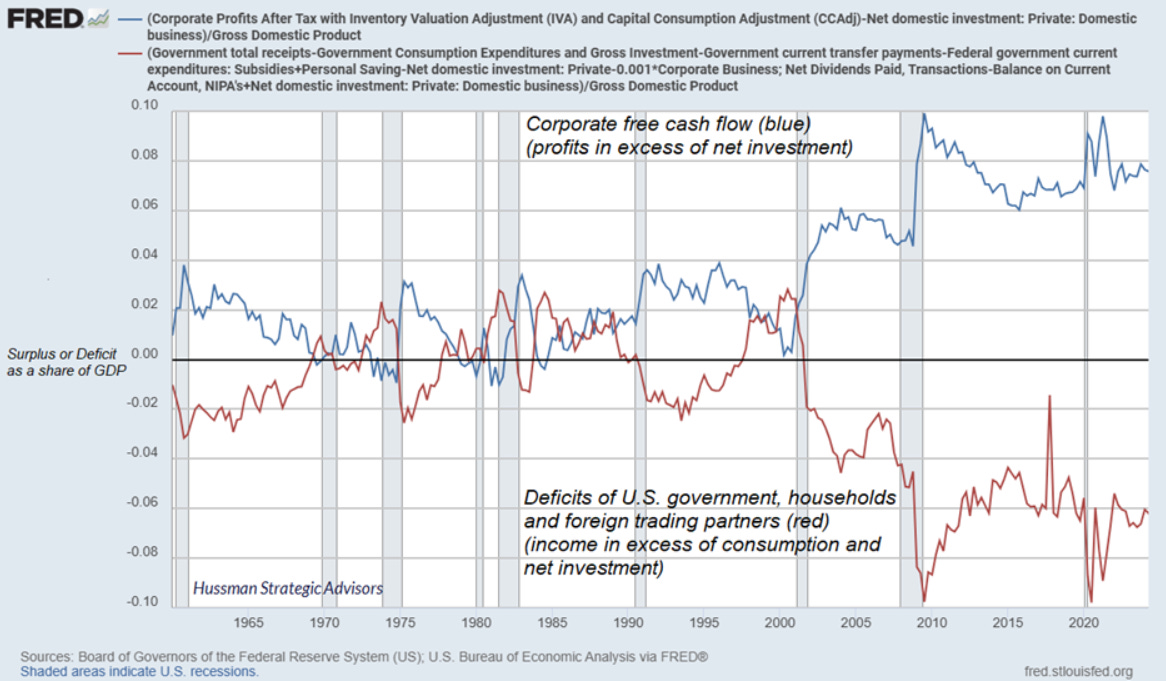

John Hussman is one of the few influential financial commentators who has repeatedly pointed out the degree to which $2 trillion-dollar federal deficits have embellished corporate profits and, similarly, free cash flow. (Free cash flow is what is residual after the capital spending needed to sustain a business.) Thus far in the U.S. government’s fiscal year that began on October 1st, the red ink is flowing ever more torrentially. Through the first five months, the deficit was annualizing at roughly a $2.8 trillion dollar rate. Big changes are coming, though, with the Trump administration determined to stop the hemorrhaging. If it succeeds, this will be another hurdle for stocks to overcome, despite the essential need for a return to budgetary sanity.

