Charts of the Week

Goldman’s former star commodities strategist Jeff Currie believes we are in the midst of a natural resources super-cycle, as do I. However, in a recent podcast with MacroVoices’ Erik Townsend, he cautioned that past commodity hyper-bull markets have been characterized by violent price spikes and sudden plunges. As a result investors, particularly those who have been lulled into complacency by the U.S. stock market’s uncannily smooth uptrend over the last 15 years (with brief shakeouts) are at risk of bailing out at inopportune times.

Illustrating the extreme volatility inherent in commodities, there may not have been a bull market as stupendous as that of gold a century ago in Weimar Germany, at least as measured by its vaporizing currency. Despite the hyperinflation that was engulfing that country, setting the stage for Hitler’s first attempted power grab, gold had several steep sell-offs. Yet, for those who stuck with the world’s oldest currency throughout its wild gyrations, it provided a lifeline from the financial ruin that befell most German citizens in those convulsive years.

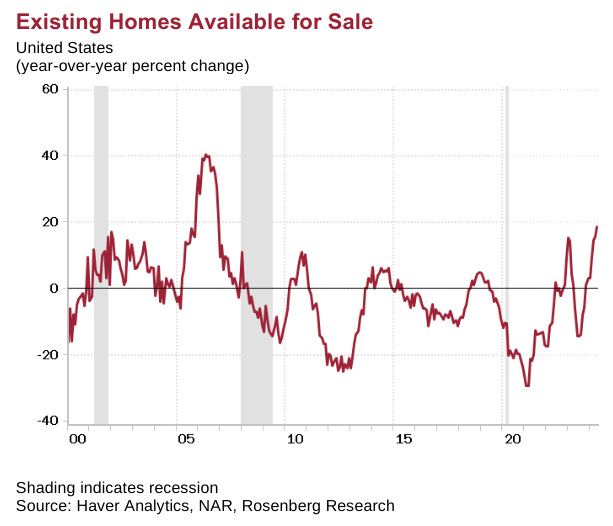

Housing prices have remained stubbornly high despite lofty interest rates. That combination has left affordability at one of its worst points of all-time. Perhaps the primary supporting factor behind the price levitation has been a limited number of existing homes hitting the market. This is mostly because owners have been understandably reluctant to give up their low-rate mortgages. Lately, though, there has been a surge of existing homes listed for sale. In fact, they have broken out to a multi-year high and appear to be trending higher, potentially considerably.

Special Message

Before getting into this week’s highlighted investment, we thought we should emphasize our growing belief that a correction, quite possibly a deep one, is close at hand.

Consider this another “Take Profits” suggestion. The first time I did that was in early 2021 under my former newsletter’s banner.

It was controversial in the extreme.

There was a misunderstanding, likely my fault, that I meant readers should get out of the stock market. This caused me to clarify in the next edition that “taking profits” wasn’t the same as a call to totally cash out. Rather, I was suggesting targeting the market segments that looked irrationally overvalued. As I’ve written on many occasions, the special objects of my derision were what I’ve long called the COPS: Crazy Over-Priced Stocks.

In many cases, they kept rising through much of 2021. However, some — particularly the most egregious COPS example: the meme stocks — hit their crescendo in early 2021.

The ultimate meme meteor back then was GameStop. On a split-adjusted basis, it rose from barely above $1 in the summer of 2020 to what would prove to be its highwater mark of $81 by late-January 2021.

Less than a month later, it had imploded back to $10 — a loss of nearly 90%.

It’s fair to say that turned its fanbase into a bunch of screaming meemies… or at least it should have.

It rose nearly seven-fold over the next few weeks. Yet, by the end of 2021, it was cut in half from that level. At the low point early this year, around $10, it had lost another two-thirds from its year-end 2021 price. It then proceeded to rocket back to an intra-day high of $65 in early June, as usual on questionably bullish news. From there, it’s been another 60% plus faceplant.

This type of casino behavior is one reason to be leery of current market conditions. But there is much about which to be apprehensive as we’ve been relaying over the past three Haymaker editions. Ironically, a new potential downside trigger might be last week’s presidential debate.

The reason for the irony is that Donald Trump clearly won, or perhaps, more accurately, Joe Biden unquestionably lost and the stock market has a decided preference for the former president with the most unusual hair style. The bond market was a different story, as it sold off at the end of last week, despite friendly news on inflation and the economy.

Bonds logically concluded that another blast of Trumponomics would be highly likely to entail a further spending blow-out, due to additional tax cuts. This, and other pro-growth Trump policies, might turn the economy around; a good thing, but quite possibly at the cost of an inflation rebound. There is the very real chance that America could see a replay of the UK’s Liz Truss moment in the fall of 2022. That was when the then-British Prime Minister unveiled an ambitious – and, ultimately, ill-advised – tax cut in the face of an already precarious fiscal position. In other words, much like what Mr. Trump may attempt.

In the wake of Ms. Truss’ plan, the UK bond market promptly did a cliff dive. This triggered her nearly overnight (technically 44 nights, but who’s counting?) resignation and bestowed upon her the decidedly un-great distinction of being Great Britain’s shortest-serving Prime Minister.

The present reality is that the U.S. government’s funding has become dangerously skewed toward short-term maturities. This has left it decidedly illiquid, with the long end of the U.S. bond market already displaying the hallmarks of fragility and illiquidity. At this point, a buyers strike caused by perceived inflationary policies is the last thing it needs to endure.

What could also aggravate the long-duration bond market’s anxiety, again ironically, would be the economy looking increasingly recessionary. As I’ve conveyed of late, there is mounting evidence that the almost universally accepted soft landing is encountering some serious turbulence as it attempts to touchdown. (The raft of consumer-facing companies that are reporting punk results, like Nike last week, is a real-time illustration of the economic deterioration.)

The reason this could be troubling for long bonds – after what Jeff Gundlach refers to as a Pavlovian rally on bad economic data – is the likelihood of a very aggressive government response to a recession. The inflationary implications of that have the potential to cause longer-term rates to rise along with recession fears, a highly ironic outcome indeed.

To reiterate, this is once again not a call to exit the stock market. Rather, it is a more strident suggestion to cash in some gains on any of your highly extended positions. In particular, I’d recommend exiting those where fundamentals are questionable. A big clue in that regard would be any security where insiders are selling hand over fist. (Please see the Down for the Count section).

On the other hand, as you’ll soon read, there are some market niches which have already corrected significantly. In the case of this week’s showcased essential commodity, the long-term story is truly glowing.

“To the making of these fateful decisions, the United States pledges before you, and therefore before the world, its determination to help solve the fearful atomic dilemma - to devote its entire heart and mind to finding the way by which the miraculous inventiveness of man shall not be dedicated to his death, but consecrated to his life.” -Dwight D. Eisenhower, excerpted from his famous “Atoms for Peace” speech (delivered in 1953 before the United Nations)

Here’s Looking At “U”…

Champions

The Western world has found itself in perhaps the strangest policy situation a civilizational collective could ever envision. Our way of life hinges on accessible, viable, and infrastructurally compatible energy sources which, for reasons stemming from ideology more than science, were long out of favor not so much with the public, but with public policymakers. To put it succinctly, oil and gas were seen not as life-enriching, energy-dense building blocks of modern civilization, but as necessary evils to be banished from usage at some indeterminate (but always just around the corner) date.

Fine, we suppose, but what about an alternative?