Making Hay Monday - April 24th, 2023

High-level macro-market insights, actionable economic forecasts, and plenty of friendly candor to give you a fighting chance in the day's financial fray.

“How can we keep the government we create from becoming a Frankenstein that will destroy the very freedom we establish it to protect?” -Milton Friedman, from his 1962 book Capitalism and Freedom

"In war, truth is the first casualty." -Aeschylus | “You know what the second casualty of war is? Bonds” -Forest For The Trees author Luke Gromen

Veteran readers of this publication, and its predecessor, the Evergreen Virtual Advisor (EVA), likely recollect that we would run a “Guest” version of our newsletters each month. Since we started the Haymaker series just over a year ago, those have become infrequent. However, it was not our intent to eliminate them entirely and forever.

To that point, we will be selectively quoting passages from a recent piece by my close friend Jesse Felder, which struck me as a perfect companion piece to last week’s Making Hay Monday (MHM) edition. For those who read it (if you haven’t, a link to it is as the end of this edition), you’re aware the main thrust related to a potential “jig is up” moment for uncontrolled U.S. government spending and borrowing. In Jesse’s note, he refers to this reality check as “The Tipping Point”. As many of you are aware, he’s borrowing from Malcolm Gladwell’s famous title for his huge best-seller and quoting from him: “The tipping point is that magic moment when an idea, trend, or social behavior crosses a threshold, tips, and spreads like wildfire.” Felder has articulated a poignant warning drawing on a single theme: that we are essentially nearing a time in which years upon years of “kick-can-down-the-road” policymaking and counterproductive inflation-control measures will transform from a problem of tomorrow into a painful and immovable catastrophe of now.

Employing the straightforward logic our present circumstances require, Felder contends: “Nobody is going to come in and tell the federal government it can’t sell any more bonds or tell the Fed it can’t print more money to buy them. But at some point, as these two trends continue to grow and accelerate unabated, crowd psychology will shift in such a way that inflation becomes self-fulfilling and both dollars and dollar-based financial assets are shunned in favor of hard ones.”

And that’s the simple reality of it. Like any string of bad decisions with poorly thought out results, the inevitable pain detonation is very often time-delayed. Pouring innumerable quantities of green paper (and its digital counterpart) into an already disjointed economy can do wonders in the short-term; however, it is ultimately a distorting phenomenon, as we all know, one that creates a divide between capital and labor, between scarcity and purchasing power. The Fed can congratulate itself for its fiscal engineering schemes while those distortions are less than apparent on Wall Street, but when the proverbial bill comes due on Main Street, the gamesmanship will have little sway. In such circumstances, to echo Jesse’s argument, hard assets stop being a mere “nice-to-have” item of portfolio decor.

Jesse’s description of the impasse towards which our economy is cascading boils a complex tale down to its most salient facts:

“To close the deficit today would require cutting total government expenditures by more than 25% which is politically impossible. Raising taxes significantly enough to close the gap is also politically impossible. And so, with debt-to-GDP already at record highs, it appears as if it is on an inexorable path higher.”

True. And scary. Later in the piece, he continues:

“… it is precisely these inexorable trends in the federal debt and monetary policy that will play catalyst for a psychological ‘tipping point.’ Record gold buying on behalf of central banks around the world is indicative of the early stages of this process.”

And what better “indicator” does one need? When the people in charge of stabilizing the perceived value of paper currency begin trucking in the yellow metal, you know all you need to about where things are and what to expect.

Or as Felder puts it in wrapping up his case: “Right now the fools are still trying to do what wise men were doing a decade ago. Wise men today, however, appear to be not just warning of it but actually betting on…persistent inflation…”

The “fools” in this summary would seem to be the world’s financial overseers who should really have known better. As for the “wise men”, we should be asking why they weren’t in charge to begin with.

Thanks to Jesse for allowing Haymaker to borrow as liberally as a central banker in quoting from his timely work.

To learn more about Evergreen Gavekal, where the Haymaker himself serves as Co-CIO, click below.

Champions

Many of you have asked how to protect your investments from this potential “tipping point”, or as I’ve somewhat facetiously referred to it: a Federal Fiscal Funding Fiasco. In prior MHM editions, I’ve suggested the highest-quality mortgage REITs (mREITs), as well as emerging market closed-end debt funds, as qualifiers in that regard. However, I also remain a fan of midstream energy infrastructure entities such as pipeline operators. This is an area I’ve often touted in recent years, again going back to when I was writing the EVA, which I authored from 2005 until early 2022, when we shifted to the Haymaker banner.

