Making Hay Monday - April 29th, 2024

High-level macro-market insights, actionable economic forecasts, and plenty of friendly candor to give you a fighting chance in the day's financial fray.

Charts of the Week

It’s ironic, based on the U.S. dollar’s current strength versus most other currencies in recent years, that it has been so severely debased since Richard Nixon took America off what was left of the gold standard in 1971. This debasement has also led to much higher and more volatile oil prices. Both trends are unlikely to reverse over the balance of this decade and might well intensify. If so, that should be beneficial to the stock prices of energy producers and gold miners.

While the U.S. federal government continues to big itself into a deeper and deeper debt hole, Corporate America is in the opposite state. In fact, net interest payments for American companies are running at the lowest percentage of after-tax profits since 1956. However, this is likely skewed by mega-cap, cash rich entities like Microsoft and Apple. For many smaller enterprises, their balance sheets are far weaker and they are paying much higher interest rates than they were two years ago, thanks to the Fed’s aggressive rate-hiking campaign.

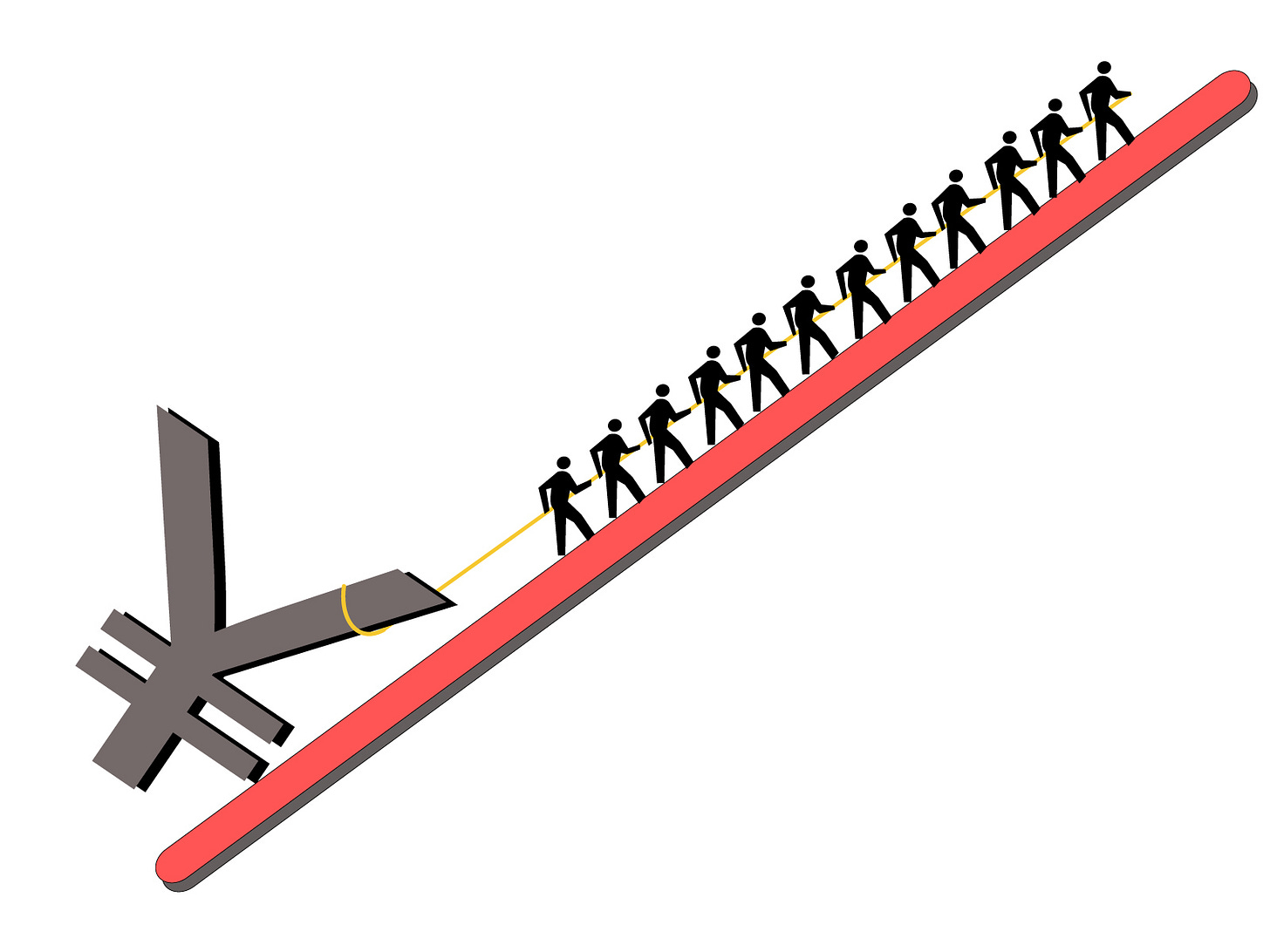

“The Yen is causing problems that are showing up in the (economic) data. How Janet Yellen and the other members of the G10 choose to deal with it is still up in the air, but we can no longer deny that it’s not affecting the global financial system. (Thursday’s) big GDP miss is just the first of many coming strains resulting from Japan’s massive devaluation.” -Kevin Muir, in his 4/26/2024 edition of The MacroTourist

The Way-Too-Carried-Away Carry Trade

Champions

Maybe I’m just experiencing a much deserved attack of humility but, in the wake of last week’s Making Hay Monday on my bullish natural gas whiff, I’m right back on the apologia kick. In my latest act of contrition, I’m going to focus on my ill-timed positive stance on the Japanese yen. My suspicion is that only a handful of Haymaker readers have been paying attention to its relentless value vaporization. However, that’s getting harder to do with articles like this one from last Friday’s front page of the Journal’s Business & Finance section.

Besides that, you might want to take your next international vacation to Japan — where prices are stunningly affordable — there are at least two big reasons you should care about the yen’s precipitous decline. The first is that it has become so severe that it is creating intense international tensions. This is because Japan remains one of the planet’s largest exporters. Therefore, an absurdly undervalued currency confers it with a tremendous competitive advantage. China is particularly displeased with the yen’s give-away valuation but it has plenty of company.

The U.S. may be feeling the ill-effects from that already. Last week’s surprisingly flaccid GDP report — which reeked of stagflation — arguably revealed the drag from a too-strong dollar. Of course, that extends to more of America’s trading partners than just Japan.

Last week, Team Haymaker did a webinar for our Founding Members, as well as a number of Evergreen clients, with one of my most valued research sources, The MacroTourist’s Kevin Muir. During it, he made a highly bullish case for the ever-melting yen. (We will be sending snippets of that webinar to all Haymaker subscribers, even of the non-paying variety; one of those will include his take on the yen.)