Making Hay Monday - October 14th, 2024

High-level macro-market insights, actionable economic forecasts, and plenty of friendly candor to give you a fighting chance in the day's financial fray.

Charts of the Week

—

Possible Upside Blow-off Drivers

There is clear evidence that investors are cooling on the once ultra-popular “T-bill and Chill” investment allocation decision. The above visual also at least partially explains why the stock market continues to make all-time highs. Bonds, too, have been a beneficiary of this phenomenon. Lately, though, U.S. Treasurys have weakened markedly. Yields on the 10-year U.S. Treasury note, which move inversely to prices, hit a low of 3.6% last month on hopes of repeated Fed rate reductions through this year and into 2025. Presently, though, the yield on the 10-year T-note has surged by 0.5% (50 basis points). This sharp sell-off has been a function of resilience in both the economy and inflation.

The preceding chart vividly illustrates the much changed perception of the Fed’s success — or lack thereof — in its war on inflation. The skepticism this image reflects is understandable given the proliferation of large labor contracts with shockingly high wage increases built in for years to come. Perhaps even more disturbing is how some of those are being rejected, despite pay increases of 6% or more per year. Boeing is an example where this has occurred, but it has also happened at AT&T and Textron. In many cases, rank and file union members are voting down contracts approved by their leadership. Further, nonunion workers have seen their wages rise at a decidedly steep slope, as you can also see above. This makes the Fed’s goal of achieving a sustainable 2% inflation rate look increasingly improbable. The economic proposals from both presidential candidates also argue against a return to the docile CPI increases that prevailed pre-pandemic.

“If it isn’t for the writing, we’ve got nothing. Writers are the most important people in Hollywood. And we must never let them know it.” -Irving Thalberg

“It’s nice to have interest rates to observe again.” -Jim Grant, mythic founder and publisher of Grant’s Interest Rates Observer

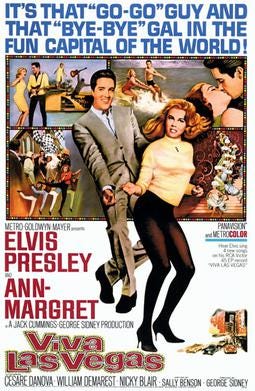

RE: Viva Las Vegas…

Few modern-day Americans know the name of Irving Thalberg. This is despite the pivotal role he played in creating the film studio that would dominate Hollywood in its golden years.

Part of his obscurity lies in the fact that he died in 1936 at the tender age of 37, a victim of a congenital heart defect. Despite his brief life, he was among the founders, in 1924, of what would become Hollywood’s largest studio. As its head of production, he oversaw the creation of over 400 films.