Making Hay Monday - September 9th, 2024

High-level macro-market insights, actionable economic forecasts, and plenty of friendly candor to give you a fighting chance in the day's financial fray.

Charts of the Week

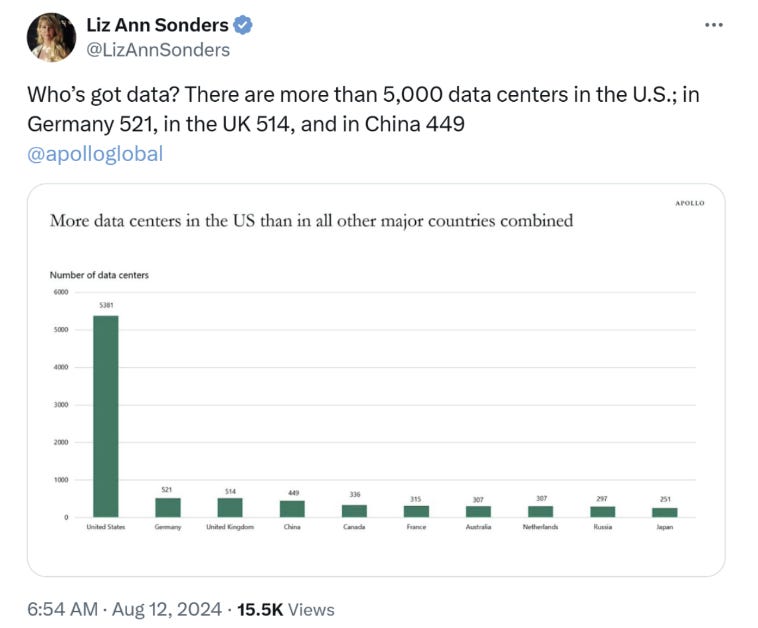

There are trillions of reasons – like two trillion, the size of the federal deficit — to be negative on America’s future. However, a highly encouraging statistic is the USA’s overwhelming number of data centers vis-a-vis the rest of the world. Some believe, and we don’t disagree, that in the information age, which is now, thanks to AI, on steroids, data is the most important asset. Well, actually, we might put in a plug here for the energy that powers those data centers. Increasingly, that means natural gas. Eventually, it is likely to be nuclear, as well. Ultimately, atomic energy might be the fastest growing source of electricity in the West, particularly if Small Modular Reactors (SMRs) take off

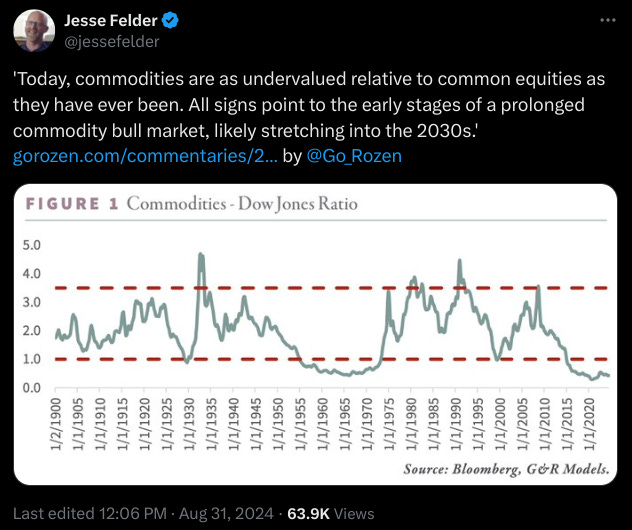

Commodities, other than gold, are once again in most investors’ doghouse. Based on their 15 years of underperformance, that is understandable. The latest slump is likely primarily due to increasing odds of a recession. Superficially, that seems reasonable, but while they tend to fall in advance of an economic downturn, as they have lately, historically they rise through the actual recession. With long-term shortages looming for many commodities, particularly those linked to the Great Green Energy Transition, they may prove even more resilient than in the past, if the U.S. economy does slip into negative growth. Per the above image from the natural resource experts at Goehring & Rozencwajg, their valuations relative to the Dow Jones Industrial Average imply minimal downside risk. They are likely even more of a bargain compared to the S&P 500 which trades richer than the Dow.

“With oil prices near 70, the (price) risks are skewed way, way in favor of a bullish situation.” -Mike Rothman, founder and president of acclaimed oil market research firm Cornerstone Analytics

Champions Section

Hopefully, most Haymaker readers are aware of our take-profits suggestion from back in late June. This was after a spirited rally had lifted prices by 15% in about 30 days. That was a timely nudge but our upgrade last month was not. Since then, oil has eased by 5%. That’s not disastrous but it has been enough to cause the high-frequency traders – hedge funds, Commodity Trading Advisors (CTAs), et al – to turn ferociously negative on crude… again.

The above visual from Raymond James’ head of energy investment banking, Marshall Adkins, is setting the tone for this Making Hay Monday (MHM). Marshall and his team published a 121-page slide deck on the oil-and-gas markets earlier this summer. Frankly, I’ve drawn heavily from that document to craft this MHM, enough so that we consider this piece an advertisement for their top-notch research service. In fact, I eventually intend to cover its smaller section on natural gas. As a “spoiler alert”, Marshall, like Team Haymaker, is more bullish on gas than he is on oil… and that’s saying a lot, as you will soon read.