Recalling The Obvious (At Our Leisure)

In The Ring - June 24th, 2022

A Word From The Haymaker

Last week’s Haymaker examined a topic about which I have a lot of thoughts and just as many strong feelings. It is also a topic I knew would invite plenty of insightful (and occasionally critical) commentary from my readers. And I was right.

Every response offered something new and useful to the debate, but one theme that stood out is the idea that climate/energy policy in the United States is disjointed and often nonsensical. This is because in many ways it denies reality (on the climate side) and the economic needs (on the energy side). Many “green” political pronouncements and corporate initiatives often seem more like virtue-signaling than serious attempts to deal with the challenges of powering the planet while dealing with the negative effects which all forms of energy production carry. This is true even with clean energy sources such as wind, solar and hydroelectric.

It should be inarguable that good intentions still need to be logically grounded, lest they prove themselves both fanciful and deleterious. A responsible energy infrastructure should acknowledge the different areas wherein various sources of power might be best cultivated, disbursed, and exhausted. And ideally sans divisive language – petroleum and nuclear plants are not analogous to a global death sentence. In fact, the near-term human project will continue to be propelled in large part by both fossil fuels and, if we can talk some sense into ourselves, nuclear.

One point I could have made last week is that climate change is incredibly complicated. It is driven by a multitude of factors, most of which humans can’t control. That certainly doesn’t mean we shouldn’t try to eliminate harmful effluents. Yet, in my mind, that means prioritizing the most inimical; logically, that would be those emitted by burning coal.

When something is as complex as climate change, it’s easy to manipulate public opinion with nearly inscrutable scientific data and interpretations. The latter are what so often get distorted to create maximum fear among laypersons. In this regard, I’d like to re-recommend Steven Koonin’s excellent book on climate change, Unsettled. As I’ve noted in the past, he was a senior energy expert in the Obama administration.

Due to the complexity of the subject, that’s why I feel the proof is in the reality. Have the nearly endless streams of dire forecasts put forth over the last few decades actually materialized? If not, there is almost unquestionably something amiss with the computer models that have repeatedly, and wrongly, predicted catastrophe. The fact of the matter is that the most extreme predictions have failed to materialize.

This is a topic that seems to activate the mind’s ideological circuit board before the rational counterpart can power itself up. The result is that most dialogue surrounding energy creation and its impact on the environment is prone to fits of anger and animus. Fortunately, we found that our readers were keen to put forth detailed input via courteous language, which was even the case with those who took exception to the article’s main thrust. We appreciate the conversation and look forward to continuing it.

Now, onto this week’s guest Haymaker, written by my colleague in creativity, Mark Joseph Mongilutz. (As a relevant aside, we’ve received considerable feedback that readers often like us to opine on topics that are not directly related to economics, energy and the financial markets.)

-David Hay

Recalling The Obvious (At Our Leisure)

Source: Shutterstock (Tenzen)

Does it seem to you that some in the American media are surprised by the ruble and the Russian people having withstood the early battery of sanctions levied against them following the (it’s been plenty harrumphed… illegal) invasion of Ukraine? It was as though so many in the bloated Western sphere of policy squabbles, cultural squabbles, and squabbles about whose squabbles are most legitimate had lost sight of the fact that the physical world and its many resources exist independently of international banking law.

Russia, for all its failings (many of them comical, others less so), is big, has a lot of stuff, is home to a sizable population, and their leadership, as much as it can be said of any country’s leadership, views the world for what it is. They are keen to ignore its trivialities entirely. The West, for its part, is so mired in trivia that we forget about the need for shared purpose; and a feeling of purpose at the national level really only works when we’re all bought in. Kind of like the markets.

Source: Shutterstock (fresher)

This is not a celebration of Russian pragmatism. Nor is it meant to overlook Ukrainian bravery/superlative resilience. It is rather a note of criticism towards a Western culture that has lost sight of immutable truths regarding human existence, just as its leaders attempt to shape a world order around hypocritical platitudes, environmental moralizing, and cultural hang-ups that create ugly schism below while fostering uglier self-satisfaction above.

