“The longer the basing pattern, the larger the eventual move.” -Trader Ferg in his 6/23/25 missive, quoting his friend Brad (for what it’s worth, Team Haymaker believes Brad is spot-on in this regard)

Yield, Baby, Yield!

You are about to read a most unusual introduction. The reason for the oddity is that first I’m going to bring up one of the more fascinating policymaking trends of which I’ve become aware. Then I will explain why it could support the U.S. dollar at its currently overvalued level. Finally, regardless of that potentiality, I’ll make the case as to why I believe you should continue buying closed-end funds holding emerging-market debt denominated in local currencies.

First, here’s the epiphany I’ve recently had in as concise a form as I can create:

Readers undoubtedly realize I’ve long been negative on crypto crap, like Dogecoin, of which there is almost a limitless quantity (and that’s a key plank of my bearish platform on them). With Bitcoin I’ve taken a more neutral view: perplexed yet intrigued.

In fact, prior to my semi-retirement (my wife thinks it’s much more “semi” than “retirement”), I had encouraged the firm of which I was formerly the Co-chief Investment Officer to think about accumulating it during the next “risk-off” episode – i.e, a serious correction. Ironically, that happened as I was entering my quasi-retirement early this spring.

It took me a long time to orient my mind to even consider buying Bitcoin. One of my biggest obstacles to a bullish stance was my belief the U.S. government was genetically predisposed to oppose its utility and, even, existence.

Obviously, Trump 2.0 has brought a radically different crypto attitude to the Oval Office than either the Biden administration or Trump 1.0. In addition to the fact the current POTUS was able to earn windfall profits on his recently issued Trumpcoin, there is a less obvious driver of this new-found affinity for the cryptoverse. And that would be what I’ve often referred to as the U.S. government’s 4F predicament: the Federal Fiscal Funding Fiasco.

As most readers are aware, I’ve been harping on the 4F scenario for years. Despite the initial promise – and promises – of DOGE, with its ballyhooed $2 trillion spending cuts, there is almost no pulse discernible among fiscal reformers in D.C. Even Elon Musk has learned the hazards of criticizing the spending laden “Big Beautiful Bill”.

This dramatic shift from might have been a serious fiscal drag if even half of that reduced $2 trillion federal expenditures had been enacted, to what is now a full embrace of spend-but-don’t-tax policies, is head-spinning. This shocking course correction has caused formerly bearish strategists, such as the man who seems to have a crystal ball, Darius Dale, to now expect the stock market bulls to keep stampeding.

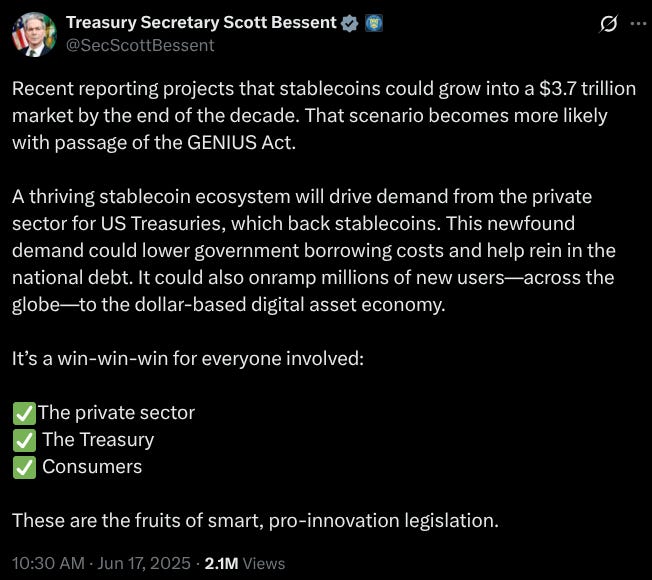

Yet, this assumes that there is no bond market riot where long-term interest rates rocket due to the continuing fiscal incontinence. This will be a hard act to pull off, but Treasury Secretary Scott Bessent might be one of the few in D.C. equal to the challenge. He’s on record deriding the Biden administration’s prior anti-crypto mentality. Moreover, he’s remarkably blunt on how he sees cryptos giving the U.S. government a big boost. The key to that is a vehicle of which I have long been extremely critical: Tether.

