“Bitfinex and Tether recklessly and unlawfully covered-up massive financial losses to keep their scheme going and protect their bottom lines. Tether’s claims that its virtual currency was fully backed by U.S. dollars at all times was a lie.” - NY Attorney General Letitia James

This is a funeral for the lightest of all boxers (a profession for which the Haymaker has a fondness): a featherweight. But in this case, as the title tells it, we're talking about a Tetherweight. Because rather than suffering just a KO, most cryptos appear to be headed for their crypts.

If you google the word “crypt”, here are the first synonyms that pop up: tomb, vault, mausoleum, burial chamber, sepulcher, and catacomb. · Maybe that should have been a big clue to all the crypto “maximalists” that they were playing a very dangerous game, one nearly certain to end in financial death, at least for the hordes of amateurs and latecomers. Suffice to say, that would be almost all of them.

Based on an eye-opening podcast my close friend Grant Williams did with George Noble and Bennett Tomlin last summer, I became convinced Cryptoland was indeed headed for a near-death experience. Actually, I felt you could strike out the “near” when it came to the thousands of different variations on the crypto craze, with Dogecoin being my favorite example of complete lunacy. (As you will read, “luna” has become a most important word in this latest example of mass speculative insanity.)

Dogecoin has been a frequent plaything of Elon Musk, presumably because he owns a Shibu Inu dog and this breed was the inspiration for Dogecoin, along with its 600 or so imitators. As you can see, the actual canine version is adorable.

Source: Wikimedia Commons

Despite his cheerleading, it has lost $77 billion of its once $88 billion market value. Consequently, Dogecoin is still “worth” over $11 billion, which means some pretty serious losses almost certainly lie ahead. As I’ve noted in earlier articles, and in my new book Bubble 3.0, its creator has been totally, and refreshingly, transparent that it’s worthless. Thus, it doesn’t take a market guru to realize this one has durable support at zero. In my view, it will soon be tested.

This newsletter, in its earlier Evergreen Virtual Advisor (EVA) form, consistently warned of crypto investing’s perils, particularly after I heard Grant’s podcast on its main funding vehicle, Tether. That was when the light went on for me as to what was nearly certain to be the nail in the crypto coffin. Essentially, Grant and Messrs. Noble and Tomlin convinced me that there is a distinct possibility–in fact, I’d hazard probability–Tether is a fraud. This is rather a big deal since most Bitcoin is transacted in Tether.

Accordingly, it was my belief that once this was exposed, the great crypto mania would meet its maker. As usual, when I form an opinion like this, premature as I so often am, the leader of the pack, Bitcoin, continued to soar. It rose from around $40,000 at the time of Grant’s exposé to a high of $66,971.83 by last November. In other words, it vaulted about 70% after my Tether tantrum. (However, it is now 30% below where it was trading when I highlighted Tether's many oddities.)

And despite some ominous news right after I put out my July 23rd EVA on Tether – such as reports of a DOJ investigation on July 26th and then a $41 million regulatory fine last October – nothing cataclysmic happened with the leading “stable coin”. However, it’s a very different story with one of its archrivals, the now-headline grabbing TerraUSD.

As their name implies, stable coins are meant to be non-volatile. In fact, they are intended to stay at almost precisely $1, kind of like a cyber-money fund. As I opined in the aforementioned EVA, as well as in Bubble 3.0, these should more accurately be called fable coins. You have likely heard and read that at least one of them has lived down to my pejorative of late. In the process, they have led to sheer mayhem in the dark and dangerous world of virtual currencies.

There was a telling tipoff earlier this year indicating a crypto crash was imminent. As you can see below, I tweeted on February 16th that the Super Bowl this year overflowed with ads touting all things crypto. Matt Damon gave a particularly impassioned endorsement of the space.

Though one of my favorite actors, Damon’s choice of asset classes to promote to a billion (or so) souls looks highly questionable at this point. The spot’s tagline, “Fortune Favors The Brave”, might more truthfully have channeled Wilson Mizner’s adage: “Gambling: The Sure Way of Getting Nothing For Something” or perhaps a cynic’s take on these promos: “Every Celebrity Has Their Price”.

Since the Super Bowl, about $800 billion of crypto-market value has gone missing, about 40% of its total back then. Nice tout, Matt! The New York Times ran an article this week describing the blow-back the crypto(-shilling)-endorsing celebs are now receiving… deservedly, in my opinion.

