Hello, Subscribers:

For years the chorus from official agencies has carried the same refrain: oil demand is peaking, green energy will displace hydrocarbons, the world is entering its post-petroleum age. The International Energy Agency has been especially insistent (and wrong), projecting a plateau not far ahead. And yet, each year the numbers arrive, and the curve bends higher.

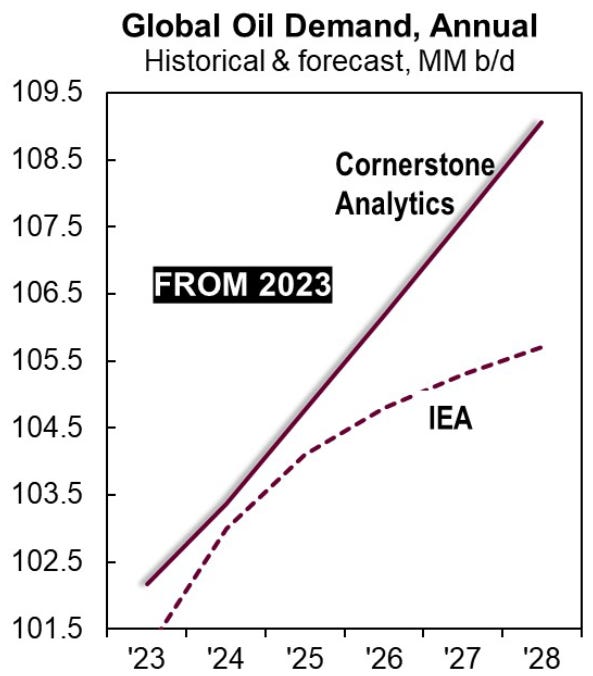

A recent comparison is striking. Cornerstone Analytics projects global demand continuing to climb steadily, nearly in lockstep with global GDP, while the IEA envisions a flattening curve. The divergence is not an academic one, and it speaks to the way narratives shape capital flows. The expectation of falling demand has contributed to chronic under-investment in supply. Refineries, pipelines, exploration budgets have all lived under the shadow of “peak demand.” But if demand continues to rise, the under-investment becomes the story, not the displacement.

There is a historical echo here.

In the first 15 years of the 21st Century, the IEA repeatedly underestimated non-OPEC supply growth which was almost totally a function of production surges from U.S. shale regions, primarily the Permian Basin. The IEA’s misplaced forecasts fanned the flames of the “peak oil” scare back then. Today, we seem to be replaying that same drama, only in reverse. Instead of a panic about depletion, we risk an eventual squeeze born of complacency and an erroneously reported supply glut.

For investors, the implication is clear. If global consumption keeps rising at even half the pace of global GDP, the system needs millions more barrels than current investment will provide. Where will they come from? That is not just a supply chain question, it is a geopolitical one, touching OPEC policy, U.S. shale economics, and the fragile balance of energy security.

David “The Haymaker” Hay

IMPORTANT DISCLOSURES

This material has been distributed solely for informational and educational purposes only and is not a solicitation or an offer to buy any security or to participate in any trading strategy. All material presented is compiled from sources believed to be reliable, but accuracy, adequacy, or completeness cannot be guaranteed, and David Hay makes no representation as to its accuracy, adequacy, or completeness.

The information herein is based on David Hay’s beliefs, as well as certain assumptions regarding future events based on information available to David Hay on a formal and informal basis as of the date of this publication. The material may include projections or other forward-looking statements regarding future events, targets or expectations. Past performance is no guarantee of future results. There is no guarantee that any opinions, forecasts, projections, risk assumptions, or commentary discussed herein will be realized or that an investment strategy will be successful. Actual experience may not reflect all of these opinions, forecasts, projections, risk assumptions, or commentary.

David Hay shall have no responsibility for: (i) determining that any opinion, forecast, projection, risk assumption, or commentary discussed herein is suitable for any particular reader; (ii) monitoring whether any opinion, forecast, projection, risk assumption, or commentary discussed herein continues to be suitable for any reader; or (iii) tailoring any opinion, forecast, projection, risk assumption, or commentary discussed herein to any particular reader’s investment objectives, guidelines, or restrictions.

David Hay is a passive owner of Evergreen Gavekal (“Evergreen”), a registered investment adviser with the Securities and Exchange Commission. As of 03/31/2025 Mr. Hay has no involvement in the day to day operations of Evergreen, nor is he involved with any investment research, or investment management performed by Evergreen. The information herein reflects the personal views of David Hay as a seasoned investor in the financial markets and any recommendations noted may be materially different than the investment strategies that Evergreen manages on behalf of, or recommends to, its clients.

Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this material, will be profitable, equal any corresponding indicated performance level(s), or be suitable for your portfolio. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on an individual’s investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Investors should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.