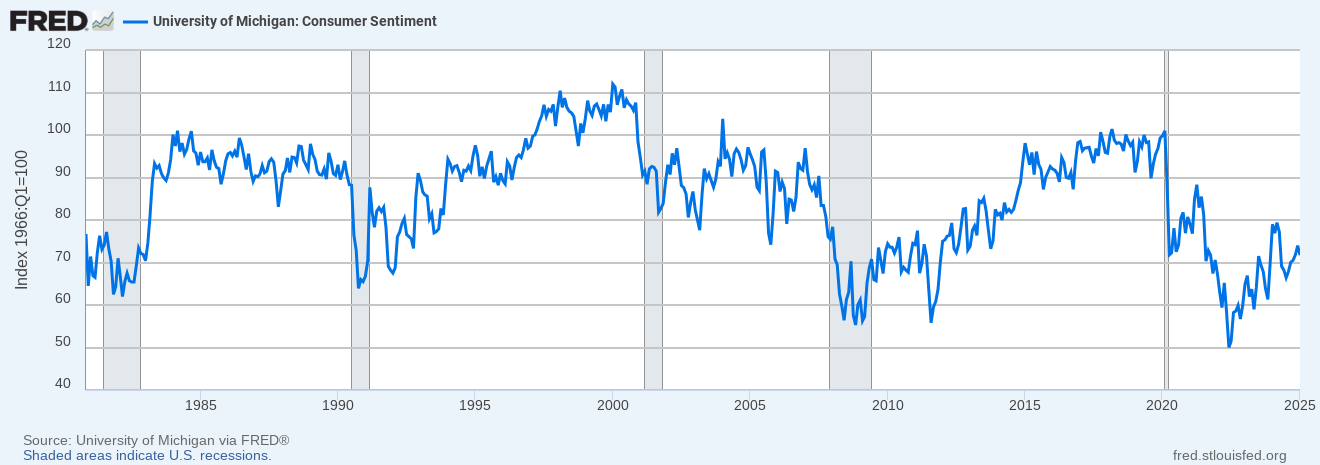

The collapse in the influential University of Michigan’s Consumer-sentiment index has been one of the sharpest on record (please see first chart which is updated through last week). In fact, it has been precipitous enough to bring it down near the Great Recession lows. However, it is not quite at the trough readings seen during the 2022 dual bear market in stocks and bonds, when recession anxiety was at a fever pitch. Today, though, Wall Street and the economic forecasting community are generally sanguine about the prospects of dodging a recession.

Part of this attitude may relate to being once burned, twice shy after having been almost all-in on the economic contraction call back in 2022 and into 2023. There are those who believe the worst is over for the UofM Consumer-sentiment index and that a turning point is near. However, in my view, the trend is clearly lower and there’s a decent chance the 2022 low is taken out.

One of the most convincing reasons to expect much lower U.S. stock market gains in 2025, besides that it is coming after two consecutive 25%-plus return years, was the extreme level of bullishness at the Goldman Sachs Strategy Conference. This is held each January and very low readings have tended to foretell strong results in the upcoming year. For example, at the start of 2023, just before those aforementioned back-to-back spectacular years, only 18% expected the U.S. to be the top-performing market. At the start of this year, that was up to 56%, far above anything seen in prior years. Thus far, both the S&P and the NASDAQ are badly lagging overseas indexes.

We've invested in excess of $30 billion into renewables, and have really completely changed the way our businesses do business, i.e. our utility businesses.” -Warren Buffett

“The market and the economy have become hooked, become addicted, to excessive government spending and there’s going to be a detox period.” -Scott Bessent, United States secretary of the Treasury (sourced from Haymaker friend, Adam Taggart)

Sunburned

Champs

It is no secret to any veteran readers of this publication that the geriatric Haymaker has long been a fan of fossil fuels. This affinity goes back to his predecessor publication, the Evergreen Virtual Advisor (EVA).

In last Friday’s Haymaker, we made a familiar case for the allure of the cleanest-burning fossil fuel: natural gas. We also criticized the naivete of those in the Western intelligentsia who felt the world could be almost totally run on renewable energy sources. (Actually, for many of them, there was no “almost”; conversely, we would point out that Warren Buffett’s company, Berkshire Hathaway, has a hamster-like footprint in green energy and a yeti-sized carbon footprint in fossil fuels.)