Making Hay Monday - April 17th, 2023

High-level macro-market insights, actionable economic forecasts, and plenty of friendly candor to give you a fighting chance in the day's financial fray.

The “F4” Risk Factor

“A house divided against itself cannot stand.” -Abraham Lincoln

“Our regulatory state is abusive and out-of-control which leads to less rather than more respect for the rule of law…Debt is a form of enslavement, not a form of freedom. In order to return to our roots, America must first break the bonds of indebtedness in which its leaders are enslaving it.” -Michael Lewitt, The Credit Strategist.

(As we periodically do, we’ve bolded the critical sections for those preferring a speed-read.)

Anyone who has read or heard me this year is aware that the possibility of a seizing up in the U.S. Treasury bond market is one of my two biggest anticipated threats of 2023. Lately, I’ve been referring to it as the risk of a Federal Fiscal Funding Fiasco. Hence, the titular “F4”. When it comes to tornadoes, this is the second-most destructive level, with wind speeds exceeding 200 mph. A seizing up of the Treasury bond market, should it happen, would rip through the financial markets, imperiling an already fragile economy.

Speaking of multiple Fs, if anyone was objectively grading Congressional financial management, a report card brimming with failing marks would be the obvious result. Frankly, it’s incredible no rating agency has downgraded America’s credit rating in over a decade. Lately, though, market forces have been indicating a brewing storm… or tornado, per this edition’s theme. (You’ll note this is another example where a multi-year breakout occurred and the upward trend has continued.)

Credit Default Swaps on U.S government debt (essentially, the cost to insure against a default by the U.S.)

One might be tempted to dismiss this spike in U.S. default insurance as a function of what could be an ugly debt ceiling battle this summer. That’s certainly reasonable, though the S&P 500 appears oblivious to that, as it does to so many dire problems. Accordingly, the odds of a debt-ceiling showdown triggering the next bout of stock market turbulence is also eminently plausible. Yet, that’s just a symptom of the underlying disease of the Federal government’s complete fiscal recklessness. As I’ve written numerous times before, including in my book, Bubble 3.0, both political parties are to blame.

On that score, I read a recent note on precisely this topic from a man I hold in high regard, Michael Lewitt, author of The Credit Strategist. Here’s what he had to say on the bipartisan budgetary debacle: “Republicans, who claim to be the party of fiscal responsibility but are nothing of the kind, offered some weak proposals but no budget (despite the law requiring them to produce one).”

The emphasis on that last phrase is mine; the reason for it is one of the most terrifying trends we’re witnessing right now: an increasing disregard for the Rule of Law in Western countries. As a result, the West is further resembling the autocratic East where the Rule of Law is whatever Putin or Xi say it is. For countries like America, the driving force in ignoring established laws is political expediency.

For example, the Fed has repeatedly displayed a desire and ability to skirt around restrictions placed on its activities. The purchase of corporate bonds it executed during Covid was a classic case in point. As many longtime readers are aware, I had been anticipating the Fed would do that in the next crisis for several years prior to the pandemic. This was actually one of the most effective triage tactics it’s ever employed, but the legality was highly questionable.

More alarming was its serial reliance on Quantitative Easings (QEs) from 2008 through early 2022. This hit its apogee during the pandemic, when the Fed and the Treasury joined forces to print and spend trillions. The net effect was a de facto implementation of Modern Monetary Theory (MMT). As I warned as far back as the spring of 2019, the Achilles heel of MMT would turn out to be surging inflation. That, of course, was precisely the result. Yet, my main point here is that it is expressly illegal for the Fed to directly finance government deficits.

Yes, I realize there was a skimpy fig leaf applied to minimize the obscene behavior. It did its Treasury purchases through the government bond dealer banks like J.P. Morgan. But, so what? It was a distinction without a difference, merely an enabling gimmick to achieve a temporary fix to a problem that requires lasting and effective solutions. It was akin to treating a bone-on-bone condition via cortisone injections rather than with the objectively necessary surgery.

Beyond the cavalier attitude toward legality, there is an equally dangerous facilitating of utterly incontinent government spending. It’s my contention that the Fed’s willingness to use its Magical Money Machine to purchase Treasury bonds whenever there are dislocations has encouraged Congress to spend as if there was no limit to the government’s financial resources. Of course, politicians of both parties need precious little in the way of encouragement in that regard.