As most of you know, newish SEC guidelines prevent me from touting my favorite names in that space — or any other, for that matter. Fortunately, this energy sub-sector has been on a nice upward trend since its cathartic bottom in late March of 2020. That was when the futures market price of oil went below zero and fears of a multi-year Covid lockdown were pervasive. Mid-stream energy has also paid lush yields to those investors who stuck with it despite a certain CNBC talking head who repeatedly screeched said that it was “uninvestable” back in 2020 when the group was left for dead. (If any readers would like to see an article I wrote on this topic in late 2020, Totally Toxic, please email us to request a copy.)

The more common name for mid-stream energy companies remains MLPs or Master Limited Partnerships. For many of them, though, that’s a misnomer. A large number have converted over from MLPs into the more familiar C-corp structure. In the process, this eliminated the oft-dreaded — especially, at this time of year — K1s. To be fair, the K1s come with a nice tax benefit, particularly for all of us older folks who plan to hold them long-term… like until we or our spouse leave this vale of tears. In that case, their income stream becomes largely tax-free, not just tax-deferred; the capital gains levy on them is also eliminated, as it with all appreciated assets at date of death. (Yes, I know, that’s a hard way to get a tax break, but we Boomers need to be realistic about our mortality; always a difficult coming-to-terms for the “Me Generation”.)

In today’s Champions section, I’m going to suggest you take a look at a related slice of the mid-stream world that isn’t a pipeline operator. In this case, I’m generically (unfortunately) highlighting those MLPs operating liquefied natural gas (LNG) ships. There are several out there but I prefer the one that is attached to America’s premier LNG company.

One of the reasons I like this niche of the energy business is that the ships are highly specialized and extremely pricey. Even better, these two characteristics necessitate long-term contracts. They typically have ultra-strong counterparties, such as large utilities or state-owned energy companies.

Asia has long been an enthusiastic importer of LNG, especially China. But India is another important buyer, as is Japan. Fortunately for America’s red-ink soaked balance of trade, we are now the planet’s leading exporter of LNG. As noted previously in these pages, over the past 15 years the U.S. has swung from a voracious importer of foreign LNG (and natural gas in general, mostly from Canada) to prime exporter, a result of the shale gas production miracle. (The Saudis produce a bit over 10 million barrels/day, about 10% of global output. America has created a second de facto Saudi Arabia through its equally miraculous shale oil revolution; this extraordinary dual achievement receives nowhere near the respect it deserves.)

Prior to Russia’s remorseless invasion of Ukraine, Europe displayed an ambivalent, even hostile, attitude toward LNG. Yet, losing 40% of its natural gas supplies nearly overnight caused an equally rapid mindset shift. It’s no exaggeration to say that U.S. LNG shipments to the Continent played a big role in keeping the lights and heat on this past winter, along with unseasonably mild weather. Europe now has a strong affinity for LNG with plans to greatly expand its LNG importing facilities. From the U.S. end, expectations are that outbound LNG will increase from about 14 billion cubic feet/day (equal to roughly 14% of U.S. consumption) to 20 billion cubic feet (BCF) per day by 2026. Incredibly, as recently as early 2016 U.S. LNG exports were essentially nil. In other words, this is very much of a growth industry.

The operator of the LNG fleet in question is structured as a partnership; thus, it generates those pesky K1s. However, it has a distribution yield in the vicinity of 9%, much of which is sheltered from current taxation. (Please note: that includes a special distribution which can be raised or lowered. The base distribution amounts to a 7% return, but I’d suspect the actual payout to be closer to the aforementioned 9%.) Distributions are not intended to serve as projections of performance.)

It has grown its payout at an 18% rate since it went public in 2007 (when it was expected to bring gas into the U.S. instead of shipping it overseas). Its unit/share price has declined from over 60 last fall to the mid-40s today. Based on the high yield and attractive fundamentals, I think this is a great yield vehicle for those looking for shelter from what could be a sudden devaluation of the dollar. One of the best insulations against a greenback crash are those securities backed by hard assets, like ships, that also have inflation-protected cash flows.