A pathological fixation on GDP as the sole measure of a nation-state’s capacity for action led so many to conclude that hurling the weight of financial arsenals at a fiat currency would negate, somehow, the endless resources and snake-like opportunism of a Russia that really can’t play fair because they don’t see themselves as playing at all.

Is much of this obvious? I thought so about a month ago. I’m no longer sure.

As media figures herald them, you could be forgiven for regarding economic sanctions as showstopping, endgame-administering retaliatory measures, rather than banking mechanisms with the power to clarify allegiances more than cripple resource-laden nation-states. They can disrupt the flow of currencies and create bureaucratic impasses, but they cannot deplete a country’s land of its energy reserves, nor its farmland of its arability. They are limited because they operate within a construct; they are not buttressed by ancient customs nor by the laws of time and space. Even so, to hear many complain of geo-economic ineffectiveness where reining in Russian aggression is concerned, is to hear one’s rules-obsessed classmate insist that a teacher adjudicate a dodgeball transgression. It looks weak, and nothing else.

Which isn’t to argue that Russia and the Russian populace haven’t suffered at all when faced with combined Western pressure (“a modern-day siege” as sanctions are sometimes described, perhaps not quite accurately in all cases). But our media complex’s post-implementation jubilation suggested that a mighty victory delivered at the business end of an accounting ledger was imminent – Russia has a strong military and nuclear weapons to spare, but have they ever faced down the intimidating might of… a ledger? (Would that battles were waged solely within accounting spreadsheets.)

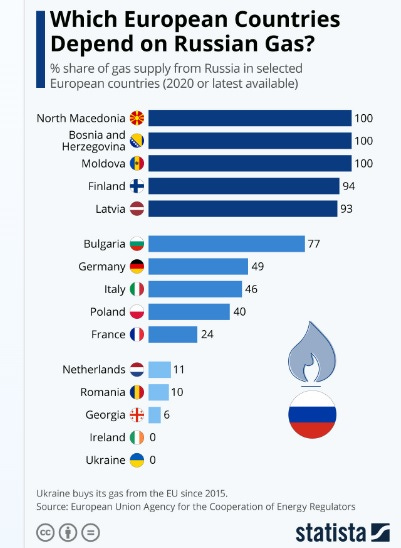

However it might rattle the foundation on which we’ve fashioned our illusions, all markets, all currencies, and all indexes are predicated to a great extent on a physical world of hard labor, skilled craftsmanship, clever material manipulation, and the raw resources that underpin so much of it. The indexes reflect economic largesse, they do not comprise it. Russia is not a nation of rubles and balance sheets, but one of oil, natural gas (see below), enormous harvests, and… okay, that’s just about it. Except for some other things people find valuable. Take their immense reserves of gold, rare-earth metals by the thousands of tons, and other physical wealth in the form of lumber, fresh water, and livestock.

Sourced via Statista

In a world where curtains are being pulled back by the day, revealing hollow promises of endless wealth for the hollow promises of endless wealth they are, tangibles like precious metals, agricultural potential, and surplus fresh water are coming into clear relief for the treasures they never stopped being… not even when Bitcoin was selling for one top-tier Tesla per coin. So long ago… perhaps even as many as five weeks.

Indexes can factor these things in and traders can correct for them – fine. But the indexes will never be a rare-earth metal. A grain future will never be grain. A sanction against paper currency will never cause Russia to be less big and less full of stuff. Alan Watts had some thoughts on this. Here’s a famous passage of his pertaining to the topic: “Money is the same order of reality as inches, grams, or lines of longitude and latitude. It is an abstraction. It is a method of bookkeeping to obviate the cumbersome procedures of barter. But our culture, our civilization, is entirely hung up on the notion that money has an independent reality of its own.”

