Hello, Subscribers:

Even as TSLA’s core EV business continues to experience negative growth, its market capitalization has soared back up to $1.4 trillion, matching its highest valuation ever.

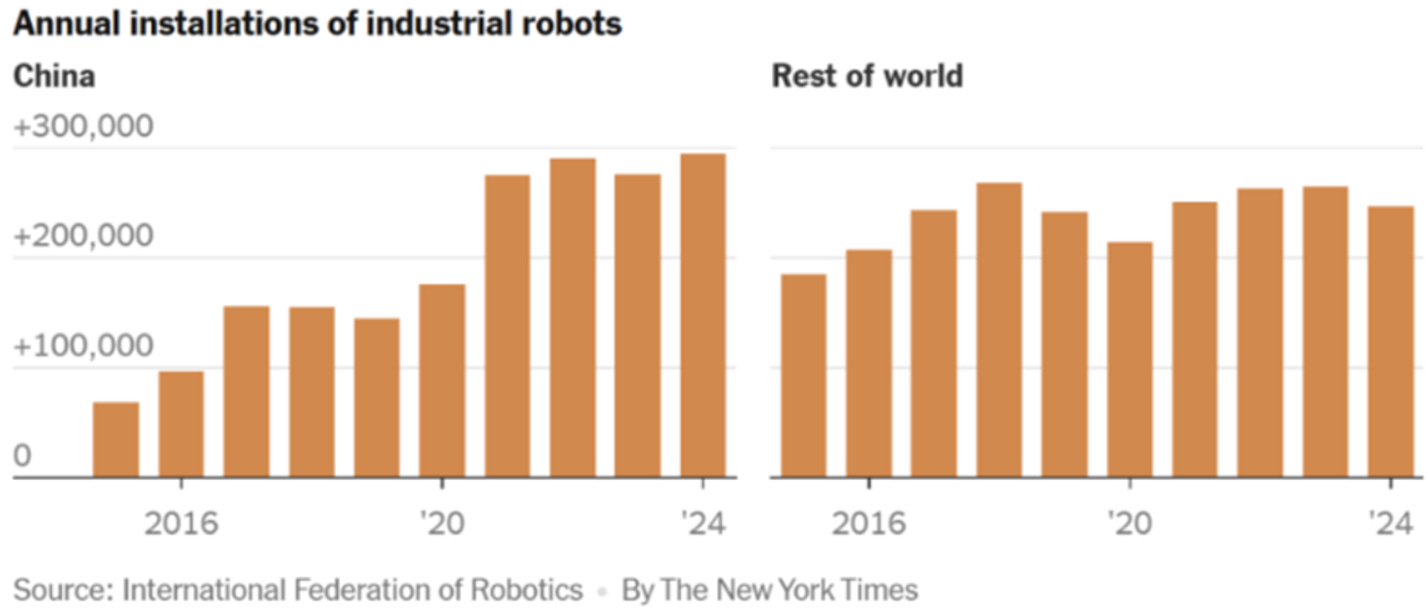

TSLA’s bullish story now rests on the twin pillars of, supposedly, its self-driving and robotics technology. With the latter it will be facing withering competition from China which, unsurprisingly, now dominates this industry. (A loud shout-out to Luke Gromen for calling my attention to the following image.)

When it comes to the former, autonomous vehicles (AVs), it’s much the same story. Low-cost models from China’s BYD are increasingly including self-driving features. The Asia-Pacific (APAC) region now represents over half of all global AV sales and, naturally, China controls the largest market share in that region which includes roughly 60% of planet’s population, or over four billion souls.

Despite the above, TSLA’s stock has enormous upside momentum and it may be in the process of making a new all-time high. Accordingly, it could continue running before experiencing another 50% decline, as it did from late 2021 to the end of 2022 and also earlier this year.

Alternatively, it could be argued it is in the process of making a double top. What is unquestionable is that it is an incredibly pricey stock. Its P/E ratio is 275 on this year’s earnings estimates, despite that profits are forecast to be down 56% from their 2022 peak.

If we are on the verge of witnessing the implosion of the fourth immense bubble of the last 25 years, TSLA’s stock could be among its worst casualties.

David “The Haymaker” Hay

IMPORTANT DISCLOSURES

This material has been distributed solely for informational and educational purposes only and is not a solicitation or an offer to buy any security or to participate in any trading strategy. All material presented is compiled from sources believed to be reliable, but accuracy, adequacy, or completeness cannot be guaranteed, and David Hay makes no representation as to its accuracy, adequacy, or completeness.

The information herein is based on David Hay’s beliefs, as well as certain assumptions regarding future events based on information available to David Hay on a formal and informal basis as of the date of this publication. The material may include projections or other forward-looking statements regarding future events, targets or expectations. Past performance is no guarantee of future results. There is no guarantee that any opinions, forecasts, projections, risk assumptions, or commentary discussed herein will be realized or that an investment strategy will be successful. Actual experience may not reflect all of these opinions, forecasts, projections, risk assumptions, or commentary.

David Hay shall have no responsibility for: (i) determining that any opinion, forecast, projection, risk assumption, or commentary discussed herein is suitable for any particular reader; (ii) monitoring whether any opinion, forecast, projection, risk assumption, or commentary discussed herein continues to be suitable for any reader; or (iii) tailoring any opinion, forecast, projection, risk assumption, or commentary discussed herein to any particular reader’s investment objectives, guidelines, or restrictions.

David Hay is a passive owner of Evergreen Gavekal (“Evergreen”), a registered investment adviser with the Securities and Exchange Commission. As of 03/31/2025 Mr. Hay has no involvement in the day to day operations of Evergreen, nor is he involved with any investment research, or investment management performed by Evergreen. The information herein reflects the personal views of David Hay as a seasoned investor in the financial markets and any recommendations noted may be materially different than the investment strategies that Evergreen manages on behalf of, or recommends to, its clients.

Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this material, will be profitable, equal any corresponding indicated performance level(s), or be suitable for your portfolio. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on an individual’s investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Investors should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.