Friday Highlight Reel: Edition #8

A sampling of interesting observations from the Haymaker's network of market experts and favorite resources.

“You know what commercial real estate is, it’s a boa constrictor tightly wrapped around the economy, suffocating growth for the next 2 years.” -Michael Hartnett, BofA

#1: The Asia Times’ David Goldman on Inflation, Treasuries & Gold (as Relayed by Luke Gromen)

“One failsafe gauge of global systemic risk is the price of gold, and especially, the price of gold relative to alternative hedges against unexpected inflation. Between 2007 and 2021, the price of gold tracked inflation-indexed US Treasury securities (“TIPS”) with a correlation of around 90%.

Starting in 2022, however, gold rose while the price of TIPS fell…In effect, the market worries that buying inflation protection from the US government is like passengers on the Titanic buying shipwreck insurance from the captain…No one has a lot of confidence in the US Consumer Price Index, the gauge against which the payout of TIPS is determined.” (Emphasis added)

Haymaker Take: The emphasized section is simply a pitch-perfect soundbite. The U.S. government is very likely to be under extreme pressure to fudge the inflation numbers as much as it can get away with in order to inflate its way out of its current financial mess. As most Haymaker readers are aware, a U.S. fiscal funding crisis is one of my two biggest underappreciated risks of 2023. (It’s also a point I frequently make when I am interviewed by bright folks like David Lin and Jay Martin.)

For now, the Fed is sticking to its plan of raising rates and shrinking its balance sheet. This is known as double tightening and it’s an extremely aggressive monetary stance by our once bubble-enabling central bank. However, as I’ve been warning since last June, the economy appears to be cracking. Admittedly, it has taken longer than I thought in some ways. On the other hand, 11 straight months of falling Leading Economic Indicators are suggest this erosion hasn’t been a recent development. How much longer the Fed can stick to its guns should the economic data continue to deteriorate is the multi-trillion-dollar question. My best guess is for a few more months, but after that it might be time for Jay Powell to bring out his Ginsu knife.

#2: CNBC’s Highly Accurate Luminary on the NASDAQ

“Short this Nasdaq and invite me to your funeral.” -Jim Cramer in a March 16th Tweet

Haymaker Take: “Booyah Jimbo” is at it again! Throughout the bear market that began in early 2022, he repeatedly claimed it was over, in his usual frenetic style. This includes when it was only about two months old. He has also sniped at Morgan Stanley’s Mike Wilson for being excessively bearish, despite Mike’s exquisitely timed recommendation to go long in mid October of last year. If anyone should be humbled by their forecasts of the last year, it’s the man who loves to start his Mad Money show by shouting “Hail Cramer!”. Suffice to say his March 16th Tweet makes me feel even better about my NASDAQ-100 short position in my personal hedge account.

#3: The Brilliant Stephanie Pomboy of MacroMavens on Greedy Banks (shared via Grant Williams and his must-read Things That Make You Go Hmmm)

“…the banks could simply have paid depositors a return anywhere in the realm of what cash was offering. But instead, they greedily held deposit rates below 1%...FOR A WHOLE YEAR…even as returns on cash topped 5%.

Why did they do this? Why did they put themselves at such risk?

One could argue they, like Wall Street, never imagined the Fed would lift rates as high as they did and were betting on a forthcoming pivot.

That would be excusable for one month, two months…heck, even six months, maybe. But as they sat there, watching their assets WHITHER you’d think they might have begun moving to protect their deposit base. I mean, they could always LOWER the rate back down if the Fed did pivot!!

Why didn’t they do that???

We all know damn well why. They were desperate to protect their margins so as to deliver on their earnings guidance. Duh!!

In other words: They were more concerned about maintaining their margins than they were about survival.”

Haymaker Take: Stephanie is a petite and lovely woman, but she can lambaste with the best of them. There’s not a lot I would add to her rant other than to say I believe depositors bear a lot of the blame. Exhorting Haymaker readers to get their cash out of yield-free bank accounts, even if they were/are insured, has been one of my main missions for almost a year. Let’s face it: banks want to pay you as little as possible to use your money. It’s up to you not to let them take advantage of what I believe to be one of the most powerful forces in the universe: inertia. To be more than a little on the blunt side, I’d also add laziness.

To learn more about Evergreen Gavekal, where the Haymaker himself serves as Co-CIO, click below.

