Making Hay Monday - April 8th, 2024

High-level macro-market insights, actionable economic forecasts, and plenty of friendly candor to give you a fighting chance in the day's financial fray.

Charts of the Week

There are likely very few investors who are aware that the S&P 500 remains far below its 2000 peak when measured in terms of a store of value that can’t be debased. That would, of course, be the “barbarous relic” known as gold. Accordingly, it’s reasonable to consider how much of the S&P’s returns this century have been a function of a “money illusion”. This is essentially the superficial return created by inflation and a chronically weakening dollar.

On the topic of real, or after-inflation, market returns, Chinese stocks have been duds going back all the way to the early 1990s. This is despite that China has enjoyed one of the greatest economic booms in world history. On the positive side, Chinese stocks are now at rock-bottom valuations. However, geopolitical risks are immense and, for now, communism is ascendant in the Middle Kingdom, while capitalism is in an eclipse.

“What generates the evils is the (monetary) expansionist policy. Its termination only makes the evil visible. The termination must at any rate come sooner or later, and the later it comes, the more severe are the damages which the actual boom has caused.” -Ludwig von Mises, ‘The Causes of the Economic Crisis’

“I cannot teach anybody anything. I can only make them think.” -Socrates

Royalty on the Cheap

Champions

It is pretty much accepted wisdom that it is impossible to beat the S&P 500 on a long-term basis. As many Haymaker readers are aware, there’s nothing I like better than to challenge the accepted wisdom… if I have strong data to back up my views. That’s exactly what I intend to provide you with in this edition of Making Hay Monday.

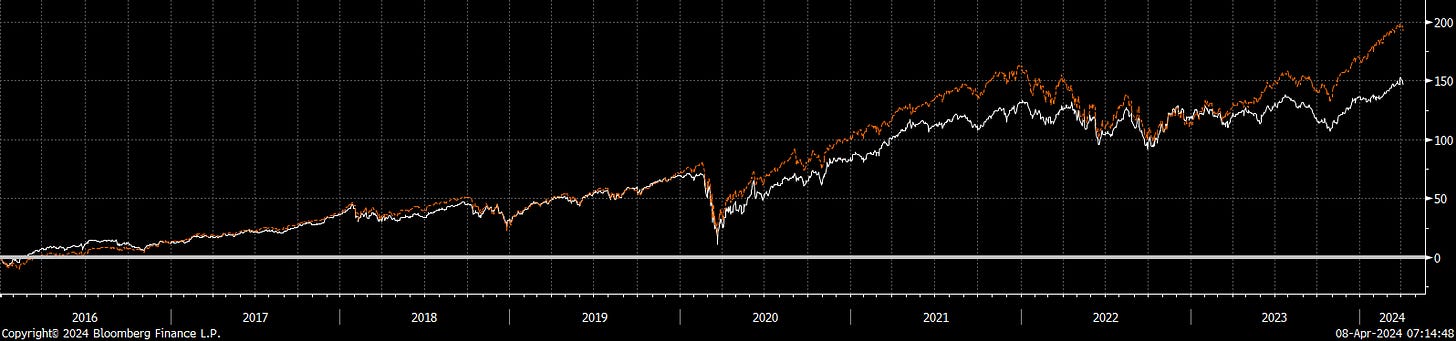

First, since we are talking about long-term results, let’s consider the total return generated by another well-known index. Admittedly, it has fallen into disfavor over the past decade and particularly since the end of 2015. Here’s a chart of how it has done versus the S&P over that timeframe. (The red line is the S&P 500; the white line is our, for now, mystery index):

(Click chart to enlarge)

A 46% price lag, 146% vs 192%, is certainly significant. In fact, it’s large enough, and long enough, to cause many investors to abandon the index represented by the white line. (As usual, that will be revealed only to paying subscribers.)

However, zooming out to the start of what would turn out to be the Roaring ‘90s, for both stocks and the U.S. economy (now, that was a real boom!), tells a radically different story. As you can see, that white line has absolutely trounced the S&P 500.

(Click chart to enlarge)

Clearly, there is something powerful at work here that, for some reason, hasn’t been exerting itself, or has been overwhelmed by other factors, for nearly a decade. Without giving too much away at this point, my contention is that “something” is called dividends.