Friday Highlight Reel - Edition #4

A sampling of interesting observations from the Haymaker's network of market experts and favorite resources.

“Suffice to say, getting inflation down to 4 to 5% will be the easy part. It’s the move down from there the Fed is worried about.” -Chris Low, Chief Economist at FHN Financial

Editor’s Note

Hello, Readers:

Below is our fourth entry in the Highlight Reel series, which we’re happy you all seem to have been enjoying. Given its popularity, please consider the series a Haymaker mainstay.

As always, we encourage you to share your thoughts with us via commenting and share the piece with others if it’s to your liking. And if you’re not yet subscribed, well, see below.

Thanks to you all.

-MJM

#1: The Daily Caller on Coal

“China approved 168 coal-fired power plants in 2022, the most rapid expansion of the country’s coal-fired power capacity since 2015, according to a report by the Centre for Research on Energy and Clean Air (CREA) and Global Energy Monitor (GEM) Monday.

Chinese companies began constructing 50 gigawatts (GW) worth of coal-fired power capacity in 2022, more than triple the rest of the world put together and spiking 50% from 2021, according to the report. Conversely, President Joe Biden’s signature Inflation Reduction Act (IRA) is expected to lead to the retirement of 30 GW to 60 GW of U.S. coal-fired power plants by 2030, by making it more difficult for coal to compete with renewables, E&E News reported, citing an analysis by analytics firm Rhodium Group.“

Haymaker Take: While I am not thrilled with many of the Biden administration’s energy policies, I empathize with its hostility toward coal-fired energy generation, at least without effluent-capture systems. Moreover, I’m encouraged by its sudden 180° on nuclear energy. The Inflation Reduction Act (the name still rankles me) contains funding for nuclear power development, including Small Modular Reactors (SMRs). As many Haymaker readers are aware, I’m a big fan of this approach for a number of reasons. They include the fact that these can be located close to their end markets, eliminating the need for long-distance transmission lines, which are highly contentious. In fact, it’s not unreasonable to say that, in many cases, they are nearly impossible to build out. My favorite SMR developer is getting closer to first fission, but it’s far from an assured event. Should SMRs proliferate over the coming decade — a good kind of nuclear proliferation — that will hopefully allow even the developing world to shift away from coal-fired electricity generation.

#2: Business Insider on Tesla’s Career

“Tesla spent the past two decades defying expectations and disrupting the automotive industry, but in 2023 the once revolutionary car company did the seemingly unthinkable: It turned fanboys against it… It's a sign that a company that has for so long relied on a near-mythic reputation as a futuristic automaker may be losing its edge.

Tesla is turning from a young and scrappy industry disrupter into a company that looks much more like the automakers it used to rattle. And the company's once grandiose leader, who showed up in "Iron Man" movies and promised to take us to Mars, is looking more human by the day.

Tesla has only ever existed without real competition and in a favorable economic environment. Now the market of electric vehicles is anyone's game, and Musk is about to find out how hard it can be to go to war with some of the world's most recognizable brands.“

Haymaker Take: Regular readers of this publication — and its predecessor, the Evergreen Virtual Advisor (EVA) — are aware that I have often been critical of Elon Musk over the years. This has mostly been due to his disregard for securities laws. Additionally, I’ve felt Tesla’s stock price assumed extremely unrealistic future earnings in order to justify a market capitalization that exceeded one trillion in late 2021. His constant touting of impending products that usually didn’t make it to the commercial production stage, struck me as the classic Silicon Valley “fake it, ‘til you make it” shtick. His success at that certainly was a factor in Tesla joining the Trillion Dollar Club, however irrationally. At one time, he was the fair-haired boy of the renewable energy movement, but those days are long gone. In addition to the above Insider excerpt, I recently read a scathing feature article in Bloomberg Businessweek, a magazine that once lionized Tesla — at least before he bought Twitter. It was so anti-Musk that I found myself subconsciously sticking up for him. And that’s a feeling I never expected to have…

#3: Fox Business on California

“California's population dropped by more than 500,000 people between July 2020 and July 2022.

That's a real danger to the state because those who leave, take their money with them.

Two thirds of California’s income tax revenue come from people making over $200,000 a year, and those are the people who are leaving.