#4: David Rosenberg on Trade Flows from his 4/6/23 Breakfast with Dave

“Business activity softened to 55.4 from 56.3 in February and 60.4 in January, while employment retreated to 51.3 from 54.0 (validating the weakness in the ADP employment report). Not just that, but two-way trade flows cratered, with new export orders (43.7 from 61.7) experiencing their largest drop on record and imports collapsing to 43.6 from 52.6. In fact, the combined export and import index, a proxy for overall trade flows, is now at a level that we only have ever see during recessions.” (Emphasis added)

Haymaker Take: Could this be the week when the consensus finally realizes the economy’s landing is looking anything but soft? Even Schwab’s calm and balanced Liz Ann Sonders said on CNBC yesterday that all the jobs market’s leading indicators are now suggesting weakness. Because that has been the most credible counterargument to an impending recession, this is important news. Yet, for all the sudden focus on the deterioration in economic data, little attention has been focused on trade flows. The above-highlighted commentary from David Rosenberg is a rare exception to that and it’s another reality check for those counting on a Goldilocks economy. The not-too-hot, not-too-cold happy ending is looking increasingly like a fairy tale.

#5: The Wall Street Journal’s Will Parker on the Rental Landscape

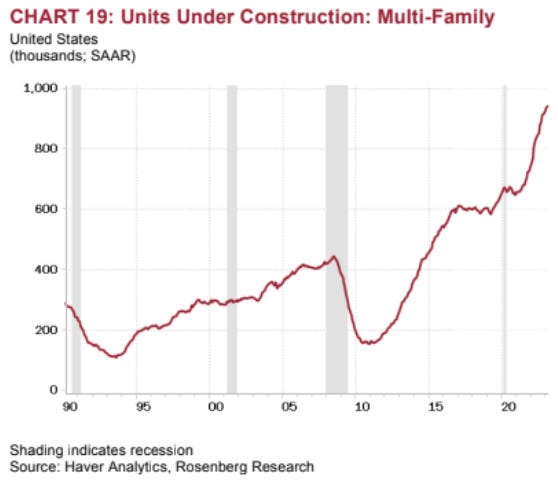

“While some seasonal stalling in rents is normal, the market faces a significant headwind in the biggest delivery of new supply since 1986… Nearly half a million new apartments are coming on line this year as developers seek to cash in on the high rents that tenants have been paying.”

Haymaker Take: Although I’ve highlighted the explosion in multifamily construction in the past, I have to admit I’m shocked at how much apartment building values have come down. This is particularly the case since the U.S. is not officially in recession. As shown above, multifamily values have tumbled almost as much as my most disliked property sector of office buildings. With a considerable amount of the new multifamily supply having only recently hit the market, further downside is plausible, even probable.

The good news is that single-family housing has not experienced the type of overbuilding that occurred from 2005 to 2007. Overall, though, I believe the above syncs with the deflation of a massive global property bubble, with the U.S. far from immune.

#6: Vincent Deluard — Director, Global Macro Strategy at Stone X Group, Inc, on Trading Algorithms and Technical Rules

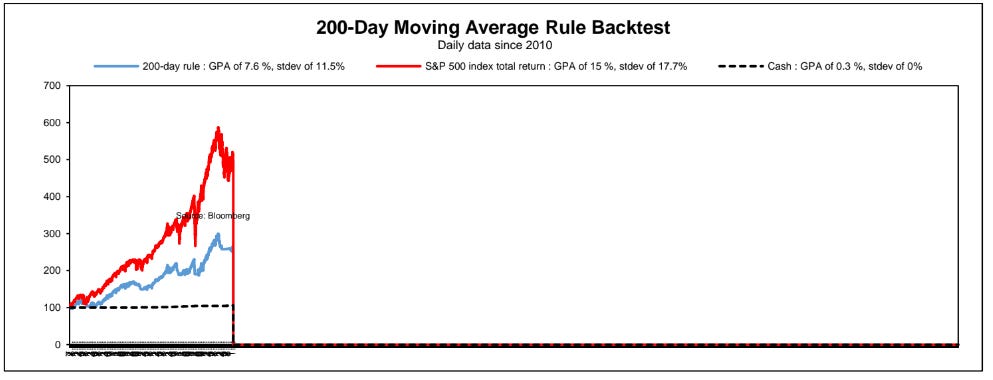

“Investors pay attention to technical rules such as the 200-day moving average because they have historically protected them from catastrophic losses. As shown in the chart below, a simple strategy of switching to cash when the S&P 500 index fell below its 200-day moving average generated the same gains as holding stocks all the time, with 40% less volatility, since 1954.

