Haymaker Daily

On tracking green trillions

Hello, Subscribers:

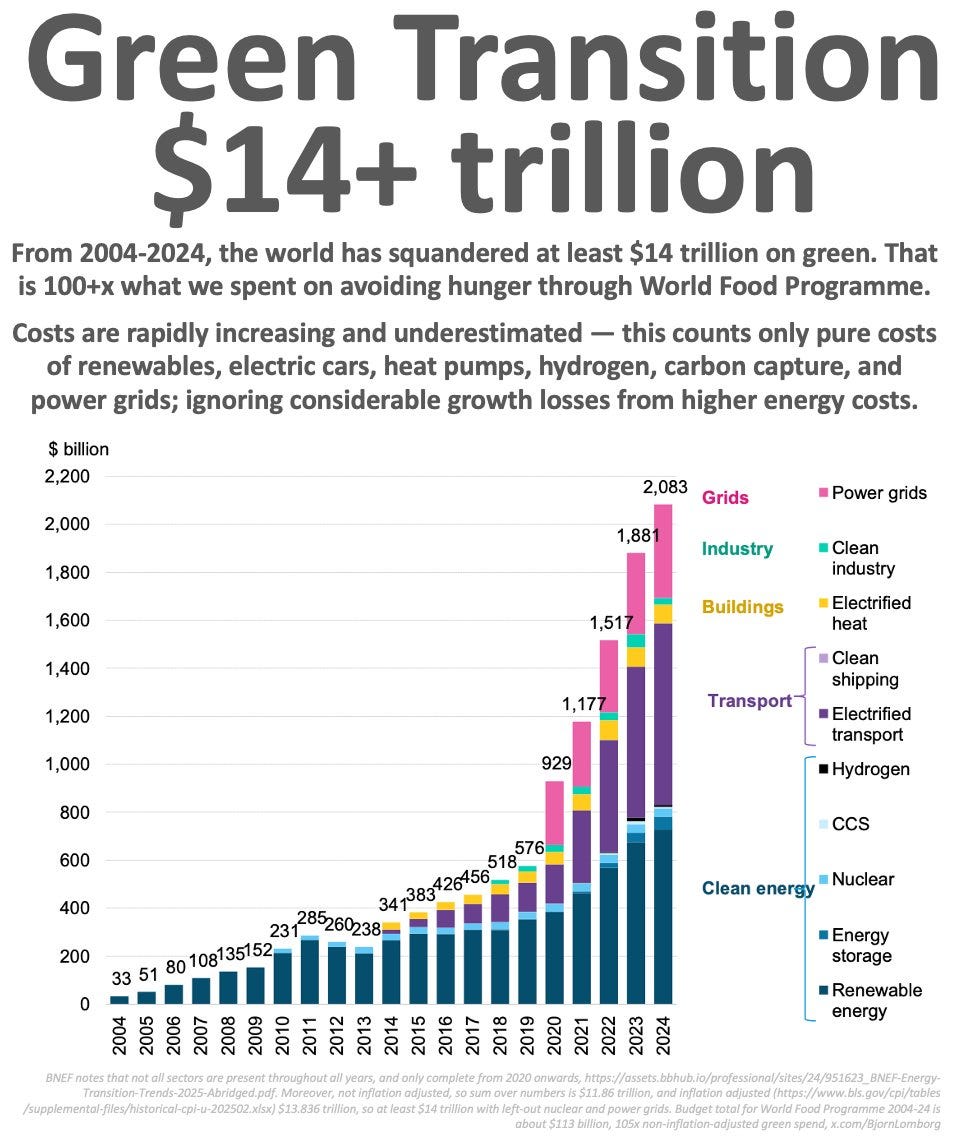

When climate activists grow tired of existential alarmism, they often switch (temporarily) to a financial pitch. As you can see below, that’s also a tough sell.

The script insists “green” energy is inherently cheaper than those disgusting fossil fuels that have… kept the lights of civilization on for the past century. This argument is predicated on the simplistic notion that because the sun always shines (somewhere) and wind sometimes blows (somewhere), that the extraction requirements are essentially negligible, thus rendering “green” both superior morally and savvier financially.

The problem, of course, is that intermittent energy sources like wind and solar entail substantial transmission/storage costs, and are also quite resource-intensive to thoroughly harvest, at least at the scale necessary to fill in where oil and gas leave off. Additionally, they require extensive back-up, usually natural gas peaker plants that power up during the frequent times when green energy sources, being intermittent, have powered down.

You’ll notice in the chart that nuclear energy is bundled under the “Clean energy” category, right where it belongs. It is clean and, for our part, we would have liked to see all or at least most of that $14 trillion poured into modular reactors, or even to upgrading/restoring existing reactors.

There’s a nuclear-lined path to energy revolution right in front of us. Unfortunately, it seems likely another trillion or two is destined for wind farms and carbon capture before we can, as a civilization, come to our senses.

David “The Haymaker” Hay

IMPORTANT DISCLOSURES

This material has been distributed solely for informational and educational purposes only and is not a solicitation or an offer to buy any security or to participate in any trading strategy. All material presented is compiled from sources believed to be reliable, but accuracy, adequacy, or completeness cannot be guaranteed, and David Hay makes no representation as to its accuracy, adequacy, or completeness.

The information herein is based on David Hay’s beliefs, as well as certain assumptions regarding future events based on information available to David Hay on a formal and informal basis as of the date of this publication. The material may include projections or other forward-looking statements regarding future events, targets or expectations. Past performance is no guarantee of future results. There is no guarantee that any opinions, forecasts, projections, risk assumptions, or commentary discussed herein will be realized or that an investment strategy will be successful. Actual experience may not reflect all of these opinions, forecasts, projections, risk assumptions, or commentary.

David Hay shall have no responsibility for: (i) determining that any opinion, forecast, projection, risk assumption, or commentary discussed herein is suitable for any particular reader; (ii) monitoring whether any opinion, forecast, projection, risk assumption, or commentary discussed herein continues to be suitable for any reader; or (iii) tailoring any opinion, forecast, projection, risk assumption, or commentary discussed herein to any particular reader’s investment objectives, guidelines, or restrictions.

David Hay is a passive owner of Evergreen Gavekal (“Evergreen”), a registered investment adviser with the Securities and Exchange Commission. As of 03/31/2025 Mr. Hay has no involvement in the day to day operations of Evergreen, nor is he involved with any investment research, or investment management performed by Evergreen. The information herein reflects the personal views of David Hay as a seasoned investor in the financial markets and any recommendations noted may be materially different than the investment strategies that Evergreen manages on behalf of, or recommends to, its clients.

Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this material, will be profitable, equal any corresponding indicated performance level(s), or be suitable for your portfolio. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on an individual’s investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Investors should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Climate change is real and is decimating ecosystems and infrastructure globally. Renewable energy is now cheaper than fossil fuels in most cases, with over 90% of new renewable projects costing less than fossil fuel alternatives. Lets stick to facts, not ideology.

All Non-carbon dioxide emissions are green now.