Making Hay Monday - August 5th, 2024

High-level macro-market insights, actionable economic forecasts, and plenty of friendly candor to give you a fighting chance in the day's financial fray.

Charts of the Week

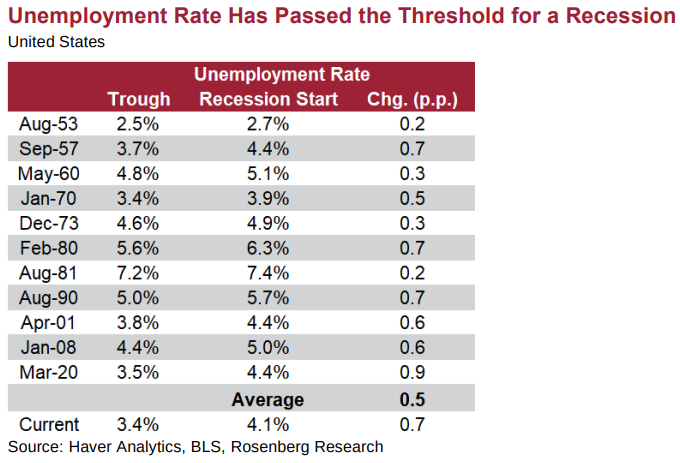

Even prior to Friday’s downbeat jobs report, the unemployment rate had risen to 4.1%. As shown above, that was high enough to have exceeded the bar for increasing joblessness that has signified past recessions. After the latest release, that rate is now 4.3%. Thus, by this measure the odds of a recession are very high. This has now also been confirmed by the Sahm Indicator, comparing the moving average of the past three months’ unemployment rate to the lowest level of the prior 12 months. The threshold for that is a one-half percent increase which has occurred.

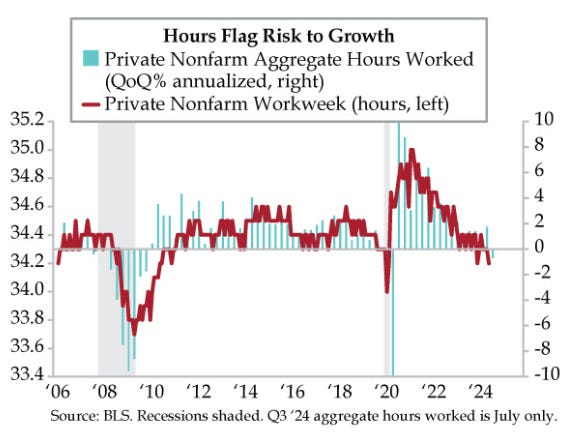

However, it is important to note that four million illegal immigrants have increased the available supply of workers. (It is fair to question how, and how accurately, government statisticians adjust for this factor.) Hurricane Beryl slamming the Texas economy last month also undoubtedly affected July’s employment picture. Time will tell if Friday’s report was an aberration, with downward adjustments to the unemployment rate to follow. However, the precipitous decline in the Private Non-Farm Workweek is ominous and is looking increasingly recessionary. (The second visual above is from Danielle DiMartino Booth who has been way out in front of rose-colored glasses wearing Wall Street on the recession call. Please see the main text for more on this critical topic.)

Five-Year Chart of the Japanese Stock Market - (Click chart to expand)

The S&P 500 has fallen 8% from its mid-July peak, rattling U.S. investors. This fear spike likely reflects how accustomed they have become to a consistent string of higher highs. Frankly, an 8% retracement doesn’t even qualify as a correction. Japan is a different story. Its main market index is now down 25% in a month, bordering on what could be considered a crash. The catalyst for this carnage has been the yen’s dramatic rally. Haymaker readers are aware of how many times this newsletter highlighted the yen’s extraordinarily depressed valuation prior to its equally extraordinary rally.

We have also been warning of how pervasive the yen carry trade has become. This is where the yen is shorted to fund investments in theoretically higher-returning assets. The unwind of this massive short position has almost certainly been a factor in the extreme stress seen worldwide in many risk assets. Cryptocurrencies have been particularly pummeled. This implies that a big driver of their appreciation over the last couple of years may have come from speculators financing their purchases of Bitcoin, et al, via borrowed yen.

“Maybe things weren’t as rosy as we thought they were.” -Eric Merlis, co-head of global markets at Citizens Financial Group, per Saturday’s Wall Street Journal

“My guess is that we remain in a secular bond bear market that began in 2021, but it might well be that we are embarked on a shorter-term bond bull market within that context.” -James Grant, editor of Grant’s Interest Rate Observer, as reported in the current issue of Barron’s

Was That The Recession Bell Ringing?

This was a table of contents headline, also from the current edition of Barron’s: A Jobs Shocker Throws the Fed for a Loop. For anyone who has been even a semi-regular reader of this newsletter, Friday’s number should have been anything but a shock. In our view, the only shocking part was that it took so long for the official data to finally sync with what’s been going on in the real world for the past year.