This became obvious when Federal tax revenues soared shortly after the pandemic waned. The fiscal year 2021, which ended in September of that year, produced the highest tax take ever recorded. Nevertheless, the budget deficit was a nearly incomprehensible $2.8 trillion.

Unquestionably, roaring inflation was great for U.S. government tax revenues but, as usual, spending went up dramatically as well. There were legitimate concerns about what would happen once the economy slowed and, God forbid, began contracting. Those days are now upon us.

The government’s fiscal year ends on September 30th. Thus, the first half of fiscal 2023 just ended. The results were coyote ugly. Revenues were off a mere 3% but spending rose 13%. This produced a $430 billion surge in the budget deficit to $1.1 trillion. Please realize that $1.1 trillion of red ink was spilled in just six months. Per another of my favorite sources, BofA’s Michael Hartnett, the deficit over the last year is already running at $1.8 trillion. He’s also projecting the U.S. to run out of cash by, ironically, July 4th. If so, it will be an unusual Independence Day when our country will be increasingly under the thumb of foreign lenders who have been divesting our sovereign debt for years.

As others, especially Luke Gromen, have observed, the Fed needs a recession to get inflation down and yet an actual economic contraction is Kryptonite for U.S. government tax revenues. Recessions also drive spending through the roof due to unemployment benefits and other support payments. The Fed has recently been conceding that getting inflation (the way it measures it) below 4% is going to be a serious challenge. Realistically, doing so necessitates a sharp rise in the unemployment rate.

Per Luke (who is hands down, in my opinion, the go-to guy on this rapidly escalating disaster), the former Bond King Bill Gross is on the scent, too, even in retirement. To wit: “There is insufficient private sector balance sheet capacity to finance US deficits at rates the US government can afford to pay.”

In plain English, there isn’t enough money to go around to fund $2 trillion Federal deficits, particularly at a time when the Fed is selling $1 trillion of bonds. The other whopper problem is that foreign central banks are also dumping Treasurys. The Fed could stop its anti-QE, QT, or Quantitative Tightening, but that would work against bringing inflation down. Hence, it’s in a wicked conundrum.

It was assumed the banks would step up and fill the void, but with deposits still fleeing the banking system, ex-the big banks, that’s no longer realistic. It’s true that there are likely to be trillions flowing from bank deposits into short-term Treasurys, a trend that is well underway. But who is going to buy the long-term crap paper? Seriously, is 3.5% on a 10-year T-note an attractive yield when even the Fed is saying sub-4% inflation might be tough to achieve?

As a result, this is the first time in my 44-year career that I’m not enthusiastically extending the maturity length, or duration, of client bond portfolios during an inverted yield curve and with a recession (barely) waiting in the wings. For sure, we did some intermediate maturity buying, particularly last fall when rates were higher. Mostly, we did that with corporate bonds in the 7-9% yield range, where at least there is decent compensation for stubbornly high inflation.