Because it’s my belief that the Fed will ultimately need to restart its Magical Money Machine — commonly known as Quantitative Easing (QE) — for all the reasons Jesse cites, I’m heavily focused on yield securities other than longer-term Treasury bonds. Given the choice between a 3½% 10-year T-note and 9% on a high-quality LNG entity, I’ll take the latter all day long. By the way, here’s the comparison of how this one has done since 2007 vs the 10-year Treasury. (Past performance is no guarantee of future results).

It’s been a dramatic out-performance, despite that Treasury yields are materially lower than they were in March of 2007 when this company went public. In fact, the outdistancing has been so dramatic as to bring to mind the words: No Contest!

Champions List

Telecommunications equipment stocks

Select financial stocks

For capital appreciation:

U.S. Large Cap Value

U.S. GARP (Growth At A Reasonable Price) stocks

Oil and gas producer equities (both domestic and international)

U.S. Oil Field Services companies

Japanese stock market

S. Korean stock market

Singaporean stock market

Physical Uranium

Swiss francs

Copper-producing stocks

For income:

Select LNG shipping companies

Emerging Market debt closed-end funds

Mortgage REITs

ETFs of government guaranteed mortgage-backed securities (alternative approach)

Top-tier midstream companies (energy infrastructure such as pipelines)

BB-rated energy producer bonds due in five to ten years

Select energy mineral rights trusts

BB-rated intermediate term bonds from companies on positive credit watch

Contenders

When Jesse refers to “fiscal dominance” in his note, he’s bringing up a subject which I think you’ll hear about repeatedly in the years ahead. This is the idea that the Fed’s policies will increasingly be dominated by the need to fund the Federal government. As usual, most of Wall Street is in denial about this near inevitability.

One manifestation of this is the inverted yield curve. The willingness to accept a 3½% yield on 10-year T-notes when a three-month T-Bill pays 5% is case-closed proof that there is almost no investment community appreciation for Jesse’s tipping point. Yet, as I’ve previously opined, I believe, before long, the Fed will be forced to cut rates on the short-end of the curve, even if inflation is still running north of 3%. Of course, there are so many ways to measure inflation that determining where it really is baffles even the Fed. You may have noticed their definition of it is highly fluid.

Regardless, my big-picture belief on inflation is that while it may cool during what I still see as a coming recession (more on that momentarily), long-term is a much different story. Because I’ve written on this extensively, I’ll keep it short and simple with these points: 1) rising energy costs, 2) the expense of fighting cold and hot wars, 3) the inflationary forcing of reshoring production back to the U.S., and 4) the productivity plunge from increasing government intervention in almost every aspect of the economy, among a host of other structural inflation drivers. Per Jesse, I think the markets are gradually waking up to this probability. If so, higher long-term interest rates, even in a recession, are in the offing.

Accordingly, there may be a sweet spot in the short-intermediate part of the Treasury yield curve, namely, the three- to five-year maturity range. These are near-term enough to benefit from an aggressive Fed rate-cutting cycle but long enough to lock in 4%-type yields for a few years. There could even be a bit of appreciation if the Fed eases significantly.

But they’re not so long as to be victims of a market demand for much higher yields in the 10-years-and-out range. The drawback right now is that they’ve come down fairly sharply of late on recession concerns. Haymaker readers know I share those worries and the recent very weak Philadelphia Fed manufacturing report reinforced those. (The Philly Fed attracts considerable attention because the area includes a number of big chemical producers that typically lead the economic cycle).

