Making Hay Monday

(Click chart to expand)

The above chart displays both the Leading Economic Indicators (LEI) and its 24-month moving average. The key message from this visual is that whenever the LEI moves below the 24-month moving average a recession has always occurred. (If you click to expand, you’ll see this goes all the way back to the 1960s.) The most recent breakdown occurred in 2023 and has not, as yet, presaged a recession. Despite this metric’s impeccable track record, the Wall Street consensus is overwhelmingly convinced a hard landing is a near-impossibility. Certainly, the stock market’s bubbly behavior evinces a no-worries mentality.

However, below the surface cracks are forming with the S&P and the NASDAQ once again increasingly pushed up by a handful of mega-cap tech companies. (Interestingly, that has not included Nvidia; since the election it is actually down and it is now slightly below where it was trading back in June). Also indicating the LEI warning should not be blown off, the economically critical housing industry is revealing growing signs of acute softness. Should stocks join in this due to, say, a serious correction early next year, that could bleed through to the real economy.

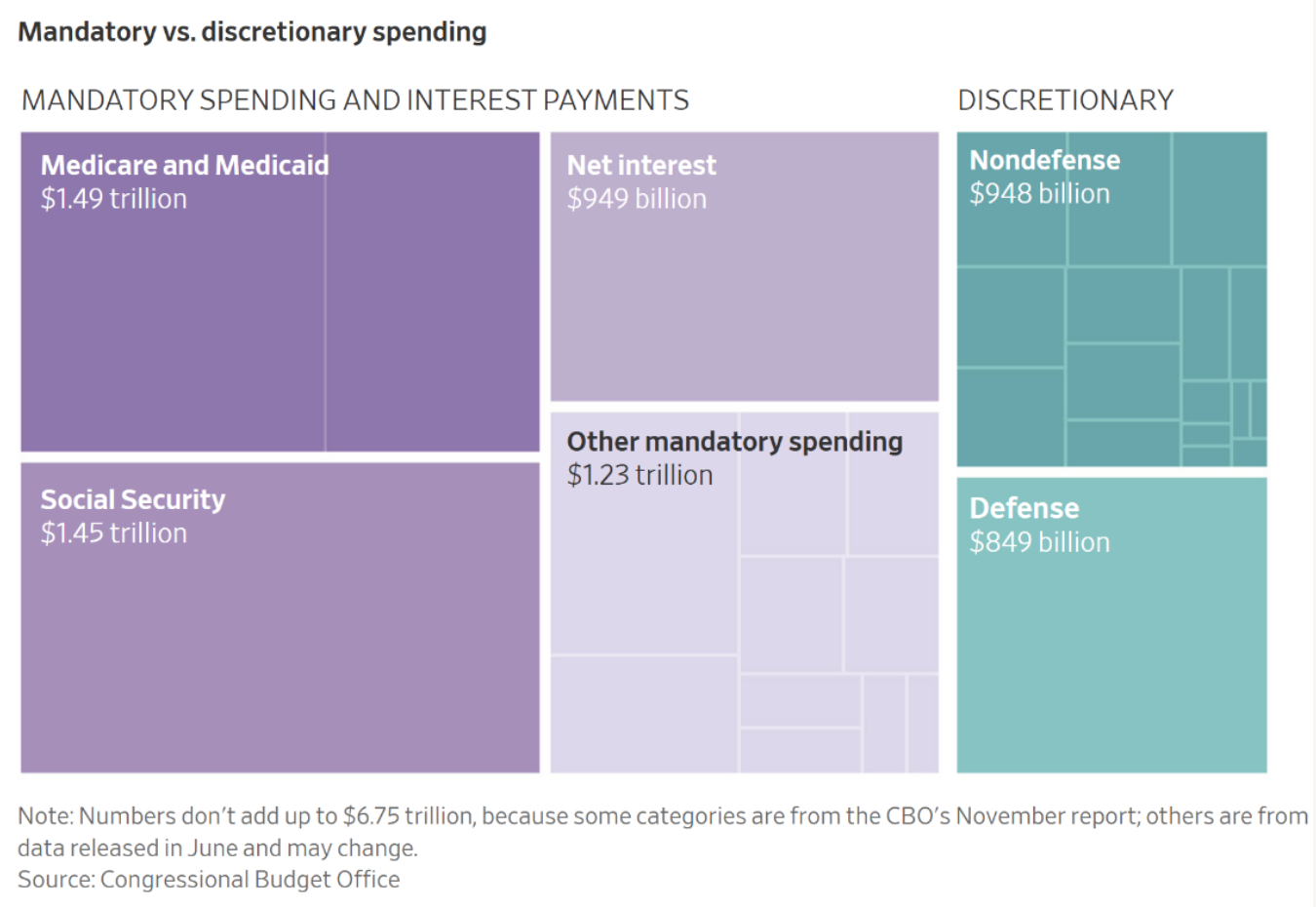

All Americans who would like the federal government to put its fiscal house in order should be rooting for Elon Musk’s DOGE efforts. However, with Donald Trump indicating entitlements are sacred cows, deep budget cuts look to be nearly impossible. Additionally, Mr. Trump has promised to cut corporate tax rates even further, as well as eliminating taxation on tips, overtime, and Social Security. Unquestionably, Mr. Musk is a miracle worker, but this one ranks right up there with walking on water and raising Lazarus from the dead.

