Making Hay Monday - April 10th, 2023

High-level macro-market insights, actionable economic forecasts, and plenty of friendly candor to give you a fighting chance in the day's financial fray.

Inflection — or Infection — Point?

“From a corporate earnings perspective, we’re already in a recession.” -Eric Gordon, head of equities at Brown Advisory, as reported on the front page of today’s Wall Street Journal.

“Once again, investors chose to focus on the headline jobs figure as opposed to the details, which flagged acute cyclical weakness as well as erosion in some of the key leading employment indicators that are within the report.” -David Rosenberg, on last week’s jobs report.

Feel free to accuse me of talking my book (investments, not Bubble 3.0), but I think last week was one of those pivot points which don’t come along all that frequently. It wasn’t that financial market action was particularly arresting. It was actually a fairly quiet week, though, below the surface, there were a couple of interesting trends evident.

The first was the continuing decline by interest rates. The second was the sneaky rotation away from economically sensitive stocks. Just a month or two ago they were ripping like the newly resurgent tech sector. This provided the innumerable soft-landing advocates out there with all the ammo they needed to dismiss “recessionisatas”, such as yours truly.

On the first point, the yield on the two-year T-note continues to trade well below the fed funds rate. This is despite that its yield has plummeted all the way down to 4%, after briefly breaking above the 5% level back in early March. This has created the situation highlighted by the following chart comparing the two key rates.

The reigning Bond King, Jeff Gundlach, has often opined that taxpayers could save a lot of money, while greatly improving forecast accuracy, by replacing the Fed with the two-year T-note. In other words, let market forces duke it out in the bond arena, thereby setting that critical yield level. He believes the two-year Treasury has done a better job forecasting the future direction of relatively short-term interest rates — and, indirectly, the economy — than has the Fed. Based on our central bank’s abysmal record of accurately predicting the rate it sets of its own accord — the aforementioned fed funds rate — it’s hard to argue with the royal highness of Bondlandia. (The Fed only gets that right a bit more than 1/3 of the time; for giggles, go back and look at what it was predicting in early 2022 for the fed funds rate by the end of last year.)

Past Haymaker publications have made the point that a strident recession siren is blaring when a deeply inverted yield curve begins to normalize. (In English, this means short rates begin to head back to where they normally are — lower than longer rates.) As you can see below, that has happened in a big way between the two-year and the 10-year. However, also note that the curve remains decidedly inverted.

Spread Between Two-year and 10-year T-notes (red signifies yield curve inversion)

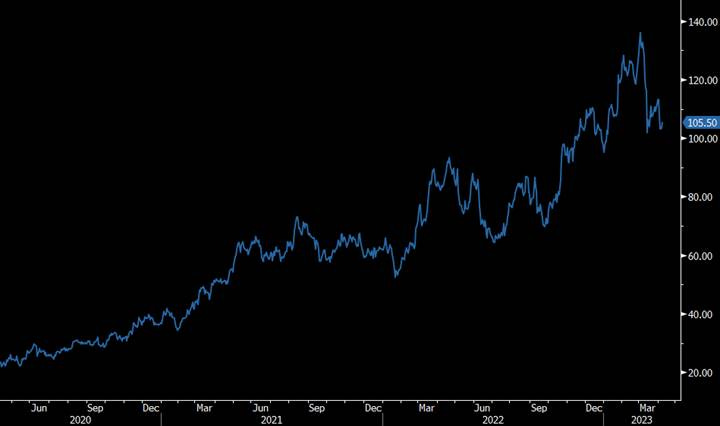

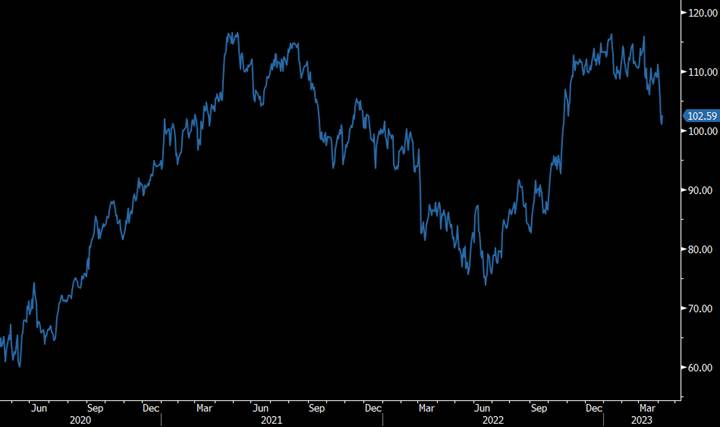

Beyond interest rates, which are obviously a function of bond market dynamics, the stock market also continued to send off some warning signals of its own. The two charts below represent one of America’s finest steel companies as well as an enterprise that sells moderately big-ticket consumer durable goods — i.e., not cars or homes. (They may be familiar to astute Haymaker readers.)

