Making Hay Monday - May 1st, 2023

High-level macro-market insights, actionable economic forecasts, and plenty of friendly candor to give you a fighting chance in the day's financial fray.

MAYDAY!

“A people that values its privileges above its principles soon loses both.” -Dwight D. Eisenhower, POTUS #34

“America doesn’t need self-congratulation; it needs a kick in the ass.” -Michael Lewitt, author of The Credit Strategist

May Day is, of course, a special day in the socialist world (see our lead image above). Based on the shift away from capitalism and toward socialism, there are likely a growing number of Planet Earth inhabitants who are celebrating both this trend and this day.

Even in America, a pronounced leftward lurch has been evident for at least the last 14 years. It’s probable that the rich world’s policy “remedies” that were put in place as a result of the 2008/2009 dual disasters — the Global Financial Crisis and the Great Recession — have been a key catalyst for socialism’s new-found popularity. It was in the wake of those twin cataclysms that the wealth divide, already yawning, has become a mammoth chasm. Free money, and even being paid to borrow, created a golden opportunity for those who realized what was going on to leverage up and make a killing. For the average man or woman on the street — not counting the one with “Wall” in front of it — it was a time when purchasing power gradually, then suddenly, eroded.

This backward slide has been even worse for the millions of young people unable to afford a home. The lead item in last Friday’s Highlight Reel was on the tragic — and shocking — rise in premature mortality rates among America’s younger population cohorts. It’s logical to assume that a sense of not being able to participate in the American Dream, especially of home ownership, has been at least partially behind the spike in suicides and overdose-related deaths. (A steady stream of the-end-is-nigh climate predictions no doubt also play a key role in this deep despair among America’s youth.) Further, America’s dangerous and generally deteriorating educational system also deserves considerable blame for our national glissade down the “hope slope”. This is despite vast sums being expended on education. A similar dynamic is evident with America’s healthcare system.

As some of you know, the U.S. spends 5% more of GDP, about $1.2 trillion annually, on healthcare than do its developed-world peers. Yet, its overall mortality rates are worse, with the horrifying trend among the young almost certainly the main contributing factor. (Obesity must be a close second.)

The reality of America’s fiscal follies is also garnering increasing scrutiny. This goes beyond maverick commentators such as Luke Gromen and yours truly. The obviousness of the U.S. government’s impossible funding needs, particularly including entitlements, is simply inarguable. It remains my view that this year will see the moment of truth, particularly in the second half. (This topic will be covered in more detail in the Champion’s section.)

But here’s the kicker for this week’s Making Hay Monday: Despite all of the above — not to mention an accelerating credit crisis and a decelerating economy — a venerable British financial magazine, the legendary The Economist, recently ran this cover story:

Frankly, when I read the cover for the first time, I couldn’t quite believe it was about America. It also amazed me it was published by a media source that is often critical of, even hostile to, what used to be a system known as capitalism. As anyone who has read my ramblings writings for very long knows, I believe one of the greatest U.S. policy failures, among a very long list, has been a persistent perversion of the free-market system this century. The Fed has been one of the main “perps” in this regard, with its constant interventions that have created innumerable distortions and, of course, asset bubbles.

To learn more about Evergreen Gavekal, where the Haymaker himself serves as Co-CIO, click below.

Accordingly, it was with a mixture of bewilderment and gratitude that I read a pro-America article from such an unlikely source. Among the reasons it gave for its “riding high” view of the U.S. were:

“America remains the world’s richest, most productive and most innovative big economy.”

“By an impressive number of measures, it is leaving its peers ever further in the dust.”

“America’s dominance of the rich world is startling…today it accounts for 58% of (developed world) GDP vs 40% in 1990.”

“Average incomes have grown much faster than in western Europe or Japan…adjusted for purchasing power, they exceed $50,000 in Mississippi, America’s poorest state—higher than in France.”

“America has nearly a third more workers than in 1990, compared with a tenth in western Europe and Japan. And, perhaps surprisingly, more of them have graduate and post-graduate degrees.”

“True, Americans work more hours on average than Europeans and Japanese. But they are significantly more productive than both.”

“American firms own more than a fifth of patents registered abroad, more than China and Germany put together.”

