Haymaker Daily

On oil draws and bulls

Hello, Subscribers:

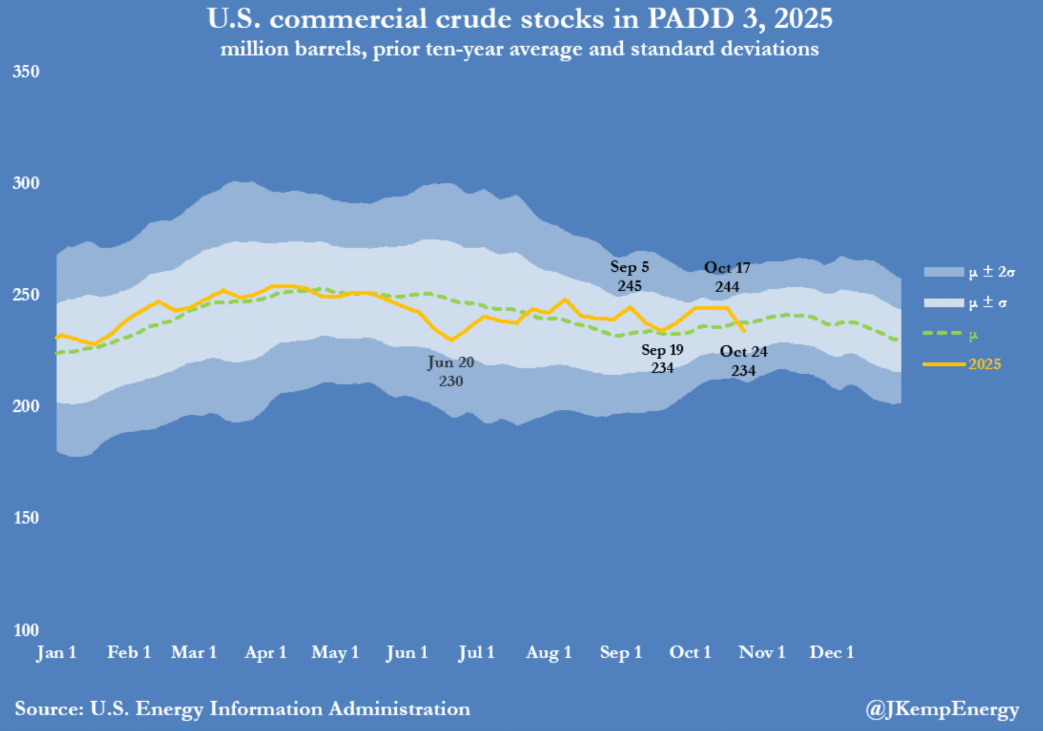

Last week, commercial crude inventories in PADD 3 (aka the Gulf Coast region) dropped by a whopping 10 million barrels. This move marks the largest single-week decline since December 2023, and it erased nearly all of the inventory overhang that had been building since the Israel-Iran ceasefire back in June. That means we’ve gone from a 5% surplus versus the 10-year seasonal norm in early September to a 2% deficit in less than two months. That’s a 13-million-barrel swing in relative inventories and a pretty seismic shift for a region responsible for roughly half of America’s refining capacity.

Historically, outsized drawdowns like this one have signaled one of two things: an abrupt spike in export demand (notable, given the Brent-WTI spread remains wide), or an intentional pullback in imports; often to goose prices when sentiment is at a nadir. Either way, the implications are significant. As highlighted in our October 20th issue, speculative positioning in crude had collapsed to levels last seen during the depths of the 2015-16 bust. That kind of sentiment washout, combined with the largest inventory draw in nearly two years, could represent a classic contrarian buying signal. If the 2025 vintage of “the cure for low prices is low prices” plays out true to form, oil bulls may soon find themselves back in the saddle.

David “The Haymaker” Hay

IMPORTANT DISCLOSURES

This material has been distributed solely for informational and educational purposes only and is not a solicitation or an offer to buy any security or to participate in any trading strategy. All material presented is compiled from sources believed to be reliable, but accuracy, adequacy, or completeness cannot be guaranteed, and David Hay makes no representation as to its accuracy, adequacy, or completeness.

The information herein is based on David Hay’s beliefs, as well as certain assumptions regarding future events based on information available to David Hay on a formal and informal basis as of the date of this publication. The material may include projections or other forward-looking statements regarding future events, targets or expectations. Past performance is no guarantee of future results. There is no guarantee that any opinions, forecasts, projections, risk assumptions, or commentary discussed herein will be realized or that an investment strategy will be successful. Actual experience may not reflect all of these opinions, forecasts, projections, risk assumptions, or commentary.

David Hay shall have no responsibility for: (i) determining that any opinion, forecast, projection, risk assumption, or commentary discussed herein is suitable for any particular reader; (ii) monitoring whether any opinion, forecast, projection, risk assumption, or commentary discussed herein continues to be suitable for any reader; or (iii) tailoring any opinion, forecast, projection, risk assumption, or commentary discussed herein to any particular reader’s investment objectives, guidelines, or restrictions.

David Hay is a passive owner of Evergreen Gavekal (“Evergreen”), a registered investment adviser with the Securities and Exchange Commission. As of 03/31/2025 Mr. Hay has no involvement in the day to day operations of Evergreen, nor is he involved with any investment research, or investment management performed by Evergreen. The information herein reflects the personal views of David Hay as a seasoned investor in the financial markets and any recommendations noted may be materially different than the investment strategies that Evergreen manages on behalf of, or recommends to, its clients.

Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this material, will be profitable, equal any corresponding indicated performance level(s), or be suitable for your portfolio. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on an individual’s investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Investors should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.