The encouraging news for the Great Green Energy Transition is that China installed 356 gigawatts of wind- and solar-generating capacity last year. To put that in perspective, a large-scale nuclear reactor typically produces approximately one gigawatt of power. America’s entire fleet of atomic energy facilities is now fewer than 100 reactors located at 54 sites (some have more than one reactor). That’s impressive, but “capacity” is the keyword in the first sentence. Because of the intermittent nature of both solar and wind, these plants operate at a fraction of nameplate capacity. As a result, they require fossil fuel back-up such as from either coal or natural gas. Coal and its derivatives, such as lignite, are the dirtiest form of producing base-load power. However, with even China more concerned about emissions, it does create an opportunity for the U.S. to increase its already rapidly growing natural gas exports

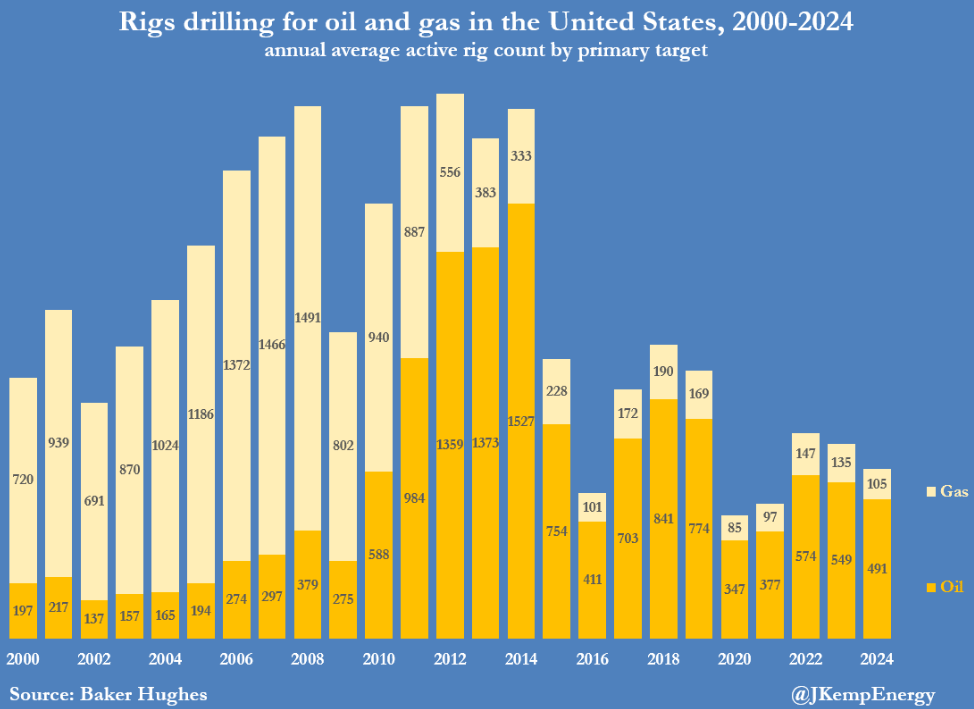

U.S. oil and gas producers have done a remarkable job of maintaining output near record highs despite a plunge in rig counts for both energy sources over the past decade. However, production growth has slowed to a snail’s pace for oil and is actually declining for natural gas. The latter is particularly alarming based on the acute need for inexpensive American gas in Asia and Europe. Per the main section of today’s Making Hay (Almost) Monday, this poses a serious threat to the Trump Administration’s goal of increasing U.S. oil equivalent barrels output by three million/day.

“Instead of replacing coal, clean energy is being layered on top of an entrenched reliance on fossil fuels. The parallel expansion of coal and renewables risks undermining Cina’s clean energy transition.” -Qi Win and Christine Shearer, in a new report from the Center for Research Energy and Clean Air (CREA) and the Global Energy Monitor (GEM), per the Financial Times 2/16/25.

Onshoring

Champs

There are numerous ironies in the financial markets these days such as how, in many cases, stocks with the most questionable fundamentals have been doing moonshots (see Carvana and, until recently, Tesla). However, oil and gas service companies certainly qualify, as well, though, on an inverse basis. There continues to be zero evidence of “Drill, Baby, Drill” in their stock prices. The fact that crude inventories are at their lowest levels in over two years deepens the irony.

Last week, we described the bull case for the offshore services stocks, drawing heavily on my Kiwi pal, Trader Ferg (who currently resides in Bali). Today, we’re revisiting a sector that, for most investors, has been dead money, or worse, for many years: those oil field services companies that largely operate on terra firma.

One of the earliest suggestions in the lifecycle of our Haymaker publications was to cash in some gains that had occurred as a result of a highlight we had made of the Oil Equipment and Services ETF. We had done so in the newsletter the geriatric Haymaker wrote from 2005 until early 2022, the Evergreen Virtual Advisor (EVA).