“All of the five biggest corporate sources of research and development are American.”

“Starting a business is easy in America, as is restructuring it through bankruptcy.”

“The flexibility of the labour market helps employment adapt to shifting patterns of demand.”

“Investors who put $100 into the S&P 500 in 1990 would have $2,000 today, four times what they would have earned had they invested elsewhere in the rich world.”

How about them apples‽ And, of course, mega-tech stars like Apple are a critical reason for several of the above stirring stats. However, even this glowing article notes that 80% of Americans now believe their children will be less well-off than they are, a number that is up from 40% in 1990. The article also briefly touches on the appalling decline in longevity for America’s Generations Z and Millennials.

It additionally disapprovingly notes that, “America’s spending on social benefits, as a share of GDP, is indeed a great deal stingier than other countries’. But those benefits have become more European and, as the economy has grown, they have grown even faster.” There is no recognition that as America has become more socialized and Europeanized, its growth rate has slowed drastically from what it was in the 1980s and 1990s. The USA looks good mostly by comparison to even more ossified economies such as those in Western Europe.

Yet, this article’s most glaring omission relates to the aforementioned abysmal condition of the U.S. government’s finances. There is not even the briefest mentions of the sheer unfundable nature of America’s current debt levels and, particularly, the crushing burden of its entitlements. The latter are somewhere in the vicinity of five times the size of the Mount Everest of official federal debt. (Right after I wrote my first draft of this issue, I read my friend Michael Lewitt’s article on Riding High and he is even more incredulous than I am… putting it politely. The title of his piece is, most appropriately, Delusions of Grandeur.)

There is also The Economist’s “curse of the cover story” history. As longtime readers recall, it has arguably the worst track record of any major media source when it comes to the boldest predictions that have adorned its covers over the years. Even ignoring The Economist’s knack for wrong-way forecasting, it takes a great deal of reality denial to characterize America as “riding high”. In my view, a repeated series of “Mayday” calls is far more appropriate.

That said, I do think they may get lucky on this — for a while — at least as far as the U.S. dollar (USD) is concerned. Presently, there is a cacophony of commentary about de-dollarization, the idea that the USD is quickly being replaced as the main monetary unit for global trade. Unquestionably, there is an erosion occurring around the edges, with an increasing number of trade blocs forming that are settling their accounts in non-dollar currencies. However, the greenback remains exceedingly dominant in that regard. At this point, there really isn’t a viable alternative to the USD as the world’s reserve currency.

Will that change over time? In my view, absolutely, and I remain a long-term bear on the buck. But it is currently very oversold and speculative positioning on it is fairly negative (though not shockingly so). Consequently, I think the odds are decently high for a powerful snap-back rally. If so, that’s not great news for the stock market. There has been a tight correlation in recent years between a strong dollar and a weak S&P, as well as vice versa. In fact, the rally off last October’s lows coincided with a deep correction seen in the USD since then.

A big risk for the greenback is, of course, the lurking debt ceiling battle. It has the potential to be a bruising one and, if so, that could force the USD down even further. However, once the debt cap has been raised for the 79th time (seriously), likely in return for some superficial spending restraint, the dollar should come screaming back.

The flip side of the current negativity on the USD is the high level of bullishness among the speculative investment community (i.e., hedge funds) on gold. The yellow metal has a lot going for it right now; however, a Fed that is nearly certain to tighten again on Wednesday — and may even make noises about more rate hikes to come — isn’t one of them. Accordingly, I’d do a bit more trimming of precious metals related securities that have been on a tear since early March (and are now outperforming the S&P, year-to-date). Please be sure to note “trimming”. Long-term, I continue to like gold, and the miners thereof, as well as plays on the Great Green Energy Transition, such as uranium, copper and, to a lesser extent, lithium.

Champions

In my ongoing quest to provide readers with yield ideas that should be largely insulated from rising long-treasury rates, I’m going to highlight a poorly understood part of the income universe. (In a bit, I’ll provide some fresh back-up on why I’m worried about another spike in longer U.S. government bonds.)

