Image: Shutterstock (Haymaker-modified)

“What's called a difficult decision is a difficult decision because either way you go there are penalties.” -Elia Kazan, Academy Award-winning director (On the Waterfront)

A Note From The Cornerman - Mark Joseph Mongilutz

Hello, Haymaker Readers:

I won’t keep you long, as this week we have a solid guest entry from Anatole Kaletsky, co-founder of our partner firm, Gavekal. Dave will make the introduction himself below. For my part, I think this is an ideal moment for a straightforward request: share this content. If you’re enjoying it, share it frequently.

Bringing you twice-weekly Haymaker editions is a privilege, one our team regards as a tremendous responsibility. Continuing to publish here, which we fully intend, will mean growing the readership – and you can help us with that by making sure you’re subscribed and making doubly sure others know about the quality work we so enjoy delivering to your inbox each week.

If you’re paying even passing attention to the media landscape in all its many forms these days, you’ve certainly noticed the absurd quantity of material in circulation. Even on a slow Tuesday morning, you can bounce from a few articles on RealClearPolitics to a handful of favorite Twitter news feeds and across the mainstream media outlets for the better part of an hour without so much as scratching the surface of everything available to you. All the audiobooks, the podcasts, the infinite minutes of streaming television, the sports channels – it’s enough to have one seriously consider making a sensory-deprivation tank one’s full-time residence.

Thus, given the many content channels that might snatch up your limited hours every day, we are immensely appreciative for the time you choose to spend engaging with Haymaker content. That said, please do share generously, comment frankly, like readily, and stick with us in the year ahead – we’re still in the early rounds.

Thank you and (after a quick word from the Haymaker) enjoy the guest piece.

-MJM

Guest Piece Introduction - David “The Haymaker” Hay

Fed chair Jay Powell delivered yet another speech on Wednesday that the Fed intends to continue hiking and keep rates elevated for an extended timeframe. Basically, he’s telling the world it will be higher for longer. This caused the market to plunge once again rally furiously. Despite his basic message, it is fair to say his new-found Dirty Harry persona was MIA this week. Regardless, one can only wonder what the stock market would have done had he stated the Fed was finished tightening. Perhaps it would have set a new all-time high–just kidding (sort of).

Based on that euphoria, today’s piece from Anatole is an important read. It’s human nature to want the stock market recovery that began on October 13th to continue through year-end, if not into 2023. Selfishly, the Haymaker would love to see that, despite my many personal short positions. This is because most Evergreen clients would likely finish what was once a difficult year close to break-even. (With more aggressive strategies and, ironically, pure bond portfolios, that would not be the case.) However, I learned long ago that what I yearn for rarely occurs, particularly on a near-term basis.

Note that Anatole wrote this two weeks ago and he presciently opined that the bear market rally might very well continue. His reasoning, as you will read, is based on the likelihood of additional softer inflation data. The more flaccid than feared release yesterday of the Fed’s preferred inflation measure was another good call on his part.

However, as he also points out, before long the market will almost certainly wake up to the reality that in order to hit the Fed’s inflation bogey, a recession is required. That’s not good for stocks but at least high-quality bonds would do well.

Alternatively, Powell & Co. could accept a higher level of normalized inflation, like 4% or 5%. That’s also not market friendly. In fact, in that scenario, bonds and stocks would both lose money as they were doing this year at a once-in-a-century rate prior to the recent upswing.

As I’ve often conveyed, the Fed has printed itself into an extremely tight corner. However, for now, I’m convinced – apparently, much more than most market participants are – that Powell’s number one priority is to bring inflation down as close to the Fed’s ideal 2% level as possible.

Consequently, like Anatole (with whom I often don’t see eye-to-eye, even when I’m wearing contacts), I believe the growing ranks of raging bulls are currently stampeding in the wrong direction. My advice is not to be trampled when they run the other way, toward the bull ring’s exit. And, boy, is there a lot of “bull” out there right now, the kind that politicians, and crypto promoters, love to excrete. Sadly, we do indeed seem to be living in a post-truth society these days. The Fed is far–very far–from blameless in that regard.