The exodus is costing the formerly golden state billions of dollars: the deficit is over $22 billion and rising rapidly.“

Haymaker Take: The precipitous quality of life decline in cities like San Francisco and Los Angeles, both near and dear to my heart, has been agonizing for me to watch. The degradation of California overall has in the past led me to tweak its glittering nickname (The Golden State) to “The Foldin’ State”. It has resolutely moved so far to the left that its policies are increasingly devoid of common sense. For example, the top 1% of income generators represent almost 50% of its tax base thanks to high marginal rates on both income and capital gains (the latter being a major revenue source for the state). The problem is that these are the people who can most easily decamp to less tax-thirsty venues. Nevada, Florida, and Texas are three that most readily come to mind. Of course, they often take their companies, and jobs, with them. Hey, Hay, that’s right! Elon Musk committed this cardinal sin against progressivism, too. On a slightly positive note, Gov. Gavin Newsom displayed a JFK-like profile in courage recently. He did so by incurring the wrath of his most extreme party members in keeping the Diablo Canyon Power Plant open. Regardless of your feelings about nuke energy the last thing — well, almost — California’s fragile grid needs right now is losing that carbon-free source of high-density power.

To learn more about Evergreen Gavekal, where the Haymaker himself serves as Co-CIO, click below.

#4: Barron’s Randall W. Forsyth on Dependency Issues in the Stock Market

“It’s also telling how dependent the stock market has been on the big technology names, as (Jim) Bianco pointed out in his webcast. From the turn of the year, the FAANG + MNT stocks—Meta Platforms (formerly Facebook), Apple, Amazon, Netflix, Alphabet (GOOGL), Microsoft, Nvidia and Tesla—accounted for 3.05 percent of the 3.8% advance in the S&P 500 through February 22nd, according to Bloomberg.”

Haymaker Take (with a little help from my friends): The legendary market technician and strategist, Bob Farrell, often observed that a stock market was healthiest when it had broad participation. A stat such as the foregoing isn’t encouraging in that regard. Neither is my pal Jesse Felder’s recent observation that the five largest companies in the S&P, comprised of several of the names listed in the previous paragraph, hit 70 times free cash flow in late 2021. That was up from 10 times a decade earlier. Should they retreat to 30-times free cash flow, their valuation prior to the Fed’s Covid-related, multi-trillion-dollar binge-print, that would be a 50% decline from current prices. Famed short-seller Jim Chanos similarly noted that no bear market of the last 42 years has traded richer than nine to 14 times the previous earnings peak. Presently, the S&P is around 20 times that prior apex. (Hat tip to another friend, Michael Lewitt, for highlighting that gem!)

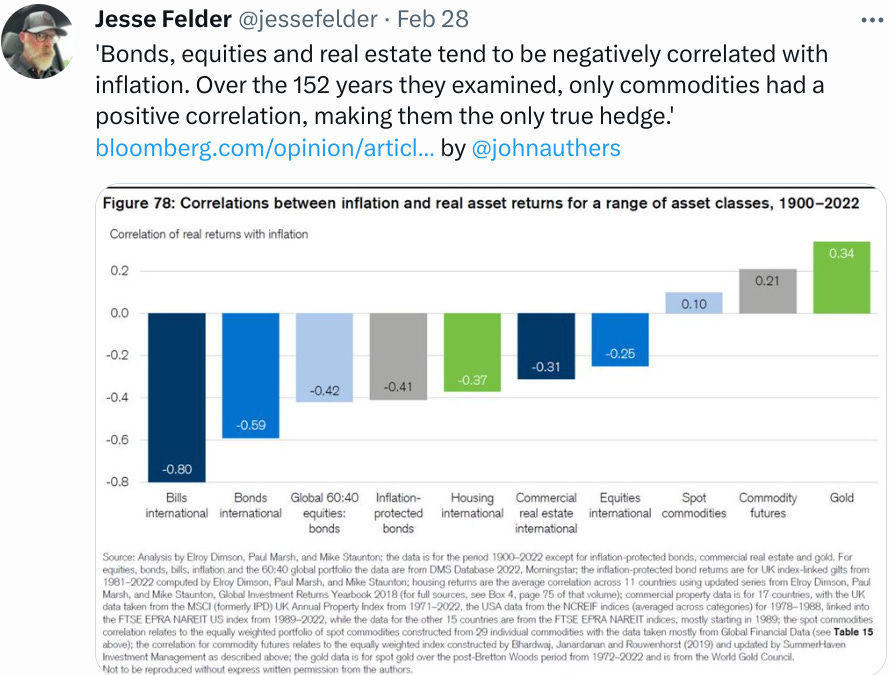

#5: Bloomberg on Hedging (Quote-Tweeted by Jesse Felder)

Haymaker Take: Going back to the prolific Felder well once again, he’s making a crucial point. If you, like yours truly, believe inflation is in a long-term up-trend, this is critical information. It’s certainly not friendly to passive investment strategies with their heavy reliance on stocks and bonds, with almost all of the former non-resource based. Undoubtedly, inflation will oscillate up and down. At times, unlike now, it may look like it is under control. However, the slope is now up, driven by a variety of factors including “greenflation” (the mammoth cost of the Great Green Energy Transition), the heavy expense of cold and hot wars, and the government’s increasing control over the U.S. economy. The latter has dire implications for productivity improvements which will be essential for controlling inflation in an aging society. In my view, the bottom line is investors need to acknowledge the new reality and position accordingly — especially, when inflation hedges experience sharp corrections. Many have done exactly that, of late.