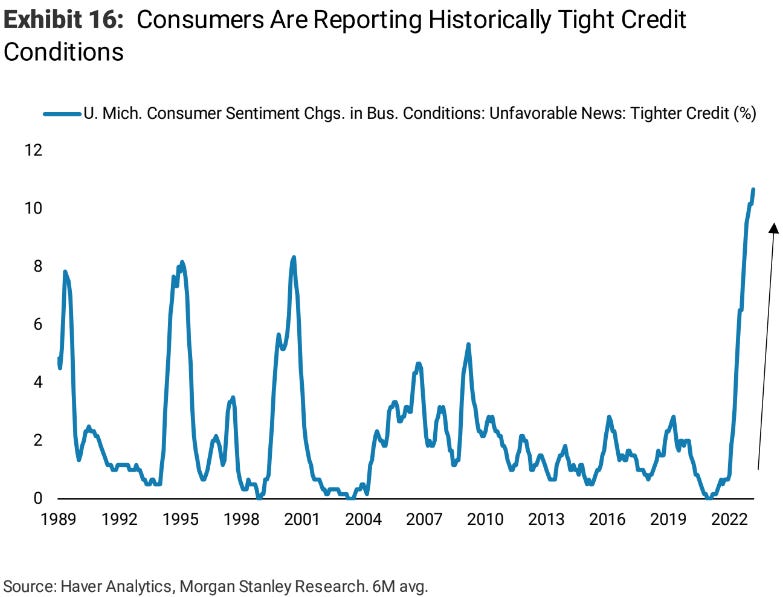

Consequently, I fear the Fed is trapped by all of its too-clever-by-half machinations that were left in place way too long. Case in point: it was still fabricating its digital money at a trillion-a-year clip a little over a year ago, despite raging inflation. If it begins easing soon, as the market hopes, the long end of the bond market is likely to fall apart due to the inflationary implications of a pivot with its inflation measures still elevated. If it tightens again next month, as seems highly likely, and then keeps rates up there, a recession becomes the base case… if it isn’t already. The below visuals are just a small sample of the many indicators that only happen when an economic contraction is in-progress or will be soon.

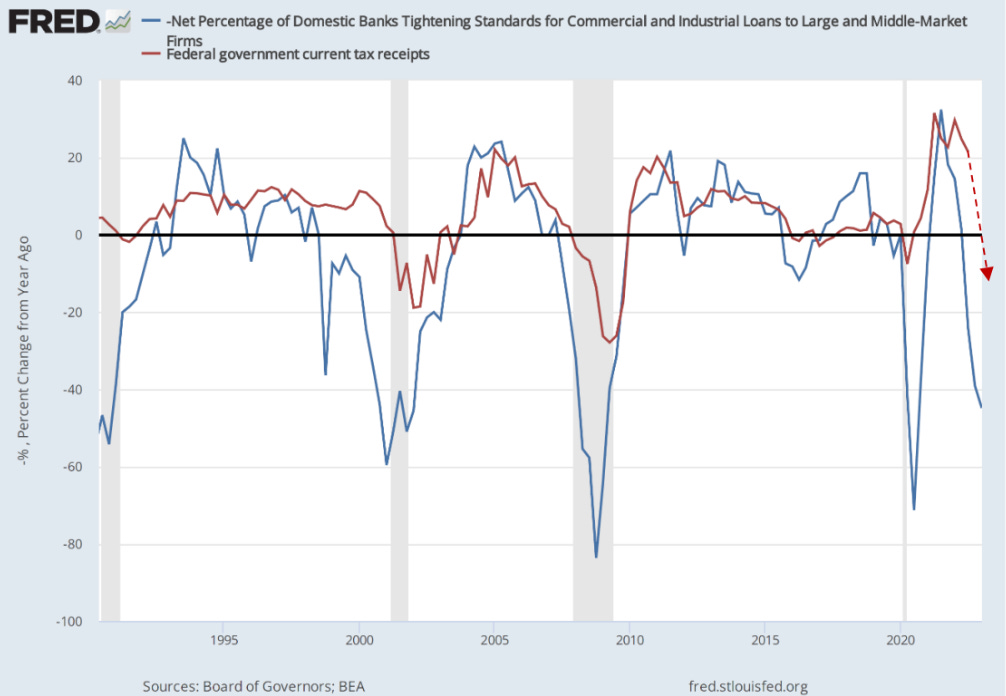

Similarly, the below chart from Luke reflects the tight correlation between bank lending standards and Federal tax receipts. The latter are clearly poised to perform a plunge worthy of an Acapulco cliff diver.

To learn more about Evergreen Gavekal, where the Haymaker himself serves as Co-CIO, click below.

Tightening the vise, 1/3 of the government’s debt is coming due over the next nine months. Again, there will be plenty of demand for the short-paper, but the longer stuff may well face a buyer’s strike. The market appears to be sniffing out the unattractiveness of 10-year and longer bonds, when the Fed is facing such a lose-lose situation. Gold hanging above $2000, rather than just touching it and falling back, as it has done repeatedly over the last 2½ years, is another reflection of loss of confidence in Treasurys as a store of value.

As I see it, the market is coming to my conclusion that bonds are once again “certificates of confiscation”, as they were at the outset of my career. Let’s face it: someone has to pay for 20 years of inexcusably lame U.S. monetary and fiscal policies. As I’ve written and said numerous times, those bond investors who believe the paradigm of the last 40 years is still in place are likely to be footing the bill… whether they realize it or not. Actually, the Fed is counting on their cluelessness to keep rates suppressed. The multi-trillion-dollar question is: How long will that last?

