Haymaker Daily

On a 400% return

Hello, Subscribers:

It is an article of faith among millions of investors that it’s impossible to outperform the S&P 500 in the long run, barring extreme luck, divine inspiration, or a constant emulation of Nancy Pelosi’s portfolio. Yet, per the brilliant minds at Research Affiliates, which manages roughly $160 billion of client assets, a simple, though unusual, way to “beat the market” is to buy those companies that are ejected from the world’s most widely held index.

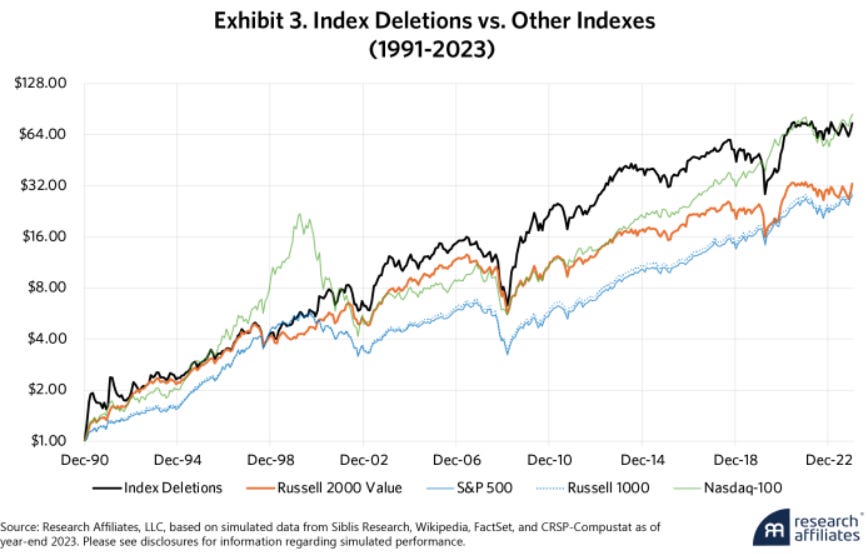

Per the research paper that contained the above chart, the companies that have been given the boot by the keepers of the S&P have outperformed the index itself by 5% per year from 1990 to 2022. The compounding effect of that has led to a cumulative excess return of approximately 400% over this 32-year interval.

This is likely due to the fact that, in most cases, the deleted issues had performed poorly leading up to this exclusion, leaving them both neglected and undervalued. If so, this is another example of the superior long-term returns that are often produced by securities which are deeply out-of-favor (like the energy sector today and gold miners earlier this year).

David “The Haymaker” Hay

IMPORTANT DISCLOSURES

This material has been distributed solely for informational and educational purposes only and is not a solicitation or an offer to buy any security or to participate in any trading strategy. All material presented is compiled from sources believed to be reliable, but accuracy, adequacy, or completeness cannot be guaranteed, and David Hay makes no representation as to its accuracy, adequacy, or completeness.

The information herein is based on David Hay’s beliefs, as well as certain assumptions regarding future events based on information available to David Hay on a formal and informal basis as of the date of this publication. The material may include projections or other forward-looking statements regarding future events, targets or expectations. Past performance is no guarantee of future results. There is no guarantee that any opinions, forecasts, projections, risk assumptions, or commentary discussed herein will be realized or that an investment strategy will be successful. Actual experience may not reflect all of these opinions, forecasts, projections, risk assumptions, or commentary.

David Hay shall have no responsibility for: (i) determining that any opinion, forecast, projection, risk assumption, or commentary discussed herein is suitable for any particular reader; (ii) monitoring whether any opinion, forecast, projection, risk assumption, or commentary discussed herein continues to be suitable for any reader; or (iii) tailoring any opinion, forecast, projection, risk assumption, or commentary discussed herein to any particular reader’s investment objectives, guidelines, or restrictions.

David Hay is a passive owner of Evergreen Gavekal (“Evergreen”), a registered investment adviser with the Securities and Exchange Commission. As of 03/31/2025 Mr. Hay has no involvement in the day to day operations of Evergreen, nor is he involved with any investment research, or investment management performed by Evergreen. The information herein reflects the personal views of David Hay as a seasoned investor in the financial markets and any recommendations noted may be materially different than the investment strategies that Evergreen manages on behalf of, or recommends to, its clients.

Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this material, will be profitable, equal any corresponding indicated performance level(s), or be suitable for your portfolio. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on an individual’s investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Investors should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Hello! I just launched my substack. I am trying to get my audience growing. I would love to earn your restack on my KKR deep dive I just wrote. If you like the content I would really appreciate a reshare. God bless you.