The Inherent Tension In Malthusian Bull Markets (Guest Haymaker - Louis-Vincent Gave)

In The Ring - July 1st, 2022

Introduction

Due to the fact I provided a short and glowing bio on Louis-Vincent Gave yesterday in advance of his podcast with my other friend Vincent Deluard, I will not repeat that (in case you missed it, here’s the link). However, because he wasn’t part of their chat, I didn’t mention his father, Charles Gave, who is referenced in this piece by Louis, our Gavekal Haymaker for this month.

Famed newsletter scribe John Mauldin, he of the 1,000,000+ followers, once said, slightly paraphrasing, that when Charles talks it’s like hearing the voice of God emanating from Mount Sinai. Though he’s eminently human, he’s definitely someone whose opinions I deeply respect. Like me, he’s been appalled by Western central bank monetary policies over the last two decades, and particularly since the 2008 Global Financial Crisis.

Now in his 70s, Charles has had a long and storied career in the financial industry. On that point, about six weeks ago, I had a chance to meet one of my other heroes in this business, Oaktree’s billionaire founder Howard Marks, as many of you are aware. As I was leaving, the last thing Howard told me was “Say hi to Charles”. Earlier, his eyes had lit up when he learned that my firm is affiliated with Gavekal - hence, Evergreen Gavekal.

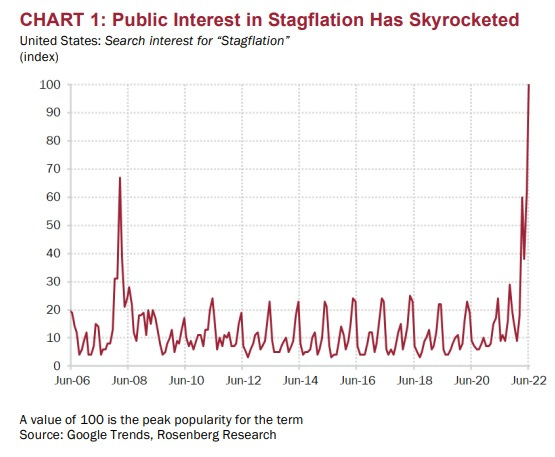

Charles and Louis are adept at creating master templates to describe the prevailing environment. In my past newsletters, I’ve cited their four quadrants matrix: Deflationary boom, Deflationary bust, Inflationary boom and Inflationary bust. Louis, Charles and I agree that the West has transitioned from an inflationary boom phase to the dreaded inflationary bust quadrant. This is another way of saying stagflation is the economic order — or disorder — of the day.

(We’re all “going stag” - some of the Haymaker’s favorite wordplay)

Sourced via Rosenberg

They’ve also done extensive research on the work of the three economists highlighted in Louis’s note below: Thomas Malthus, David Ricardo and Joseph Schumpeter. This trio had radically different views of optimal economic paradigms and/or the path down which humanity was likely to tread. Fortunately for mankind, the Malthusian world view has generally turned out to be excessively pessimistic and inherently erroneous… except when policymakers really screw things up. Suffice to say, that has been happening on an epic scale this century/millennium, particularly over the last decade.

Source: Wikimedia Commons

Regular Haymaker readers know my fondness for energy securities as powerful protection against lame-brained policies. My affinity has only grown stronger as they have been slammed since early June. But don’t take it from me; please read Louis’s thesis on why this is a buy-the-dip moment – unlike with the overall market where the proper reaction function continues to be, in my view, sell the rips.

Now, here’s Louis!

The Inherent Tension In Malthusian Bull Markets

- Originally Published in Gavekal Research | June 27th, 2022 - Edited/reformatted here as necessary

Charles and I have often argued that bull markets can be seen through the lens of three brilliant economists, namely, (i) Thomas Malthus and the fear “there won’t be enough for everyone”, (ii) David Ricardo, and the excitement of opening new regions and countries to capitalism, and (iii) Joseph Schumpeter, and the hope that humanity’s challenges will be addressed using “creative destruction”. Each of them addressed a key factor that drives capitalism: the need to save for an uncertain future (Malthus), the urge to see if others are doing things more efficiently than us (Ricardo) and the need to improve on what our forefathers did (Schumpeter). And because the stock market is both a temple of regrets and a field of dreams, it will always latch on to one of these three ideas and thus provide investors with long trends to ride. Only when all investors agree that the urgings one of these three economists is paramount should they radically shift their portfolio.

This bear market has been different in that it has been an “everything” bear market

It can be said that bear markets are there to transfer leadership from one set of firms to another. The current iteration is unusual in that, while global equity markets are flirting with bear market territory, more capital has been destroyed in the past six months than in any previous bear market. This is because the world is experiencing an “everything” bear market: government bonds, corporate bonds and real estate have all destroyed capital. Also, while this bear market is not yet an ursus magnus, the “Schumpeterian” parts of the market will certainly feel like they have had a grizzly mauling.

We have probably been in a Malthusian environment for a couple of years

In recent years, Charles and I have argued that the world economy was entering a Malthusian environment (see Portfolio Construction In A Malthusian World and Abundance And Shortages). This was not down to the world lacking physical resources, or population growth overwhelming resource supply, but because energy policies followed in the past decade or so have been inherently Malthusian (see An Own Goal Of Epic Proportions). As economic activity is energy transformed, if Western leaders are determined to constrain energy usage, the outcome must be higher energy prices or a collapse in growth—a Malthusian outcome if ever there was one!