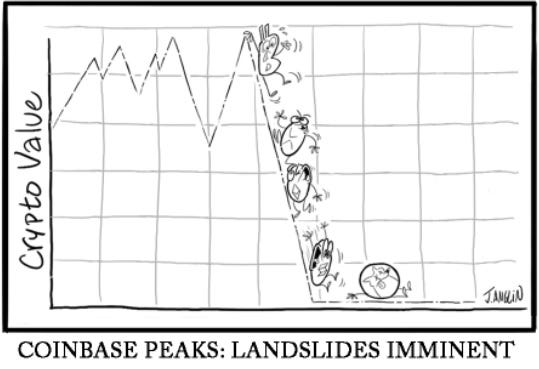

Coinbase (COIN), a leading crypto exchange, was one of the biggest sponsors of this year’s ubiquitous crypto Super Bowl ads. The response to those was so overwhelming in the immediate wake of the game that its website crashed. However, that wouldn’t be the only thing to crash. Since Super Bowl Sunday, COIN’s stock has experienced a 70% thrashing. That’s obviously some serious misfortune for this once brash “de-fi” (decentralized finance) leader.

A regulatory filing by COIN last week sent shudders up and down the crypto food chain when it noted that bankruptcy proceedings might render customer assets unrecoverable. The CEO immediately explained this was only a required disclosure. However, his denials of an imminent filing had echoes of “Methinks thou dost protest too much!” It also smacks of the jaded old epigram, usually applied to governments when they are in crisis mode, that you can’t be certain something will happen until it’s officially denied.

But the precipitating factor behind last week’s very real — i.e., anything but virtual — implosion, was Terra USD and its “sister token”, Luna. Unlike Tether, still the planet’s dominant stable coin, TerraUSD wasn’t backed by actual assets, such as T-bills. Rather, its supposed stability was a function of an algorithmic mechanism. That, in and of itself, should have made a discerning investor suspicious but, in addition, the key backing was Luna.

The scheme was that if TerraUSD slid even slightly below par, $1, Luna tokens would be burned — aka, sold — in exchange for TerraUSDs. Similarly, if it rose much above $1, the reverse process would occur. While I admit this one was off my radar since I’ve been mostly focused on Tether, I wasn’t aware of the highly precarious nature of this structure. Basically, it was like having the Argentinian peso backed by Zimbabwean dollars.

In mere days, TerraUSD’s price not only “broke the buck”, it vaporized all the way down to $0.1621 by last Friday. On Monday, it further eroded to a mere $0.11. This left it with a market value of around $2 billion after having been as high as $19 billion earlier this year (apparently, redemptions lowered it to $1.3 billion).

TerraUSD

Source: CoinMarketCap.com

Meanwhile, its supposed support system of Luna went into a total eclipse, hitting a price that was close enough to zero for government work: $0.0002 per The Wall Street Journal and CoinMarketCap. This wiped out an even greater sum, about $41 billion.

Luna

Source: CoinMarketCap.com

Of course, a dramatic recovery is certainly possible but it’s by no means certain. The reserve fund the Luna Foundation maintained to support TerraUSD was a considerable $3.5 billion as of May 7th. This week that had dwindled down to $9.3 million. As you can see, Cryptoverse fortunes are made and lost at the speed of light in a vacuum.

Bitcoin, by far the most important virtual currency, hasn’t exactly been a stellar performer over the last six months. From that nearly $67,000 peak this past November, it fell as low as $28,000 last week. That’s a loss of roughly 60%.

Interestingly, this has occurred at a time of high and persistent inflation. Bitcoin’s many admirers had whipped up enthusiasm for it as an inflation hedge and one that is far better than gold. Accordingly, such horrific performance is more than a little narrative shaking. Gold is back in the doghouse for many investors after its latest correction, but at least it's roughly flat since November, which strikes me as preferable to the 60% hammering in Bitcoin or an 87% slam-fest with dodgy Dogecoin. In fact, with almost every global asset class in retreat, I’ve been telling my team, “Flat is the new up”.

