Making Hay Monday - January 8th, 2024

High-level macro-market insights, actionable economic forecasts, and plenty of friendly candor to give you a fighting chance in the day's financial fray.

Some Like It Too Hot

“There is more dementia about finance than there is about sex.” -Charlie Munger

“It’s perhaps the greatest example of confirmation bias in the financial markets. The television outlets will feed whatever emotion you’re feeling at the moment and probably dial it up to the next level. After all, that’s how you get viewership and ratings.” -Michael Gayed, author of the Lead-Lag Report

Champions

To say that market conditions at the end of 2023 were somewhat on the toasty side is a bit like saying the University of Washington Huskies’ Michael Penix played well this season. (Similar to almost all Seattle-area natives, I’m rooting beyond hard for him and his team to beat the Michigan Stealers, sorry, Wolverines, tonight in their national championship contest.) As you can see below, the S&P 500 was radically overbought in mid-December and it got more so from there. Even the long ignored small caps, a Haymaker favorite from last year, when they were still moribund, have seen inflows into that style go postal.

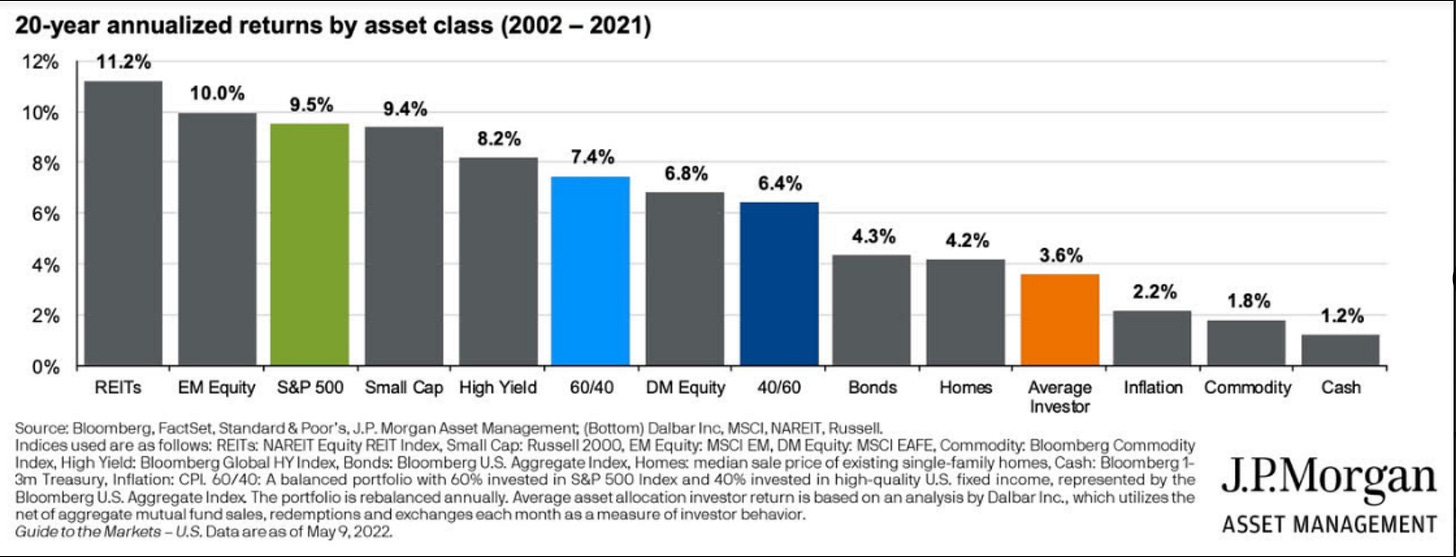

Yet, for most it seems, it’s a case of “buying high and buying higher still”. The allure of momentum and instant gratification seems too great for most to resist. Then, when the inevitable reversion to the mean occurs, it’s a very mean reckoning indeed for the blundering thundering herd of performance chasers. This proclivity has undoubtedly played a starring role in the decidedly inferior returns generated by the average investor shown below.

It is further astounding, at least to me, that investors seem oblivious to the obviously ominous national political and societal trends. It’s as if we’re still in the prosperity-drenched and bipartisan-spirited 1990s. In reality, nothing could be further from the truth. Of course, so much money is moved mechanically these days, with little interpretation of big-picture trends, no matter how glaringly apparent, I guess it’s not all that surprising. But, in my view, it is dangerous in the extreme. The most graphic example of that is the utter nonchalance toward the increasingly out-of-control Federal Fiscal Funding Fiascos on which I’ve so frequently written and spoken.

But since this is the Champions section, I need to highlight some securities that might weather any unexpected (at least by the consensus) tempests. Logically, I think, that means avoiding stocks at inflated valuations. The poster child for that continues to be the purveyor of one of the most mundane consumer products, the liquid lubricant that comes in a blue and yellow aerosol can. Incredibly, it continues to trade at 50 times its slow-growing earnings. (We’ll look at another super-pricey stock in the Down For the Count section, though its brand is perceived as sexy in the extreme.)

So, what are some names that might fare better in a much overdue market correction (that may be already in progress)? Please note the “might” and, as always, do a much deeper dive into them than I have the space for or check with your trusted financial advisor.