Again, that used to be obvious. For heaven’s sake, it was once so obvious. But Western insularity has allowed us to see our neuroses as overriding forces that must be yielded to, with the physical world being ignored in favor of our panoply of said neuroses. We consistently try to deny the world’s immutable realities, and instead persist in our illusions. Why? I don’t really know. There’s something about being prosperous that places a nation’s collective mindset one or two degrees out of sync with objective truth. These days, it seems some among us (perhaps, and hopefully, a dwindling number) have enough time to indulge in fantasies and misconceptions. For example:

The CDC is a neutral/apolitical actor – Nope

Electric vehicles are, as a concept, a standalone energy-policy pillar – No. But the marketing surrounding the claim is pretty good.

Inflation will come and go by the time you’re done reading this article – Incorrect. It won’t.

So, why is it important to address and overcome our misconceptions?

And what really matters?

And why are we fated to soon recall what matters?

I’ll take those convenient rhetorical questions in order:

1) Because it is.

2) Reality.

3) Have you seen the market lately?

The importance of affording geopolitical realism more space in our public discourse goes beyond recognizing the limitations of economic sanctions. America is seemingly wading into a 21st century that promises to be unforgiving in many ways; we simply won’t the have the margin of error we’ve enjoyed since Eisenhower was at the helm. Whether militarily or economically, we’ll likely need to take some chances in the near future, and we’ll need to do so with a clear understanding of what we’re facing, rather than a cartoonish characterization of what we wish we were facing.

Should we find ourselves beset by resource scarcity, energy-production challenges, conventional war (let alone proxy war) with another superpower, human rights initiatives, or something I’m not thinking of, a wish-list approach to negotiating with reality will do our nation, and the West as a whole, no favors. We can fantasize about a world made better by a Russia weaker than it actually is, but exacting that outcome requires more than haughty language from world bankers, no matter how many of them see fit to adorn their online profiles with #StandWithUkraine (I wonder how many of them are actually standing when they apply that hashtag; I’ve asked that a couple times before and never received a decent answer).

That’s it. For insightful market advice, Making Hay Monday comes out next, well, Monday. Until then, here are some suggestions we might all consider: visit a farm or a mine. See livestock up close or chop down a tree (my favorite exercise, incidentally); do so and be reminded that the academic discipline of economics is not itself the raw stuff and immense labor of an economy; it can only offer us useful but limited spreadsheet interpretations. Countries are not their GDPs any more than a nutritional chart is the meal. Russia remembered this, or never forgot it, because they probably don’t care to think in abstractions, at least not geopolitically speaking. With chess, maybe…

Remember that many mainstreamers have already talked themselves into believing sanctions can work perfectly because serious-faced, humorless policymakers assured us they would; you can always listen to them for a laugh, but like so much Russian propaganda, that’s about all they’re good for.

A Word From The Haymaker’s Corner

Our readers have been helping out greatly with plenty of “Likes” and insightful commentary on our work. We thank you for that and will always eagerly check out what you have to say. And if you’re loving the Haymaker’s content enough to regularly visit us ringside, we invite you to become a subscriber (if you aren’t one already) and hope you’ll share the content with any friends who might enjoy weekly thoughts on markets, banks, commodities, politics, and more.

There’s that bell once again. The fight continues.

(Note: Post updated to include select stock photo details, per new convention)

Sadly, as more smart people than me have said in the past, (way) more pain is needed until the mainstream (people, media, representatives) will be forced to face reality. Hopefully its only economical pain.

Great job (as usual) David. I have only one criticism of you and Joseph Mongilutz in this piece.....

You are both WAY too polite. The fools who have wrought these asinine policies and the destruction to human development and advancement that they have resulted in will pay no price for their folly.

These are the intellectual elites, who have the full confidence and belief that they are superior in every way to the commoners. These people dictate policy under a very strict doctrine of "Imagine a perfect world, then operate as if it exists." Evidence to the contrary is 'disinformation'.

Keep up the good work,

Kevin