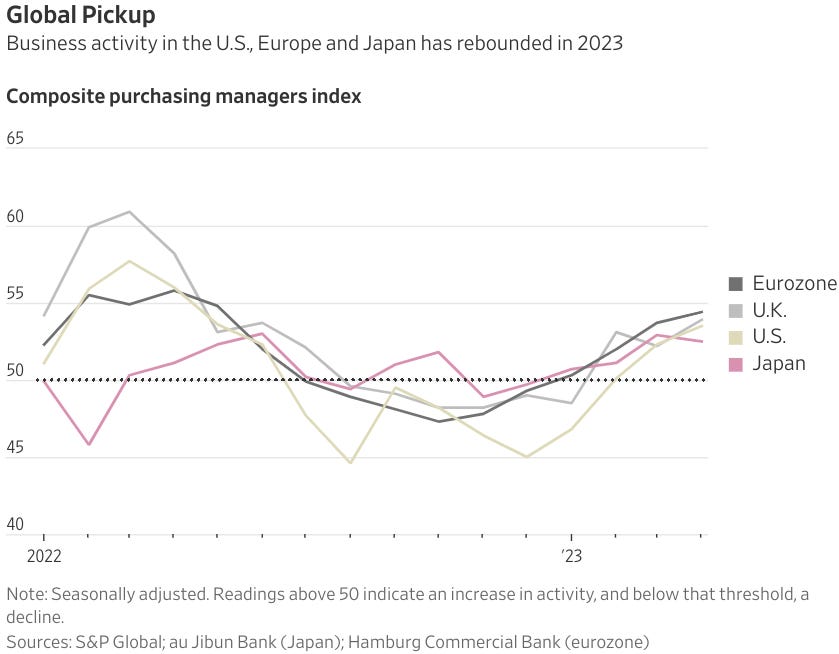

However, on Friday, the April Purchasing Manager Index (PMI) reports for Europe, Japan, the UK and the U.S. all came out very strong. (Don’t ask me how the April numbers could be out yet when Friday was the 21st of the month!)

This, along with persistently elevated inflation readings, increases the odds that central banks have further to go in their tightening campaigns. If so, we could see a powerful snap-back rally in the oversold U.S. dollar if it’s perceived the Fed needs to move well above 5%. In turn, this could lead to a nasty selloff with intermediate and longer-term Treasury bonds. Hence, for now, three- to five-year T-notes are Contenders, not Champions.

Short-intermediate Treasuries (i.e., three-to-five year maturities)

Gold & gold mining stocks

Intermediate Treasury bonds

European banks

Small cap value

Mid cap value

Select large gap growth stocks

Utility stocks

Down For The Count

Regular Haymaker readers are aware that I’m not a fan of electric vehicle (EV) stocks. The planet’s most famous producer of EVs had an explosive move early in the year but has been notably softening of late. Weaker players have been even worse performers, though, even in the former case, its stock remains down 60% from its late-2021 peak-mania high.

In my personal long/short portfolio, I’ve begun to slowly cover my EV shorts. One where I’ve done so is now down over 90% (by the way, I didn’t catch it anywhere near its peak, but it’s still down considerably over the past six months). Despite that pummeling, it retains a market cap in the multi-billions. This strikes me as absurd given it has been plagued by product recalls and missed production targets. It’s also rapidly burning cash. Regardless, I have reduced my short position despite my belief it has much further to fall.

When it comes to the EV leader, I think it’s at risk, too. Competition is becoming increasingly fierce, as I noted in our Highlight Reel last week. This is particularly the case with Chinese EV manufacturers that are selling new EVs at prices as low as $11,500. Accordingly, expect more price cuts among the higher-priced models.

On a less positive note for my long/short portfolio, a purveyor of chicken wings has made a new all-time high. That’s a cover signal for me and it likely should be for anyone with a bearish bet on this stock. I’ll keep an eye on it for a re-short opportunity. The valuation remains beyond pricey, but when you make bearish bets you need to keep your losses under control. Fortunately, because this was highlighted near its multi-year apex, it’s a fairly small loss. (My suspicion is that I’m the only loser on this one; hopefully, I’m not wrong in that regard.)

Electric Vehicle (EV) stocks

An operator of appetizer-based restaurant fare

The semiconductor ETF

Meme stocks (especially those that have soared lately on debatably bullish news)

Bonds where the relevant common stock has broken multi-year support.

Long-term Treasury bonds yielding sub-4%

Profitless tech companies (especially if they have risen significantly recently)

Small cap growth

Mid cap growth

April 17th, 2023 Making Hay Monday edition:

Making Hay Monday - April 17th, 2023

The “F4” Risk Factor “A house divided against itself cannot stand.” -Abraham Lincoln “Our regulatory state is abusive and out-of-control which leads to less rather than more respect for the rule of law…Debt is a form of enslavement, not a form of freedom. In order to return to our roots, America must first break the bonds of indebtedne…

So does anyone here venture a guess which is that LNG shipper? I already own $AMLP for inflation protected income.

Thanks “brother haymaker”. Took me a few minutes of sleuthing, but really appreciating the good game. Turns out to be fun and educational for a small investor like me.

Please consider playing this same game with something like mortgage reits in the near future. Cheers mate.