From what I can tell, few investors, especially amateurs, are aware of income securities that are known as fixed-to-floaters. As their name implies, they pay a fixed rate for a period of time and then the rate adjusts up or down. The direction and magnitude depends on what’s happened to short-term yields once the fixed-rate period terminates. A compelling aspect, as you’ll soon read, is that their base (or minimum) rate is typically attractively high.

Often, these are structured as preferred stocks. Thus, investors are subordinate to debt holders in the event the issuer experiences financial difficulties. Clearly, then, you need to be particularly mindful on the topic of creditworthiness.

Along these lines, a name my firm owns for many clients (as do I personally) is a fixed-to-floater preferred from a leading automaker. Its bond debt is low-end investment-grade-rated, but preferred issues always carry a lower rating for obvious reasons. Thus, the preferred is rated in the BB range.

It is generating a considerable amount of free cash flow and holds more in liquid securities than it has in debt on its automotive side. (Generally, with large auto companies the debt related to vehicle financing is excluded, as that is covered by borrower receivables; it is fair to note that in a serious recession a larger than normal portion of those receivables could default.) This entity’s unfunded pension liabilities are relatively modest, a dramatic improvement from 15 years ago. Even after considering non-finance debt and retirement obligations, the net cash position is about $10 billion.

The preferred in question is down from a high of $117 in 2021 to around $94. The call date is 9/30/2030 and the yield to call is a hefty 7.85%. The current coupon, or prevailing face interest rate, is 5.7%. Thus, the current yield at $94 is 6%. The rest of the 7.85% return comes from the discount to par value.

However, it’s very fair to point out it may not get called. If not, come 10/1/2030, it will pay essentially 5% over the five-year T-note at that point. Let’s assume that yields on the five-year Treasury have fallen precipitously to 2% by then. If so, this security will have a current yield of 7%. Should rates stay around where they are now, it will yield 8.5%. If the Fed has lost control of inflation, causing the yield on the five-year Treasury to surge, say to 10%, it will yield 15%. Again, this presupposes it doesn’t get called along the way. If it does, there will be a gain of 6% realized because of the above-described discount, creating the 7.85% yield to call. (A later call than 2030 will serve to reduce this yield. — Disclosure: The yields and potential gains discussed are not to serve as projections of performance. Investing involve risk, including the loss of capital due to default. Please see the full disclosure available on the link following the piece.)

Lastly, I promised to provide you some compelling reasons why I continue to worry about a federal fiscal funding fiasco later this year. Here’s a brief excerpt from a recent note by my partner and great friend, Louis Gave on this topic, along with some related charts.

Excerpted from The Three Prices: An Update On US Treasury Yields

By Louis Gave | April 25th, 2023

Surging US treasury supply

The second half of 2023 is set to see a surge in the supply of new US treasuries.

Firstly, this is because the US Treasury’s own “checking account” has almost been run dry. The US government is preparing for a bruising battle on Capitol Hill over its debt ceiling with very little spare cash in the bank.

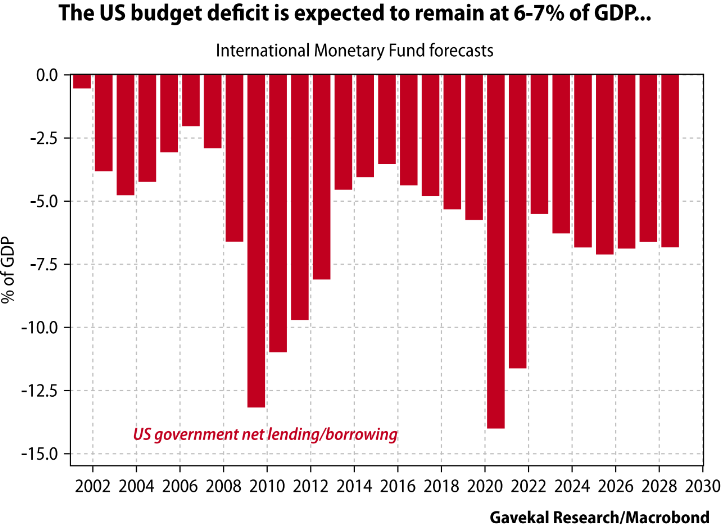

Secondly, it is because despite near record low unemployment, the US budget deficit is projected to remain between 6% and 7% of GDP for the next few years—assuming there is no recession. And it could be worse; in the first half of the current fiscal year, the US deficit came in at a much bigger than expected US $1.1trn.