More and more pundits are warning of an impending credit crunch. In a highly leveraged system, like America’s, this poses extreme risks. Yet, I hear almost nothing in the financial media about the implications of this to the funding of the U.S. government. The chatter on CNBC, et al, is about the latest earnings reports (mostly dismal, by the way) or how much money is flowing into Apple and Microsoft.

Please allow me to close this Making Hay Monday with another quote from Luke Gromen (by the way, in the Champions’ section I’ll articulate a way I think you can make money on this debacle): “What is not yet well-understood by the consensus are the second derivative impacts of the deflationary credit curtailments: When they occur in a highly indebted sovereign running large twin deficits* (like the US), deflationary credit curtailments will quickly force the sovereign into an existential choice—print or default on your sovereign debt…and sovereigns almost never choose ‘default’.”

*I.E., both budget and trade deficits.

(Special note: For those who are as disgusted with the current state of American politics as the Haymaker is, please see the section at the end of this MHM edition.)

Champions

Two of the worst predictions by yours truly in Bubble 3.0 were my related negativity on the U.S. dollar (USD) and positivity toward emerging-market (EM) debt. The monster USD rally (which almost perfectly coincided with our digitally publishing Bubble 3.0), that continued until last fall, created a major drag for the closed-end funds focused on EM debt. Of course, surging global interest rates didn’t help, either.

Despite that, if you compare the return on the EM bond index from the beginning of 2022, when rates began lifting off around the world, it has actually outperformed longer-term Treasurys.

It’s been a bedrock belief over the last 40 years that U.S. Treasurys are an excellent portfolio hedge. That was true up until last year, when both bonds and stocks were pummeled. (While my tout of emerging market debt hasn’t paid off yet, this was a forecast I got spot-on in Bubble 3.0.) Similarly, it’s been a core conviction that EM debt was far riskier than U.S. Treasurys. As you may be suspecting, I believe that is about to be flipped on its head.

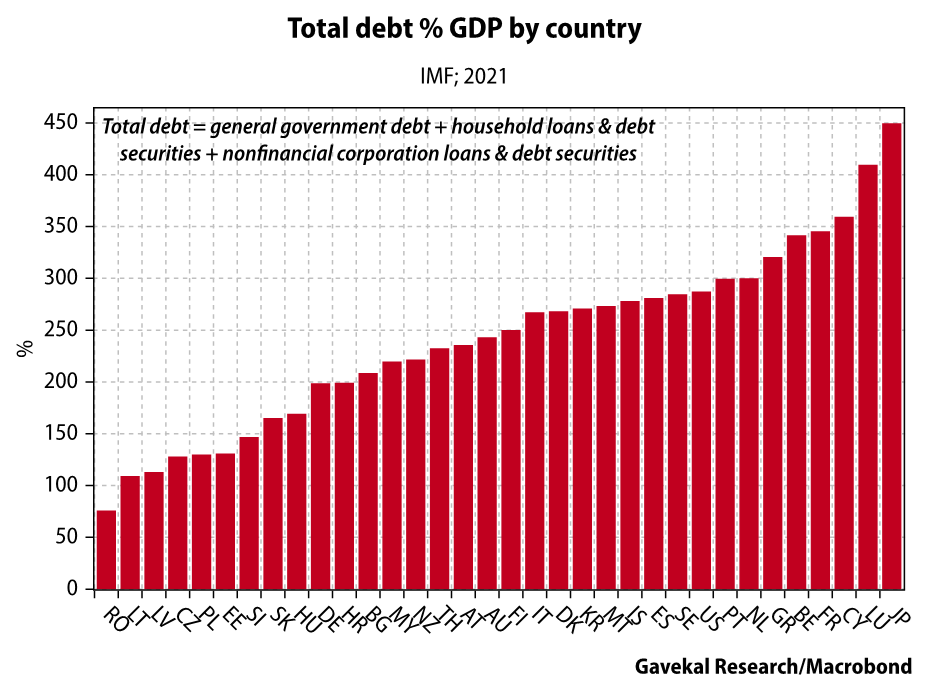

For the most part, over the past 15 years, fiscal and monetary policies in the developing world have been more disciplined than in the so-called “Rich World”. There are glaring exceptions, such as Turkey, of course. But, as you can see below, courtesy of our partner firm, Gavekal Research, almost all of the most heavily indebted countries are in the developed category. (“CY” is short for Cyprus, the rest to the right of the U.S., are Portugal, the Netherlands, Greece, Belgium, France, Luxembourg, and Japan.)

