Image: Shutterstock

“The most important thing to remember is that inflation is not an act of God; inflation is not a catastrophe of the elements or a disease that comes like the plague. Inflation is a policy…” -Ludwig von Mises

—

Readers of this newsletter, going back to its long-running precursor, the Evergreen Virtual Advisor (EVA), may recall the name Gerard Minack, author of the Down Under Daily. If so, my corny joke that the “DUD” is definitely no dud may also come to mind.

In reality, I rarely fail to read his short-but-incisive commentaries. They also include some of the best charts I see out of the dozens or so distinctive research sources I review.

Gerard’s recent note, which he graciously permitted us to publish as this month’s Guest Haymaker, is, as usual, notably chart-rich – despite the fact that some of them have negative implications for our financial market riches. On that topic, another chart, shown immediately below, from BofA’s crack market strategist, Michael Hartnett, dramatically drives home just how much wealth destruction has already occurred. As you can see, we’ve experienced a once-in-century wealth wipe-out.

Chart: Hartnett, et al.

As many of you know, my team and I rushed to get my book Bubble 3.0 out in a digital form early this year due to my fears that this type of hangover from the maniacal speculation in recent years was looming. Frankly, though, I’m surprised how quickly this has all unfolded.

One of Gerard’s key points in this piece is also related to a primary theme of Bubble 3.0; namely, that inflation is the ultimate bubble buster. When it runs hot, as it has been doing since early 2021, central banks can’t play their usual role of providing a never-ending supply of helium to keep asset prices inflated.

He further notes that the stock market’s earning-per-share (EPS) forecasts are “a mile from pricing the likely cycle downside”. In other words, Wall Street earnings estimates need to come down… a lot. This echoes a sentiment from a Haymaker we ran this summer that covered a podcast my great friend Grant Williams did with Bridgewater’s Co-Chief Investment Officer, Greg Jensen. Greg opined that the market carnage thus far has almost exclusively been attributable to the extraordinary spike by interest rates and had very little to do with downward earnings revisions. (By the way, I will be spending considerable time over the next few days with Grant at his favorite venue for rest and restoration: Kiawah Island, South Carolina. Our youngest son, his wife, and their three beautiful–not that I’m biased–daughters, will also be joining my wife and I for a truly grand weekend.)

One of Gerard’s most timely comments – based on yesterday’s massive reversal, from a big loss to an even bigger gain – relates to the market’s obsession with when the Fed will “pivot”. In other words, that point at which time the Fed goes from tightening like an OCD piano tuner to cutting like its old easy-money self. Another nifty line in that regard is that “obsessing about a central bank pivot is like obsessing about what the band is going to play after the ship hits the iceberg.”

His point is that the market is missing the bigger issue of an earnings swan dive by excessively focusing on a Fed policy reversal. Regardless, such expectations will lead to snappy rallies, such as seen yesterday, regardless of how misguided those are in reality.

One of the most interesting charts in here displays the present stunning gap between manufacturing Purchasing Manager Indexes (PMIs) and the yield on the 10-year T-note. Typically, when PMIs have fallen out of bed, as they have lately, interest rates on the 10-year treasury are heading in a southerly, not northerly, direction. This is another illustration of how unusual conditions are presently – not to mention, unusually hazardous. Once again, notwithstanding yesterday’s rousing rebound, caveat investor!

To learn more about Evergreen Gavekal, where the Haymaker himself serves as Co-CIO, click below.

We sincerely welcome all your thoughts and any opinions you’d like to share for our consideration and for that of your fellow subscribers. Please help us keep the conversation going.

What follows are the writings and research of Mr. Minack. We’re honored to borrow his insights and to share them here for your benefit.

Enjoy the guest contribution.

Rates have better adjusted to a new normal than equities - Gerard Minack

Originally published in Down Under Daily | October 5th, 2022

Rate markets have undergone a massive hawkish repricing. In the US the bulk of the adjustment is complete. Equities have not adjusted enough. They remain desperate for, and highly sensitive to, any prospect of central bank wavering. But high inflation means the bar for a policy pivot is likewise high. Meanwhile, consensus EPS forecasts are a mile from pricing the likely cycle downside.

Rate markets have gone through a sea change this year. At the end of last year short rate futures implied that the cycle peak for the Fed fund rate would be under 1½%; last week the market priced a peak around 4¾% (Exhibit 1). There may be further upside – a 2006-type peak, 5¼%, is the hawkish scenario – but after a 300 basis point-plus adjustment most of the move is done.

Importantly, markets now expect that the real Fed fund rate – based on the gap between the expected nominal fund rate and prospective inflation – will peak around 1½-2% (Exhibit 2).

