, a major whiff by this author.

Cherishing your weekly Haymaker reads? Let us know by liking, commenting, and (if you haven’t yet done so) subscribing.

Over the course of the last six months or so, I’ve been dropping hints that I would address this extraordinary greenback ascent. It’s now time for me to stop hinting and start hitting — something that comes naturally to the Haymaker.

One reason I’ve held off this long was my concern that it could keep running. Myriad hedge funds, commodity trading advisors (CTAs) and other trend followers love to play momentum, upward or downward. In the case of the USD, there has been plenty of “mo”—and totally of the upward variety, at least until very recently. The extreme bullishness of speculative positioning seen lately was also reflective of this phenomenon.

This powerhouse move has even attracted some of the same crowd that piled into the meme stocks when they were in moonshot mode last year. The Twittersphere has been crackling with their typically snarky takedowns of anyone who dares to question the USD’s supremacy. Even pundits as credible as Luke Gromen have been victims of their acerbic blowback. This is despite the fact that he’s repeatedly stated the USD might keep flying should the current supportive conditions remain in place. As you can see below, it’s had few historical rivals.

** USD - U.S. dollar; CHF -Swiss franc; EUR - euro; GBP - pound sterling; JPY - yen **

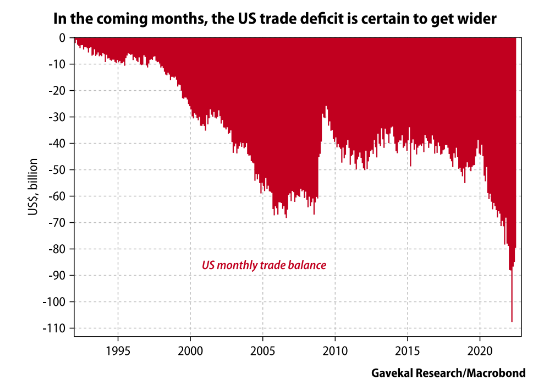

We’ll get to the USD’s elevating forces soon, but let’s start with what hasn’t been a driver: the U.S. trade balance. Usually, strong currencies correlate with hefty, or at least improving, terms of trade, also known as the current account surplus or deficit. Per Figure 2, based on this critical metric the USD should be slipping not ripping.

Another non-supportive influence is that of its reserve currency status. While it certainly remains in place, there is, in much of the world, an unmistakable move afoot to shift away from the USD. As my great friend and partner (some would add “in crime”, at least when it comes to our long-term bearish USD views) Louis Gave recently wrote: “Both the world’s largest commodity exporting nation and the biggest commodity importing nation are turning their back on the USD.” Of course, he’s referring to Russia and China, respectively.

To learn more about Evergreen Gavekal, where the Haymaker himself serves as Co-CIO, click below.

Yet, there’s much more than just a Russian and Chinese transition afoot. Saudi Arabia, increasingly at odds with the Biden administration, is cozying up to China. It is making noises that it will accept payment for oil in renminbi (RMB), China’s currency. This is a significant threat to the Petrodollar paradigm that has been in place for half a century.

Since the early 1970s, OPEC members have recycled their oil windfalls into dollars, primarily U.S. treasuries. This is one of the many reasons why the U.S. has been able to live beyond its means — actually, way, way beyond its means! China is also vectoring to be able to buy a long list of commodities in its own currency, directly from its suppliers, bypassing the USD as the medium of exchange. To this point, trading between China and Russia in their own currencies is up 1000% this year, once again per Luke Gromen.

One driving force behind the incipient move away from the USD is the specter of asset seizure by the U.S. government. An increasing number of countries are worried that their hard-earned — or, in some cases, ill-gotten — USD reserves might be appropriated in the event they do something that displeases the current occupant of the White House. This makes holding said reserves in greenbacks a distinctly less appealing option than it was in years gone by.

Another powerful influence not in the USD’s favor is its valuation versus other currencies. There have been numerous times in the past when the buck has been undervalued. Not so today — in fact, it is as overpriced as it has ever been on a Real Exchange Rate basis, at least since the mid-1980s during the Reagan-dollar rocket ride. The fact this has happened with the kind of trade deficit displayed in Figure 2 is particularly astounding.

Chart: Kemp

But let’s return to why the greenback has created such copious amounts of red ink for those who have been intentionally, or unintentionally, short the USD. On that most salient point, there is an estimated $25 trillion of emerging market debt denominated in USDs. While that’s not technically a short position, like someone who has expressly shorted Tesla, it essentially has the same effect. When the dollar rips against a currency like the Turkish lira, it takes much more in the way of lira to service the USD-based debt. When a currency does the kind of implosion seen below, it’s beyond a serious problem; it’s more like an existential crisis.

Chart: Exchangerates.org - (Turkish currency vs USD - Begins November 2021)

In reality, much of the USD’s strength this year is due to the weakness in most of the leading global currencies. Intriguingly, though, many emerging market currencies have held up remarkably well this year; in fact, some have actually risen versus the buck. This is in vivid juxtaposition to nearly all developed world currencies like the euro, the pound and, particularly, the yen. Its horrific performance this year lends credence to a phrase I’ve used about Japan in the past: The Land of the Setting Yen. (Sharp-eyed Haymaker readers will note the extremely prescient sell signal for the yen triggered when it broke below multi-year support late last year. Billionaire trader and hedge fund manager Paul Tudor Jones calls these “range expansions”, as I’ve previously highlighted.)