-DH

To learn more about Evergreen Gavekal, where the Haymaker himself serves as Co-CIO, click below.

Enjoy The Rally, While It Lasts - Anatole Kaletsky

Originally Published November 16th, 2022 (Gavekal Research)

Will this market rally prove to be a selling opportunity, as the rallies in May and July?

Markets have turned bullish. This is the third time since late February, when the world changed and I changed my mind from buy-on-dips optimism to sell-on-rallies gloom. As in the previous two cases, the present rally is driven by a hope that US inflation “has peaked” and a prayer that the Federal Reserve will soon share this view. The previous two rallies were great selling opportunities, as was obvious not just in hindsight but even at the time, in both May (see Preparing To Sell The Rally) and July (see Why Are Financial Markets So Complacent?). Will investors who bet on the present rally suffer a similar disappointment? I think that the answer is not quite as unequivocally negative as it was in May and July, despite the fact that I fully agree with the bearish economic analysis presented on Monday by Charles (see No, US Inflation Has Not Peaked Yet).

High inflation remains the main threat to economic stability and financial assets for at least the next few years

I fully agree with Charles that US inflation is not under control and that high inflation will remain the dominant threat to economic stability and financial assets for at least the next year or two and possibly for the rest of the decade. But in the next month or two, the bear-market rally may well continue, because the persistence and seriousness of the US inflation problem may not become clear to investors until next spring or early summer. Until then, a few more prints of relatively weak inflation data will probably increase the complacency among investors that has come to dominate market sentiment after last week’s benign inflation “surprise”.

In the short term, inflation prints will be flattered by base effects, propelling the bear-market rally

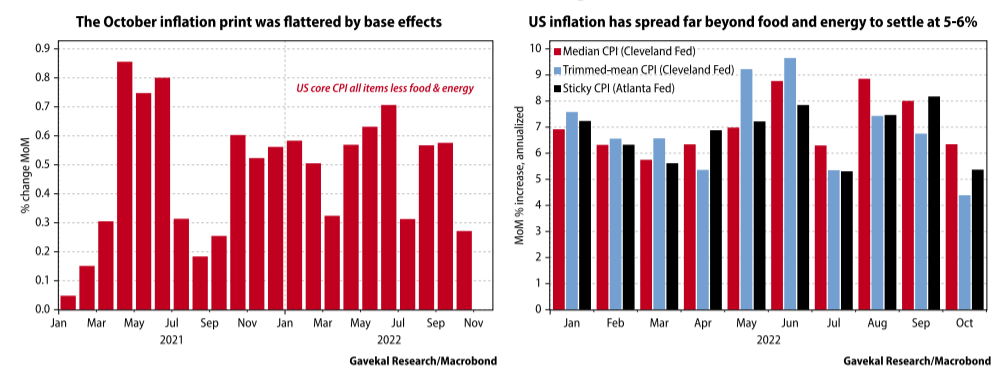

To start with the good news, the rally may be sustained for another month or two by evidence that US consumer price inflation continues to decline from the 40-year records hit by the headline rate in July (9.1%) and the core rate in September (6.7%). We can be fairly confident of such improvement because of the base effects which largely explained the two previous periods of inflation optimism in May and July this year.

As shown in the left-hand chart overleaf, US inflation accelerated strongly in April and May 2021 due to post-Covid reopening. As a result, the 12-month comparisons improved in April and May 2022, but this turned around in the July data (reported in mid-August), when the flattering base effect disappeared. The reverse then happened, when the low 2021 inflation readings of July, August and September dropped out of the annual comparisons, making this year’s summer data look very bad. The October inflation data which was published last week seemed a dramatic improvement partly because the base effect turned favorable—and the base effect will remain favorable for the next three months. As a result, the current rally could well continue through the seasonally bullish Christmas and New Year period.

