Making Hay Monday - October 7th, 2024

High-level macro-market insights, actionable economic forecasts, and plenty of friendly candor to give you a fighting chance in the day's financial fray.

Charts of the Week

Charts of the U.S Treasury Bond Index, the S&P 500 and the Bloomberg Commodity Index from 4/30/1973 through 12/31/1979

In addition to emerging market (EM) bonds, another asset class that typically responds very favorably to a Fed easing cycle is commodities. This newsletter has long posited that the present decade may resemble the 1970s when the Fed cut rates even as inflation remained elevated. Based on the still-rising cost of home ownership (particularly including property taxes and insurance), as well as extraordinarily generous unionized worker settlements (see the recent dockworkers strike), it may be committing the same mistake once again. If so, hard assets might provide investors with returns commensurate with the “Disco Decade”. That was when they massively outperformed both stocks and bonds. (We could only locate Treasury data back to April, 1973, at least on short notice; however, it was after that when both U.S. government bonds and stocks were clobbered.")

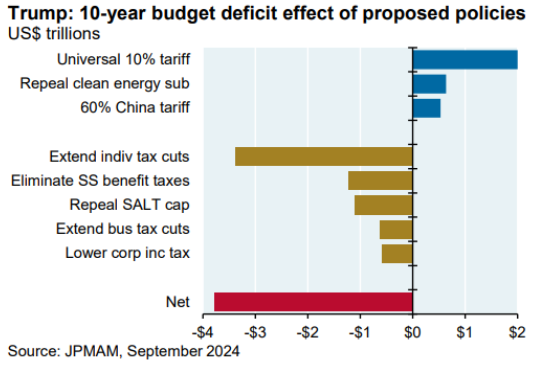

In case you were wondering what the impact on the $2 trillion federal deficit (about 7% of GDP) would be based on the Trump vs Harris policy proposals, the above is a helpful comparison. Clearly, the former’s package of tax cuts and tariffs increases would be worse for future U.S. government red ink. However, the economic drag from Vice President Harris’ proposed tax increases might be understated. Regardless, both candidates display a disturbing lack of concern for the looming fiscal funding crisis. It’s unlikely the Treasury bond market will share their cavalier attitude, particularly if either candidate’s proposals are actually passed into law.

“Demand for raw materials is at record levels, inventories are low and spare production is largely exhausted. This is just classic ‘own commodities’ …” -Jeff Currie, former Global Head of Commodity Research at Goldman Sachs, now Carlyle’s Chief Strategy Officer of Energy Pathways

“In times of rapid change, experience can be your worst enemy.” -John Paul Getty

Champions

Are you getting that sinking feeling? You know, that queasy sensation in the pit of your stomach that indicates you’ve over stayed the whole “T-bill and chill” thing. There’s little doubt a multitude of investors and, especially, savers have done exactly that by failing to lock in the highest yields since 2007.

If this applies to you, I’ve got some very good news: It’s not too late to lock in yields in the 7% to 9% range. Better yet, I’m going to contend you can also position for capital gains at the same time.