Haymaker Daily

On what(?) could go wrong

Hello, Subscribers:

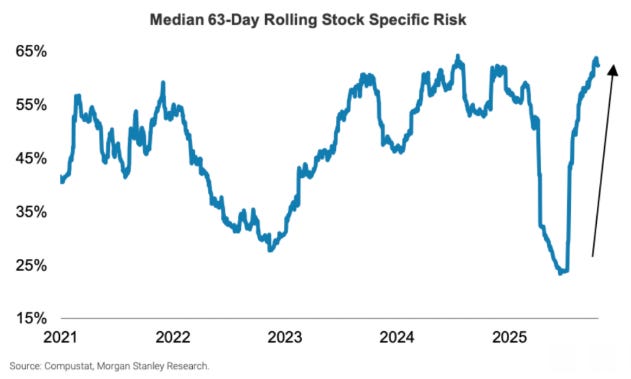

One of the more interesting visuals I’ve seen lately tracks something known as Median 63-Day Rolling Stock Specific Risk. While that may sound a bit academic, its implications are actually quite grounded in the real world.

As you can see, this measure just underwent one of its most violent reversals on record, sling-shotting from the lowest level in years to near the top of its multi-year range in just a few months. Put more clearly, individual stock volatility has exploded, and with it, the dispersion of outcomes across equities. It’s a market no longer broadly driven, but is now hyper-focused on individual stock selection.

To put this in historical context, the only prior episodes of this magnitude over the past half-decade occurred near major inflection points: the post-COVID melt-up in 2021, the early stages of the 2022 bear, and again in mid-2023 when AI-mania was just revving its engines. In each instance, elevated specific risk either preceded or coincided with sharp rotations under the surface, often away from market leaders and into more idiosyncratic names.

So, what might this mean now?

For one, the passive party may be winding down. When correlation breaks down and stock-specific risk spikes, index-hugging loses its punch. This environment tends to reward active strategies, and punish closet indexers. Second, it’s a flashing yellow light for portfolio concentration.

The backdrop of the last few months, a handful of mega-caps dragging the market higher, may be giving way to something less rewarding, at least for passive, non-thinking investors. That heavily populated cohort is the most exposed to the tech sector than it has been in over 25 years as it now represents roughly half of the S&P (when including “stealth tech” like Amazon and Meta). What could go wrong?

David “The Haymaker” Hay

IMPORTANT DISCLOSURES

This material has been distributed solely for informational and educational purposes only and is not a solicitation or an offer to buy any security or to participate in any trading strategy. All material presented is compiled from sources believed to be reliable, but accuracy, adequacy, or completeness cannot be guaranteed, and David Hay makes no representation as to its accuracy, adequacy, or completeness.

The information herein is based on David Hay’s beliefs, as well as certain assumptions regarding future events based on information available to David Hay on a formal and informal basis as of the date of this publication. The material may include projections or other forward-looking statements regarding future events, targets or expectations. Past performance is no guarantee of future results. There is no guarantee that any opinions, forecasts, projections, risk assumptions, or commentary discussed herein will be realized or that an investment strategy will be successful. Actual experience may not reflect all of these opinions, forecasts, projections, risk assumptions, or commentary.

David Hay shall have no responsibility for: (i) determining that any opinion, forecast, projection, risk assumption, or commentary discussed herein is suitable for any particular reader; (ii) monitoring whether any opinion, forecast, projection, risk assumption, or commentary discussed herein continues to be suitable for any reader; or (iii) tailoring any opinion, forecast, projection, risk assumption, or commentary discussed herein to any particular reader’s investment objectives, guidelines, or restrictions.

David Hay is a passive owner of Evergreen Gavekal (“Evergreen”), a registered investment adviser with the Securities and Exchange Commission. As of 03/31/2025 Mr. Hay has no involvement in the day to day operations of Evergreen, nor is he involved with any investment research, or investment management performed by Evergreen. The information herein reflects the personal views of David Hay as a seasoned investor in the financial markets and any recommendations noted may be materially different than the investment strategies that Evergreen manages on behalf of, or recommends to, its clients.

Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this material, will be profitable, equal any corresponding indicated performance level(s), or be suitable for your portfolio. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on an individual’s investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Investors should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.