Hello, Readers and Subscribers:

From time to time, a handful of “must see” charts pile up here at House Haymaker (we analyze a lot of them), necessitating a chartbook edition — this is one of those times. Today’s high-finance smorgasbord starts off with some AI data, courtesy of the Rosenberg Research team, and wraps up with a look at cash on the sidelines relative to market capitalization, per the astute analysts of BCA Research. Everything in between is also worth a gander (whatever a gander is).

We hope you enjoy the charts and, especially, your weekend. As mentioned earlier this week, we’ll be taking a close look at natural gas in the upcoming Making Hay Monday edition. It’s possible the bottom is in for energy after the recent nasty sell-off. And as much as we like oil at these depressed prices, we believe the long-term outlook for gas is even brighter!

The Haymaker Team

P.S. We encourage you all to read this linked piece from Haymaker friend Michael Lewitt, The Credit Strategist. It deals with one of the pressing matters of our day: the deterioration of institutional trust, in this case furthered by serious rule violations on part of several Federal Reserve officials.

“Russia is the leader in reserves of a number of strategic raw materials: for natural gas, this is almost 22% of world reserves, for gold - almost 23%, for diamonds - almost 55% … Maybe we should think about certain restrictions: uranium, titanium, nickel.” -Russian President, Vladimir Putin

Haymaker Chartbook

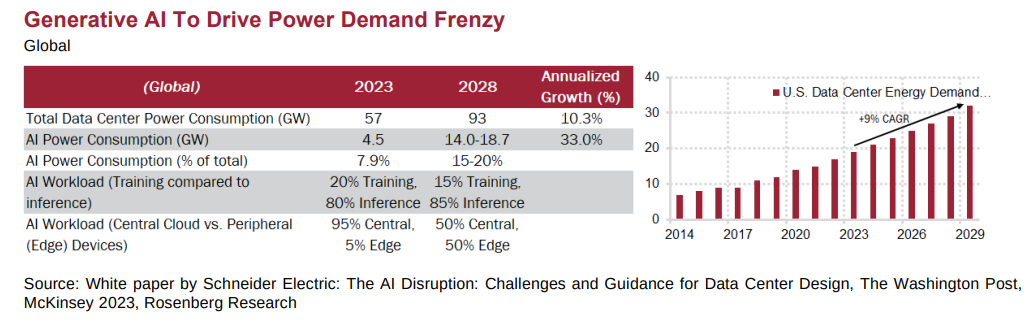

Oil demand is likely to increase at a slow but steady rate over the balance of this decade, led by emerging market usage. The biggest upside may come from supply shortfalls, despite current concerns about a crude glut. For natural gas, the consumption outlook is much more bullish driven by rapidly growing U.S. data-center power needs. There is also the surging demand globally for American liquefied natural gas (LNG). This increase could amount to over 11 billion cubic feet/day, about 10% of total current U.S. production, and roughly a doubling of current LNG exports. It does beg the question of where all the gas will come from to supply those shipments. As with oil, natural gas production growth in the U.S. appears to be stalling out.

It is becoming increasingly obvious that EV growth is decelerating and, in some countries, such as Germany, actually contracting. Yet, there is a pervasive view that oil is destined to be phased out. Even prior to the mounting EV travails, forecasts were for gasoline-powered vehicles to be much more numerous in 2040 than they are today. Naturally, there is a big difference between predictions and reality, but the move away from EVs toward hybrids elevates the credibility of the below. (Copious thanks to the talented and data-driven team at Cornerstone Macro for the below visual.)

While U.S. nuclear plant construction is now dormant in the wake of the opening of the two Vogtle atomic facilities (approved 15 years ago), Asia is aggressively embracing nuclear energy.