Making Hay Monday - March 25th, 2024

High-level macro-market insights, actionable economic forecasts, and plenty of friendly candor to give you a fighting chance in the day's financial fray.

“All we know about the new economic world tells us that nations which train engineers will prevail over those which train lawyers. No nation has ever sued its way to greatness.” - Richard Lamm

Charts of the Week

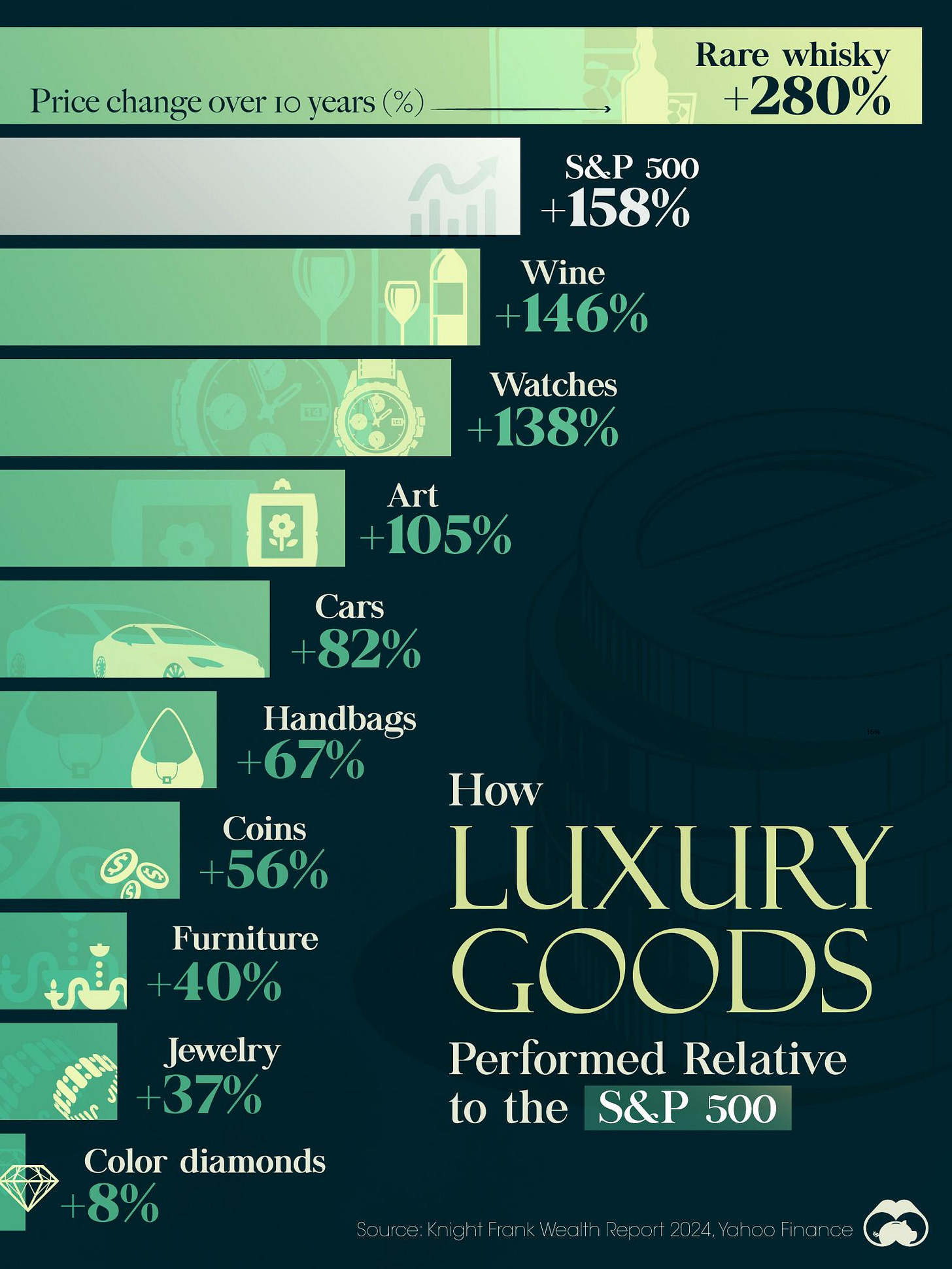

Surpassed only by whisky and closely trailed by fine wine, the S&P is proving itself quite a bit more resilient than most of the mainstay stores of value financially savvy souls have relied on for generations. Per Visual Capitalist:

Over the past 10 years, rare whisky (or whiskey, depending on where it was made) has been the best performing luxury asset, appreciating by 280% and even besting the S&P 500.

* * *

In November 2023 for example, a bottle of The Macallan Valerio Adami 60 Year Old (of which only 40 bottles were produced) sold for $2.7 million at a Sotheby’s auction. Before bidding commenced, Sotheby’s had given the bottle a high estimate of $1.5M.

Fine wine and luxury watches were the next two best performing luxury goods by 10-year returns, at +146% and +138% respectively.

At the bottom were jewelry (+37%), such as rings and necklaces, and colored diamonds (+8%), including rare pink and blue diamonds.

It should be noted that including dividends the S&P has generated a return of $240% since year-end 2013. That closes the gap with rare whiskeys by a fair amount and meaningfully exceeds the return on fine wines. It’s also interesting that America’s most famous bourbon distiller, Brown-Forman, maker of the iconic Jack Daniel’s Old No. 7, has been struggling in recent years. It appears that is due to whiskey drinkers trading up to pricier brands, such as those considered truly rare. Brown-Forman is fighting back by pushing its high-end bourbons. However, its stock broke multi-year support around 60 last fall. It has now tumbled to 50 and change. In other words, it was another excellent warning of looming poor stock price performance.

If the stock market was in imminent danger of suffering a sharp correction, one would think insider selling should be accelerating. Actually, that’s putting it much too mildly. The reality is that insider selling right now is looking like NVIDIA’s stock price chart. Meanwhile, retail investors are pouring money into stocks at a record clip. Need I say more?

Solution(s) Set…

Champions

It’s pretty much stating the obvious that few industries are as cyclical as construction. Accordingly, it would seem be to quixotic to attempt to locate a company in that sector carrying Value Line’s highest earnings predictability rating of 100. Yet, there is one that qualifies and, as you now undoubtedly suspect, it is the focus of this week’s Making Hay Monday (MHM).

It probably is also no surprise that the shares of the company in the spotlight of this MHM are breaking out to a new three-year high. Even better, it has achieved a fresh all-time high (ATH). Moreover, its profits are additionally attaining a new peak. With companies that have its type of dependability, such earnings milestones are to be expected. Nevertheless, it’s more significant when an ATH is accompanied by record profits.

Further, I am particularly intrigued by those situations where net income has been steadily rising and the stock has been treading water. This creates a coiled spring-type of situation. In my mind, the confirmation that the spring is poised to release is when the upside breakout, or range expansion, actually occurs. As you can see below, that is what has happened with our star of the week. As usual, more details will be shared for paying subscribers beyond the paywall.