As you can see, both have experienced unusually steep declines lately. These could certainly be fairly dismissed as a very small sample set though, as hinted, they were previously highlighted as picks-not-to-click. (For new readers, I am no longer able to make recommendations, pro or con, on individual securities.) Often, it’s prudent to reduce negative positioning after deep corrections.

One of the reasons for my negativity toward these shares was the underlying economic sensitivity of their business models. It’s no secret that I have failed to join the stampede into the soft-landing, or even no-landing, camp that was so popular for most of this year.

From an economic data-flow standpoint, last week also exuded that sea change feeling. Even the perennial see-no-recession talking heads on CNBC seemed to be acknowledging the large (overwhelming?) number of indicators that have been, or now are, hitting economic DEFCON 4 levels. Morgan Stanley’s Mike Wilson has been long noting the much darker message emanating from the “soft data”, like consumer and CEO outlook surveys. Most seem focused on the “hard data” such as the jobs numbers, despite the well-known lagging nature of the labor stats. Now, it appears as though the hard data is catching down to the soft data. Even the Energizer Bunny, the jobs market, is rolling over, particularly the more forward-looking versions.

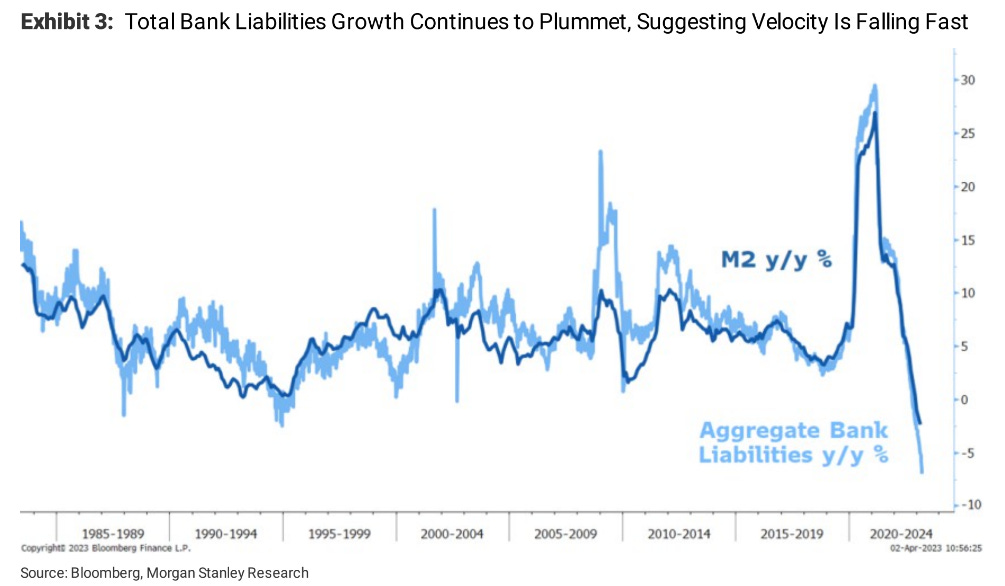

If you’ve been reading Haymaker publications since the latest banking dislocations started, you’re aware of how concerned I am about a declining money supply combined with falling velocity. It’s a message I’ve also conveyed in virtually every podcast I’ve done since SVB and Signature Bank went down. At first, I felt as lonely a sunscreen peddler at Augusta National on Saturday (where it rained relentlessly — and it was a Seattle-like 48° to boot!). Lately, though, I’m seeing an increasing amount of commentary on what is still, in my view, a greatly overlooked risk to the economy… and the stock market’s complacency.

Last week, Mike Wilson went into the most detail I’ve seen on this topic: “Through February, M2 growth was still decelerating and at the lowest level (~ -2.5%) we have observed in over 60 years (Exhibit 3). Meanwhile, the velocity of money was actually accelerating. In our view, the recent stresses in the banking system will lead to a decline in velocity. The question is how much and will it be enough to fully offset the increase in reserves or not? As mentioned above, we won't have M2 data for March for another month. However, the Fed's weekly report on bank reserves and deposits can shed some light on where M2 is likely headed. More specifically, we look at line H.8, which is essentially a measure of the aggregate reserves in the banking system available for lending.

Importantly, it excludes bank deposits leaving for money market funds. This is an important factor because even if the Fed and Treasury are successful in stemming bank stress, they won't be able to stop the migration of assets from low yielding bank deposits to these much more attractively yielding securities. Indeed, over the past 2 weeks, these money market flows have continued to accelerate (Exhibit 4), while bank deposits as measured by the Fed fell further.” (Emphasis added)

The reason I put the above sentences in bold font is that they get to the heart of the dilemma the Fed and the banking system are facing. The yield differential is so great that even if depositors aren’t afraid of having their bank go under, they now have woken up to the far better yields on offer in government money funds. There remain many trillions of uninsured deposits in the system, not to mention even more in an insured status. Consequently, the amount of money still likely to move into lower velocity money funds from bank accounts is truly mammoth. (As noted in prior Haymaker editions, the money multiplier of bank accounts is much higher than in government securities.)