However, I doubt that these simple strategies work in the age of algorithmic trading and widespread quantitative models. The 200-day moving average rule underperformed the S&P 500 index by 6% annually since 2010…

Furthermore this technical rule has worked only when the Fed eased policy…This makes intuitive sense since technical indicators work best when stocks experience steady uptrends, which is facilitated by friendly central bank (sic). On the other hand rallies tend to be shorter during periods of hiking cycles, and momentum traders get whipsawed by vicious bear market rallies.”

Haymaker Take: Vincent is making a number of important points for those of you who are fans of the 200-day moving average rule. In my experience, there are times when it works spectacularly well (2008) but, as he notes, lately it has generated a string of head fakes.

For example, in early 2022 the break below the 200-day was almost immediately followed by a reversal back above that in March. That may have led Jim Cramer to declare the bear market dead in its infant stage at that point. Shortly thereafter, it broke below again, which was a decent warning signal. However, in December it appeared to be moving above the 200-day only to fall off and then more meaningfully pierce it to the upside in January. It then proceeded to fall off again before rallying once more. Accordingly, I think it’s fair to say that’s a lot of “whipsaw” indeed.

At this point, I believe it’s best to focus on the mounting evidence of economic distress (heck, Costco reported negative same-store sales yesterday!). History is high-def clear that true recessions lead to much more downside than we’ve seen thus far. There’s an extraordinary buying opportunity up ahead but, for most stocks, we’re not there yet.

#7: Ars Technica on “Hallucinating Artificial Minds” - Cornerman (MJM) Entry

“In some ways, ChatGPT is a mirror: It gives you back what you feed it. If you feed it falsehoods, it will tend to agree with you and "think" along those lines. That's why it's important to start fresh with a new prompt when changing subjects or experiencing unwanted responses. And ChatGPT is probabilistic, which means it's partially random in nature. Even with the same prompt, what it outputs can change between sessions.

All this leads to one conclusion, one that OpenAI agrees with: ChatGPT as it is currently designed, is not a reliable source of factual information and cannot be trusted as such.“

Cornerman Take: Ars Technica asks (and answers) the foremost question of the day, and one not asked at a rate nearly commensurate with the problem at hand: Can we trust AI?

At some length, I’ve been addressing that question in a philosophical sense on my own Substack page, though largely from a broader perspective. This excellent piece by Ars Technica analyzes ChatGPT at the direct-engagement level and reveals some interesting information as to why, from a technical standpoint, ChatGPT might be novel, it might be exciting, it might even be useful at times, but it isn’t reliable, and, to my mind, the reasons underlying that fact could well be persistent and widespread across the AI landscape.

As we have seen in recent years, there exists within large swaths of the American populace an instinctive, and frequently unthinking deference to expertise (so often vaguely categorized). Even hearing the term “Experts say…” has for many been enough to, at once, activate a feeling of intellectual sanctity and deactivate any impulse towards intellectual responsibility. The result? A sort of unspoken refrain of, “Who are you to question what experts have to say? I mean, look, that guy’s wearing a lab coat, he clearly has a monopoly on knowledge, public policy, and, uh, the economy, man.”

Now, if that level of deference was achievable simply by pointing to a bureaucrat’s credentials, how far off are we from a “Who are you to question ChatGPT’s ~64,000,000,000,000 terabytes of data?” version of that same appeal to authority? Guarding against such appeals requires that we keep in mind (always keep in mind) AI’s shortfalls, blindspots, and user-error-related biases. It’s powerful software and it (along with its myriad competitors) will inevitably participate to a vast extent in human affairs; but if we’re to accurately concern ourselves with the harms it can cause, we must also maintain an objective understanding of the things it can’t do… let alone what it shouldn’t do.

Thanks for another excellent Friday reel! Really appreciate your terrific free service. Especially since I’m a very tiny investor, and SS payments are the majority of my income. 🤯 So, thank you very much.

#2 Banks. I am not going to argue that they are not greedy. My question is aren't they drowning in money(supply)? Isn't there something like $2 trillion that is getting invested in overnight?