Image: Shutterstock

“A number of indicators, such as the Conference Board’s Leading Economic Index, suggest recession is not only likely but may have already begun.” -Jesse Felder

Introduction

This edition of our Guest Haymaker is courtesy of my great mate, Sydney, Australia-based Gerard Minack. Gerard has been a frequent contributor to this newsletter going back to the many years when it was known as the Evergreen Virtual Advisor (EVA).

His current note, displayed below, is both concise and timely. Its timeliness is a function of this month’s remarkable and continuing rally in stocks, not just in the U.S. but around the world. In fact, several other key equity markets have been much stronger than the S&P and even the NASDAQ (up nearly 7% and 12%, respectively).

Perhaps the main driver of this latest recovery is the growing conviction among market participants — including the critically important computerized trading programs — that the dearly hoped for economic soft-landing is near at hand. As Gerard notes, those rare events have been extremely bullish in the past.

Lending credence to his view is the remarkable tendency for January to set the trend for the year. Historically, as I’ve noted before, 70% of the years that have had up Januarys have led to positive full-year returns. My good friend Jesse Felder, author of the ever-insightful The Felder Report, correctly pointed out in an email to me today that this is essentially how often the market rises in general. However, as you will see in next week’s Making Hay Monday edition, the results since 1970 are even more encouraging.

He’s further pointing out that what we saw prior to last year was the inflation of the Everything Bubble. Since I’ve often referred to that speculative frenzy as “the biggest bubble of all-time”, I obviously concur with his appraisal. This salient fact calls into question how it could be unwound with modest pain to the S&P 500. Given that the S&P was down 18% last year and is now back up 7%, this is an exceedingly mild correction relative to the degree of overvaluation that climaxed in 2021.

Be that as it may, per Gerard’s missive, the Fed is nearing the end of its nearly unprecedented tightening cycle, a typically a bullish development. Yet, as his third graphic displays, it’s unusual to have the market in serious rally mode prior to the cessation of Fed hostilities. Moreover, I would add that this doesn’t incorporate that other, and stealthier, aspect of the Fed’s liquidity withdrawal program — quantitative tightening (QT). For now, it is projected to run for years to come (mark me dubious on that part). The only other up January when the Fed was double tightening was 2018, and that year finished down 4%, with most stocks getting hit much harder. Of course, it’s an extremely small sample set.

Gerard additionally observes that the stock market is clearly not pricing in a recession. This is despite an increasing number of weakening economic data points. Even yesterday’s superficially healthy fourth quarter GDP report was, in reality, underwhelming, as a number of pundits are highlighting this morning. That includes Gavekal’s Fed and economic expert, Will Denyer.

There is also the distinct possibility the year finished in the black but with wicked volatility along the way. On Monday, I’ll delve into the details of another year that started out strong and became far stronger — before a stock market event of historic proportions occurred. In the meantime, please enjoy Gerard’s take on the powerful crosscurrents presently underway.

-DH

To learn more about Evergreen Gavekal, where the Haymaker himself serves as Co-CIO, click below.

Guest Piece by Gerard Minack

(Originally published in Down Under Daily on January 17th, 2023)

There is good news driving markets, but will it last?

The bullish start to 2023 is based on good news: inflation is rolling over, China is backflipping on market-unfriendly policies, and warm weather is easing Europe’s energy crunch. I don’t expect this rally to survive a US recession, which remains my base case. But perhaps the nasty-first-half-buy-in-the-second-half consensus view will need to be tweaked to start-with-a-bang-sell-in-May (?) view.

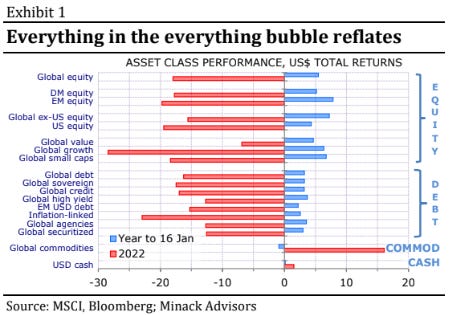

The everything bubble is trying to reflate in 2023. Everything that fell last year is up, and the only thing that’s down is (of course) last year’s big winner: commodities (Exhibit 1). That performance in 2023 is a mirror image of 2022 suggests that positioning is a factor in the market moves.

But there is also good news to support a rally. Inflation is rolling over almost everywhere. Market forecasts (based on inflation swaps) point to a rapid decline in US headline CPI towards the Fed’s target (Exhibit 2). All this without (so far) any material damage to the real economy.

Rate markets expect the Fed to stop tightening mid-year. Historically the end of Fed tightening cycles has been bullish for risk assets (Exhibit 3). Investors now seem willing to front-run that trade.

There is also good news from China, where policymakers seem willing to backflip on several of the market-unfriendly policies of the past few years. The Covid reopening is the most obvious shift, but there’s also promises of help for the beleaguered property sector, hints of less hostility to the technology sector, and moves to improve foreign relations by, for example, ending the embargo on selected Australian exports. The China MSCI index is up over 50% from its October low (Exhibit 4).

There’s also good news from Europe. Europe’s energy crunch has eased, and energy prices are falling, partly due to unseasonably warm weather. European macro data are now surprising to the upside (Exhibit 5). Europe’s widely expected recession has been avoided or delayed.

The prospect of a Fed pivot, better macro news from outside the US and weaker commodity prices are all working to weaken the US dollar. The euro is up 13% from its late September low (Exhibit 6).

A few thoughts on this bullish start to 2023:

· Whether or not the US has a recession remains the crucial call for absolute risk asset returns in 2023. A recession is not in the price, and the further the current rally extends the greater the set-back a recession would trigger.

o The market would be unsettled if the Fed makes clear that the upcoming decline in inflation will be treated as transitory unless it is accompanied by significant labour market weakness. I continue to think that labour market data are more important than inflation data in dictating Fed policy. Because the Fed wants a looser labour market it is likely to get a recession.

o If there is no recession, then it is correct to be bullish. Soft landings – the Fed pivoting to easier policy without a recession – are rare but very bullish for risk assets. If the Fed changes its rhetoric – and downplays a looser labour market as a prerequisite for a policy shift – then that would be bullish.

The change in Chinese policy – if sustained – is good news for Chinese assets specifically, but also will have spill-over benefits for China-related plays.

o I have no edge on what Chinese policy makers will do, but I assume that recent backflips will not be quickly reversed.

o There was already a case for non-US markets to outperform the US in 2023 – as they did last year – even if absolute returns were mediocre. That case has been strengthened by what’s happened in China.

o However, I don’t think good news in China could insulate non-US markets from a set-back if there is a US recession.

The consensus view on 2023 – amongst pundits, not necessarily priced by investors – seemed to be that risky assets faced a difficult first half year due to economic weakness, but that central bank easing and signs of cycle recovery would lead to a stronger second half. It may be that something like the reverse unfolds: start with a rally that only gets undercut when it becomes clear that central banks – notably the Fed – will not relent until the labour markets weaken, and that implies recession. That realisation may come sooner than mid-year: my best guess – it is only a guess – is that the rally ends in the current quarter.