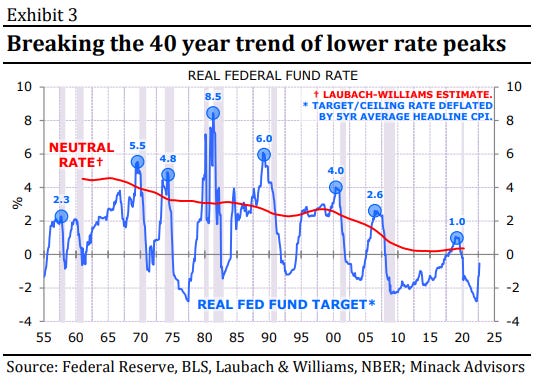

This is one of several examples where rate markets have conclusively broken 40 year secular trends. One hallmark of secular stagnation was the decline in neutral policy rates. Each cycle peak in the real Fed fund rate was 1½-2% below the prior peak (Exhibit 3). This cycle will break that pattern.

Unsurprisingly, long-end rates have also adjusted. Ten year yields have broken the 40 year trend of lower lows/lower highs. Long end yields normally peak at, or above, the Fed fund peak – although, to be fair, that was not the case in the high inflation 1970s (Exhibit 4) – pointing to a 4-5% cycle peak. Long rates started 2022 at 1½%, so most (but not all) of the adjustment has now been made.

While rate markets have seen significant cycle adjustments and are even starting to hint at a change in the secular trend, equity markets have not appropriately priced in the likely cycle downside and remain stuck with a pre-pandemic framework.

An example of the latter is the exaggerated hope for a central bank pivot. When central banks pre-emptively tighten, they are looking to slow growth to prevent a rise in inflation. Being ahead of the curve gives them room to ease when growth indicators inflect. But central banks are not ahead of the curve now; the hurdle to easier policy is higher now because inflation is higher. It’s that simple. Rate markets get this. The link between long-end rates and a cycle indicator such as the manufacturing ISM has broken. Equity markets continue to not understand this change.

Equity markets have adjusted to higher rates. But they are a mile from pricing the likely cycle downside. My base case is recession in the US, recession in Europe, recession in the UK, Japan is a SNAFU and China is stuck in a self-inflicted Covid nether world. Outside China, earnings forecasts reflect none of this (Exhibit 6).

In short, it may be unclear how high the peak in rates will be in this cycle, but it’s much clearer what the subsequent slowdown will do to earnings. Obsessing about a central bank pivot is like obsessing about what the band is going to play after the ship hits the iceberg.

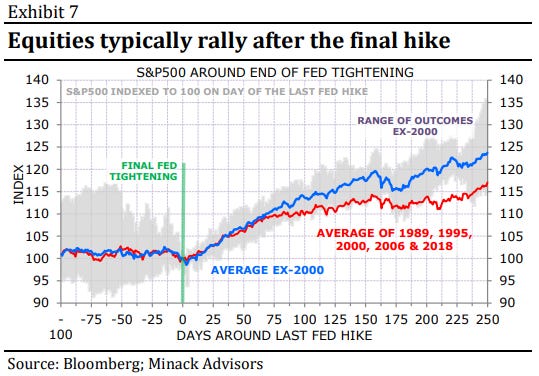

To be fair, this is longstanding equity market behaviour. Equity markets typically rally after the final hike in a Fed tightening cycle (Exhibit 7). I don’t think we are close to that final hike, but I concede a tactical rally is likely at the time. These rallies are driven partly by the fact that on average the first cut in a rate cycle comes 4 months after the final hike in the prior cycle.

However, by the time the Fed is easing the only thing that matters is the recession call. If the Fed achieves a soft landing, equities do well; if it’s recession – my base case this cycle – equities fall.

—

Minack Advisors

Office Suite 6, Level 4, 95 Pitt Street, Sydney NSW 2000, Australia

Postal PO Box 284, Mosman NSW 2088, Australia

Phone +61 419 247 981 (m) +61 2 8249 8219 (o)

Email info@minackadvisors.com

Web www.minackadvisors.com

Authorised Representative No. 443937

Minack Advisors Pty. Ltd. ABN: 84 163 503 044

Did you enjoy Mr. Minack’s piece as much as we did? If so, please leave us a comment and a like on your way out. Thank you much!

Terrific commentary and analysis. Thank you very much for sharing this.

Great report, Thank you. So interest rates will continue higher for substantially longer and the market will continue to decline from a decrease in earnings. When I look back over my investing career, these are types of markets that I have made most of my returns.