Haymaker Daily

On the Great Eight's cash & debt

Hello, Subscribers:

The comparative outperformance of the largest eight AI companies versus the other 492 companies in the S&P 500 since the summer of 2003 is one for the record books. Several of these companies now have multi-trillion-dollar market values with Nvidia pushing $5 trillion. As a result, their outlook has significant implications for equities overall.

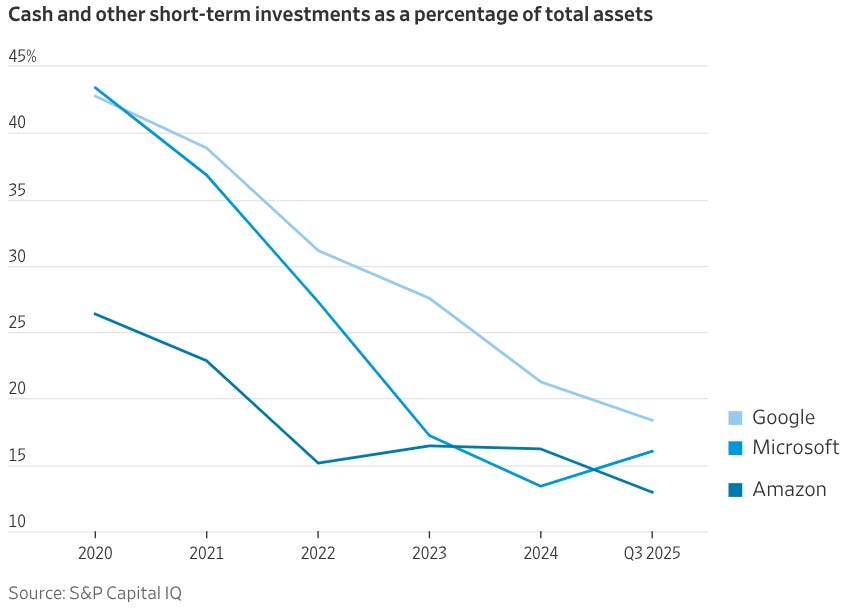

As you will notice in the above image, this Great Eight is beginning to behave in a decidedly less great manner. It could be, of course, just a pause on the way to another up-leg. Alternatively, it could be reflecting growing investor unease with the hundreds of billions of AI-related capital spending and the deleterious impact that is having on the balance sheets of companies like Meta and Oracle. This is because a considerable amount of the development outlays are being financed with debt (several of these entities have already blown through their once immense cash holdings).

There is also the related and growing fear that returns on these towering expenditures will be inadequate, at least relative to the previously lush profit margins these companies once enjoyed. Because their valuations are exceedingly generous, this has the potential to cause some serious disappointment.

BoA’s highly regarded chief strategist, Michael Hartnett, is suggesting shorting the bonds of some of the top hyperscalers, such as those shown above, to profit from this situation. While only the most sophisticated investors will attempt such a move, a more plausible reaction might be to simply take some gains on these hyper-valued names.

David “The Haymaker” Hay

IMPORTANT DISCLOSURES

This material has been distributed solely for informational and educational purposes only and is not a solicitation or an offer to buy any security or to participate in any trading strategy. All material presented is compiled from sources believed to be reliable, but accuracy, adequacy, or completeness cannot be guaranteed, and David Hay makes no representation as to its accuracy, adequacy, or completeness.

The information herein is based on David Hay’s beliefs, as well as certain assumptions regarding future events based on information available to David Hay on a formal and informal basis as of the date of this publication. The material may include projections or other forward-looking statements regarding future events, targets or expectations. Past performance is no guarantee of future results. There is no guarantee that any opinions, forecasts, projections, risk assumptions, or commentary discussed herein will be realized or that an investment strategy will be successful. Actual experience may not reflect all of these opinions, forecasts, projections, risk assumptions, or commentary.

David Hay shall have no responsibility for: (i) determining that any opinion, forecast, projection, risk assumption, or commentary discussed herein is suitable for any particular reader; (ii) monitoring whether any opinion, forecast, projection, risk assumption, or commentary discussed herein continues to be suitable for any reader; or (iii) tailoring any opinion, forecast, projection, risk assumption, or commentary discussed herein to any particular reader’s investment objectives, guidelines, or restrictions.

David Hay is a passive owner of Evergreen Gavekal (“Evergreen”), a registered investment adviser with the Securities and Exchange Commission. As of 03/31/2025 Mr. Hay has no involvement in the day to day operations of Evergreen, nor is he involved with any investment research, or investment management performed by Evergreen. The information herein reflects the personal views of David Hay as a seasoned investor in the financial markets and any recommendations noted may be materially different than the investment strategies that Evergreen manages on behalf of, or recommends to, its clients.

Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this material, will be profitable, equal any corresponding indicated performance level(s), or be suitable for your portfolio. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on an individual’s investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Investors should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

This article comes at the perfect time, offering a crucial analysis of the AI giants' spending. It's incredibly insightful to consider the long-term balance sheet implications. Thank you for this esential perspective.