Trading Alert / Power Punchers (Note, this is another installment in our mini-series on stocks that have likely been casualties of year-end tax-loss-selling. Haymaker Founding Members received the Power Punchers portion last week; however, this iteration includes Charts of the Week (see above) as well as the Promising Picks and Down-&-Out sections. Be sure to check out the latter for some general market and sector specific comments.)

“Investing success is when the market agrees with you…eventually.” -Grant’s Interest Rate’s Observer, Jim Grant

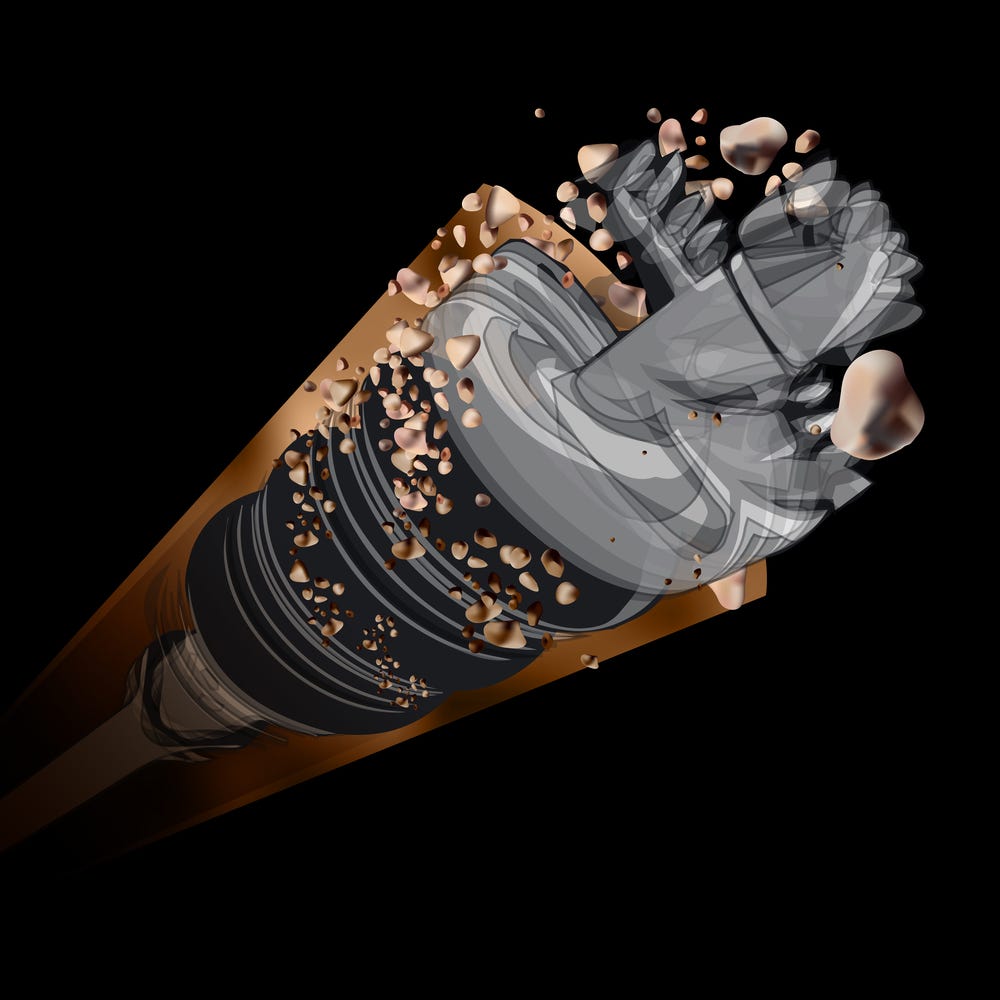

Drilling Down… Way Down

There may be no market sub-sector that has been pulverized as severely as the offshore drillers. Apparently, the Trump administration’s plans to increase U.S. oil production do not include the leading companies that operate in the Gulf of Mexico.

The fact that the once rapidly growing U.S. shale basins such as the Bakken, the Eagle Ford, and the Barnett, not to mention the Big Kahuna, the Permian, are all either seeing declining or flattening output seems to be of no consequence to most energy market observers. At this point, only the Permian is still eeking out some modest production increases.

There is a growing belief, which Team Haymaker shares, that we have entered the Twilight of Shale era. (Hat tip to Cornerstone Macro on that one, a theme they’ve been articulating for several years now.)

Moreover, as this newsletter has repeatedly conveyed, the decline rates in shale are very steep. Specifically, about 70% of a shale well’s output has been exhausted after a mere two years. That was not a major issue when there was a seemingly inexhaustible supply of Tier One (i.e., the richest) production zones. This is often referred to as “rock” in oil industry lingo.

At this point, though, producers are having to drill even longer “laterals”. These are the horizontal bores that have been every bit as critical to the shale miracle as has fracking. (Fracking is oil industry short-hand for hydraulic fracturing, where water, chemicals and specialized sand are injected into rock formations to release oil and gas.) Tier Two and even Tier Three rock is now being drilled and fracked.

As a result, there is a growing cadre of energy experts who believe offshore exploration and production will be where major U.S. hydrocarbon output increases are achieved. The highly regarded hedge fund manager known as Kuppy, Harris Kupperman, is one of the most vocal and vehement advocates of this belief.

Yet, as you can see from the following charts of three of the largest offshore oil service companies, the stock market seems to be pricing in an anti-boom for this slice of the traditional energy complex.