As you may know, it is the leading stablecoin. Roughly half of all Bitcoin purchases and sales are effected through Tether. Despite its stature, it has not produced an audit from the time it went live in 2014, notwithstanding repeated promises to do so.

It was my belief, and still is, that it was heavily exposed to a plethora of questionable assets in order to earn some income when short-term interest rates were around zero. After the Fed’s long rate-hiking campaign, however, just sitting in T-bills creates a windfall for Tether since it doesn’t pay its customers any interest on their balances. Thus, it can earn close to 4% on a rapidly increasing asset base with no risk and very little overhead.

As of March 31, Perplexity reports it had $150 billion in assets under its custody. Most probably, those are much higher now, but even that sum likely generates around $6 billion of revenue. A very high percentage of that undoubtedly falls to Tether’s bottom-line given its modest overhead. It’s a great irony that its founders, with their highly controversial past activities, have fallen ass-backwards into what has become a veritable cash machine.

Frankly, I still don’t get why transactors in Bitcoin (BTC) need to use Tether as the conduit. Regardless of my obtuseness, however, it is the dominant stablecoin issuer. Based on what you’re now going to read, Tether’s assets are likely to soar much, much further.

Don’t take my word for it. Please peruse this X post from Secretary Bessent:

Let’s unpack this a bit: U.S. T-bills are the most popular stablecoin asset and are likely to stay that way for the indefinite future; the U.S. Treasury needs to rollover something like $6 trillion of maturing debt over the next 12 months, as well as fund the $2 trillion annual deficit; foreign buyers of Treasury debt are increasingly wary of U.S. fiscal policies and also their tax treatment (the proposed federal levy on overseas holders). Ergo, you can easily see why Mr. Bessent is so enthusiastic about having trillions of new buyers of T-bills (which is mostly what the Treasury issues to fund itself).

But, you might wonder, how does it save the U.S. government money when it has to pay Tether 4% on the T-bills it holds?

That’s where Mr. Trump’s intensifying campaign to cajole Fed head Jay Powell into cutting its overnight rate – which, in turn, lower T-bill rates – enter the picture. He’s even threatening to appoint Mr. Powell’s replacement soon despite that the latter’s term doesn’t end until next May. This “shadow” chairman, if he or she does get named, would almost certainly be the ultimate dove: aka, easy money proponent. Consequently, markets may quickly price-in lower rates in the short-term U.S. Treasury market.

The other card the Treasury may play is to issue special obligations to stablecoin players, like Tether, that carry much lower-than-market yields. The carrot might be that the government will give its stamp of approval to those entities which go along with this program. For those that refuse, the government may well play hardball with them.

Both of these ploys seem like a high-probability outcome to me. The Trump administration desperately wants to lower its cost of capital. These moves would be a logical way to do so.

If I’m right – and I give lavish credit to the always-brilliant Luke Gromen for my awakening – the flow through to Bitcoin should be enormous. Luke notes that, over the past four years, the lowest ratio of Bitcoin’s market value relative to the stablecoins’ capital base has been 2.5 to one. Accordingly, the $3.7 trillion increase Secretary Bessent is throwing around could easily equal $9.25 trillion of additional BTC buying power. Not all of it will go into the King of Crypto but a high percentage likely will.

As a result, BTC could experience the mother of all upside blow-offs. There are rumors the U.S. government is surreptitiously accumulating BTC. If so, and it goes postal, the Treasury could use any windfall from that to buy back government debt. It may also do that if it values its gold at fair market value.

There are a number of entities setting themselves up to be Bitcoin “warehouses”. This is similar to what Michael Saylor’s phenomenally successful Microstrategy has done. Accordingly, there is an exploding amount of demand for BTC, the other cryptos and stablecoins. Of course, all manias end and this one will, too, but it could easily be from a much higher level.

Another implication is that the dollar, which has been sucking wind this year, might rally versus other currencies that don’t have this type of synthetic demand. Which leads me to my strange segue…