Making Hay Monday - May 13th, 2024

High-level macro-market insights, actionable economic forecasts, and plenty of friendly candor to give you a fighting chance in the day's financial fray.

Charts of the Week

The interest rate on the 10-year T-note crashed during the summer of 2020 all the way down to nearly ½% (50 basis). That yield collapse was enough to cause the author of this newsletter to turn bearish on longer-term U.S. government bonds. This was after a nearly continuous bullish stance on extended maturity bonds by the Haymaker going back as far 1981. (Yes, I really am that old.) In recent years — and, particularly, once credit spreads surged in 2022 — my recommendation was to focus on corporate bonds for income investors versus U.S. Treasurys (USTs). Now, as you can see, corporate debt is the most expensive it has been relative to USTs in at least 100 years. This clearly diminishes their relative attractiveness but it could also be reflecting that markets are pricing in the Federal Fiscal Funding Fiasco I’ve so often discussed in these pages. It might sound outrageous, but I think there is an increasing likelihood high-grade corporate bonds will trade at lower yields than USTs in the not-too-distant future. That has been the case in certain emerging markets and America’s government seems intent on “Turning Turkish”, as Gavekal co-founder Charles Gave has written recently.

After a brief popularity surge this spring, the energy sector is once again in its familiar benign (and, often, not so benign) status. Despite that, it is actually outperforming the S&P so far this year, as it has done by a wide margin since its Covid-induced meltdown in early 2020. Irrespective of that outstanding performance, hedge funds have one of their lowest exposures to energy stocks over the last 15 years. In fact, outside of the immediate aftermath of the pandemic panic toward all things fossil-fuel related, when they were resoundingly undervalued, the degree of disinterest by the hedge fund community was only rivaled by the first post-Great Recession oil bust. That was in 2016, after oil prices had fallen from over $100/barrel down to $40, creating another exceptional buying opportunity. The message from this visual (which also ran in April) is clear: When hedge funds are light on energy, a wise investor should be heavily exposed to it… and vice versa.

“I see a future where, similar to the bait-and-switch from '100% renewables' to green energy (including nuclear), we get a slight of hand from EV mandates to low-emission vehicles (hybrids).” -Trader Ferg, highlighted in this week’s Making Hay Monday.

“The preliminary May reading for the University of Michigan Survey of Consumers plunged to 67.4 from 77.2 in April. This report was nothing short of recessionary, with the weakness seen by consumers across all ages, incomes, and levels of education.” -David Rosenberg, from his May 13th Breakfast with Dave edition

Playing the Palladium, Act II

Champions

This is the time of year when the Haymaker, along with his wife and two roughly 100-pound dogs, make the long drive north. We start near the Mexico border and finish on Canada’s doorstep. Because “happy wife = happy life”, this takes four days rather than the two I’d prefer. Thus, it’s five to six hours a day of driving. Fortuitously, my beloved likes to drive, so she does that while I catch up on my stack of unread research.

On Friday, day three of our trek, I came across the most intriguing factoid of the 10,000 or so I read last week. It was from a new research source (yes, another one for me to track!), Trader Ferg.

Ferg was recommended to me by my partner and bestie, Louis Gave, and it was a great suggestion. Ferg’s May 6th note “Pulling the Trigger on Gold” contained said factoid. Ironically, his note really wasn’t much about gold but rather that silvery metal that is in the title of this Making Hay Monday (MHM).

Per Part I of this unintentional series, palladium is one of the essential metals that enable the effluent-capturing wonder that is a catalytic converter. This gives me an opportunity to modify a point I made in the May 3rd Haymaker (Questions That Bother Me So). In it, I stated rather simplistically that America’s shift to gas from generating most of its electricity by burning coal was responsible for the 75% improvement in air quality since the early 1970s. What I neglected to acknowledge then (though I’ve done so in previous posts) is that catalytic converters have played a major role in that clean-up effort, as well. (Of course, in recent years, renewables have also contributed to cleaner air.)

Because of the enormous demand for use in catalytic converters in internal combustion engines (ICEs), palladium often traded at a premium to gold over the last decade. In fact, in 2021 it was nearly double gold’s market price when it hit nearly $3,000/ounce. Today, though, palladium trades at about 40% of bullion’s quotation, near $980/oz.

