Haymaker Daily

On volatility and a lack of precedent

Hello, Subscribers:

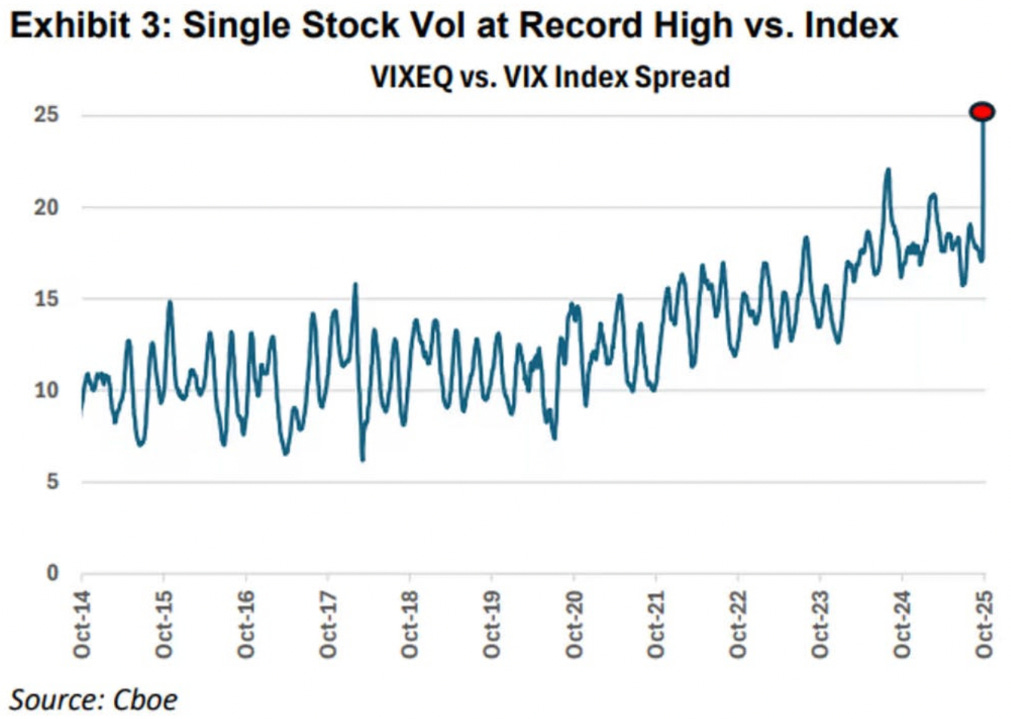

There’s a fascinating, and potentially ominous, development playing out in the volatility complex, one that closely echoes the topic we covered in yesterday’s Daily (Median 63-Day Rolling Stock Specific Risk). As the chart below illustrates, the spread between single stock vol (VIXEQ) and index vol (VIX) has just hit its widest point on record. We’ll put that in context by quoting Trader Ferg (from whom we sourced the chart), “index vol has never been this cheap relative to single stock volatility.” Not in the 2022 bear market, not even in the pandemic panic of 2020, nor 2018 in the midst of the “Volmageddon” market seizure, nor during the 2013 Taper Tantrum, has it ever been this elevated.

Historically, this kind of dislocation doesn’t persist because one of two things tends to happen: either the chaos brewing beneath the surface fades (and single stock volatility comes in), or more likely, a rude awakening occurs at the index level. Typically, it’s been the latter since volatility doesn’t just disappear, it migrates. And this chart suggests it’s about to migrate up the food chain, from stocks to sectors to the index itself. On its own, this doesn’t guarantee a major correction, but it strongly suggests the next leg of the market won’t be as smooth as the last.

David “The Haymaker” Hay

IMPORTANT DISCLOSURES

This material has been distributed solely for informational and educational purposes only and is not a solicitation or an offer to buy any security or to participate in any trading strategy. All material presented is compiled from sources believed to be reliable, but accuracy, adequacy, or completeness cannot be guaranteed, and David Hay makes no representation as to its accuracy, adequacy, or completeness.

The information herein is based on David Hay’s beliefs, as well as certain assumptions regarding future events based on information available to David Hay on a formal and informal basis as of the date of this publication. The material may include projections or other forward-looking statements regarding future events, targets or expectations. Past performance is no guarantee of future results. There is no guarantee that any opinions, forecasts, projections, risk assumptions, or commentary discussed herein will be realized or that an investment strategy will be successful. Actual experience may not reflect all of these opinions, forecasts, projections, risk assumptions, or commentary.

David Hay shall have no responsibility for: (i) determining that any opinion, forecast, projection, risk assumption, or commentary discussed herein is suitable for any particular reader; (ii) monitoring whether any opinion, forecast, projection, risk assumption, or commentary discussed herein continues to be suitable for any reader; or (iii) tailoring any opinion, forecast, projection, risk assumption, or commentary discussed herein to any particular reader’s investment objectives, guidelines, or restrictions.

David Hay is a passive owner of Evergreen Gavekal (“Evergreen”), a registered investment adviser with the Securities and Exchange Commission. As of 03/31/2025 Mr. Hay has no involvement in the day to day operations of Evergreen, nor is he involved with any investment research, or investment management performed by Evergreen. The information herein reflects the personal views of David Hay as a seasoned investor in the financial markets and any recommendations noted may be materially different than the investment strategies that Evergreen manages on behalf of, or recommends to, its clients.

Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this material, will be profitable, equal any corresponding indicated performance level(s), or be suitable for your portfolio. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on an individual’s investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Investors should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.