This means US$2trn, and probably more, in additional debt issuance per year for the next five years or so. And again this assumes no recession. If the US were to experience a recession, then the annual increase in debt for that year would likely be closer to US$3trn.

So, the supply of debt is unlikely to run dry. And with the US government’s outstanding debt increasing by at least US$2trn a year, it’s safe to say there will be enough debt to go around for anyone who wants to buy some. So, who will buy this debt?

Haymaker note: Who indeed? The uncertain answer to that question is why I am convinced Wall Street is much, much too complacent about Treasury-financing risks. Suffice to say, complacency and multi-trillion-dollar funding shortfalls make for a most dangerous combination (see the earlier suggestion for “Mayday!” calls).

Champions List

For capital appreciation:

Telecommunications equipment stocks

Select financial stocks

U.S. Large Cap Value

U.S. GARP (Growth At A Reasonable Price) stocks

Oil and gas producer equities (both domestic and international)

U.S. Oil Field Services companies

Japanese stock market

S. Korean stock market

Physical Uranium

Swiss francs

Copper-producing stocks

For income:

Certain fixed-to-floating rate preferred stocks

Select LNG shipping companies

Emerging Market debt closed-end funds

Mortgage REITs

ETFs of government guaranteed mortgage-backed securities (alternative approach)

Top-tier midstream companies (energy infrastructure such as pipelines)

BB-rated energy producer bonds due in five to ten years

Select energy mineral rights trusts

BB-rated intermediate term bonds from companies on positive credit watch

Contenders

Although I like the Singapore stock market’s modest valuation and its prospects to be the dominant financial hub in Asia – booting Hong Kong from the top spot – I am downgrading it to Contender. The reason I’m doing so is because two men who know far more about Asia than I do – Louis Gave and Ajay Kapur (former Chief Asia Strategist for BofA and Morgan Stanley) – have both convinced me its growth prospects are unexciting. Thus, the downgrade.

Singaporean stock market

Short-intermediate Treasuries (i.e., three-to-five year maturities)

Gold & gold mining stocks

Intermediate Treasury bonds

European banks

Small cap value

Mid cap value

Select large gap growth stocks

Utility stocks

Down For The Count

It’s rare when I close out a position soon after recommending it; however, based on the ongoing stresses in the financial sector, I’d suggest you reexamine any name in it that you may have bought lately based on this newsletter. In keeping with the new SEC rules, I didn’t specifically highlight a particular financial company. But I did suggest looking for one that was experiencing considerable insider buying and was attracting assets into the overall entity, even if it was shedding assets on the bank side.

However, the tragic collapse of First Republic, despite $30 billion of deposit aid from larger banks, has changed my mind about financial enterprises with huge losses on the banking side. There may come a time to revisit this one and — who knows? — by then, I may be able to actually mention it by name!

Financial companies that have escalating bank run risks

Electric Vehicle (EV) stocks

The semiconductor ETF

Meme stocks (especially those that have soared lately on debatably bullish news)

Bonds where the relevant common stock has broken multi-year support.

Long-term Treasury bonds yielding sub-4%

Profitless tech companies (especially if they have risen significantly recently)

Small cap growth

Mid cap growth

As a closeout, here’s a Simpsons excerpt which The Economist itself once highlighted in an article titled Is Indonesia at a Crossroads?

Link: TheEconHomer

The way I see the Economist article its that the USA is the cleanist shirt in the dirty laundry. Its not us but all the others that have gone downhill. Where is the growth in this world? Look at demographics on the G7 countries, China and Russia. In todays world Israel, with all its problems is the only country growing its population and economy today. Are there any others? I am 88, born in 1935 , Civil Engineer, made what I have in my heavy construction co and the markets in the growth years of the late 80s to 2005. Besides computers and the internet (great for advertising) I don't see much progress. My Father, who was born in 1903 and died in 1976 saw much more progress than I have. I worry about my Grandchildren.

👏🏾