High inflation is now pervasive, spreading to most categories of goods and services

By next spring, however, it will become clear that the “peak” inflation of 2022 was not really a peak, in the sense that inflation falls precipitately after reaching this level, but more of a plateau. By March or April next year US inflation may be reduced to 5% or even 4%, but any further declines from this level are unlikely. There are two reasons—one factual, the other theoretical— to believe that inflation will stay stuck on a high plateau from March or April next year. The factual reason is that high US inflation has become pervasive, spreading beyond energy and food to most categories of goods and services. This can be seen in the most reliable measures of underlying inflation—the median, trimmed-mean and “sticky” inflation indexes published by various branches of the Fed, all of which show underlying inflation settling at 5-6% with no evidence of a downtrend (see right-hand chart below and Another Predictable Inflation Surprise).

The mechanism for a big and unprecedented disinflation does not exist

The theoretical reason for believing that US inflation will stabilize at a high level, rather than continue to decline, is that monetary tightening has not been remotely sufficient to cause the tremendous disinflation which the Fed and the markets now assume. For inflation to collapse from 9.1% last July to around 3% by late next year, while interest rates remain negative or zero in real terms and while US unemployment stays near record lows, would be unprecedented in economic history. Of course, unprecedented events sometimes happen. But with no evidence of a significant weakening of US labor markets, or of corporate pricing power, at least in the next couple of quarters, the mechanism for a tremendous and unprecedented disinflation simply does not exist.

Investors will have to accept either a high inflation plateau, or a serious and protracted recession

Which brings us to the biggest challenge to the present market rally in both equities and bonds. At some point in the spring or summer of next year, investors in US assets will have to confront a very unpleasant question which they have been dodging all this year. To push US inflation down from a 4-5% plateau to somewhere near the 2% “price stability” target, will US policymakers accept a serious and protracted recession, caused deliberately by a further tightening of monetary policy substantially more aggressive than anything the markets have discounted so far? Or will US political and public opinion instead decide to accept 4-5% inflation as the “new normal” and a satisfactory fact of life, at least for the next few years?

Nobody can predict with confidence which of these alternatives US policymakers, politicians and voters will choose. But both will be very negative for asset prices. Either because the Fed raises policy rates much further than the 5% “terminal rate” currently expected and forces the economy into a deep and prolonged recession. Or because the Fed fails to do this and, although a serious recession is avoided, permanently high inflation has to be reflected in much higher bond yields, a steepening yield curve and equity valuations that reflect bond yields permanently in a range of 5-6% instead of the 3-4% range that investors currently expect.

The US faces a very painful choice by next summer...

Either way, the US will face a very painful choice by next spring or summer: a deep recession and significantly higher interest rates than the markets or the Fed have contemplated thus far; or a plateau of permanently high inflation, along with a new normal of asset valuations and business strategies. Since US investors, central bankers and politicians have not even considered this difficult dilemma, never mind resolved it, I am convinced that the bear market in both bonds and equities still has a long way to run.

...and when investors realize this, the present rally will end in a costly reversal

The present rally will therefore end in a costly reversal. The only question is: will the markets anticipate the trouble that lies ahead for the US next year and turn bearish again quite soon, perhaps after the next CPI print in mid-December? Or will investors keep chasing equity and bond prices higher until the spring or early summer, when the painful choice between permanently high inflation or deep recession becomes impossible to dodge or disregard?

I'm not sure the choice for the US is all that difficult. Painful, yes. Enormous debt burdens are likely to be inflated away, but Powell made it clear earlier that RE was going to be hit, hard, and that means rates will be higher, longer, than many of the equity bulls believe.

Imagine if the FED publicly accepts, even e temporary, a 4-5% of inflation. Silver and Gold limit up ?