#6: Doomberg on Dilution (from his March 3rd article, Torching Retail):

“On December 14, 2022, the Securities and Exchange Commission (SEC) announced charges against eight social media influencers for running a sophisticated pump-and-dump scheme that ultimately netted the group more than $100 million. Well, it wasn’t that sophisticated. The group built significant followings on Twitter and YouTube, parlayed that effort into a Discord chat room with more than 150,000 members, and allegedly used those social media assets to execute their scheme. According to the SEC, after selecting a target stock, the group would surreptitiously accumulate large positions in their individual accounts, “pump” the stock to their legions of followers without disclosing their stakes, and finally “dump” their shares into the resulting liquidity frenzy.“

Haymaker Take: Longtime readers, going back to the Evergreen Virtual Advisor, may recall my attacks* on the pump-and-dump tactics used by social media personalities with stocks like GameStop and AMC Entertainment. In my book, Bubble 3.0, I also went on a tirade against these brazen shenanigans. Add the recent experience of Torchlight Energy to this long list of brazen “bezzles”. As my friend and mentor Doomberg (aka, the Green Chicken) pointed out in his Torching Retail missive that came out today, swarms of Twitter influencers lured naïve retail investors into bidding up the price of a Torchlight spinoff, MMTLP, to $12.50/share (a $2 billion market cap!) This was mere days before it collapsed to zero. Any bets that these digital floggers sold into the buying frenzy they created? The SEC appears to be cracking down on these schemes — finally! Yet, an incalculable sum of money has been lost by unsophisticated investors. This is just in case you were wondering where countless billions of stimulus money went to die.

#7: Deutsche Bank’s Head of Global Fundamental Credit Strategy, Jim Reid, on Money & GDP

“Ever since Milton Friedman suggested monetary policy had ‘long and variable’ lags, economists have written trillions of words trying to understand the lags better.

This cycle poses a fairly challenging task in identifying the length of the lag for a variety of reasons. One big problem is that the US money supply saw the largest YoY spike in 2020 since 1943, with 2021 the largest outside of that since 1976. However 2022 then saw the first annual decline since 1948.

As today’s CoTDs show, US nominal GDP has generally tracked money supply fairly well since our data starts in 1831 so you would have to conclude there is a strong correlation between the two whatever the exact lag. However after a 25% and 12% spike in money supply in 2020 and 2021, nominal GDP rose ‘only’ 12% and 7% in 2021 and 2022. To help illustrate the lag, the 25% increase in 2020, coincided with 0% nominal US GDP in the same year.

So does the fact that the money supply saw a very rare (small) fall in 2022 mean US nominal GDP will grind to a halt at some point in the next year or so? Or does the fact that nominal GDP never responded in full to the surge in money supply mean it will stay elevated for longer before falling?

Understanding the lag of monetary policy might be the most important macro theme of the next 12-18 months.“

Haymaker Take: Jim Reid’s first and last sentences are spot-on, in my view. Of course, it doesn’t hurt to quote the iconic Milton Friedman when you’re striving for credibility! He’s making an interesting point that, frankly, I hadn’t thought of before — basically, that as strong, and inflationary, as the economy was in 2021 and 2022, it should have been even more so. Perhaps the residual, or lag, from that is why the U.S. economy has, thus far, refused to buckle. Eventually, that impetus will fade, but unquestionably it’s still a factor. No one knows when that point will be reached, not even the Fed. Actually, based on its forecasting record, especially the Fed. In that regard, it should concern all soft-landing believers that a gentle touchdown is now its official forecast. Per the opening quote, if Chris Low is right, as I think he is, the Fed needs to keep cranking rates up, at least until the labor market cracks. There are growing signs that’s happening, but the process likely has much further to go.

*Pertaining to a couple of my aforementioned “attacks”:

https://evergreengavekal.com/when-yolo-meets-fomo/

Thank you David. The highlight reel is a delicious yet free smorgasbord!

markets can stay up longer than people can stay solvent. Nice pieces this week. Many big thank you