Haymaker Daily

On oil at sea

Hello, Subscribers:

Sanctions have always been a tricky move in the world of international conflict (whether martial or strictly economic). The main and commonly acknowledged reason for that, of course, is the hardships a country’s population might or will likely suffer on part of their government. Thus, sanctioning is something of a mixed bag, often drawing tremendous criticism from the peoples belonging to the sanctioning government.

The other tricky aspect is that sanctions can very seriously impede or halt the flow of resources and goods other nations actually depend on or simply want. True, this is generally by design, but the consequences of such moves are inherently difficult to predict or fully prepare for. Sanctioning a country whose chief exports are coffee beans, textiles, or apparel might not be ideal for restaurants and retailers, but the world can adjust. Sanctioning a country whose chief export is energy (and large quantities of it), and, well, the geopolitical formulation changes. Suddenly, realpolitik factors start weighing on the situation as it becomes obvious to all that leverage exists on both sides of the conflict.

A recent piece from OilPrice.com titled Russian Crude Piles Up but Oil Prices Refuse to Move, had this to say on the current state of Western sanctions targeting Russia:

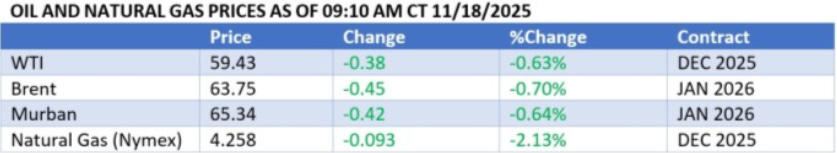

November might go down as one of the most uneventful months in oil pricing as ICE Brent continues to hover between $62 and 66 per barrel, notably narrower than the $9-per-barrel gap in October. The oil market’s main bullish momentum now comes from Rosneft/Lukoil sanctions, however up until now they’ve resulted in a build-up of Russian crude on sea rather than a collapse in day-to-day loadings.

[Emphasis added]

Preceding that passage was the following table, which fully supports the “uneventful” characterization:

The question we’re left with is what happens to these prices when the aforementioned build-up makes landfall? That doesn't strike us as an “if”, while the provided “when” is undeniably a volatile variable. What’s clear is what we’ve always known: Russian energy can be sanctioned but its massive place in the world’s energy matrix means it can never be fully marginalized.

Whether affecting markets because it is being purchased in abundance or looming over future prices because of its growing maritime supply, Russian oil will have its say one way or the other.

Benjamin Graham’s famous saying about markets shifting from voting machines to weighing machines could certainly apply to this scenario. In the case of energy sanctions, he might have said that they are initially about global optics but ultimately about the price of a barrel.

David “The Haymaker” Hay

IMPORTANT DISCLOSURES

This material has been distributed solely for informational and educational purposes only and is not a solicitation or an offer to buy any security or to participate in any trading strategy. All material presented is compiled from sources believed to be reliable, but accuracy, adequacy, or completeness cannot be guaranteed, and David Hay makes no representation as to its accuracy, adequacy, or completeness.

The information herein is based on David Hay’s beliefs, as well as certain assumptions regarding future events based on information available to David Hay on a formal and informal basis as of the date of this publication. The material may include projections or other forward-looking statements regarding future events, targets or expectations. Past performance is no guarantee of future results. There is no guarantee that any opinions, forecasts, projections, risk assumptions, or commentary discussed herein will be realized or that an investment strategy will be successful. Actual experience may not reflect all of these opinions, forecasts, projections, risk assumptions, or commentary.

David Hay shall have no responsibility for: (i) determining that any opinion, forecast, projection, risk assumption, or commentary discussed herein is suitable for any particular reader; (ii) monitoring whether any opinion, forecast, projection, risk assumption, or commentary discussed herein continues to be suitable for any reader; or (iii) tailoring any opinion, forecast, projection, risk assumption, or commentary discussed herein to any particular reader’s investment objectives, guidelines, or restrictions.

David Hay is a passive owner of Evergreen Gavekal (“Evergreen”), a registered investment adviser with the Securities and Exchange Commission. As of 03/31/2025 Mr. Hay has no involvement in the day to day operations of Evergreen, nor is he involved with any investment research, or investment management performed by Evergreen. The information herein reflects the personal views of David Hay as a seasoned investor in the financial markets and any recommendations noted may be materially different than the investment strategies that Evergreen manages on behalf of, or recommends to, its clients.

Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this material, will be profitable, equal any corresponding indicated performance level(s), or be suitable for your portfolio. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on an individual’s investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Investors should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.