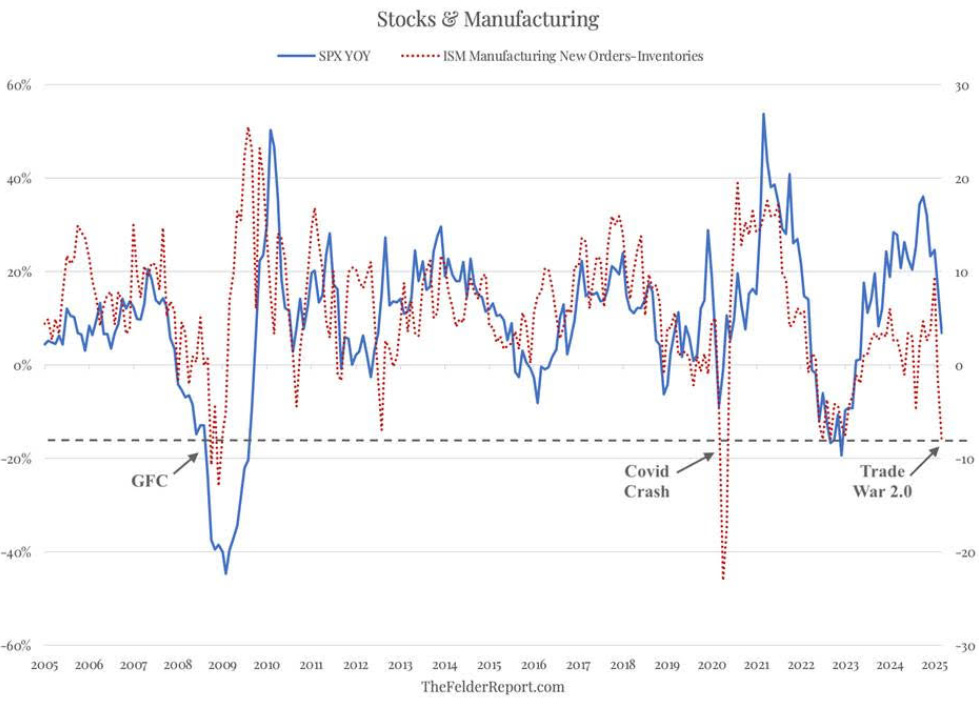

The above chart looks ominous and, well, it should. (ISM stands for the Institute of Supply Management and its surveys are closely followed by economists.) When inventories are extremely elevated relative to new orders, bad things tend to happen. In fact, this indicator is 11 for 11 in forewarning of recessions. To be fair to the no-recession believers, there have been a number of leading indicators – including the Leading Economic Indicators themselves – that have been flashing red for over two years with no actual downturn ensuing. An optimist could even argue that this ratio was concerning in 2023. However, the negative economic momentum that is gathering steam currently is likely to push the red dotted line into much deeper negative territory, perhaps soon rivaling the Great Recession/Global Financial Crisis.

"It’s striking how little Wall Street analysts recognize the extent to which the government deficits of recent decades have contributed, directly and indirectly, to record corporate profits.” -John Hussman

“Value investing is pain, and the higher the level of pain, the better the future performance.” -Jean-Marie Eveillard, the celebrated former manager of First Eagle's Global Value Fund

To Buy or Not To Buy, That Is the Question

It’s not often that someone simultaneously feels both vindication and humiliation. Yet, that’s my emotional pairing right now in the wake of last week’s disastrous market performance. As of about 7 a.m., Left Coast time, the bloodbath was continuing, but the announcement that Donald Trump is proposing a 90-day pause on tariffs, ex-China, has caused a head-spinning reversal… and at least somewhat scooped the main point of this Making Hay Monday, namely, that a rally should be near at hand.

To put Thursday’s and Friday’s wind shear into perspective, what were essentially two consecutive days of 5% declines (for nitpickers, 4.84% and 5.97%, respectively) are very rare occurrences. According to Gavekal’s Anatole Kaletsky, two-day plunges of this magnitude previously only occurred three times since WWII: in the crash of October 1987, during the Global Financial Crisis of 2008 and in the thick of the Covid collapse in March of 2020. In other words, the prior instances were all in the midst of major bear markets and/or crashes. Consequently, it’s no wonder investors are currently shell-shocked.

For the first half hour of today’s trading, it looked like it might be three straight 5% plunges. That would have been a completely unprecedented event. And, who knows? (We’re really asking: who knows?) That could still happen, given the frenetic trading activity that continues to grip the U.S. stock market.