The reality that much of America’s economic growth since the pandemic has been a function of mammoth federal spending, often hitting wartime-like levels of 7% of GPD, is gaining traction even at the highest levels of government. For example, Treasury Secretary Scott Bessent has repeatedly emphasized the urgency of breaking the dependency on this Himalayan-level deficit spending. Accordingly, he is warning of a “detox” phase to move away from what this newsletter has referred to as pseudo-prosperity. This is almost certain to hit GDP in the near term, as necessary as it is to avoid an eventual fiscal funding crisis.

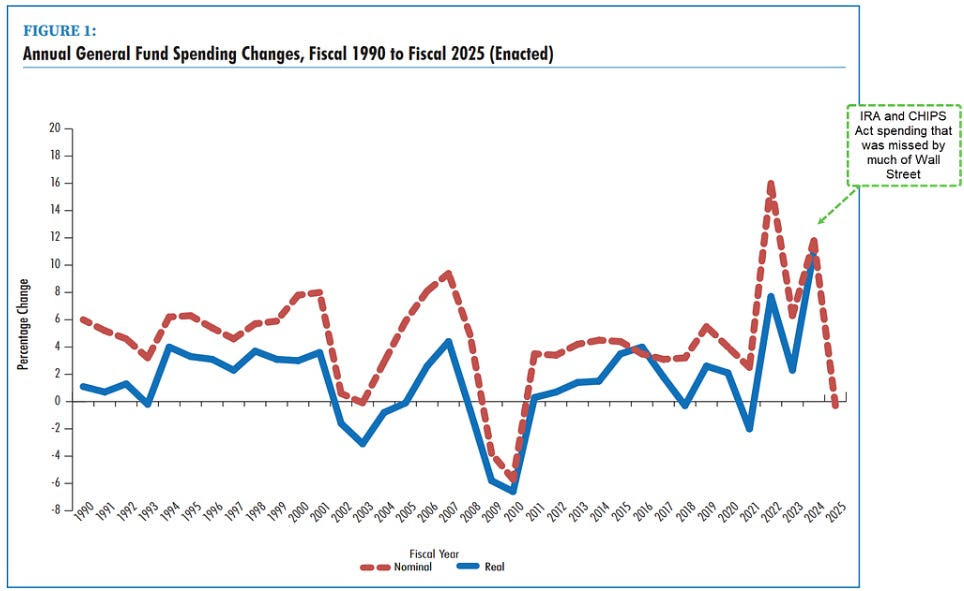

What is much less widely appreciated is the degree to which state spending has also inflated U.S. economic activity. Per my two good friends Vincent Deluard and Kevin Muir, the National Association of State Budget Officers, NASBO, maintains the above chart on their website. As you can see, state spending in real terms (i.e., adjusted for inflation) was higher in 2024 than it was during the immediate aftermath of the pandemic. For 2025, however, it is projected to swing to slightly negative. As Kevin observes, “this is a HUGE change in spending”. The majority of economic forecasters, who are crowded into the no recession camp, should take note.

While fully realizing it’s not fashionable to be saying the odds now favor a U.S. recession this year, it’s becoming increasingly difficult, bordering on obtuse, to overlook the slew of economic data that has fallen off a cliff lately. The above image of the Philly Fed’s New Order Forecast is an example. It’s also an important one because of the Philadelphia area’s sensitivity to economic trends. This is due, in part, to the heavy concentration of chemical production within its boundaries. The fact that the three-month average is the weakest on record should be an eye-opener. At this point, we do believe a recession is more likely than not, despite the high level of Wall Street conviction to the contrary.

“Could we be seeing that this economy that we inherited is starting to roll a bit? Sure… We’ve become addicted to this government spending, and there’s going to be a detox period.” -Treasury Secretary Scott Bessent — March 7th, 2025

Truly Toxic

Paraphrasing my friend Kevin Muir, the main benefit I provide to Haymaker readers is the 46 years of mistakes I bring to the table. As I’ve previously written, one of the worst was my bailing on tobacco stocks in the late ‘90s.

Like avoiding fossil-fuel shares and switching into green energy shares four years ago, this was totally a socially acceptable, even commendable, move to make. That should have been my first clue. As with the spectacular outperformance of the S&P by “old energy” since 12/31/2020, and the equally spectacular underperformance by “new energy” over the same interval, exiting tobacco stocks at the start of this century/millennium was a colossal investment blunder.