There’s likely no one who has been as vocal on the absurdity of the contemporaneously released jobs data as Danielle DiMartino Booth. As a result, she’s taken a lot of heat, but she has a history of being able to stay in the kitchen even as the temperature rises to uncomfortable levels. In fact, at May’s influential Strategic Investment Conference – organized as usual by John Mauldin and populated by many of the world’s finest financial minds – she made the controversial statement that a recession had already begun.

Not long after, she was the only macroeconomic expert, at least that I’ve read, to point out that last year’s third-quarter jobs data displayed precisely what she’s been repeatedly highlighting (a reality we also picked up on): the large and persistent downward revisions to what were initially robust reports on the labor market. Specifically, Q3 of 2023 was originally supposed to have seen almost 500,000 net jobs created. However, upon the final calculation there was, in reality, a net loss of 192,000 jobs. I.E., it was almost a 700,000 swing the wrong way. Again, this garnered almost no media, or Wall Street, coverage of that highly significant revision.

Friday’s bombshell jobs release, following closely on the heels of Thursday’s very recessionary Institute of Supply Management (ISM) Manufacturing Index print, has caused a head-spinning change of position by Wall Street on the cadence of Fed rate cuts. (It is possible that a decent amount of the July payroll weakness was due to Hurricane Beryl but that can’t account for the decidedly downward revision trend.) On the encouraging side, today’s ISM Services Index release was better than expected.

Prior to Friday, there was considerable uncertainty if the Fed would even cut once. Now, there are growing expectations of a ½%, versus the usual ¼%, September reduction. Moreover, the interest rate future market is pricing in the probability of a full percent (100 basis points) plunge in the fed funds rate by year-end. From Nicholas Jasinski of Barron’s:

Fed officials will also get a look at August jobs and inflation data before their Sept. 17-18 policy meeting. “We will be data dependent but not data-point dependent, so it will not be a question of responding specifically to one or two data releases,” Powell said on Wednesday. Fair enough, but that was one heck of a data point on Friday.

The bond market, of course, has been celebrating this economic cliff dive, perverse creature that it is. Rates are crashing all across the curve (from the short end to the long end). This is the “Pavlovian bond rally” that the reigning King of Bonds, Jeff Gundlach, has been predicting once it became clear the economy was rolling over. How far will it go? No one knows, of course, but that’s a good segue into what U.S policymakers will do in response to the recent data. It’s safe to say that Janet (the Juicer) Yellen will do everything in her, and the Treasury department she controls, considerable power to bolster Kamala Harris’s odds of beating Donald Trump. A recession and bear market in stocks right now would likely tip the scales decidedly in the former president’s favor. Plainly stated, in her view, those must be prevented at all costs.

As no doubt you’ve seen, right now it’s pretty much a dead heat with the current VP wisely tacking to the center. This shift includes disavowing many of her prior ultra-Left-wing stances such as a complete fracking ban. The flip is so drastic as to smack of political opportunism but it’s a clever move nonetheless. In contrast, Mr. Trump continues to suffer from foot-in-mouth disease. In our view, this was his election to lose and he’s been doing an excellent job of that lately. However, you can bet he’s going to be all over the economy’s sudden loss of altitude.

If we’re right that Janet Yellen is going to pull out all the stops to avoid a recession and the resulting inevitable bear market in stocks, an investor may want to methodically buy into the recent weakness. The reason for the methodical part is that this is not even a 10% correction in the S&P 500… yet. For now, it’s been a mild 8% retreat and that was off an inflated level. Actually, this remains one of the most overvalued stock markets in history.

Warren Buffett is certainly aware of that as he has been persistently reducing Berkshire’s equity allocation. He has now amassed a cash hoard of almost $280 billion. A guiding principle at Evergreen Gavekal, where the elder Haymaker serves as co-CIO, is small correction, small buying; big correction, big buying – 8% is definitely a case of the former. However, the speed with which events are changing could create a more compelling opportunity in the near future. This is the time of year when market air pockets often occur.

Friday’s stock market beating is ironic based on the joyous anticipation about the next Fed easing cycle. This expectation has been a key driver of the incredible rally since October 2022. Numerous Haymaker editions have warned that the bullish majority should be careful about what it’s been wishing for – recent history is high-definition clear that aggressive Fed easing is bearish, not bullish. To doubters, please refer to 2000 to 2002, and 2007 to early 2009.

Similarly, Jeff Gundlach has been warning that real trouble ensues once the yield curve begins to uninvert. That’s been happening lately as short-term interest rates have fallen further than long rates. This is a necessary event in order to restore the yield curve to its normal slope. But, as he points out, it’s a warning light flashing on the economy’s dashboard. And there were already plenty of those lighting up.

It was more than a tad comical to listen to the parade of pundits on CNBC last Friday who were blowing off the significance of the Sahm rule’s activation. (See Friday’s Haymaker.) This is in spite of the fact that it has had a flawless record of presaging economic downturns. What was not addressed is that the same is true when the yield curve has been upside down this long and there have been such continually negative readings from the Leading Economic Indicators (with just one up month in the last two and a half years). Accordingly, the Street may be guilty of having mistaken a delayed recession for no recession.

With that as our attempt to as briefly as possible cover last week’s most salient developments, let’s look at some specific asset classes and sectors you may want to be tracking… and, in some cases, accumulating.