Hello, Subscribers!

On May 28th, the below Trading Alert (abridged here) was sent out to our Founding Members:

Is Oil the Best Portfolio Hedge?

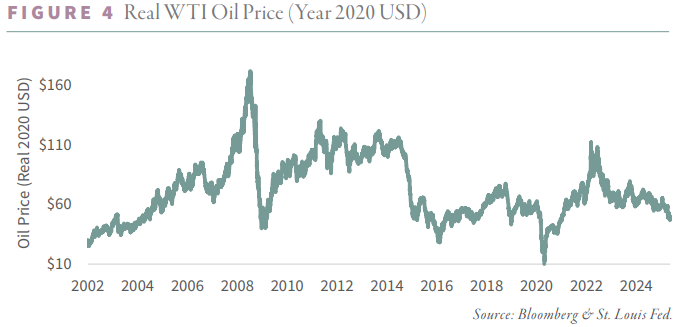

It's been the contention of this newsletter for most of the last two years that there has been almost no geopolitical risk embedded in the price of oil. Proof of that is the following visual, from the most recent Goehring & Rozencwajg communication. (Their quarterly Natural Resource Market Commentary is essential reading for all those who are interested in hard assets; in the Haymaker view, most investors should be gradually accumulating depressed natural resources, excluding gold which has clearly had a monster run.)

G&R

As the above image makes clear, there have been very few times over the past nearly quarter-century when crude traded cheaper than where it is now, adjusting for inflation.

Similarly, the energy sector's weighting in the S&P 500 is a miniscule 3%. Considering that without energy, economic activity would quickly skid to a stop, this is an amazing factoid.

Yet, there are some exceedingly plausible reasons to believe oil prices should contain a sizable geopolitical risk factor. Related to that, the illustrious George Noble sent us this article the other day:

By Gregg Roman - May 24, 2025

Israel will strike Iran’s nuclear facilities within days.

* * *

Hopefully, outright war between these two adversaries will be avoided. However, given the numerous acts of war that have already been committed, especially on Iran's part, a major escalation cannot be ruled out. In fact, one could argue it is even probable.

If so, oil is likely to spike while global stocks will almost certainly plunge, at least initially. Consequently, investors who believe this is a clear and present danger may want to accumulate oil and oil-related securities while they remain deeply out-of-favor.

Since we ran this piece, oil is up 18%. Based on the probability Israel will continue attacking Iranian nuclear sites, crude is likely to experience ongoing price resilience.