Last week, I asked Ethan Englert, one of Evergreen Gavekal’s bright young analysts, to examine the total debt levels (i.e., private and public) of the constituents of a leading EM closed-end bond fund. The two most indebted countries in it had a debt-to-GDP ratio of 4.8-to-1. The U.S., by comparison, is a full turn higher, at 5.8-to-1. One other was 4.6-to-1 but the rest were in the 1.5- to 3-to-1 range.

Also, many of these countries actually run trade surpluses. Further, and critically, they don’t have America’s crushing off-balance-sheet entitlement burden. As a reminder, the current Bond King, Jeff Gundlach, estimates those to be around $150 trillion, about five times GDP. Thus, one could make a rational case that the U.S. of A’s all-in debt ratio is more like 11 to 1. Many developed countries also have massive unfunded entitlement liabilities.

Interest rates in most of these emerging countries are typically above inflation, in contrast to the U.S. and many of its developed peers. Reflecting that, the yield on this fund is around 10%. It also trades at a double-digit discount to its underlying portfolio value, or NAV. This is generally the case with the EM debt closed-end fund universe, indicating its present out-of-favor status.

Consequently, I believe one of the best ways to play the coming decline by global interest rates — which looks to be already underway — is with these vehicles. One of my recurring recommendations to investors during this Alice In Wonderland era is to own assets and asset classes the Fed, and other central banks, can’t print. That’s one reason why I have stuck with gold and gold miners which, just a few months ago, were widely neglected. (More on that in the Contenders section.) However, the Fed also can’t print, and otherwise monetize, EM debt. As indicated above, it’s in much shorter supply than developed-world government bonds.

Accordingly, put aside your ingrained biases accrued over the last four decades and add some EM fixed-income exposure to your portfolio. There’s a new world emerging and, unfortunately, most U.S. investors are ill-prepared for its arrival.

Champions List

Telecommunications equipment stocks

Select financial stocks

For capital appreciation:

U.S. Large Cap Value

U.S. GARP (Growth At A Reasonable Price) stocks

Oil and gas producer equities (both domestic and international)

U.S. Oil Field Services companies

Japanese stock market

S. Korean stock market

Singaporean stock market

Physical Uranium

Swiss francs

Copper-producing stocks

For income:

Emerging Market debt closed-end funds

Mortgage REITs

ETFs of government guaranteed mortgage-backed securities (alternative approach)

Top-tier midstream companies (energy infrastructure such as pipelines)

BB-rated energy producer bonds due in five to ten years

Select energy mineral rights trusts

BB-rated intermediate term bonds from companies on positive credit watch

Contenders

You may be noticing increased chatter about something referred to as de-dollarization. Basically, the growing focus on this is a function of the structural weaknesses in America’s currency. As described above, this is a theme I’ve been on in both my newsletters and Bubble 3.0. It’s why I’ve been an advocate of buying precious metals and the miners thereof whenever they’ve sold off.

As anyone who has been involved with them for a few years knows, they are prone to powerful rallies — often when most people have fled them — and precipitous declines. In the latter case, this is typically once they’ve attracted a lot of precious metals “tourists”. I.E., those who are chasing performance and not fully appreciating the existential threats to fiat currencies.

As recently as early March, the main gold miner ETF was languishing close to the lows of the last few years. As a result, there was considerable disenchantment with the performance of the gold complex, in general, and this ETF, specifically. This caused me to highlight it as attractive. Despite easing back a bit lately, it’s popped 27%.

For anyone who feels they are a bit heavy in gold miners, doing some profit-taking now may be prudent. Personally, I believe gold and its producers are heading much higher over time, but taking advantage of the numerous rallies seen in recent years has been a winning strategy. By all means, don’t exit entirely.

Yesterday, I listened to a persuasive podcast from the folks at Goehring and Rozencwajg. They made a strong case for gold to rise as high as $10,000 before this decade is over. The reason they believe this seemingly outlandish price target might be realized is based on how much fiat money is now in circulation. A high enough price might also allow the U.S. government to once again back the dollar with gold.

