Making Hay Monday - July 29th, 2024

High-level macro-market insights, actionable economic forecasts, and plenty of friendly candor to give you a fighting chance in the day's financial fray.

Charts of the Week

One of the reasons this newsletter issued a recent warning on the stock market and its poster child, Nvidia, was due to the tsunami of insider selling. Because of lavish stock option plans, tech companies like NVDA tend to consistently experience heavy insider liquidations as they seek to lock in their immense gains. (Naturally, those come out of the pockets of ordinary shareholders and typically don’t impact profits, a reality about which Warren Buffett has long been critical.) However, the recent market turbulence was about much more than just the frenzy of insider selling. Close to record high valuations (actually, all-time high by some measures), extreme performance concentration, stiff competition from yield instruments, the appalling state of U.S. government finances, and, related to the latter, the potential for turmoil in the Treasury bond market, all were – and are – reasons to be reducing stock exposure. The end of last week brought a relief rally, but the downward pressures are unlikely to be over. On the plus side, it is encouraging to see a swelling number of stocks in rally mode. Accordingly, we might be experiencing another “Great Rotation”, similar to what occurred in 2000 and 2001. That was when the first mega-bubble in tech stocks popped and the formerly left-for-dead value sectors came roaring to life.

One of the strongest indications the Japanese yen was poised to vigorously rally, after a brutal sell-off, was the overwhelming negativity toward it by the investment community at the end of June. This was the polar opposite of positioning in 2020 prior to what would be a one-third price collapse versus the U.S. dollar. For a major currency, that was a nearly unparalleled loss of value. This has left the yen stunningly cheap versus its developed-world peers on a purchasing power parity basis. (The Economist’s famous Big Mac Index reflects this as well; a Big Mac in Japan is 47% cheaper than in the U.S.) However, since July 6th the yen has been ripping higher, up 6%. Again, for a currency, that is an impressive move in such a short time.

“The US is taking a big risk by running large and chronic fiscal deficits. The more it borrows, the greater the chance it’ll end up in a vicious cycle, in which government debt and interest rates drive on another inexorably upward.” -Bill Dudley, former head of the NY Fed.

Good Call, Bad Call

(We’ve applied a bold font to some of the more pertinent sections for those who prefer a speed read)

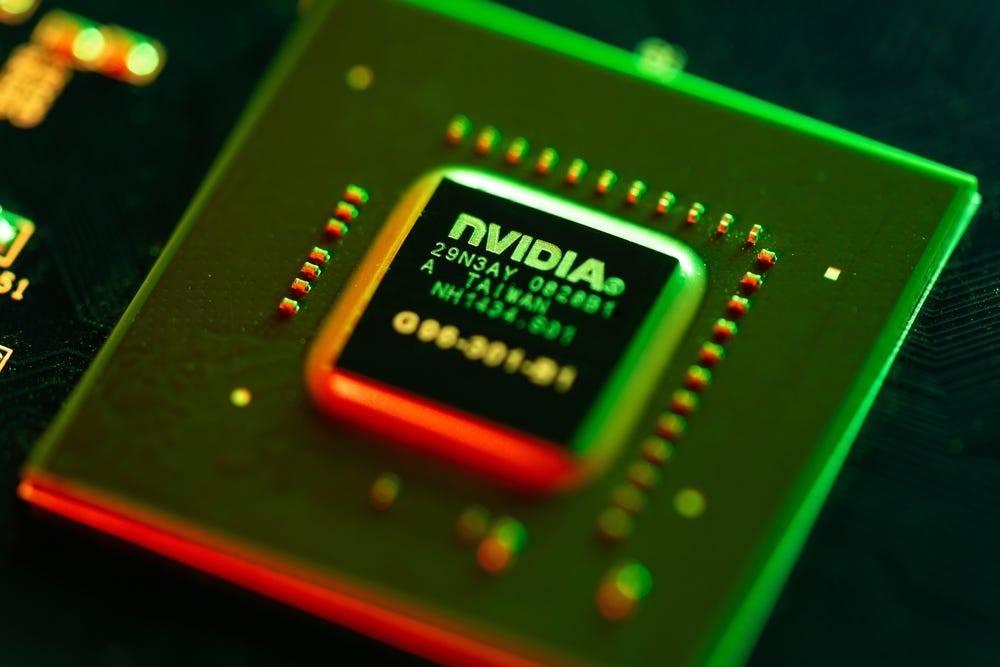

If you’ve ever zip-lined 2,500 or so feet above a valley floor, that’s pretty much the same sensation I had back on June 10th, when I suggested those holding the shooting star known as Nvidia (NVD) might want to cash in some of their gains. At that point, it was trading around $120.

As usual when I make such comments, it immediately spiked to $140. That was a move I anticipated when I wrote these words back on June 10th:

Please don’t misconstrue: I’m not remotely suggesting you fully exit NVDA for any of you fortunate enough to hold this rocket ship. Rather, you may want to lop off 20% or 30%. If it continues to zoom, count that as another blessing and sell it down again.

In other words, I was conceding $120 (split-adjusted) might not have been the top and that a dollar-cost-averaging sell-down approach might be the best. Frankly, I see very few investors, particularly of the retail persuasion, who utilize that discipline. Yet, it’s an excellent way to reduce exposure to a stock that has gone postal. This is opposed to trying to play Carnac the Magnificent from the old Johnny Carson show and pretend you can top-tick a moonshot.

With the stock now at $112, a phased reduction now looks quite respectable. This assumes an average trim price of $130 (the split between $120 and $140).