The only way banks can effectively prevent this is by drastically raising rates for their customer. That’s something they are loathe to do under all but the most exigent circumstances. (For the 186 banks out there that are “at potential risk of impairment to insured depositors”, as reported this weekend by Barron’s, citing a new academic paper, that time may be now.)

Bulls on both stocks and the economy might point out that the S&P 500’s 7% first-quarter rise is conclusive evidence that all is well. However, the S&P made a new high in late 2007 even as the Great Recession was mere weeks away. Also, please realize how narrow the Q1 advance was, with the top 10 stocks producing 95% of the return. It’s a repeatedly proven reality that market halitosis — bad breadth — is a bright-red flag.

If I’m right that the first “normal” economic downturn — excluding the brief but calamitous Covid collapse — is near at hand, the seasonal weakness referenced last week (sell in May and go away) is also likely to occur. Again, as noted a week ago, that pattern didn’t play out with much consistency during the Fed’s serial binge-prints of the last 15 years. Now, with it both raising rates and doing the reverse of QE, Quantitative Tightening, it’s a totally different story… one that’s unlikely to have a happy ending for Wall Street’s plethora of perma-bulls.

Champions

Encouragingly, there are ways to make money even if a recession is dead ahead. One is to position for a steeper yield curve, the aforementioned interest rate normalization. This can be done in the futures markets and even with some ETFs that use derivatives to bet on this outcome. A much simpler way is to purchase certain mortgage REITs (mREITs). These were favorably mentioned in our March 17th Haymaker edition, but they haven’t done much since then. However, yields are in double-digits so even sideways action is not a bad result.

To learn more about Evergreen Gavekal, where the Haymaker himself serves as Co-CIO, click below.

The reason for their special appeal presently is that they consistently rise when the yield curve uninverts. This is because, like banks, they borrow via short-term interest rates and invest in longer-lived mortgages. But, unlike banks, they have done a far better job of hedging their interest-rate risks (I know that’s not saying much nor am I suggesting they’ve totally negated them).

There are ETFs made of mREITs but that may not be the best way to play this theme. Many invest in non-government-backed mortgages, including those based on commercial real estate. As most of you are now aware, that is currently the asset class on which I am max bearish (conceding that there are regions and property types able to ride out the storm). A few, however, focus primarily and/or exclusively on government-guaranteed mortgages. Those appeal to me the most right now.

For the risk averse, some of these have outstanding preferred issues… outstanding both in terms of issued and with lofty yields. One of them is trading at more than a 20% discount from face value and yields 9.6%.

Champions List

Telecommunications equipment stocks

Select financial stocks

For capital appreciation:

U.S. Large Cap Value

U.S. GARP (Growth At A Reasonable Price) stocks

Oil and gas producer equities (both domestic and international)

U.S. Oil Field Services companies

Japanese stock market

S. Korean stock market

Singaporean stock market

Gold mining stocks

Physical Uranium

Swiss francs

Copper-producing stocks

For income:

Mortgage REITs

ETFs of government guaranteed mortgage-backed securities (alternative approach)

Top-tier midstream companies (energy infrastructure such as pipelines)

BB-rated energy producer bonds due in five to ten years

Select energy mineral rights trusts

BB-rated intermediate term bonds from companies on positive credit watch

Contenders

Based on how much yields have declined on two-year and longer Treasurys, I’m taking a more cautious view of them for now. Reducing positions somewhat, particularly on longer issues, strikes me as prudent — despite rising recession risks.

It remains my view that yields on more distant maturity U.S. government bonds might actually rise during an economic downturn due to an explosion of new supply. This would be a very abnormal outcome but, as we all sadly know, there is nothing normal about our country’s fiscal condition these days.

Intermediate Treasury bonds

European banks

Small cap value

Mid cap value

Select large gap growth stocks

Utility stocks

Down for the Count

One of my last comments on individual securities, before new SEC rules inhibited my ability to make those, involved one of the more notorious famous meme stocks. At the time, I suggested taking some profits due to the risk of “powerful, though illogical, rallies”.

That’s exactly what happened last week based upon a court decision denying a proposed settlement. As a result, the gap between the two classes of equity securities has widened out once again. Because they represent effectively the same ownership, that makes little sense. Further, I continue to believe both are heading down to near zero. The balance sheet of the company in question is simply atrocious. Enough said!

Meme stocks (especially those that have soared lately on debatably bullish news)

Bonds where the relevant common stock has broken multi-year support.

Long-term Treasury bonds yielding sub-4%

Profitless tech companies (especially if they have risen significantly recently)

Small cap growth

Mid cap growth

Can you say what mineral trusts you like may rhyme with? No one could possibly construe something like that as investment advice. You're just a poet.

David - how would you screen for the mREITs with the government backed agencies?