Personally, I think a basket of hard assets will ultimately need to be established to shore up confidence in the dollar, at least for foreign trade. No way, you say? Well, before Richard Nixon took the U.S. off the gold standard in 1971, demanding bullion for dollars was limited to foreign central banks. In fact, at that time it was still illegal for private US citizens to own gold. That didn’t change until January 1st, 1975.

It continues to be my overarching investment recommendation to own scarce assets the Fed can’t print. Gold definitely qualifies in that regard. But the dollar has sold off so hard since last fall that a rally strikes me as probable. If so, be prepared for another gold selloff… and another buying opportunity.

Gold & gold mining stocks

Intermediate Treasury bonds

European banks

Small cap value

Mid cap value

Select large gap growth stocks

Utility stocks

Down For The Count

The semiconductor ETF, SOXX, is up 40% from its nadir last fall and 20% this year alone. Consequently, valuations look stretched for most of its constituents. (Even beleaguered Intel is up around 30% from its recent trough.) Semis also tend to be economically cyclical. Thus, if a recession is dead ahead, that’s another reason to be reducing exposure to this sector. For anyone seeking hedges, this is a reasonable one to bet against, in my view. (Full disclosure: I am personally short this ETF.)

The semiconductor ETF, SOXX

Meme stocks (especially those that have soared lately on debatably bullish news)

Bonds where the relevant common stock has broken multi-year support.

Long-term Treasury bonds yielding sub-4%

Profitless tech companies (especially if they have risen significantly recently)

Small cap growth

Mid cap growth

Special Section

An increasing number of Americans seem to believe our country is beyond saving. Based on our current crop of (mostly) clueless and avaricious political leaders, I would agree. In fact, I am the Washington state co-chairman for No Labels, the political movement Admiral Dennis Blair, former commander of the Pacific Fleet and Director of National Intelligence, started back in 2010, along with co-founder Nancy Jacobson. It’s the first time I’ve ever become involved with politics. Frankly, I’d prefer to stay light-years away from anything political, but I don’t think I — or we — have that luxury any longer. The situation has simply become far too perilous for our nation.

No Labels is tightly connected with the bipartisan Congressional Problem Solvers Caucus. They attempt to bridge what has become a yawning and ever more vitriolic chasm between the parties. I think it’s fair to say that in my lifetime, which goes back to when Eisenhower was in the White House, we’ve never seen Democrats and Republicans as divided as they are now. Nor have we ever seen this degree of enmity between them.

It's also fair to say that I don’t agree with every No Labels position, nor every politician they support. But if you’re looking for perfection, you’ll be searching a very long time… most likely forever.