To shore up confidence in Tether, its chief technology officer, Paolo Ardoino, said via Twitter last week that his firm has been purchasing “a ton” of U.S. government bonds. Let’s see, taken literally that would be 2000 pounds of Treasuries. Given how little each certificate weighs, that’s impressive indeed. However, this does get to the heart of the Tether enigma. Vague declarations like “a ton” fail to instill confidence in all but the most gullible; admittedly, there are “a ton” of those to go around. There is also considerable irony in a prominent crypto entity seeking to shore up its reputation by pointing out its aggressive accumulation of something as old school as U.S. dollar-based bonds. Moreover, these are denominated in a crypto fanatic’s uber-detested fiat currency of the U.S. dollar.

The venerable and perma-bowtie-clad Jim Grant, founder of Grant’s Interest Rate Observer, had this to say about Tether’s artful dodging: “Investors will have to take the executive’s word for it, as Ardoino’s firm has famously resisted calls to produce an audit verifying the composition of the reserves backing its $82 billion market capitalization… Asked by the Financial Times this afternoon for more information on its Treasury holdings, including the custodian and trading counterparties, Ardoino demurred: ‘This is information that is privileged. . . we don’t want to give our secret sauce,’ he said. ‘We keep that information [to] ourselves, but we are working with many big institutions in the traditional financial space’.”

As I’ve noted in the past, I’ve been surprised that the SEC and the DOJ have let Tether largely carry on with business as usual. But last week’s dramatic reveal that Terra was anything but firma is a gamechanger. About $1.7 trillion of total crypto value has evaporated and the stunning, almost overnight, meltdown by TerraUSD and Luna, both backed by prestigious venture capital firms, is almost certain to trigger a brutal regulatory backlash almost any day. SEC chief Gary Gensler has already voiced concerns the crypto exchanges are trading against their own customers. That’s a shock right up there with gambling at Rick’s Café Américain in Casablanca, but it’s just another indication the Cryptoverse’s Wild West days are NFL—as in Not For long and not to be confused with the National Football League. Critically, and thankfully, in my view, entities like Tether aren’t going to be allowed to blow off audits much longer.

In last July’s alarm bell EVA on this space, I suggested that people who know much more about virtual currencies than I do (which, admittedly, isn’t saying much) were advising crypto maximalists to get their holdings off the exchanges like Coinbase. Given what’s happening with that one, I’m reiterating their suggestion. Among its other disquieting disclosures was that it lost $430 million in the first quarter. Per my good friend and mentor, Doomberg, it also blew through $1 billion in cash. To be fair, it still has around $6 billion in the bank more than offsetting $3.44 billion in debt. However, it is once again disturbing that its bonds are trading at a deep discount, offering yields of 10%, implying a distressed credit. It holds $250 billion of customer assets, so this is no small risk to the financial system should it do a Terra/Luna.

So, as Luke Gromen, author of the insight-rich financial newsletter Forest for the Trees, likes to ask, how do we make money off of this? Personally, I’ve been short some of the peripheral plays, including a certain popular crypto exchange that might have been mentioned earlier. However, that’s a hazardous line of work I wouldn’t recommend to readers. A safer route is to let this long overdue reckoning with reality run its course. If I’m right about the impending untethering (see the linked article above) of the world’s most widely used stable coin, that could trigger the final flush out.

Last summer, I suggested that, should this happen, it might produce an intriguing chance to build a position in Bitcoin. As I noted at the time, I’m convinced it will be a survivor along with Ethereum. But beyond those two, I’d suggest all those who’ve been playing this most egregious example ever of the Greater Fool game to be ready for that solid support… at zero.

Good article. Of course note that Bitcoin has been down 50 -60% on multiple occasions and come back thereafter. As an unreasonably long precious metals / miners investor I do also own about 1/3 as much BTC/ETH and both are down 50%/33% against my purchase price respectively. When I went in to them I accepted the 50% drawdown as a reality for speculations that have the ability to soar several hundred percent in a relatively short time.

There are too few people out there really focussing on why people have become so attached to crypto in the knowledge "it goes up and down like a whore's drawers", to use a crass but picturesque analogy from the old country. I don't think its just a get rich scheme for all. I do think its just another example of how the younger generation in particular are fighting back against what they see as a rigged financial system run by the boomers. However as those who have read Manias Panics and Crashes by Kindleberger already know, speculations are part of the human investment psyche, they have always been here and probably always will.

Just an excellent article full of valuable information mixed with great humor. A total pleasure to read!