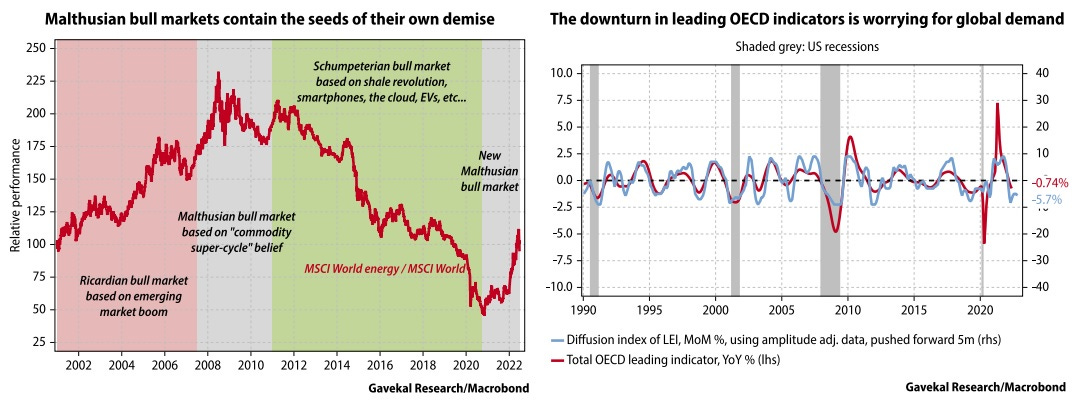

This Malthusian bull market does look to be at risk from falling demand

This brings me to the -20% drop in global energy stocks in the last two weeks, and their -15% underperformance against MSCI World since June 8. The reason for this pullback is not a hope that energy supply is set to surge, but that demand will falter as big economies slip closer to recession (see Brace For A US Recession). This reflects the contradiction at the heart of all Malthusian bull markets: the fear that at some point, the rising cost of energy, or other commodities, will choke off the expansion on which the rise depends (see left-hand chart below). So have we reached the point when time should be called on the Malthusian bull market? OECD leading indicators do show the growing threat of a recession (see right-hand chart below).

There are, however, at least four reasons to think that energy demand stays high

But against that fear lies the following factors:

1) Hopes that China can boost its economy ahead of the Communist Party congress this autumn. Some comfort can be taken from Chinese equities having held up fairly well in the past month’s global sell-off (see Looking For Silver Linings). Still, it seems likely that Chinese energy demand will remain dependent on Covid policies. So long as the threat of lockdowns exists, consumers in China will minimize both their internal and external travel. But once Covid restrictions are no longer seen as a threat, China will likely see a travel boom that causes energy demand to surge.

2) In Europe, energy storage facilities are running critically low. Indeed, at the current pace of depletion, the faithful will run out of candles to light in Lourdes, Rome and Santiago de Compostela to pray for a warm winter. That will leave Europe with the option to (i) re-embrace Russia (hard to see with Vladimir Putin still in the Kremlin), (ii) re-embrace coal in a big way, (iii) ration energy and so shove European industry into a depression, or (iv) pay a lot more for energy from the Middle East.

3) The geopolitical situation is fraught, as shown by Lithuania refusing Russian trains access to the Russian pocket of Kaliningrad. And indeed the mood may further sour as demonstrated by the Group of Seven imposing new restrictions on Russia this weekend (see The Age Of Weaponization). One view in Western capitals is that Putin is “on the ropes” and adding pressure could prompt either regime change, or more strategic blunders. On the flip side, Putin’s situation arguably looks better than two months ago. Russia’s army seems to have secured control over the Donbass region, Russia’s economy is still growing and the ruble keeps making new highs. The risk is that Putin’s retaliation for the weaponization of Kaliningrad rail links is a further weaponization of energy markets.

4) The political response to high energy prices in many advanced economies has been to either offer consumers direct subsidies (California, France, Italy), or cut taxes on gasoline (US, UK) or to threaten the nationalization of producers (Colombia). In other words, little has been done to either reduce demand or increase supply.

Investors should be buying this dip in energy market.

Putting it all together, energy remains a key building block for any portfolio. In the past year, energy assets have been negatively correlated to most other asset classes and delivered strong positive returns. This is because we have now entered a Malthusian bull market that is unlikely to end until every major commodity has made new all-time price highs, not just in weak currencies (gold, oil and natural gas recently made new highs in terms of euros, Japanese yen and British pounds), but also in US dollars and renminbi. For such reasons, dips in energy markets are to be bought.

Louis-Vincent Gave

lgave@gavekal.com

A Word From The Haymaker’s Corner

Our readers have been helping out greatly with plenty of “Likes” and insightful commentary on our work. We thank you for that and will always eagerly check out what you have to say. And if you’re loving the Haymaker’s content enough to regularly visit us ringside, we invite you to become a subscriber (if you aren’t one already) and hope you’ll share the content with any friends who might enjoy weekly thoughts on markets, banks, commodities, politics, and more.

There’s that bell once again. The fight continues.

the expediency of immediate necessity over even the dreams a few years out. Humanity overestimates that productivity growth has not increased much more than 2-3% a year despite advances. That means a doubling every 30-35 years. That is far too slow for a single human lifetime to malinvest in essentials such as fossil fuels yet.

The world is quickly becoming less "energy blind" thanks to Putin. I share the authors' opinion that ESG politics have left the world in a short energy position. All it takes is marginal demand exceeding supply consistently over a relatively short time to launch energy prices dramatically higher. Other investors are arriving at the same conclusions. See here for some other compelling research into oil demand/supply analysis: https://tinyurl.com/bx97ab95. Haymaker series has been fantastic! Great gift from David.