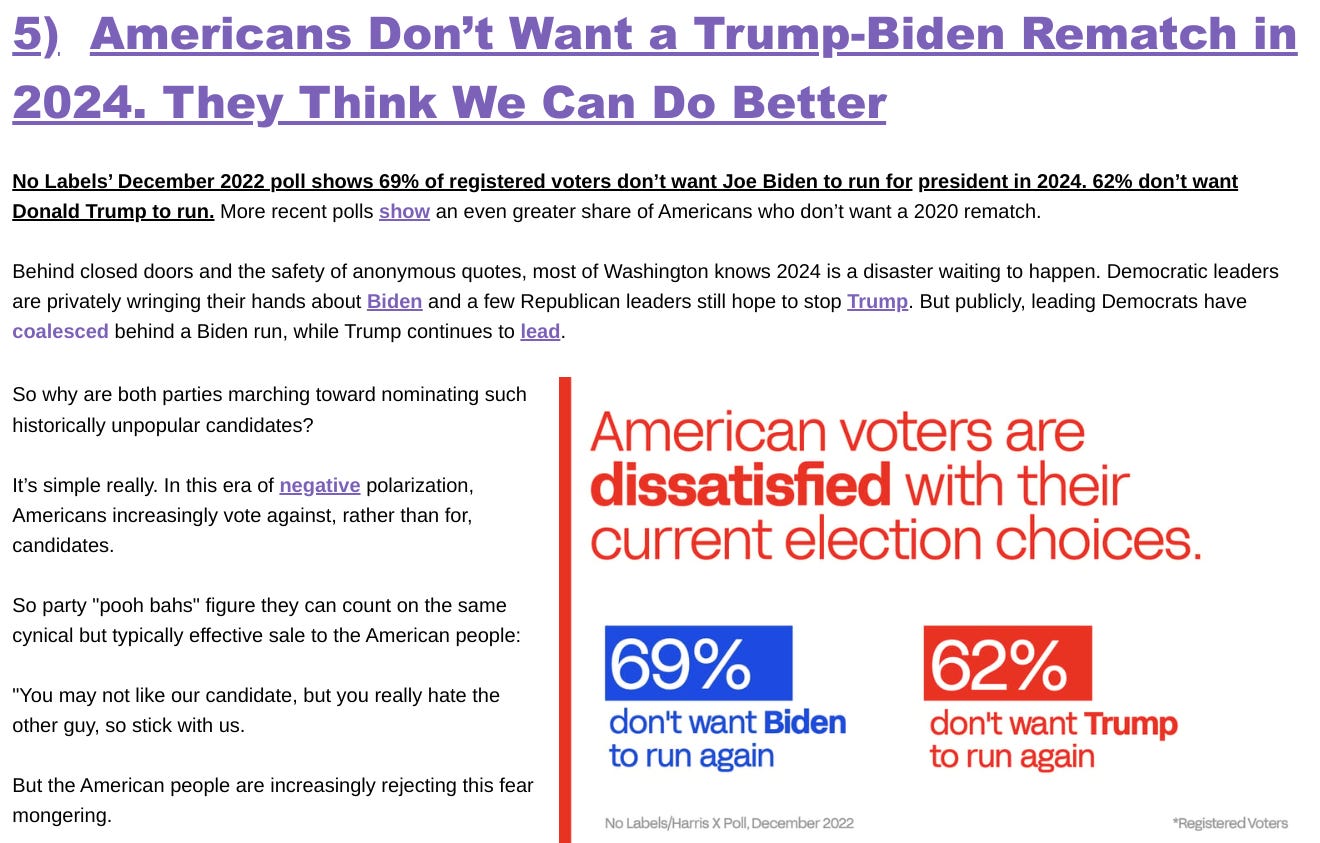

At this point, No Labels is preparing to offer up a “Unity” presidential ticket, should it appear that a Joe Biden vs. Donald Trump rematch is likely. It’s been amusing to me to see the blowback they’ve attracted from the extreme ends of the political spectrum. The political hate machines are ramping up their RPMs to undercut No Labels’ ballot access. That further convinces me that they are on the right track, as does the intensity of the misinformation that is being disseminated to discredit them.

Rather than go on any longer, we’ve included a screenshot hyperlinked to some No Labels content and embedded one of their YouTube videos (which is itself in the linked material; we’re adding it here for your convenience). If you’re happy with the political trends in this country, don’t waste your time. But, if not, please realize there is an increasingly viable option out there that doesn’t involve establishing a third party. God bless America… once again!

-DH

Good issue. I read Micheal Lewitt's output constantly and he has the appalling situation nailed down quite well.

One thing on gold. I am a holder of the physical and mining stocks but I thought the 2020 price rise was the start and so doubled my miner positions. Consequently I am still about 10% in deficit today on the miners, although up about 15% on the metals overall.

One thing that has now entered my thought process is the possibility / probability that gold will be made illegal once again if it gets to $5k let alone $10k. I have read many saying that this wont happen in todays world since gold is no longer transactional "money" for the masses. However I see Russia and China (latter probably has 2-4 times more gold than the official statistics) and a host of others leaning toward a gold backed future and in a "war" scenario, be it a hot one or a financial one, I can see our corrupts government system "nationalizing" the mines and the metal to save the dollar from collapsing. Most probably feel thats very unlikely but just take a look at what governments are already doing. Even if it's only a 10-20% chance it seems like some form of self protection is wise. What I certainly do believe is that the capital gains taxes on gold (and probably silver too) will soar. Forget the 28% collectible level. At $5000/oz gold I expect gains taxes will be windfall(d) at 50% minimum and quite possibly toward 70 -80%. Something to consider.

The twin deficits come from the same place. We have open capital markets which allows foreign countries to suppress their own workers and export their resulting weak demand to the US. Blaming Congress is silly. When trade is more balanced, they won’t be able to spend like they do now. As long as it is imbalanced you will have large deficits in either the public, private, or a combination of those sectors.