Before I go on to make the bull case — again — for palladium (Pd), with a kicker that hopefully justifies this second tout, I’d like to pause to note the “range expansion” event that occurred with Pd. In early 2023, it broke multi-year support. As I trust most Haymaker readers are now aware, that’s an ominous development. This downside break happened at $1,300 and, since then, it’s obviously continued south. This is in vivid contrast to gold, which has popped almost 30% from that point. Silver is up approximately the same percentage from then, as well. (Conversely, there was a clear upside breakout signal sent in 2017 when Pd decisively took out resistance at $950. That helped set up the powerful run that would take it up to $3,000 — twice.)

As noted in the first entry of this series, the primary downward pressure has come from the seemingly inexorable trend toward electric vehicles (EVs). As most of you may know, EVs don’t require catalytic converters.

But the bear case on palladium is missing a most important reality — with each passing day, EVs are passing the widespread adoption baton to hybrids. In my view, that is a trend with legs — those worthy of Kenenisa Bekele, the world’s reigning long-distance running champion.

It goes without saying, but I will anyway, that I am no expert on the automotive industry. However, a friend of mine, a retired owner of multiple Toyota dealerships, is and he’s given me some valuable intel on this issue. Toyota is a key consideration in this regard because it is the world’s leader in hybrids. It stayed the course when it was under extreme pressure from Western governments and its competitors to go all-EV.

Toyota’s logic was that it doubted the majority of consumers would want to own an EV, particularly once government incentives were withdrawn. That is increasingly looking most prescient. The growth rates of hybrids are now smoking EVs (apologies for the environmentally awkward verb).

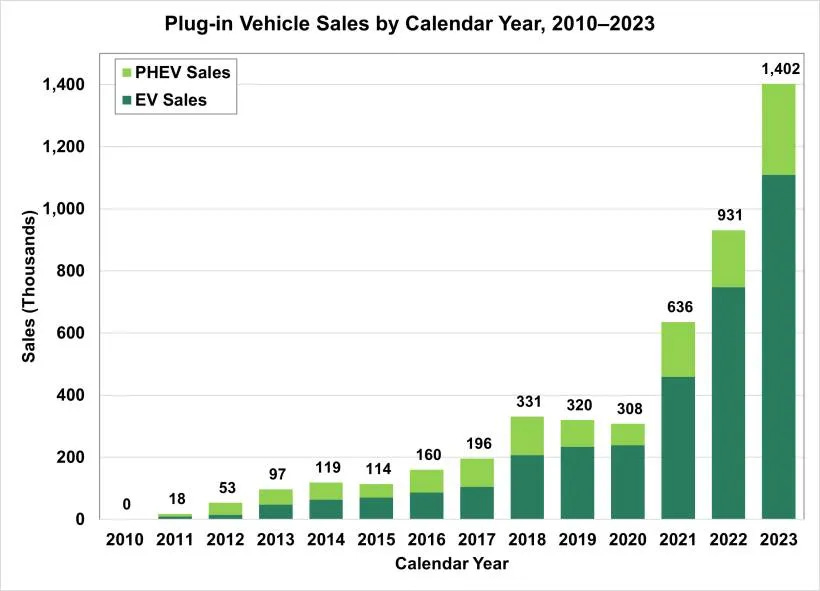

(Note: “PHEV” is the initialism of “plug-in hybrid electric vehicles”)

Perceptive Haymaker readers (isn’t that almost all of you?) are probably thinking: “Wait a second! You’ve been telling us how the Chinese are taking over the automotive world. Aren’t they focused far more on EVs than hybrids?”

Well, that has been the case, but no longer. China’s leading automaker, Berkshire Hathaway’s beloved BYD, which sold 3 million units last year, saw its hybrid sales rocket 83% in 2023. EVs were up but by about ¼ as much, or 21%.

Trader Ferg quoted Louis Gave on this aspect in the same note.

To wit:

Part of the reason the market for EVs has become saturated so quickly may be that demand for electric vehicles is starting to stall, both in China and around the world. In China, while EV sales to state entities …have remained strong, sales to individuals have been disappointing, as Chinese households appear to have turned more toward hybrids. This is probably because few among China’s urban population--the class that can typically afford an EV—own designated parking spots where their cars can be charged. (Emphasis added)

Louis’s last point is huge for this reason: Chinese auto exports to the emerging world are going vertical, with no plateau in sight. That same charging dilemma is true in most developing nations. Ergo, hybrids are a much more compelling offering.

Now, what about that “intriguing factoid”. For those of you who are essential in sustaining the Haymaker enterprise, that’s right behind the paywall.