Chart: Google Finance

The primary reason the yen has been in free fall is the Bank of Japan’s (BOJ) insistence on maintaining its 10-year government bond yield (JGB) at 0.25%. This is in contrast to almost all of the planet’s other central banks that have been frenetically, albeit belatedly, raising rates. The BOJ is forced to print yen in order to finance the purchase of vast sums of JGBs at 0.25%, a rate that interests nary any other buyer.

This glut of yen forces it down even further, along with the related depressing factors of yield curve control and debt monetization. In other words, to keep rates at ¼% — despite what, for Japan, is roaring inflation of 3% — it needs to resort to its own version of the now thoroughly, and appropriately, discredited Modern Monetary Theory, aka MMT. (As an aside, I’m convinced the BOJ will soon need to say sayonara to its implementation of MMT, of which it was the first mover in the developed world. This much overdue cessation should lead to a muscular rally in the yen.)

That’s an apt lead-in to another of the USD’s propellants this year. In contrast to the BOJ, the Fed has been the developed world’s leader in the latest war on inflation. Yet, despite the rapidity and magnitude of Powell & Company’s interest-rate hikes, the reality is U.S. treasury yields are well below the current CPI. Per several prior Haymaker publications, this never happened, even in the inflation-wracked 1970s, under the much-derided Arthur Burns, other than for short time intervals. Despite his badly tarnished reputation, he got the fed funds rate above inflation in a few months, something Powell & Co is not even close to achieving.

Regardless, the Fed has been the toughest kid on the block, though one populated by wimps, when it comes to tightening. Again, this is true in the developed world, but a number of developing countries aggressively responded to non-transitory inflation last year. Several have successfully pushed their policy rates above inflation.

My brilliant friend Vincent Deluard has coined a new acronym for these emerging market stars: the BIMCHIPs. This stands for Brazil, India, Mexico, Chile, Indonesia, and Peru. It is his twist on the famous “BRIC” acronym that you may recall received tremendous publicity 15 years ago. As Vincent pointed out in his November Global Macro missive, most BIMCHIP bond markets have outperformed those in Germany, Japan, the UK, and the U.S., in dollar terms. Even more impressively, all have experienced positive stock market returns this year, even in USDs, with the exception of India, which is down a minor amount.

Despite this remarkable performance by a number of developing countries, the greenback’s valuation perception is a function of its behavior versus Japan, Germany, the UK and, to an extent, China. (The latter’s currency and government bond market have also held up much better than the first three.) There is little doubt our higher rates and earlier tightening have been a key factor in the USD’s ascent vis-à-vis the yen, euro and pound.

Another strong tailwind for the buck has been the escalating liquidity crisis. When there are problems erupting on a regular basis, money moves into the USD. This is despite some of the blow-ups that have been happening here, like last week’s complete nuking of FTX. These events can feed on themselves as spreading crises trigger a further loss of confidence and yet more inflows into the greenback. The chaos in the UK pension system over the last two months is a graphic example of this scenario (though it does seem to have led to a blow-off top in the USD).

Consequently, I would argue the four main positive influences on the dollar this year have been momentum, rapidly rising rates, a growing global liquidity crisis, and a monster short squeeze. But at least three out of those four may be slowing down and even reversing.

For one thing, cover stories like the below are typically the sign of a top in whatever adorns publications like Bloomberg, Fortune, and The Economist. The latter has had a particular knack for Wrong Way Corrigan feature pieces. Perhaps it’s no coincidence the buck has been buckling since these appeared.

Chart: Evergreen via Bloomberg

Image: Barron’s

Image: Businessweek

However, I will say this one by Fortune on FTX’s founder, Sam Bankman-Fried, might go down in history as the most embarrassing of all time. Given the sorry history of these events, that’s quite an achievement.

Image: Fortune

Then there is the horrific deterioration in America’s Net International Investment position. This tracks how much the U.S. owns vs how much it owes. Per the following image, I don’t think “horrific” is hyperbolic. Meanwhile, in Japan, despite its abundant problems (especially staggering government debt levels) its cup of foreign assets is overflowing. That’s another reason to expect a reversal of fortune between the USD and the yen, one that could be surprisingly powerful.

As a special Thanksgiving treat – hopefully, not a turkey of one – we will run the second half of this note tomorrow, particularly since we aren’t sending out a Making Hay Monday or written Haymaker next week. However, we will share the latest Haymaker As Host, starring the cerebral and exceedingly lucid Jim Rickards.

Another reason to do this as two-parter, in addition to avoiding information overload, is to highlight the importance of this topic. The so-called “Wrecking Ball Dollar” has been a critical factor in why 2022 has been so brutal for a wide-range of global investments. Accordingly, its reversal would be a major positive. This is especially probable for the hard assets that are such a vital hedge against the very real possibility that fiat currencies receive the last rites before long (just don’t ask me how long, long is!).

Love your articles, well written with some interestng pics but as an old timer one lesson I WILL NEVER violate is " Don"t fight the Fed" They told you rates are going up and this rally since Oct 10 is not believing them. Retirees with decent accounts are better off now with 3 mo T bills paying 4.25 % and will go up again in Dec. when they renew. History tells us that the odds favor waiting going back into stocks untill the first time the fed drops rates after a time of long increases.

David, you mentioned you think its time to start nibbling at mortgage REIT's maybe. But then you mention commerical real estate could be a major problem going forward. I would think most mortgage REIT's would be exposed to commerical real estate?